Albertson’s (ACI) short run as a public company may be coming to a close as it enters talks to merge with the nation’s second largest grocer and largest supermarket chain, Kroger (KR). However, the companies must first prove to regulators that their combined footprint is not a threat to a competitive economy. According to Earnest spend data, the biggest sales overlaps are in Texas and Illinois.

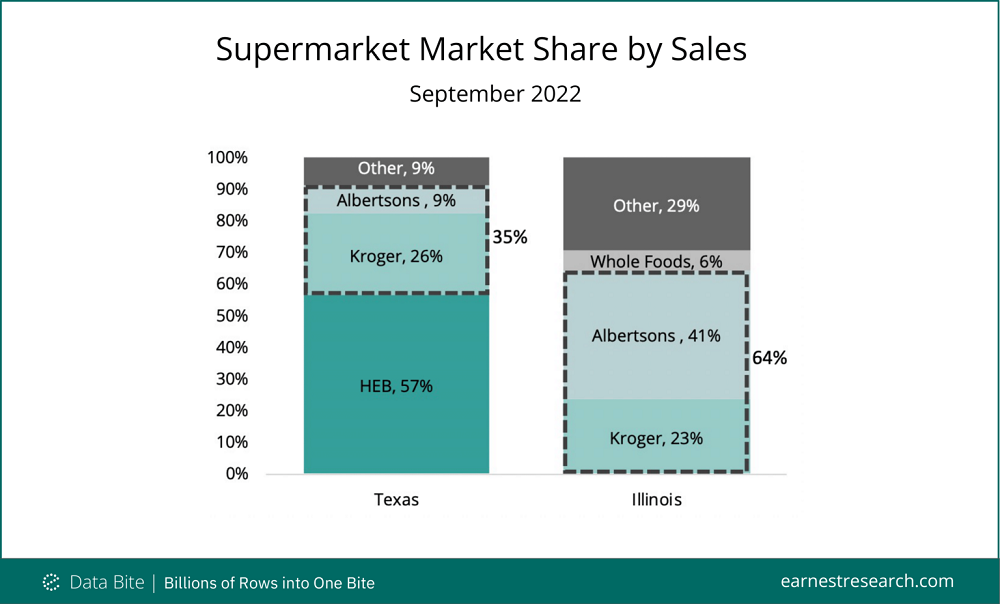

Neither chain is a clear market leader in Texas, where HEB controls over half of sales. A combined Kroger and Albertsons would control 35% of the market and fight for share in the competitive Dallas area. Albertsons has historically led in Illinois through its local Jewel Osco chains. The combined company in Illinois would account for 64% of the total supermarket share, mostly in and around Chicago.

Consumers spend upwards of 6% of their entire monthly budgets at supermarkets, the second largest category by wallet share, making such a large combination an obvious target for regulators. However, the grocery market has fragmented beyond supermarkets in recent years. Budget grocers Aldi, Grocery Outlet, and Trader Joe’s are gaining share as inflation pinches shoppers. Meanwhile supermarkets’ push into delivery through Instacart partnerships and investment in rapid delivery apps like JOKR sputtered since the pandemic. The tie up of the two stores may be the best option they have to survive the increasingly competitive grocery market.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.