According to ATTOM’s Q3 2022 U.S. Home Equity & Underwater Report, 48.5 percent of mortgaged residential properties in the U.S. were considered equity-rich in the third quarter. The report noted that figure was up from 48.1 percent in Q2 2022 and 39.5 percent in Q3 2021.

ATTOM’s latest home equity and underwater analysis also noted the latest increase fell below other gains in recent years, but still marked the 10th straight quarterly rise, and resulted in virtually half of all mortgage payers landing in equity-rich territory.

The Q3 2022 report found that at least half of all mortgage-payers in 20 states were equity-rich in the third quarter, compared to only seven states a year earlier. According to the report, the highest levels of equity-rich properties around the U.S. remained in the West in Q3 2022, with six of the top 10 states located in that region. The report noted the top states were Vermont (75.9 percent of mortgaged homes were equity-rich), Idaho (65.8 percent), Arizona (63.4 percent), Florida (62.8 percent) and Utah (62 percent).

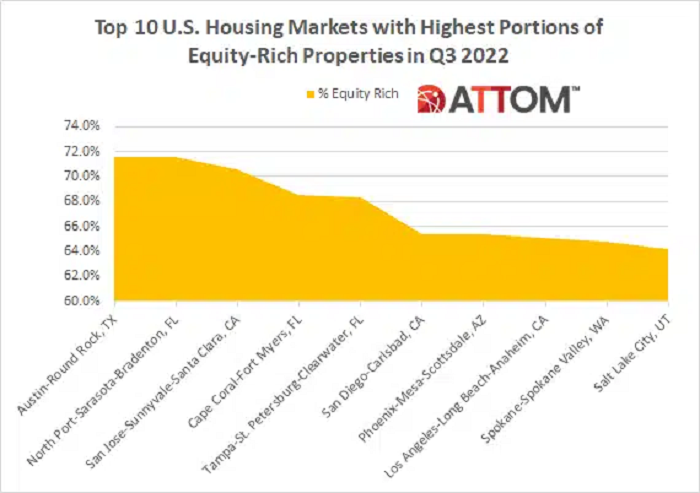

The report also found that among 107 U.S. metros with a population greater than 500,000, both the West and South dominated the list with the highest portion of mortgaged properties that were equity-rich in Q3 2022. The report noted that all but one of the top 25 were in those regions, led by Austin, TX (71.6 percent equity-rich); Sarasota-Bradenton, FL (71.6 percent); San Jose, CA (70.6 percent); Fort Myers, FL (68.5 percent) and Tampa, FL (68.3 percent); while the leader in the Northeast region again was Portland, ME (63 percent), and the top metro in the Midwest continued to be Grand Rapids, MI (51.9 percent).

In this post, we dive deep into the data to round out the complete list of the top 10 metro areas with the highest portions of equity-rich properties in Q3 2022. Rounding out the top 10, following Tampa, FL are: San Diego-Carlsbad, CA (65.4 percent); Phoenix-Mesa-Scottsdale, AZ (65.3 percent); Los Angeles-Long Beach-Anaheim, CA (65.1 percent); Spokane-Spokane Valley, WA (64.7 percent); and Salt Lake City, UT (64.2 percent).

The report also noted that just 2.9 percent of mortgaged homes, or one in 35, were considered seriously underwater in Q3 2022 – the same as the 2.9 percent recorded in Q2 2022, but down from 3.4 percent, or one in 29 properties, in Q3 2021.

ATTOM’s latest report found that the top 10 states with the highest shares of mortgages that were seriously underwater in Q3 2022 were in the South and Midwest, with the top five including Louisiana (10.8 percent seriously underwater), Mississippi (9 percent), Iowa (6.5 percent), Illinois (6.2 percent) and Kentucky (6 percent).

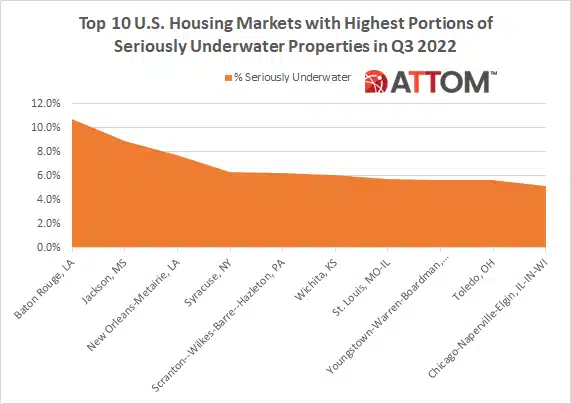

Also according to the report, among the 107 metros with a population greater than 500,000, those with the largest shares of mortgages that were seriously underwater in Q3 2022 included Baton Rouge, LA (10.7 percent); Jackson, MS (8.9 percent); New Orleans, LA (7.8 percent); Syracuse, NY (6.3 percent) and Scranton, PA (6.2 percent).

In this post, again we dive deep into the data behind ATTOM’s Q3 2022 home equity and underwater report to round out the complete list of the top 10 metros with the largest shares of seriously underwater mortgaged properties in Q3 2022. Rounding out the top 10, following Scranton, PA are: Wichita, KS (6.1 percent); St. Louis, MO-IL (5.7 percent); Youngstown-Warren-Boardman, OH-PA (5.7 percent); Toledo, OH (5.6 percent); and Chicago-Naperville-Elgin, IL-IN-WI (5.2 percent).

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.