Pet supply companies saw their sales rise early in the pandemic, as many U.S. consumers adopted pets during the pandemic lockdowns. In the case of Chewy (NYSE: CHWY), a digitally-native pet supply company, sales remain elevated more than two years into the pandemic, Bloomberg Second Measure’s consumer transaction data shows. A closer look reveals, however, that the company’s year-over-year growth in sales slowed down between January and August of 2022, compared with the corresponding periods in 2020 and 2021, while customer counts during most months of 2022 remained relatively consistent year-over-year, but higher than in 2020 and 2019. Meanwhile, the company’s average transaction values between January and August of 2022 grew, on average, at a similar rate as in the comparable period of 2021, but higher than between January and August of 2020.

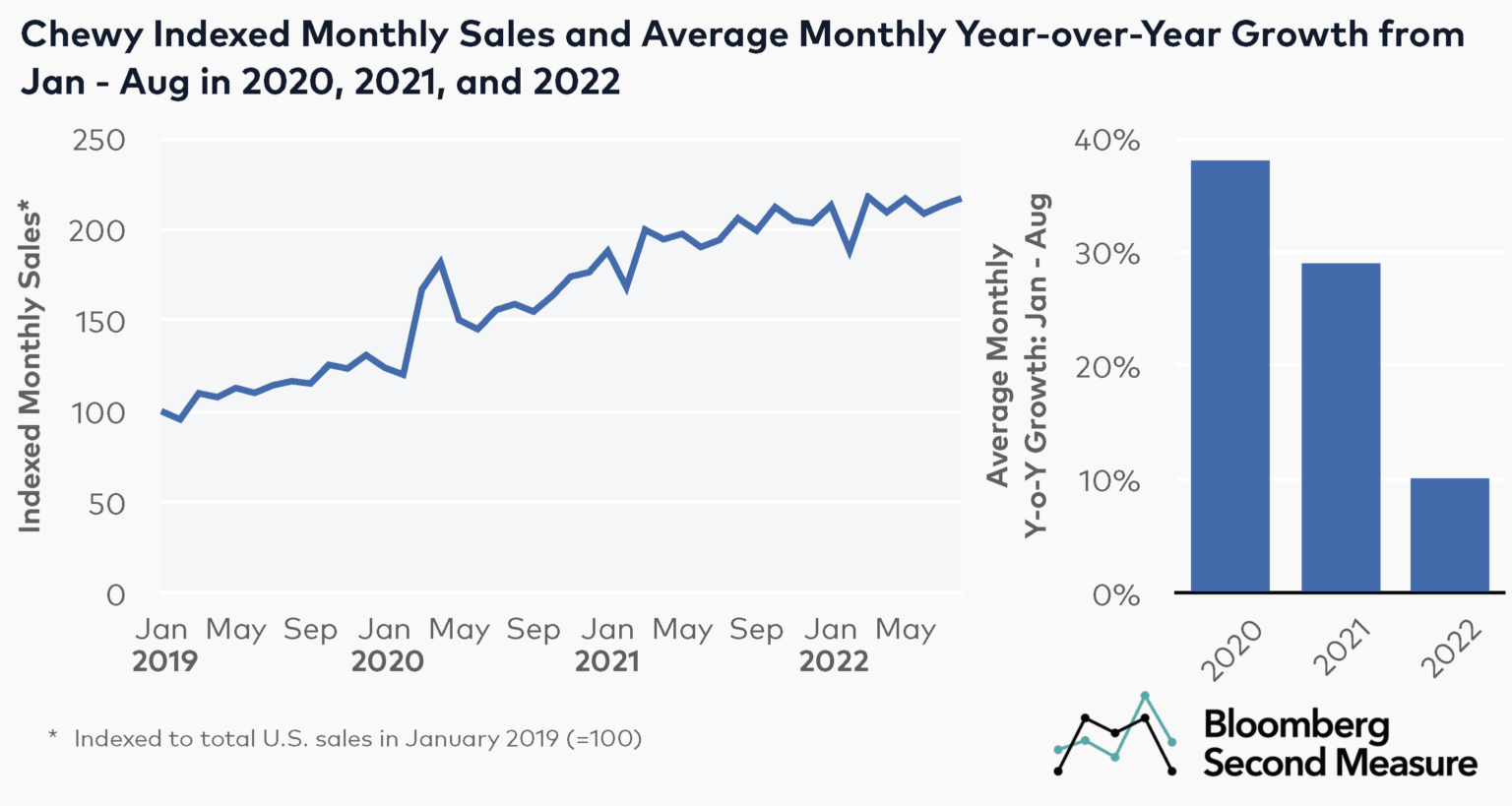

Chewy’s (NYSE: CHWY) monthly sales have grown so far in 2022, but at a lower rate than in 2020 and 2021

Consumer transaction data shows that, in 2022, Chewy saw its sales grow 10 percent year-over-year, on average, each month between January and August. By comparison, Chewy’s sales grew, on average, 29 percent year-over-year each month between January and August of 2021 and 38 percent year-over-year each month between January and August of 2020.

On a year-over-year basis, the sales growth Chewy saw in August 2022, at 5 percent, was the slowest since the beginning of the pandemic. Notwithstanding, Chewy’s sales in August 2022 were up 37 percent compared to August 2020 and up 86 percent compared to August 2019.

Among the possible factors that may have affected the company’s sales growth in 2022 are supply chain issues that Chewy experienced earlier in the year, as well as stricter return-to-office rules that might be moving demand away from pet supplies and toward pet care services.

Notably, Chewy’s sales generally follow a similar pattern each year, experiencing a slight increase annually in January, followed by a slight dip in February. A possible explanation for this might be a temporary sales increase due to Chewy’s post-holiday sale.

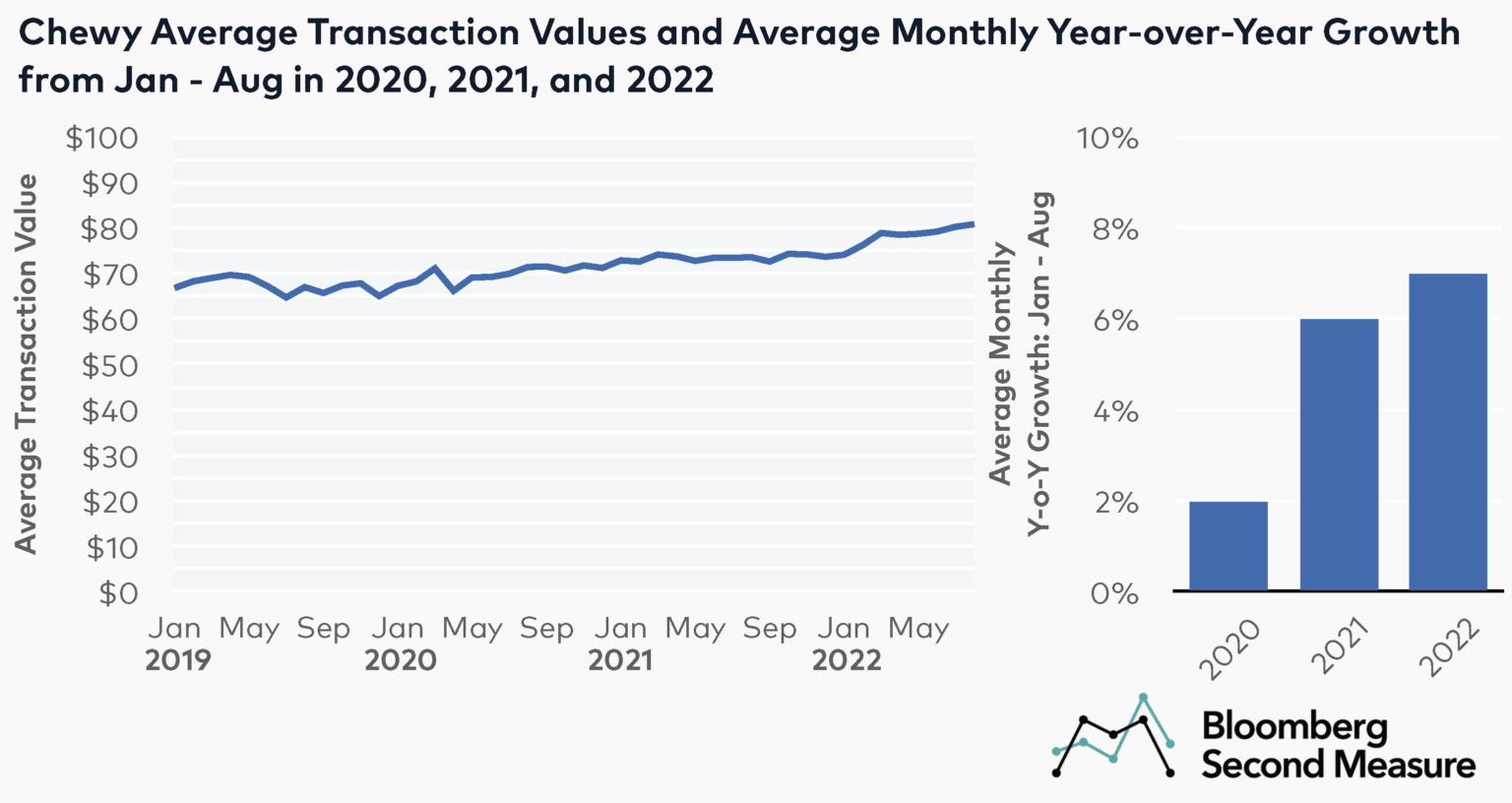

Chewy’s average transaction value grew at a similar rate in 2022, compared to 2021, but higher than in 2020

Consumer transaction data shows that, in 2022, Chewy’s monthly average transaction values grew, on average, 7 percent year-over-year each month between January and August of 2022. Between January and August 2021, Chewy’s monthly average transaction values grew at a similar rate and were up, on average, 6 percent each month year-over-year. By comparison, between January and August of 2020, average transaction values grew, on average, 2 percent year-over-year each month.

In August 2022, Chewy’s average transaction value, at $81, was 10 percent higher year-over-year, 13 percent higher than in August 2020, and 21 percent higher than in August 2019.

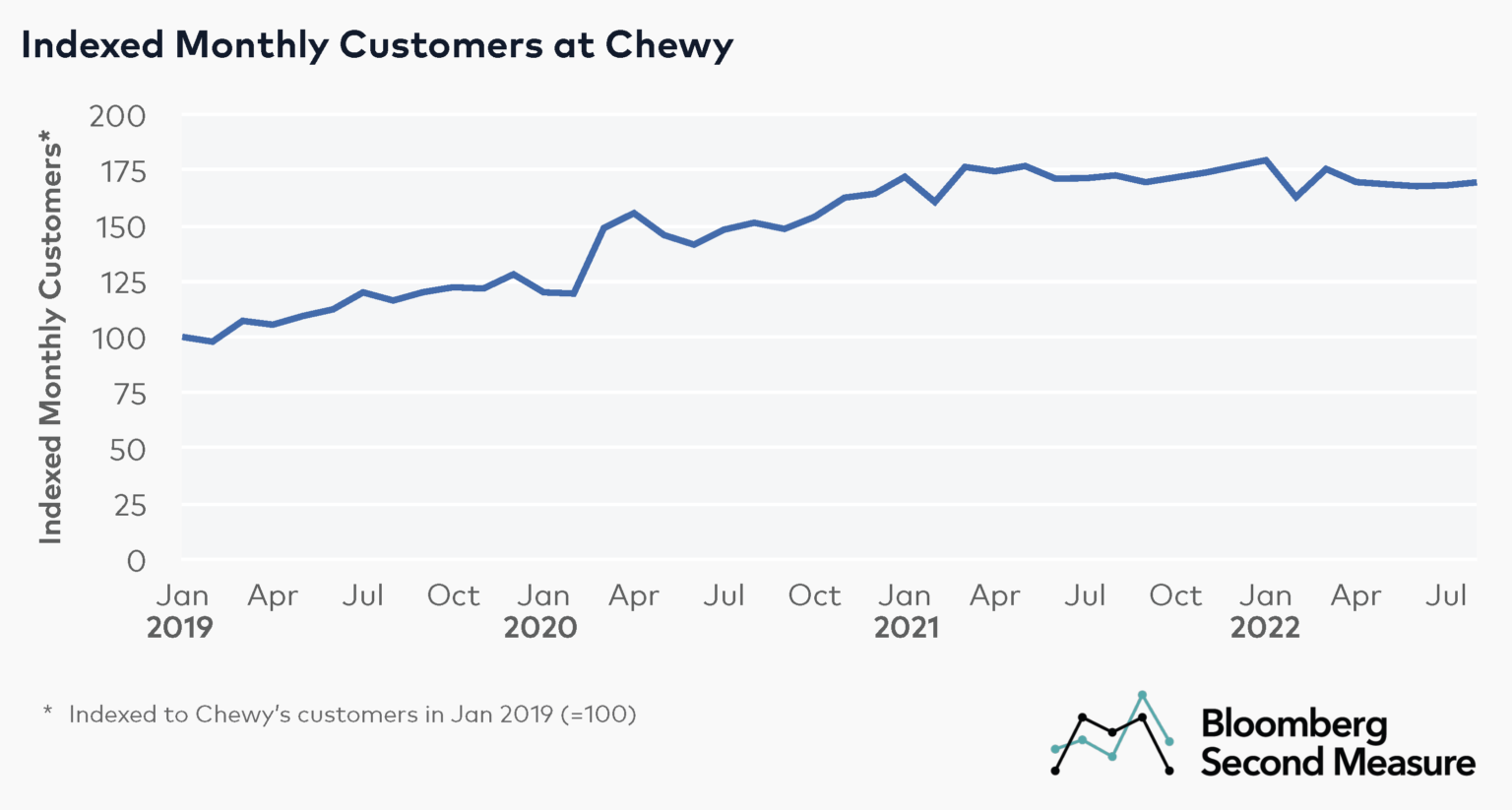

Chewy’s monthly customer counts have remained relatively consistent year-over-year in most months of 2022

Apart from January, when Chewy’s customer counts increased 4 percent year-over-year, and May, when the company’s customer counts decreased 5 percent year-over-year, for most months between January and August of 2022, Chewy’s customer counts remained relatively consistent compared to the same period of 2021. However, compared to the corresponding months in 2019 and 2020, customer counts were elevated. In August 2022, Chewy’s customer counts were 12 percent higher than in August 2020 and 46 percent higher than in August 2019. On a year-over-year basis, customer counts were down 2 percent.

Chewy’s customer counts followed a similar pattern as the company’s sales over the past four years, experiencing a slight uptick in January, followed by a slight decline in February.

Chewy and its competitors are increasingly expanding their offerings beyond pet supplies

Chewy is actively expanding its offering beyond pet supplies. In August 2022 the company launched its CarePlus program, providing preventative care coverage for pets. The new program adds to the number of initiatives Chewy introduced over the course of the pandemic, including launching a telehealth platform linking pet owners with veterinarians in 2020, as well as opening a veterinarian marketplace, and making its first foray into pet insurance services by partnering up with Trupanion in 2021.

Chewy’s competitors have also been expanding their pet care-related offerings. In the fall of 2020, Petco launched its wellness program for pets, while PetSmart, a company that between 2017 and 2020 was merged with Chewy, launched a new online pharmacy in October 2021.

Interestingly, big box stores such as Walmart and Target have also been launching initiatives catering to pet owners, including Walmart rolling out its pet insurance program in November 2020 and Target unveiling a private-label food line.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.