As inflation in categories like grocery restricts consumer spending in other areas, and as rising interest rates make auto loans more expensive, have used car sales hit a speedbump? Following up on our data’s accurate capture of last week’s CVNA reported sales decline – which sent the stock plummeting 50%, in today’s Insight Flash we dig into how competitor sales are trending, how the average inventory price compares to the average selling price of vehicles, and how many days vehicles are staying listed on websites before being sold.

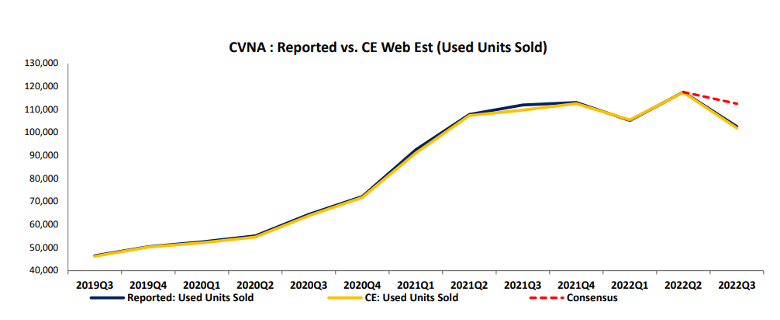

CE Web vs. Reported Units Sold

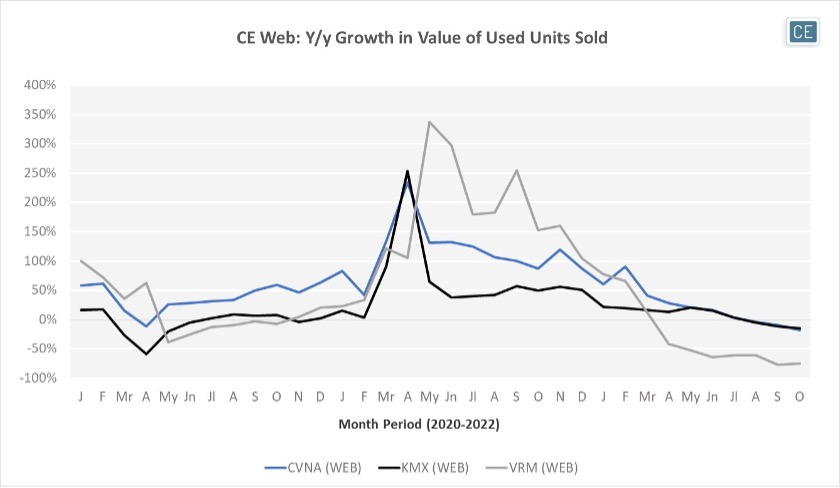

Year-over-year spend growth in our CE Web data for CVNA used vehicles has been slowing since March of 2022, entering negative territory in August. Although KMX spend growth matched CVNA’s in April 2021, it showed a much steeper decline from that peak, with another large decline in January 2022. Spend growth started to even out with CVNA in May of 2022, with year-over-year spend changes roughly in line since then. VRM, in contrast, was able to maintain much higher overall spend growth in the later months of 2021, but lapping these harder compares caused year-over-year declines in April that were much sharper than anything CVNA and KMX have experiences year-to-date. These declines have accelerated over the summer and into the fall.

Used Vehicle Spend

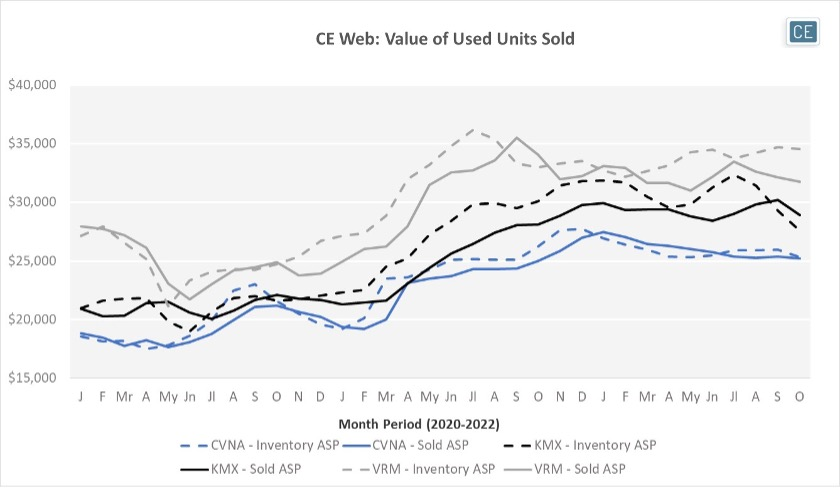

Although the average value of vehicles sold for CVNA, KMX, and VRM has been generally increasing throughout 2021, more recent trends have not been as favorable. CVNA’s average price per vehicle sold is down -8.2% since January, more than twice the decline of -4.0% for VRM and -3.4% for KMX. VRM seems to be the slowest of the three tracked players at adjusting its inventory strategy – the average inventory value is actually up 5.6% from the beginning of the year, while CVNA’s has dropped -6.0% and KMX’s has fallen -13.5%.

Average Price

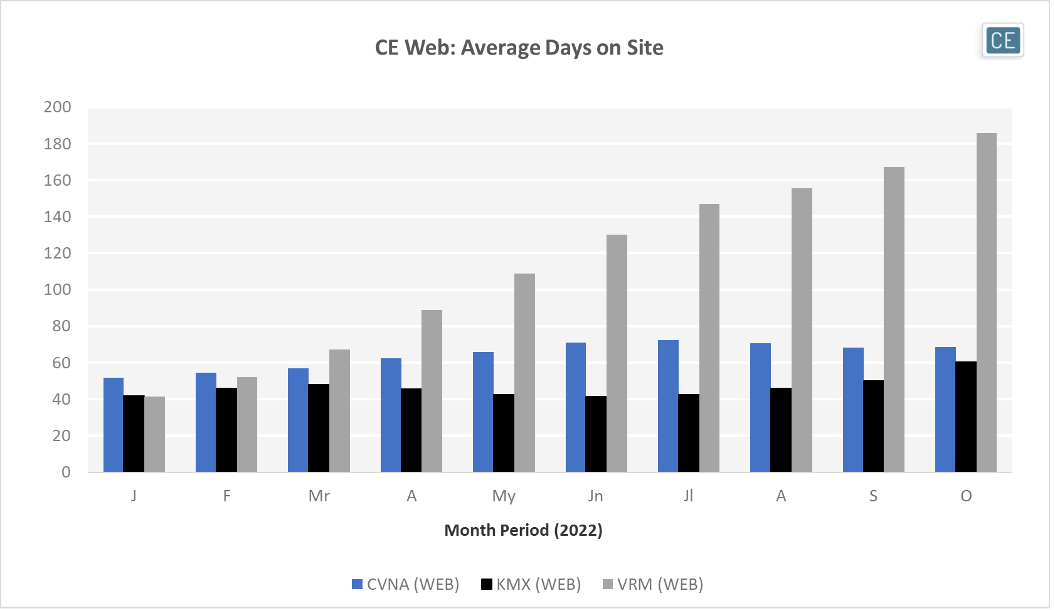

Some of the reason VRM’s inventory may be so expensive is that cars purchased earlier in the year when prices were higher haven’t turned over yet. The average number of days a vehicle sits on the site has been increasing throughout the year, hitting 185 days and over half the year in October. Increases since the beginning of the year have been still present, but less dramatic, for CVNA and KMX. KMX vehicles now are listed on their site for an average of 60 days, up 19 from January. CVNA vehicles are now listed on their site for an average of 69 days, up 17 from January.

Days on Site

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.