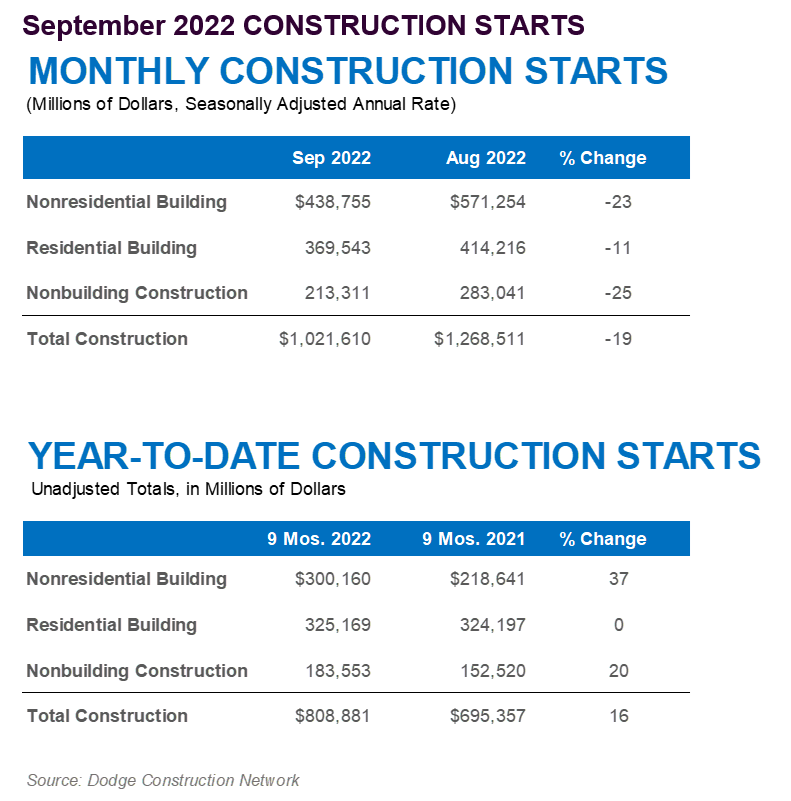

Total construction starts decreased 19% in September to a seasonally adjusted annual rate of $1.02 trillion, according to Dodge Construction Network. In September, nonresidential building starts dropped 23%, residential starts fell 11%, and nonbuilding starts declined by 25%.

Year-to-date, total construction was 16% higher in the first nine months of 2022 compared to the same period of 2021. Nonresidential building starts rose 37% over the year, residential starts were flat, and nonbuilding starts were up 20%.

For the 12 months ending September 2022, total construction starts were 15% above the 12 months ending September 2021. Nonresidential starts were 34% higher, residential starts gained 2%, and nonbuilding starts were up 17%.

“September’s decline in construction starts should not be seen as a precursor to a cyclical pullback in the industry,” said Richard Branch, chief economist for Dodge Construction Network. “The previous two months saw the start of several megaprojects, and the decline in September returns starts activity to its trend level. It is likely, however, that as interest rates move higher in the coming months, marginal construction projects may not get underway and construction activity will begin to settle back.”

● Nonbuilding construction starts fell 25% in September to a seasonally adjusted annual rate of $213.1 billion. Highway and bridge starts fell 31%, and environmental public works starts lost 38%. On the positive side, gas/utility starts rose 8%, and miscellaneous nonbuilding starts increased 17%. Through the first nine months of the year, total nonbuilding starts were 20% higher than in 2021. Utility/gas plant starts gained 62% through the first nine months, highway and bridge starts were 20% higher, and environmental public works were 13% higher. Miscellaneous nonbuilding starts, by contrast, were down 10% through the first nine months.

For the 12 months ending September 2022, total nonbuilding starts were 17% higher than in the 12 months ending September 2021. Utility/gas plant starts were 61% higher, highway and bridge starts rose 11%, and environmental public works starts increased by 13%. Miscellaneous nonbuilding starts decreased by 14%.

The largest nonbuilding projects to break ground in September were the $302 million Sunflower Wind Farm in Fairplay, KS, the $267 million Orinda waste treatment plant in Oakland, CA, and the $246 million Cattlemen Solar Park in Milam County, TX.

● Nonresidential building starts dropped 23% in September to a seasonally adjusted annual rate of $438.8 billion. In September, commercial starts inched 2% higher led by office and warehouse starts, while institutional starts lost 39% despite solid growth in the education category. Manufacturing starts were 22% lower in September. Through the first nine months of 2022, nonresidential building starts were 37% higher than the first nine months of 2021. Commercial starts grew 19%, and institutional starts rose 19%. Manufacturing starts were 240% higher on a year-to-date basis.

For the 12 months ending September 2022, nonresidential building starts were 34% higher than in the 12 months ending September 2021. Commercial starts grew 16%, institutional starts rose 18%, and manufacturing starts rose 240% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in September were the $5.7 billion oil platforms in the Gulf of Mexico, the $2.9 billion Metro-North Penn Station Project in New York, NY, and the $800 million Meta data center in Kuna, ID.

● Residential building starts fell 11% in September to a seasonally adjusted annual rate of $369.5 billion. Single family starts lost 7%, while multifamily starts dropped 16%. Through the first nine months of 2022, residential starts were flat when compared to the same timeframe in 2021. Multifamily starts were up 25%, while single family housing slipped 9%.

For the 12 months ending September 2022, residential starts improved 2% from the same period ending September 2021. Single family starts were 7% lower, while multifamily starts were 27% stronger on a 12-month rolling sum basis.

The largest multifamily structures to break ground in September were the $1 billion AEG Nashville Yards mixed-use project in Nashville, TN, the $300 million Sterling Okan building in Miami, FL, and the $230 million Majestic mixed-use project in Gowanus, NY.

Regionally, total construction starts in September fell in all five regions.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.