About the Placer.ai Mall Indexes: These Indexes analyze data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

The end of the pandemic was supposed to trigger an extended period of retail success, with brands finally seeing the wider constraints of COVID removed. Yet, with the decline of the pandemic came the rise of significant economic headwinds like rising inflation and gas prices. And so the challenges have continued with the retail sector pushing to cope with a seemingly endless period of volatility.

But how would malls cope in October following challenging summer months ahead of a critical holiday shopping season?

Falling Short of 2021 Heights

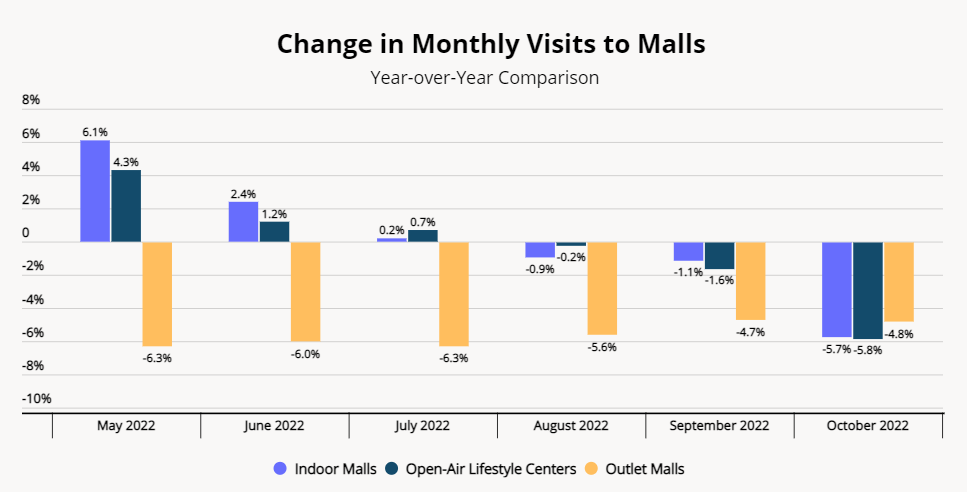

For the third consecutive month, the year-over-year (YoY) visit gap increased for Indoor Malls and Open-Air Lifestyle Centers with the two Indexes down 5.7% and 5.8% respectively. Outlet Malls also saw the continuation of YoY visit gaps, with traffic down 4.8%, a slight increase on September’s 4.7% visit gap.

However, the declines remained fairly limited in the face of significant economic headwinds, especially when considering the comparison to the unique strength that was seen in October 2021 for all three formats.

Potential to Overperform in 2022

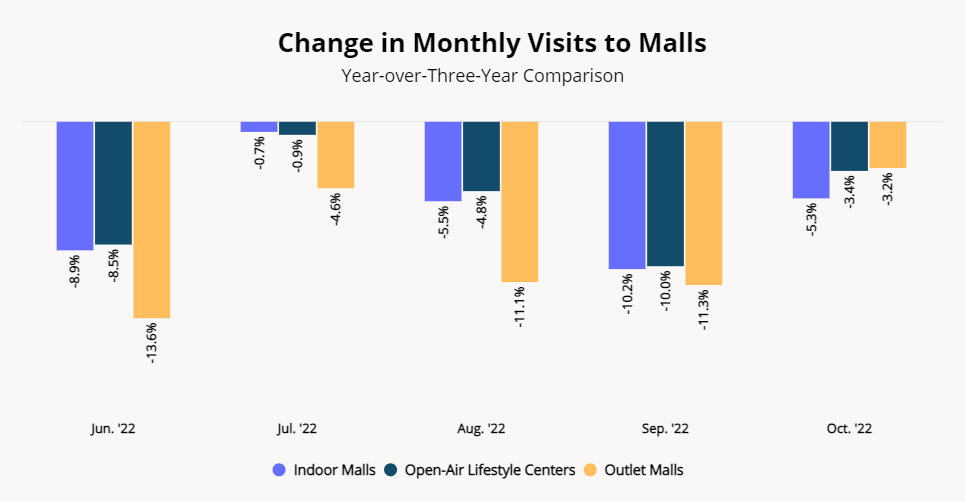

And in fact, the deeper one dives in, the more positive the scenario looks. Comparing these same months to their pre-pandemic equivalents in 2019 shows a much narrower visit gap across the board in October, showing the challenging comparison being made to October 2021.

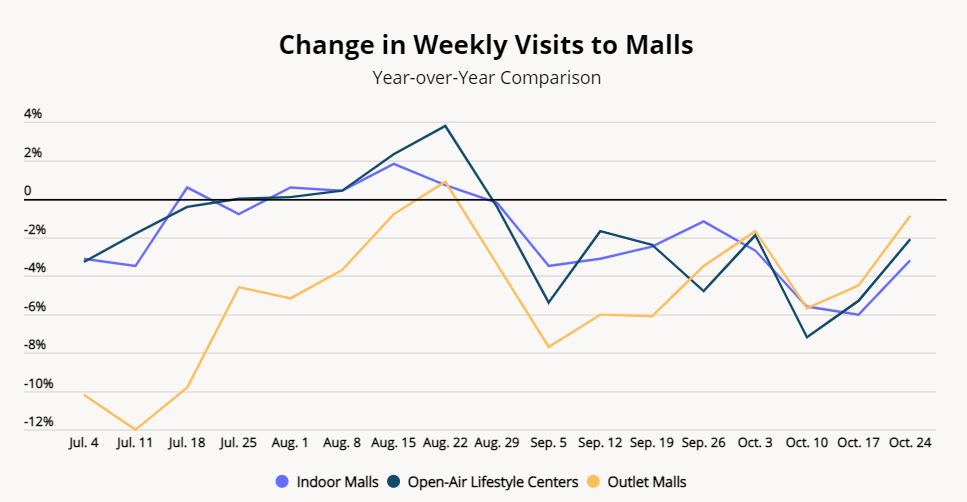

But looking at weekly visits reveals the true patterns currently impacting top tier malls and shopping centers. 2021 saw retailers aggressively communicate the need to begin the shopping season earlier than in the past in order to ensure visitors ended up with the products on their wish list in the face of significant supply chain and COVID concerns. The result was higher than normal visits in October.

Yet, these same pressures do not exist in 2022, and while a healthy portion of consumers do appear to be taking advantage of early shopping, the urgency is not the same. As a result, the weekly YoY visit gap has been shrinking steadily since mid-October, with the visit gap narrowing significantly by the end of the month. And this trend is unlikely to slow as the YoY comparison shifts from a particularly strong October in 2021 to a November that was heavily affected by rising COVID case numbers.

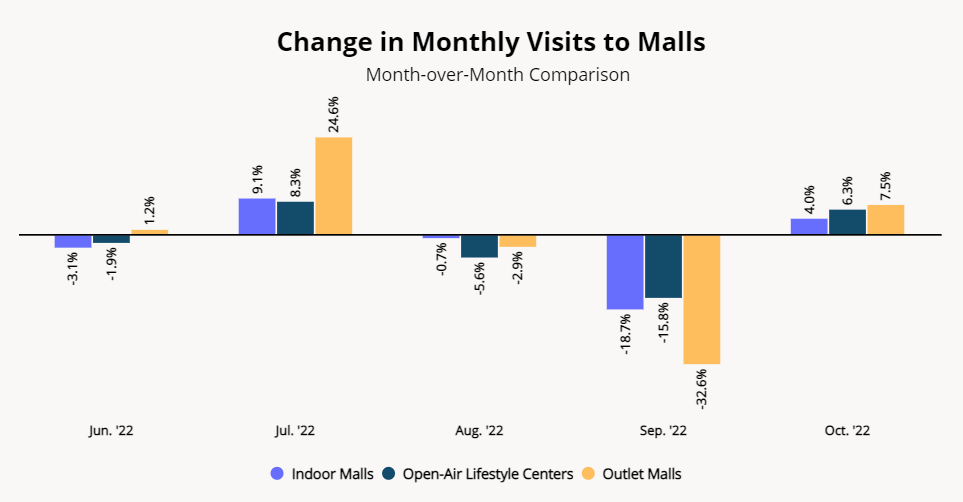

This could add fuel to a trend that has already been showing itself in October, as visits to all three shopping center formats were up Month-over-Month (MoM) after a difficult September. Indoor Malls saw an increase of 4.0% MoM, while Open-Air Lifestyle Centers and Outlet Malls were up 6.3% and 7.5% respectively. And Outlet Malls could be uniquely well positioned because of their orientation to value in a period of continued inflation.

These shifts are also only part of the reason for optimism. There is a high likelihood that key retail holidays like Black Friday play a bigger role in physical retail in 2022 than they did in 2021 considering the impact of Omicron in 2021. Pushes to handle excess inventory could drive more ‘door buster’ sales that incentivize in-store visits. In addition, the heavy limitations on 2021’s holiday season could power a renewed vigor for brick-and-mortar shopping in 2022 – especially considering the greater emphasis on experiences malls have made in recent years. The ability to provide a ‘full day experience’ alongside external shifts that privilege in-store visits should position all three formats well in the coming months.

Will malls see the culmination of their 2022 bounceback in the holiday season?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.