We dove into the foot traffic data to the off-price apparel sector and took a closer look at two leading sports retailers, Hibbett Sports and Dick’s Sporting Goods to see what visits can tell us about the upcoming holiday season.

Continued Visits to Budget-Friendly Retailers

There are four chains that dominate the off-price apparel category – T.J. Maxx and Marshalls, which are owned by the same parent company, Ross Dress For Less, and Burlington. These retailers performed remarkably well during the pandemic, consistently outperforming the overall apparel sector – a trend that has persisted in recent months.

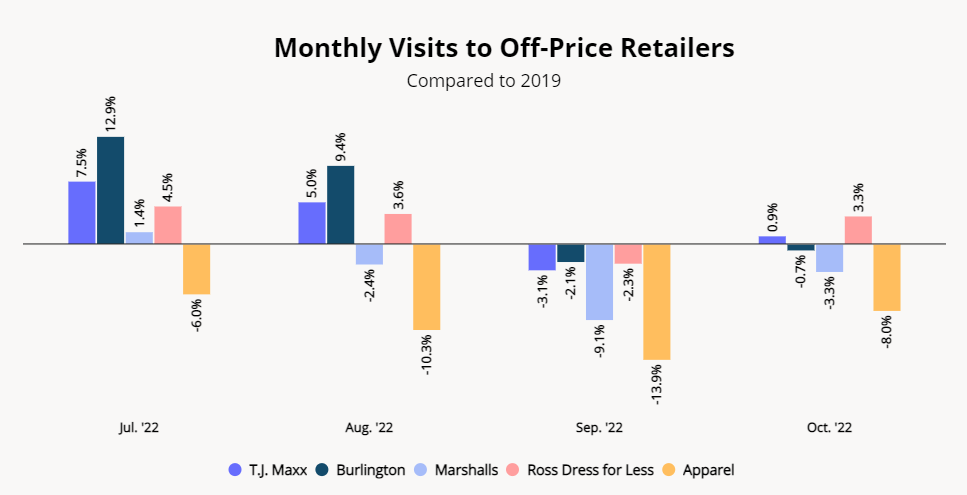

Year-over-three-year (Yo3Y) foot traffic to Ross and T.J. Maxx was up 3.3% and 0.9%, respectively, in October 2022, while Burlington foot traffic remained on par with pre-pandemic levels with just 0.7% fewer visitors than three years prior. Marshalls’ visits fell 9.1% Yo3Y in September 2022, but by October the chain had narrowed its visit gap to 3.3% while the wider apparel category saw its foot traffic decline 8.0% Yo3Y.

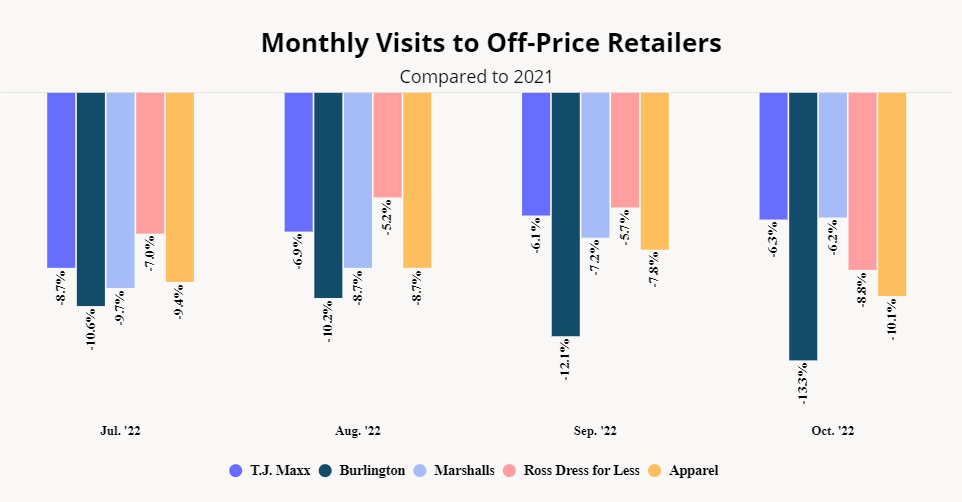

Year-over-Year Visits Returning to Normal

The Yo3Y visit numbers provide critical context for year-over-year (YoY) foot traffic declines in the off-price apparel segment. All four brands saw their visits fall relative to 2021, but the drop in traffic is likely more of a testament to off-price’s particularly strong performance last year than to any real dip in demand.

Off-price’s recent performance may also be hampered by the inventory gluts impacting the wider apparel space. With customers across the board cutting spending, many traditional apparel retailers have begun offering steep discounts to move stock out of overflowing warehouses, which could be cutting into off-price’s customer base.

Still, these inventory surpluses may ultimately help the category, as products not sold through traditional channels are likely to end up on off-price retailers’ shelves. And once excess inventory clears conventional retail channels, apparel brands may well raise their prices to offset the previous discounts – and the famously recession-proof off-price segment will be well positioned for further growth.

Hibbett and Dick’s on a Winning Streak

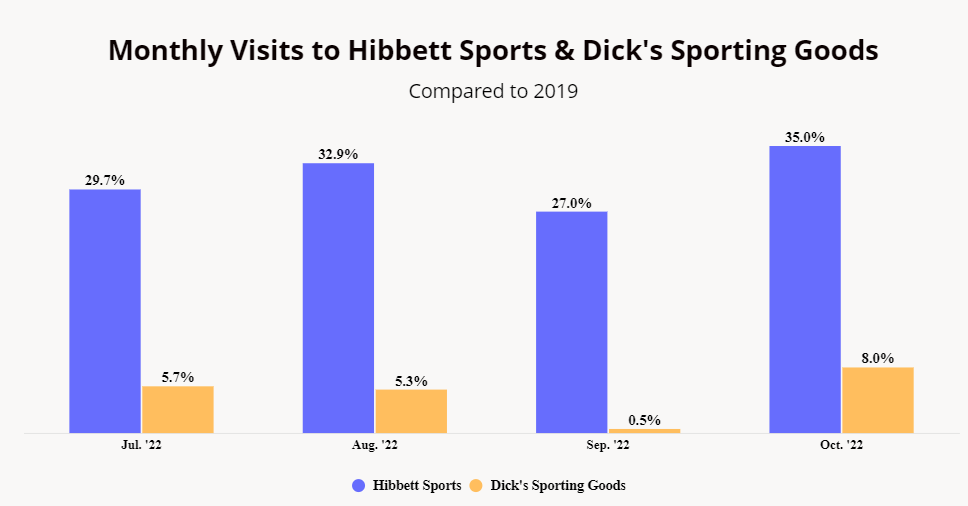

The sportswear and sporting goods market has been reaping the benefits of Americans’ interest in health and wellness for several years. Dick’s Sporting Goods is a leading name in the industry that operates several outdoor-focused chains in its 850-strong store fleet, including Dick’s House of Sport, Field & Stream, and Golf Galaxy. Hibbett is another major sporting goods chain with nearly 1,100 stores across the U.S. that operates several brands, including sneaker destination City Gear.

Hibbett and Dick’s performed well during the pandemic, and this strength has persisted in the face of the current economic headwinds. Both chains exceeded their Yo3Y visits by comfortable margins, with October 2022 visits up 35.0% for Hibbett and 8.0% for Dicks compared to 2019 – a promising performance ahead of a critical holiday season.

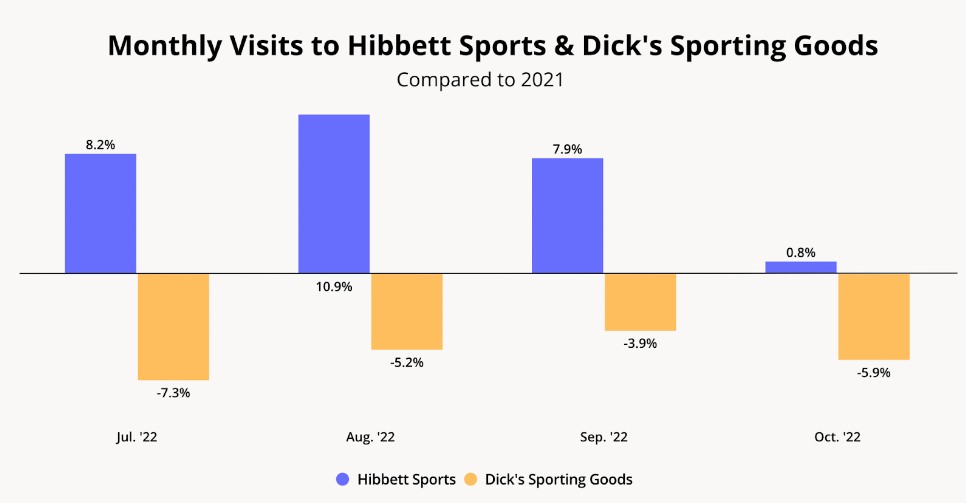

Game On Ahead of The Holidays

But while both chains outperformed their Yo3Y foot traffic levels, Hibbett appeared to pull ahead of Dick’s on a YoY basis. Despite inflation and supply-chain challenges, Hibbett posted YoY visit growth of 0.8% in October, while Dick’s visits fell 5.9% in the same period. And while the relatively minor visit gaps in the face of 2021’s outsized performance and current economic conditions indicate that Dick’s is still extremely well positioned, Hibbett’s continued YoY growth may mean that the sporting goods space is becoming increasingly competitive.

Hibbett’s Growing Visit Share

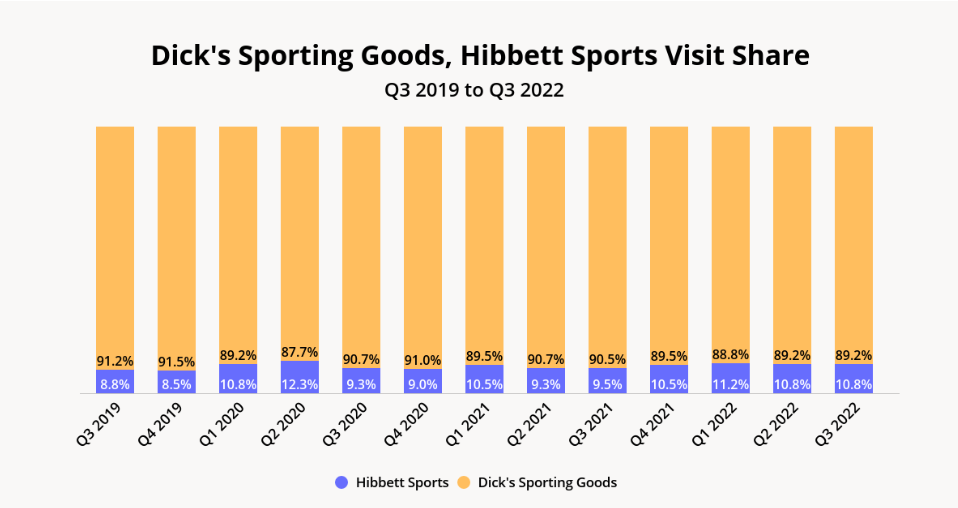

Looking at historical foot traffic data indicates that Hibbett has been steadily cutting into Dick’s Sporting Goods visit share. In Q3 2019, Dick’s received 91.2% and Hibbett received 8.8% of the retailers’ combined visit share. But thanks to Hibbett’s successful expansion, the Alabama-based retailer grew to command 10.8% of the two retailers’ combined visit share by Q3 2022.

Of course, Dick’s visits still far outnumber Hibbetts’ – and visits to Dick’s stores represent only a fraction of the foot traffic to Dick’s Sporting Goods’ wider ecosystem of stores. But the recent success of Hibbett does mean that the brick-and-mortar sporting goods space is getting slightly more competitive. And with interest in fitness at an all-time high, consumer demand for sportswear and equipment is likely strong enough to sustain even further growth in this arena.

Post-Pandemic Predictions

The upcoming holidays will be closely-watched as the first truly post-pandemic shopping retail season kicks off. Off-price retailers are poised to benefit from a customer base looking to cut costs while the sporting goods space can hope to continue reaping the benefits of increasingly health conscious consumers.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.