For the first time ever, Amazon.com Inc (NASDAQ: AMZN) hosted two Prime Day sales events in the same year—one in July and one in October of 2022. So how did the Amazon Prime Day 2022 results in October fare against previous Prime Days, as well as competing sales events held by retail competitors Walmart Inc (NYSE: WMT) and Target Corp (NYSE: TGT)? Consumer transaction data reveals that Amazon.com Inc’s U.S. consumer sales during the week of the Prime sales event in October 2022 were lower than Amazon Prime Day week in July 2022, but higher than Prime Day weeks in prior years. At the same time, Amazon’s week-over-week sales growth during the October event outpaced sales growth at Walmart and Target during their respective events in early October.

Amazon.com Inc (NASDAQ: AMZN) sales during the week of the Prime Early Access Sale in October 2022 were lower than during the week of Amazon Prime Day in July 2022

In late September, Amazon announced that it would hold a second discount event in 2022 called the “Prime Early Access Sale” from October 11-12. This is the second time that Amazon hosted a Prime Day event in October. The first time occurred in 2020, when the company shifted the date of its annual Prime Day from mid-July to mid-October in response to the COVID-19 pandemic.

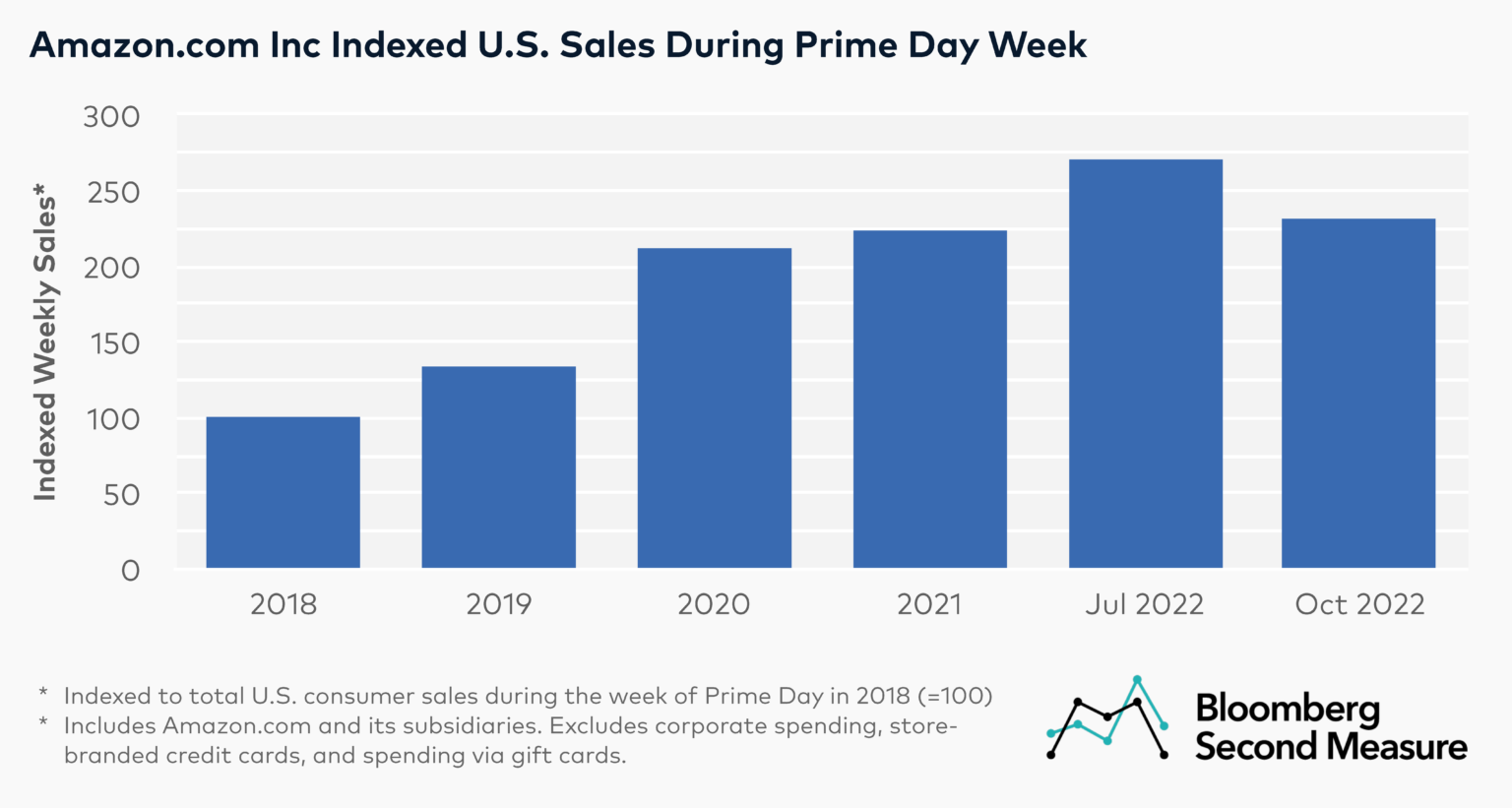

Our data shows that the Prime Early Access Sale in October 2022 bucked the trend of increasing sales for each successive Prime Day. Amazon.com Inc’s U.S. consumer sales during the week of the Amazon Prime Early Access Sale in October 2022 were 15 percent lower than Amazon Prime Day week in July 2022. However, sales were higher than Prime Day events before 2022, including 4 percent higher than sales during Prime Day week in 2021 and 9 percent higher than Prime Day week in 2020.

Additionally, the Amazon Prime Day 2022 results in July were the highest among Prime Day events in the last five years. Sales during the week of Prime Day in July 2022 were 21 percent higher than during Prime Week in 2021, 27 percent higher than Prime Week in 2020, and double the volume of Prime Week in 2019 (the first year the event lasted for a full 48 hours).

One potential factor in the sales decline between the two Amazon Prime Days in 2022 was a decrease in per-customer spending. The average weekly sales per customer during the week of the Prime Early Access Sale in October was $107, a 12 percent decrease from Prime Day week in July 2022 and about the same as Prime Day week in 2021. Conversely, average weekly sales per customer during the week of Prime Day in July 2022 was $122, a 16 percent increase compared to the previous year’s event.

How does Prime Day compare to holiday spending at Amazon?

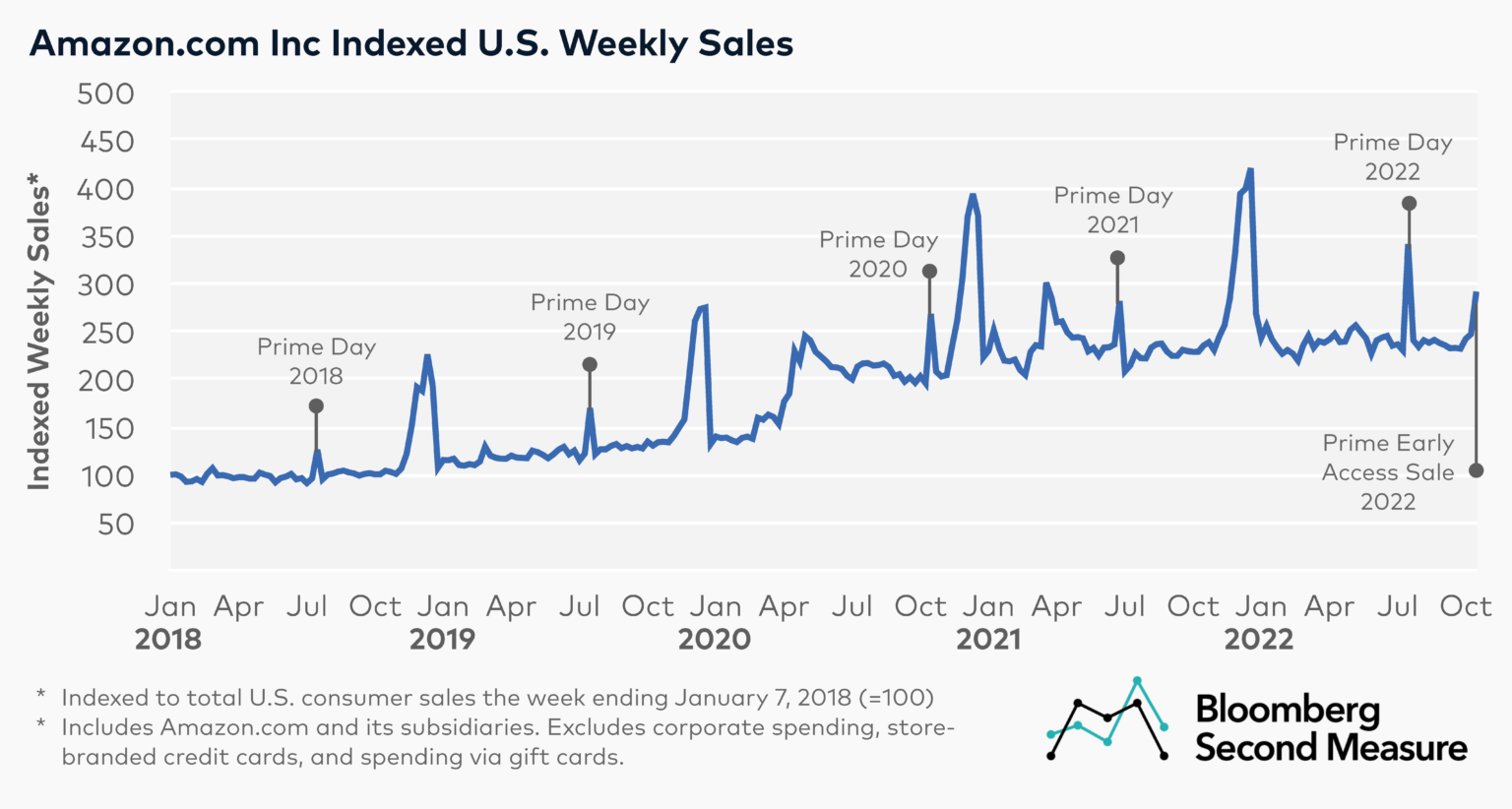

Consumer transaction data further shows that while Amazon experiences a clear sales boost from Prime Day, it is still lower than sales during December. For example, in 2021, weekly sales during the first three weeks of December were between 40 percent and 49 percent higher than sales during Prime Day week that year.

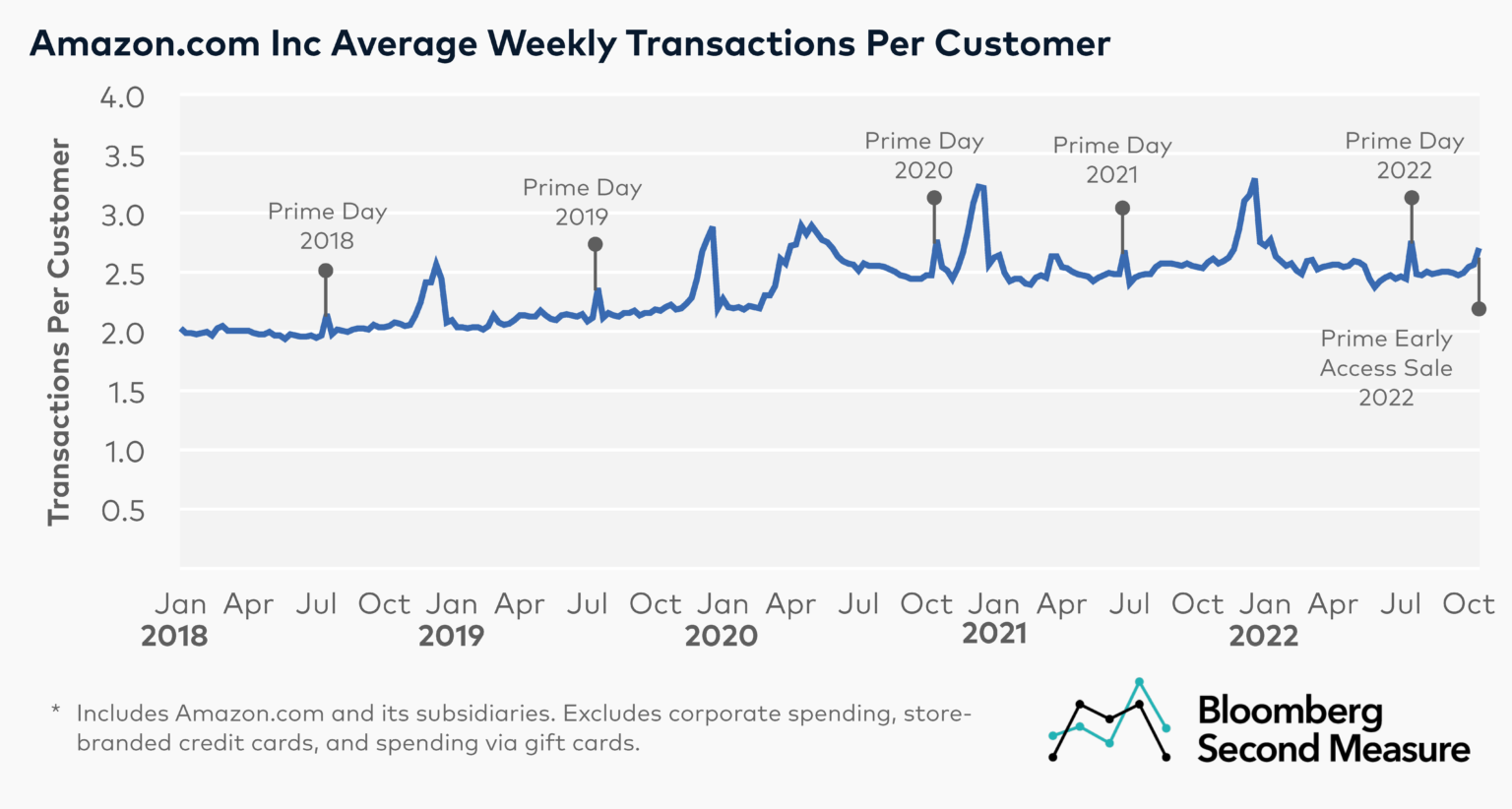

Increased shopping frequency is a trend likely impacting sales spikes during Prime Week and the weeks leading up to Christmas. During the week of Prime Day in July 2022, Amazon customers made an average of 2.77 transactions, a 13 percent increase from the previous week. During the week of the Prime Early Access Sale in October 2022, customers made an average of 2.71 transactions with Amazon, a 5 percent increase from the previous week.

Though Amazon.com Inc experiences a notable uptick in average transactions per customer during the week of Prime Day, the increase is smaller than during the holidays. For example, in the third week of December 2021, the average transactions per customer was 3.3.

How did the Prime Early Access Sale compare to similar sales events hosted by Target and Walmart in early October?

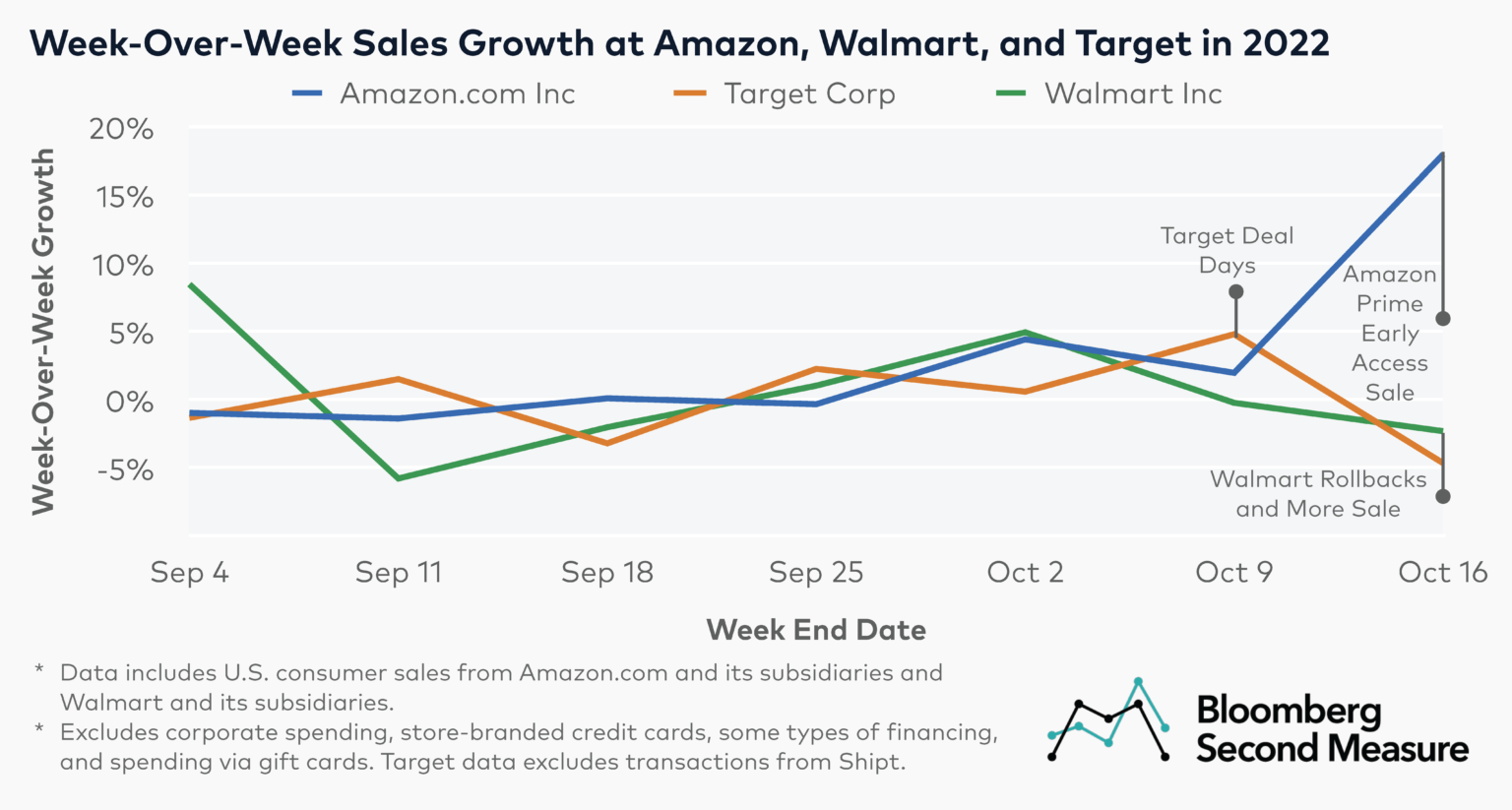

In addition to Amazon’s surprise Prime Day event, some retailers have also been launching sales events earlier in the fall to kickstart the holiday shopping season in 2022. Target launched its “Deal Days” about a week before the Prime Early Access Sale, while Walmart’s surprise “Rollbacks and More” sale took place the same week as Amazon’s event.

The week that Target’s Deal Days launched, Target sales grew 5 percent week-over-week. However, sales declined 5 percent at Target the following week, when Walmart and Amazon’s sales events launched. Amazon’s weekly sales during the Prime Early Access Sale in October 2022 increased 18 percent compared to the week before. Conversely, Walmart Inc sales declined 2 percent week-over-week during the week of its discount event.

Inflation and excess inventory are reportedly some of the factors prompting retailers and e-tailers to start their holiday sales events earlier this year and offer steeper discounts compared to 2021. In its recent third quarter earnings report, Amazon also forecasted weaker sales in its holiday quarter.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.