Target Deal Days have come a long way since the company first launched the event in 2018. Initially scheduled to overlap with Amazon’s Prime Day, the Deal Days slowly but surely took on a life of their own. In October 2021, Target kicked off the extended holiday shopping season with its first independent Deal Days event and the second Deal Days of the year, in a move that is now being used by Amazon. And this year, Target’s October Deal Days took place October 6th to 8th 2022 – almost a week before Amazon’s first-ever second Prime Day of the year scheduled for October 11-12.

Now, with another Deal Day behind us, we dove into the foot traffic data to assess the offline impact of this emerging stand-alone retail holiday.

Going Into October Deal Days Strong

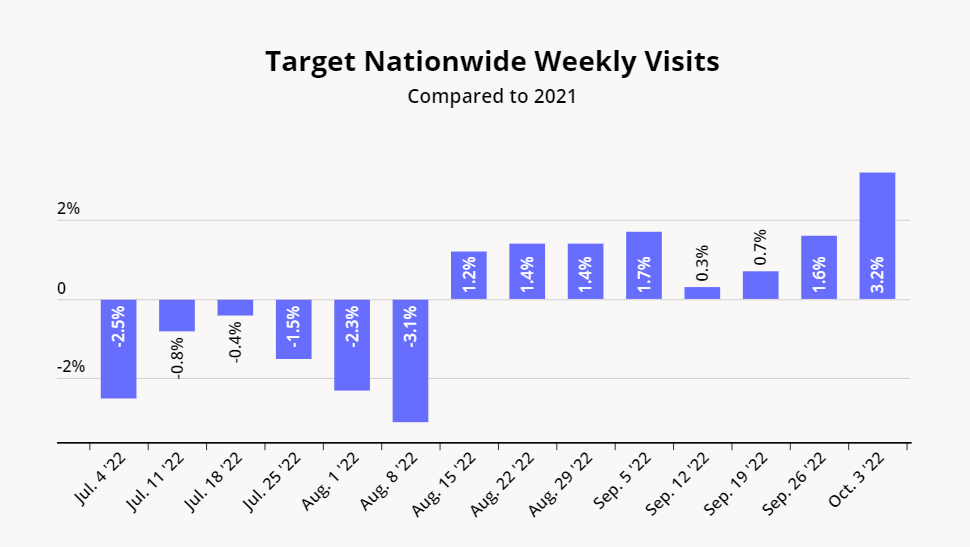

Following several weeks of year-over-year (YoY) visit declines largely driven by comparisons to a strong 2021 back-to-school season, Target’s YoY foot traffic rose once again in mid-August 2022. Visits the week of August 15th increased 1.2% relative to the equivalent week in 2021, and the company kept the momentum going through Deal Days maintaining positive YoY foot traffic numbers every week leading up to the retail event.

During the week of October 3-9, 2022 – the week of Deal Days – Target’s nationwide foot traffic increased 3.2% relative to the week of October 4-10 2021, or double the YoY increase of the previous week. And critically, last year’s October Deal Days took place between October 10th and 12th 2021, so the 2022 October Deal Days week is being compared to a 2021 week with Deal Days as well. This means that 2022’s October Target Deal Days were able to generate impressive YoY in-store weekly visit gains despite the comparison to a particularly strong October in 2021.

Thursday-Saturday Deal Days – A Winning Combination

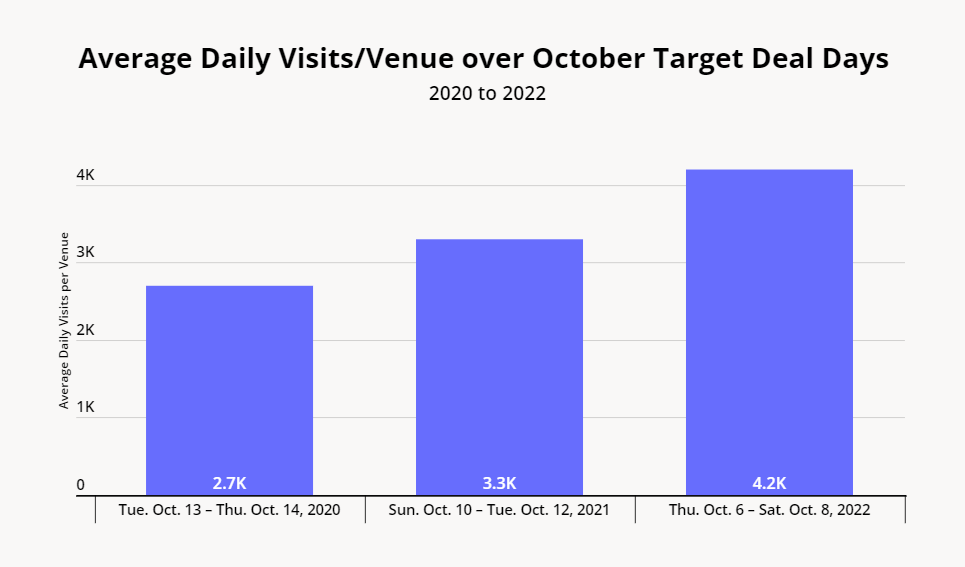

Zooming into daily visits further confirms the success of this year’s sales event. Target tends to see its nationwide visits peak on Saturday, so the retailer had traditionally held its Deal Days mid-week in an effort to generate traffic during an otherwise slower shopping period. The company began bucking its tradition in 2021, and held its Deal Days partially over the weekend, with the sales event beginning on Sunday, October 10th.

This year was the first time that a Deals Day event fell on Saturday – the brand’s most popular visiting day – and foot traffic data indicates that the overlap with Target’s weekly visit peak gave this year’s retail holiday a significant boost. Comparing average daily visits per venue over the company’s October Deal Days in 2020, 2021, and 2022 showcases the success of this year’s Deal Days timing. Analyzing foot traffic to Target’s stores nationwide over Deal Days indicates that 2022’s October Deal Days drew almost 28% more average daily visits to Target stores than in 2021, and around 57% more daily visitors per venue than in 2020.

Owned Retail Holiday Creates Visit Boost

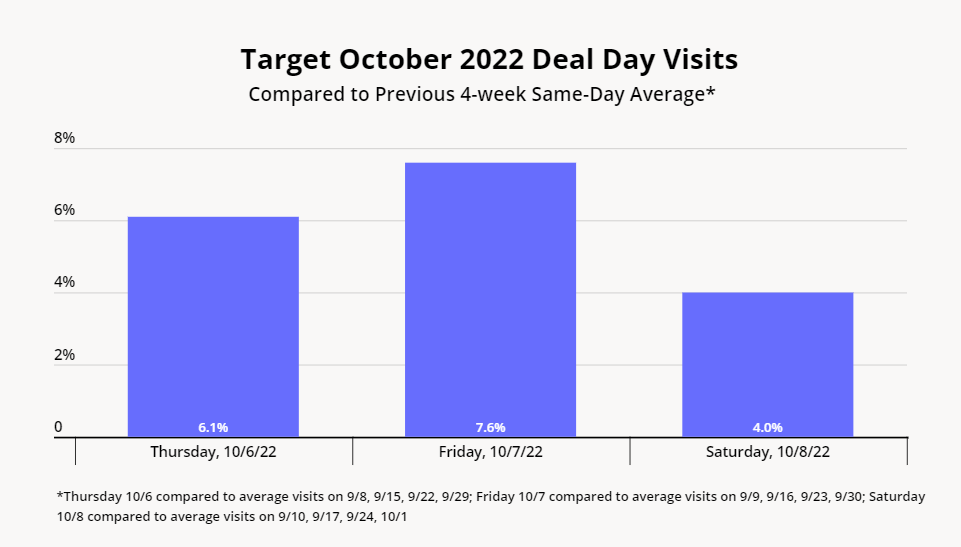

And comparing daily visits over Deal Days to the previous 4-week daily average shows that the heightened traffic on Target’s 2022 October Deal Days relative to previous years was not just due to a strategic calendar shift. Visits to Target nationwide on Thursday, October 6th were 6.1% higher than the previous 4-week Thursday visit average, while Friday, October 7th foot traffic saw a 7.6% increase relative to the previous 4-week Friday average. The Saturday of Deal Days received a 4.0% boost when compared to average visits over the previous four Saturdays – a significant increase when considering how high Target foot traffic is on a typical Saturday.

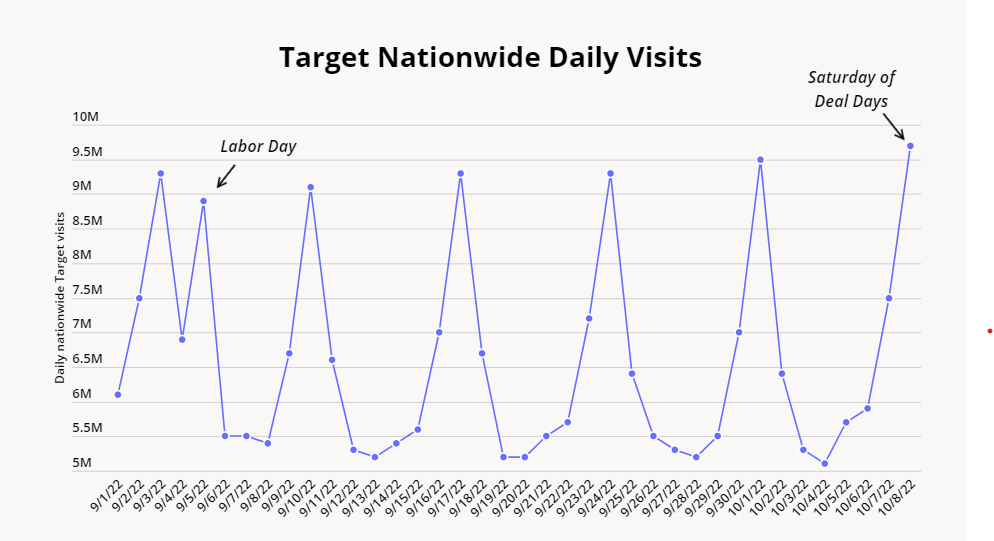

ֿDeal-Days Saturday Beats Labor Day

Perhaps even more impressive, the Deal Days-driven increase in Saturday visits was significant enough to beat the Labor Day visit heights. Targets nationwide saw more visits on Saturday, October 8th than on both the Saturday and the Monday of Labor Day 2022. Of course, the combined visits over Labor Day 2022 weekend still beat the combined visits over October 2022 Deal Days – but Labor Day is an extremely well-established retail holiday that is widely advertised across the retail space.

Target Deal Days, on the other hand, are only a few years old, and almost exclusively advertised by Target – especially this year, when the Target Deal Days did not overlap with the Amazon Prime Day event. The fact that Target succeeded in attracting so many visitors to its stores on a seemingly “random” Saturday speaks to the power of retail giants to establish owned retail holidays that have a clear impact on shopper behavior.

Many retailers are still struggling with inventory stockpiles, consumers are gearing up once again for an extended holiday season, and more and more shoppers are on the hunt for value. Target’s Deal Days success highlights the potential of company-led owned sales events to drive traffic during traditionally slower periods.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.