With the peak of the retail holiday season kicking into high gear, we dove into the visit performance for two of retail’s giants.

Visits Show Relative Strength Post-Summer Season

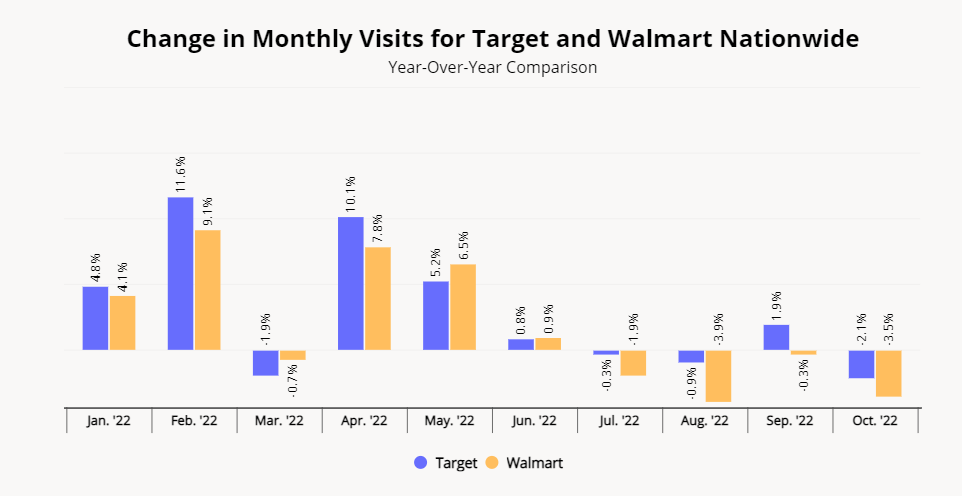

In 2021, both Target and Walmart saw uniquely strong performances during Back-to-School season and again in October as retailers pushed to extend the holiday shopping period earlier. Last year’s visit peaks set a critical context for understanding the traffic to both retailers in recent months. Target saw year-over-year (YoY) declines of 0.9% and 2.1% in August and October – relatively minimal considering the heights hit during those months in 2021. September – a slightly weaker month in 2021 – saw a YoY visit increase of 1.9%. This shows Target’s success in keeping its visits relatively stable and maintaining the strength gained since the onset of the pandemic.

Walmart saw a similar pattern with YoY visits down just over 3.0% in August and October, while September visits were essentially in line with 2021 levels. For both retailers, the ability to maintain strength is impressive and indicates the ongoing demand they are able to generate.

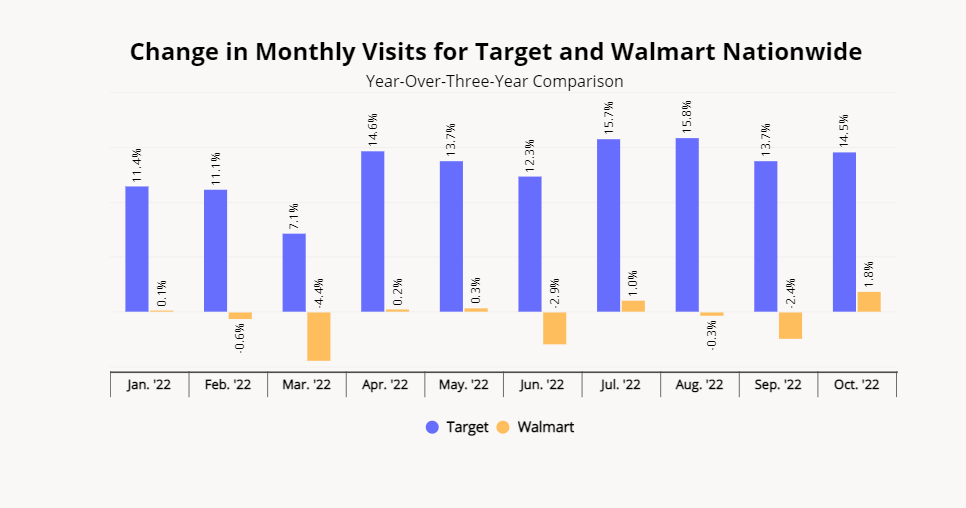

This strength becomes even clearer when looking at those same months compared to a pre-pandemic 2019. In recent months, year-over-three-year (Yo3Y) visit growth for Target has consistently surpassed 13.0%, while Walmart saw its foot traffic increase most months as well.

Positive Signs for the Holidays

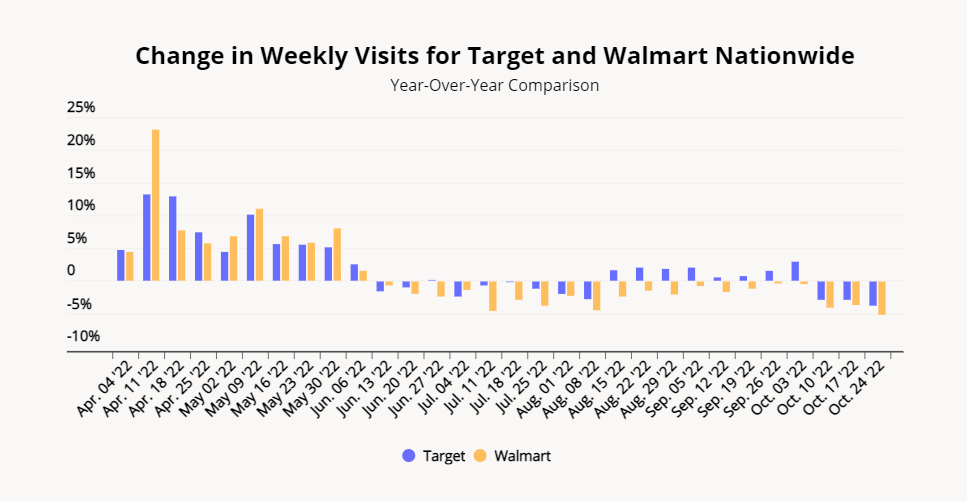

And while the overall metrics look strong, there are other perspectives that lend further confidence to the power both could show during the holiday retail season. Target saw visits up 2.9% the week beginning October 3rd – largely a result of the success of its Deal Days promotion.

This is incredibly important ahead of the holidays as it shows that retail ‘holidays’ have maintained their ability to drive urgency and interest. So while key days like Black Friday have struggled to reach their former peaks, they could hold significant opportunities this year.

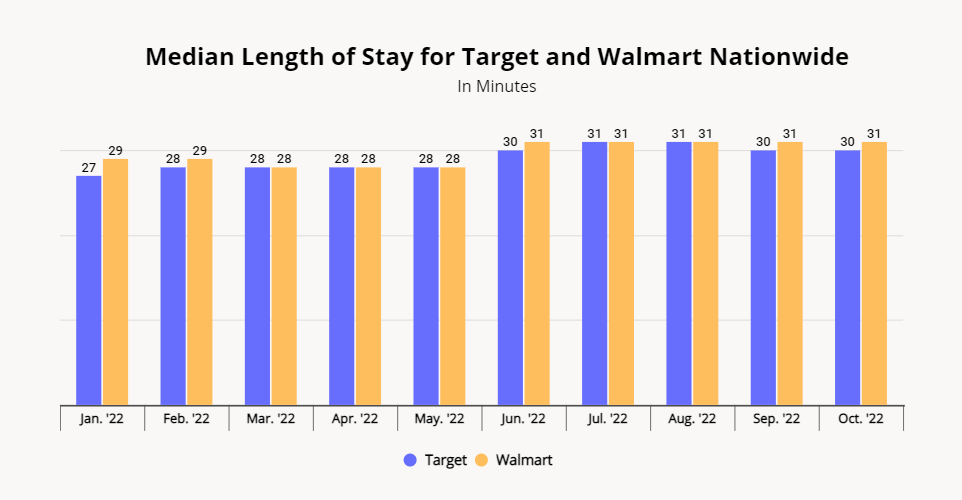

In addition, while visits may have been down in some months, there are signs that consumers are simply shifting their patterns as opposed to reducing their interest. Median visit duration for both chains has been up in recent months, likely indicating the return of ‘mission-driven shopping’ – a trend where visitors look to accomplish more with fewer visits – in this case, likely to offset high gas prices. The increase in visit duration shows continued consumer demand for both retailers, a critical factor ahead of the holiday shopping season peak.

Long Term Strength Solidified

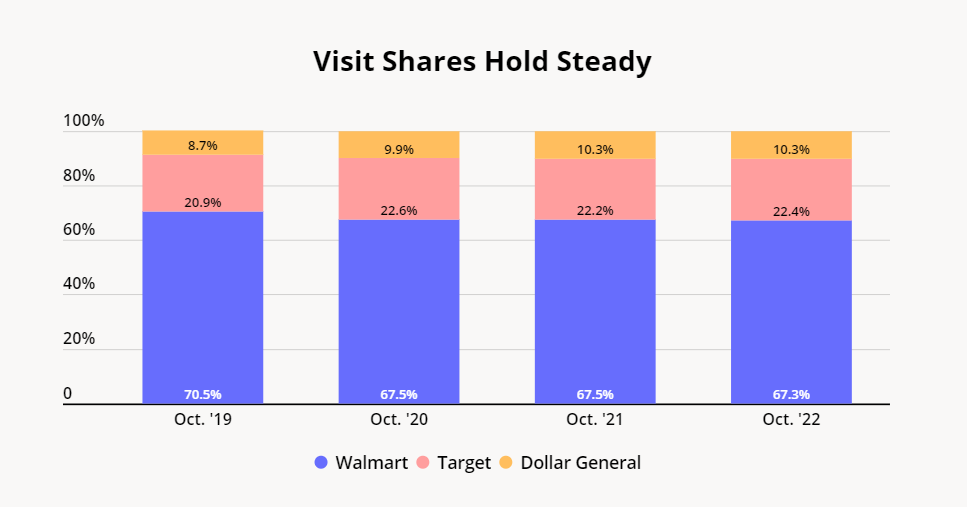

A final element that shows the continued strength of both Target and Walmart is the visit share breakdown compared to rising competitors. Dollar General has seen rapid store expansions in recent years, but the wider visit share has remained largely the same.

The stable visit shares show both the resilience of Walmart and Target in the face of rising competition, and is especially important considering the unique positioning dollar brands have had as a result of the pandemic’s economic impact and recent inflation. In short, both Target and Walmart not only managed to navigate the pandemic environment effectively, but seem equally well positioned in the face of significant economic headwinds.

Will Target and Walmart continue their dominance into the holiday season?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.