“Obviously, Peacock sucks.”

That’s what one executive said about NBCUniversal’s (NBCU) take on streaming.

On the surface, the statement seems harsh—after all, Peacock is growing.

In August 2022, Peacock reached 28mm monthly active accounts (MAAs), putting it on track to reach its goal of 30mm to 35mm MAAs by 2024.

By 2026, Peacock could reach 84mm MAAs, representing a 250% increase in users from 2022.

So, what gives, and what does the contradiction mean for the future of Peacock advertising?

Ad strategies from July 1, 2021, through June 30, 2022, tell that story.

Growing, but Not Fast Enough

Full disclaimer: There’s nothing wrong with Peacock.

In terms of content, Peacock was the streaming home of the Winter Olympics in 2022.

Peacock also streams Sunday Night Football & Football Night in America and will do the same when the 2022 FIFA World Cup kicks off next month.

The platform also includes hit shows like Yellowstone and cult-favorite The Office.

This combination of hit shows and exclusive content has fueled growth.

Between Q2 2021 and Q1 2022, MAAs increased by 40%.

Between December 2020 and Q2 2021, sign-ups increased by nearly 64%.

Unsurprisingly, advertisers have taken note.

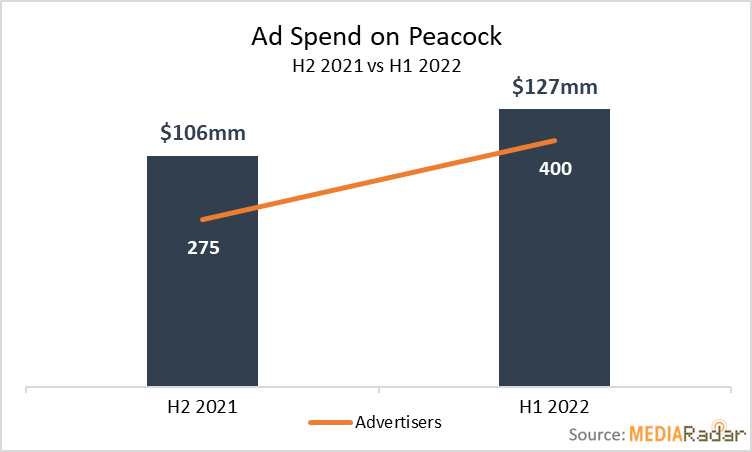

From July 2021 through June 2022, 480 advertisers bought nearly $233mm worth of ads on Peacock, representing increases of 47% and 20% YoY, respectively.

The user growth is impressive and even puts it ahead of Discovery+.

Unfortunately for Peacock, it could be too little too late.

Compared to its rivals, Peacock lags considerably on all fronts.

To put this into perspective, between January 1 and August 31, 2022, 785 brands bought ads on Hulu, while 565 did so on Paramount+.

Keep in mind that Paramount+, the replacement to CBS All Access, launched almost a year after Peacock.

In terms of ad revenue, Hulu generated nearly double.

With Netflix likely emerging as the next OTT advertising giant and stealing a ton of ad dollars, it’s hard to imagine that Peacock’s upward trend continues at the rate necessary to survive.

Big Brands Are Giving Up on Peacock

Peacock was late to the OTT party, launching nationally on July 15, 2020.

With plenty of established ad-supported players, no one expected it to dethrone the likes of Hulu, Amazon and HBO Max.

The only expectation was that it’d have to offer something radically different, and it did that by offering a “free-to-watch tier with a light advertising load.”

As one of the last major media companies to push into OTT, this was the only option.

Leading up to Peacock’s launch, Laura Martin, senior media analyst at Needham & Co., said, “This is the only strategy that NBCU can really have.”

This strategy may have attracted cost-conscious users as other platforms increased their prices, but it appears Peacock advertising is falling out of favor with some big brands.

Target, for example, decreased its spending on Peacock by 69% YoY, while Walmart was down 44% YoY.

At the same time, The Coca-Cola Company decreased its spending by 94%, while Volkswagen, L’Oreal and Unilever did so by 92%, 95% and 42%, respectively.

These Fortune 500 advertisers don’t shy away from a channel that can give them ROI. The fact that they’re cutting back on Peacock, undoubtedly in favor of other platforms, sends a strong signal that they don’t see a future with the platform.

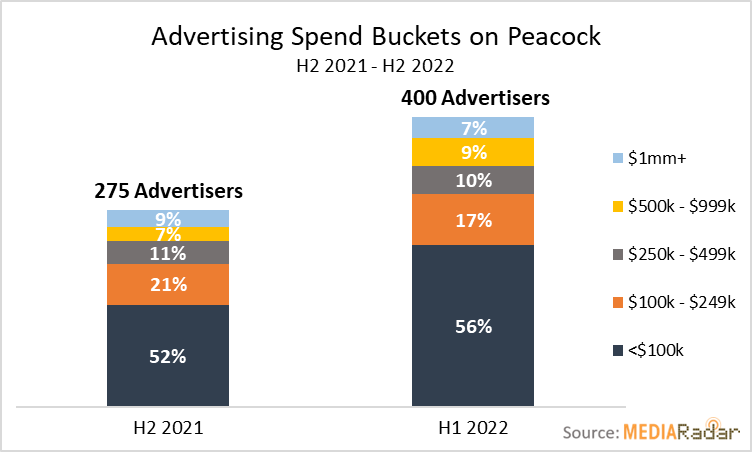

Overall, the percentage of advertisers investing more than $100k in Peacock ads decreased from 48% in H2 2021 to 43% in H1 2022.

While some big brands are still spending, including Macy’s (up by 140%), Grocery Delivery E-Services USA (up by 626%) and Expedia (up by 119%), Peacock has work to do—and its popularity with smaller advertisers likely won’t cut it.

Peacock attracted smaller advertisers in H1 2022—those investing less than $100k increased by more than 60%. But 74% percent of the “new advertisers” in H2 2022 only spent in the $7mm range.

When big brands are saying goodbye, niche advertisers with less money to spend could be Peacock’s saving grace. Unfortunately, $7mm is just a drop in the bucket.

A Love-Hate Relationship

Not all advertisers are saying goodbye to Peacock.

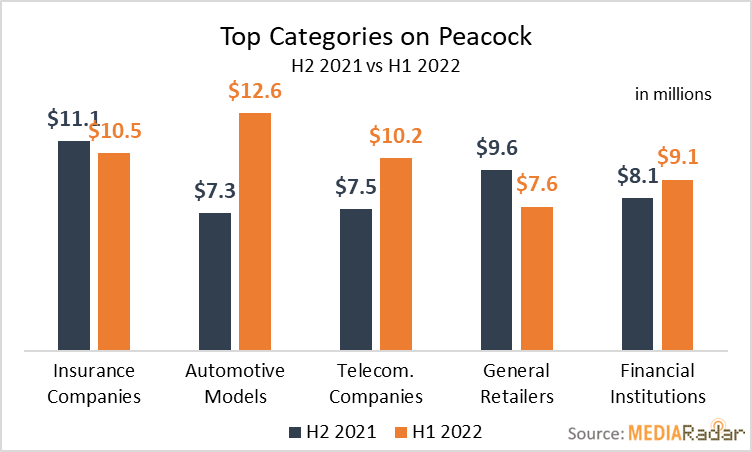

Automotive advertisers are all about it, collectively increasing their spending by 73% YoY (9% of the total ad spend on Peacock).

Hyundai, for example, increased its spending by nearly 500% YoY as it upped its investment to promote eight of its models.

Meanwhile, Toyota spent 36x in H1 2022 than it did in H2 2021.

Advertisers for telecommunication companies (T-Mobile and Verizon) and financial institutions (Bank of America, Citigroup and Discovery) also spent more.

It’s not surprising to see these advertisers spending more on Peacock because their industries are spending more across OTT. But the advertisers that are pulling back make for a far more compelling headline:

Insurance advertisers.

In H1, insurance advertisers, including those from Berkshire Hathaway (GEICO) and State Farm, decreased their spending by 6% YoY, making it the only platform among its competitive set to see a decline.

To put this into perspective, these advertisers increased their spending on Discovery+ by more than 411%.

On Hulu and HBO Max, they increased spending by more than 57% and 65%, respectively.

The love-hate relationship may point to Peacock falling out of favor with certain big OTT spenders while becoming home to a subset of advertisers who align with the platform’s sports-obsessed audience.

Again, there’s nothing fundamentally wrong with this, but mass appeal is essential for a platform that’s already behind. As of right now, it doesn’t have that.

A Small Fish in a Massive Pond

Peacock is in a tough spot.

Despite growing its user base and ad revenue, the end may be near.

In fact, a merger between Warner Bros. Discovery and Peacock could be in the cards.

That’s pure speculation and something both company’s CEOs deny, but the mere rumor points to the shaking ground on which Peacock sits.

Speculation aside, Peacock is at a point in its progression where it’s either evolve or die.

With the OTT world expanding rapidly and the major players, including Netflix, Hulu, Amazon and HBO Max, continuing to eat ad budgets, long-term sustainability for Peacock seems unlikely.

Does Peacock actually suck?

Absolutely not.

But it could be too little, too.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.