HELOC lending rose to highest level since 2007 in the first half of 2022

In the past two years, many creditworthy borrowers have taken advantage of ultralow interest rates to refinance their mortgages. As of July 2022, 80% of outstanding home mortgage loans had interest rates below or equal to 4%. However, rising interest rates have significantly reduced refinancing opportunities. With interest rates hovering around 6% and higher in September, refinancing activity has plummeted. Instead, home equity lines of credit (HELOCs) and home equity loans are gaining popularity as homeowners seek to tap their accumulated equity.

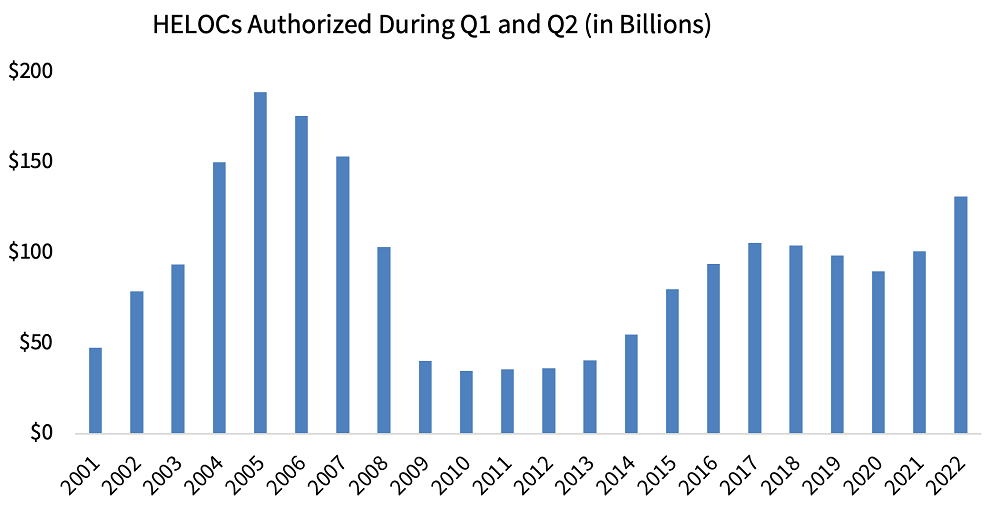

Figure 1 shows that HELOC activity grew to the highest level since the first half of 2007 in the first two quarters of 2022. During that period, lenders originated more than 807,000 new HELOCs totaling almost $131 billion. Both HELOC counts and amounts have increased by 30% year-over-year in 2022.

Figure 1: HELOC Activity Grew to the Highest Level Since 2007

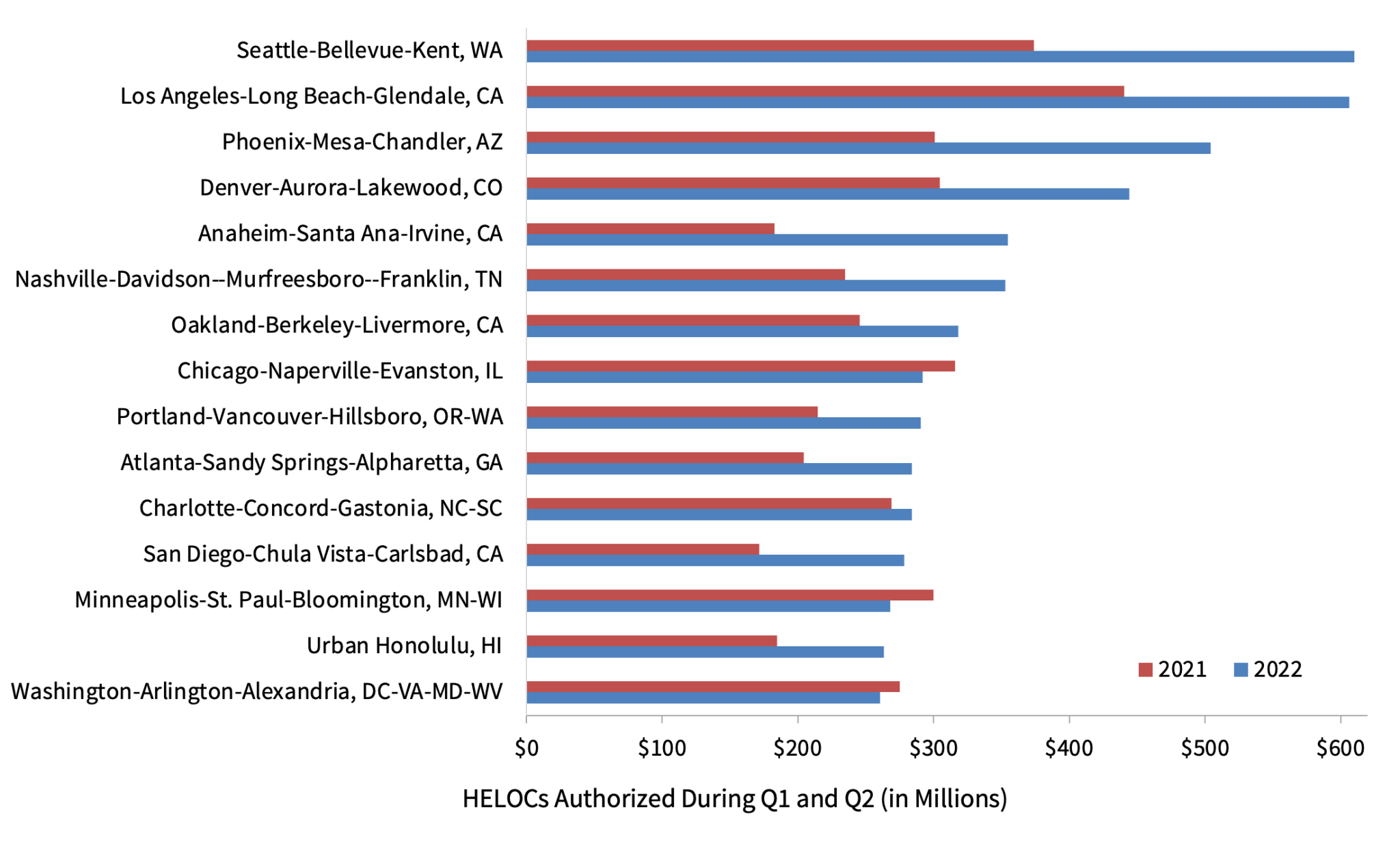

HELOC demand and trends vary nationally by metro area. Figure 2 shows the top 15 metros by approved HELOC amount in the first half of the 2022 compared with the same period in 2021. Except for a few metros – Chicago, Minneapolis, and Washington – HELOC amounts increased in all other metros in 2022 compared with 2021. So far in 2022, Seattle has the highest amount of approved HELOCs, totaling almost $610 million, for an increase of 63% from 2021. Los Angeles followed with $606 million, while Phoenix ranked third at $504 million. In general, markets with the largest home price growth over the past two years were among those with the biggest year-over-year gains in HELOC activity.

Figure 2: Top 15 Metros with Highest Amount of Approved HELOCs: Q1 and Q2 2022

HELOC demand is likely to remain strong, as cash-out refinances are waning because of rising interest rates. Home equity grew significantly over the last couple of years, and owners with substantial equity may prefer to keep their existing low rates, thus choosing HELOCs over cash-out refinances.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.