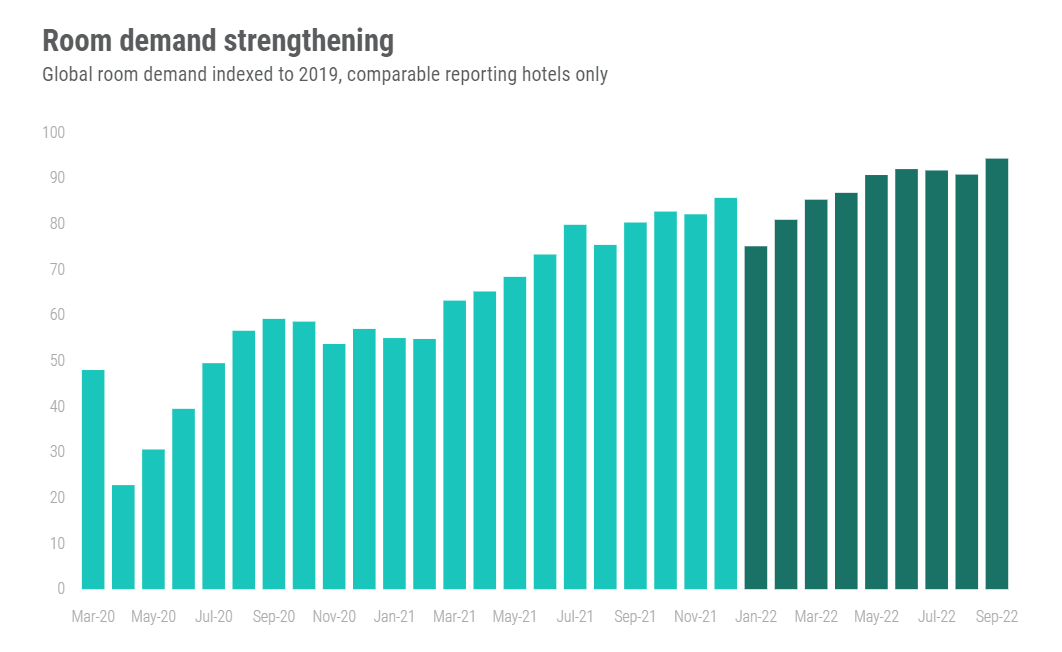

Global hotel hotel demand continues to strengthen, and the recovery index for the metric hit a pandemic-era high at the end of the third quarter of 2022. Among comparable, reporting hotels—those properties reporting data for the 2019 and 2022 year-to-date periods—September demand was just 6% shy of pre-pandemic levels.

September was the fifth consecutive month with global demand recovery at a relatively stable point, at slightly more than 90% of pre-pandemic levels. That means recovery hasn’t ramped up significantly since earlier this year, however, that isn’t necessarily a bad sign. Recall that for most of this COVID-era, leisure and/or domestic demand have been the primary drivers of hotel performance around the world. The moderation in recovery pace over the past several months suggests there has likely been a reset in demand mix, as above-average leisure demand heads toward normal levels and corporate travel picks up steam.

Groups have broadly started to return across most of the globe as well, and most countries have significantly reduced, if not completely dropped, international inbound travel restrictions, leading to increased international demand.

The shift in demand mix indicates sustainability for the hospitality industry, as reliance on the full historical complement of demand drivers should help hotels maintain demand across the seasonal shifts in demand, political instability, and economic challenges affecting the various world regions.

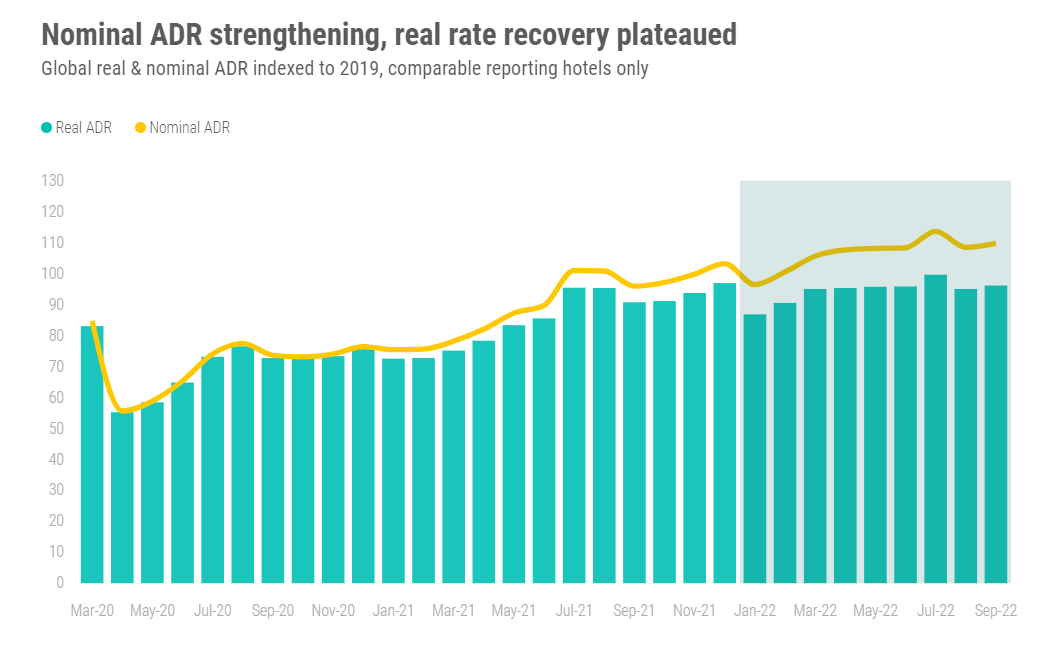

While demand tip-toes toward full recovery, average daily rate (ADR) has not just reached but surpassed pre-pandemic levels by a wide margin. While part of that growth has been driven by a global inflationary environment, real ADR, or ADR absent the impacts of inflation, has consistently remained at more than 90% of pre-pandemic levels.

Inflation may be a major consideration to rate growth, but the strong rebound in global demand has had more influence in pushing real ADR to new heights each month. Demand growth, more so than absolute demand levels, heavily influences ADR growth four to six months down the road. Thus, high demand growth today supports rising rates down the line.

Of course, while certain trends develop at a global level, the story is not always the same when drilling down to the country, market and submarket levels. Europe and the Americas are dealing with record-high inflation. The Middle East, in a strong position economically, looks to continue driving major event demand to counter high supply growth all while seeing some of its primary source markets affected by economic concerns. The Asia Pacific region only recently saw several major destinations (Japan, Thailand) reopen, and China, the region’s largest source market, remains restricted with “zero-COVID” policies.

What all this means is while encouraging trends continue to develop, recovery of revenue per available room (RevPAR) in real terms will continue to play out unevenly and remain elusive for another year or two depending on the region.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.