About the Placer.ai Mall Indexes: These Indexes analyze data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

When we last looked at malls, there was an expectation that declines compared to 2021 in October could actually signal potential strength in November and on Black Friday. Yet, that potential failed to materialize, with Black Friday and the corresponding weekend seeing visit declines compared to a pre-pandemic 2019 and even 2021.

But there’s more to the mall story in 2022, and this could have very interesting implications for retail strategies moving forward.

Holiday Pattern Shifts

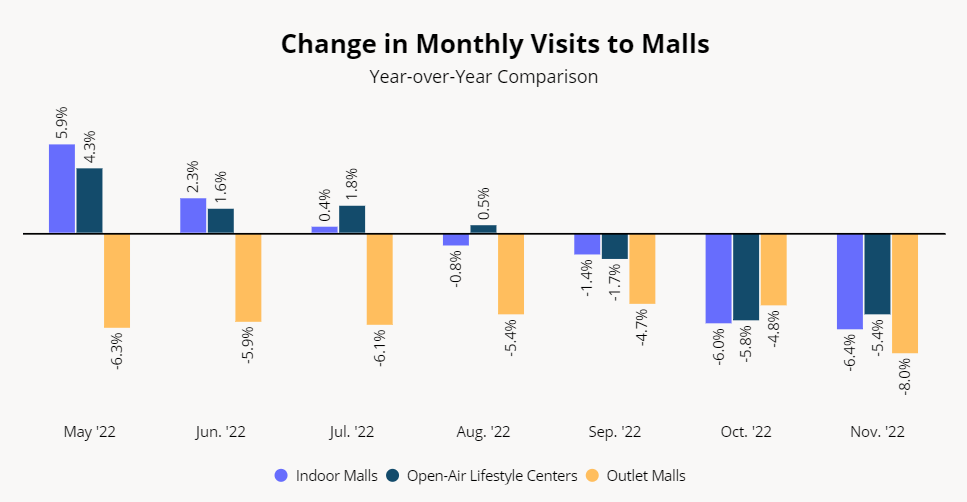

In November, visits for the indoor malls were down 6.4% year-over-year (YoY), while visits to open-air lifestyle centers were down 5.4%. These were essentially the same metrics as were seen in October, which shows a flattening of the current visit rates. Yet, while October visits were being compared to an especially strong month in 2021, November visits were going against a relatively easier comparison to a more challenged month in 2021.

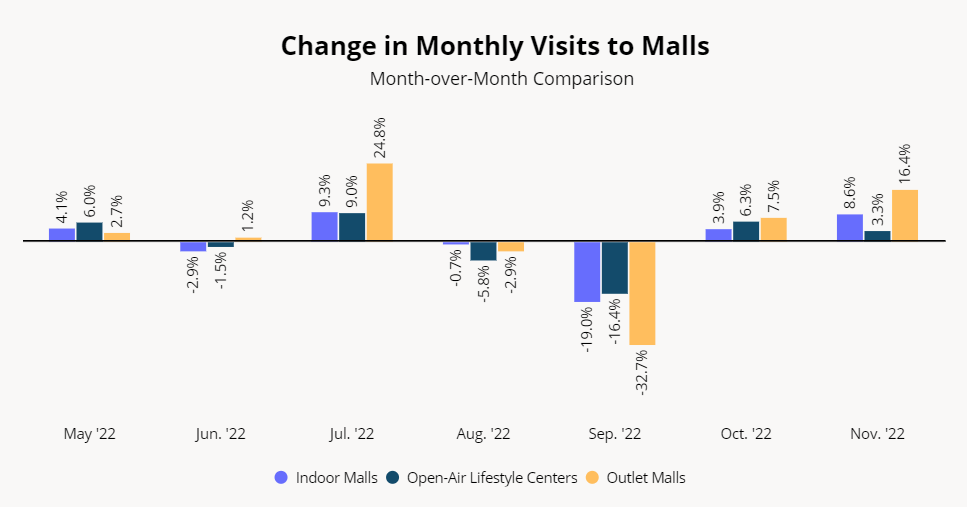

November also marked the second straight month of month-over-month (MoM) visit growth for all three formats, with outlet malls seeing the strongest jump of 16.4%. These jumps – on the back of a strong early shopping season in October – show the continued demand for November mall visits as part of the wider holiday retail season.

However, when seen in historical context, it also shows the impact of the extended holiday season and new shopping behaviors. From 2017 through 2019, the average increase in visits between October and November for indoor malls was 21.7%, while average MoM increase during that time was 12.1% for open-air lifestyle centers and 34.0% for outlet malls. In 2021 and 2022, the average MoM increase between October and November was 8.8% for indoor malls, 3.0% for open-air lifestyle centers and 18.3% for outlet malls. This shows a significant shift in the overall centrality of November shopping within the wider holiday retail context – a reality that has benefits and risks for retail.

The Bright Side for Malls

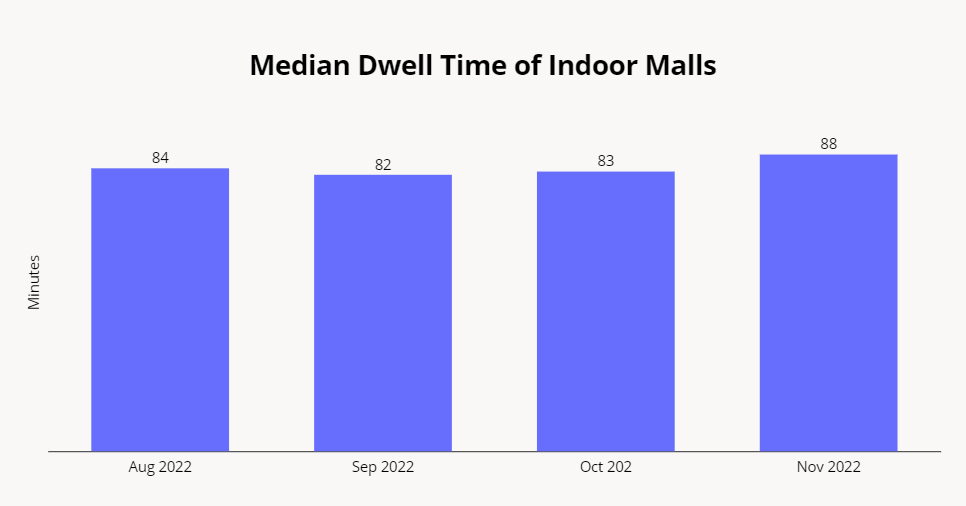

While the combination of the YoY drops alongside November’s declining centrality could be cause for concern, there are also important signs that show retail’s evolving, and in some ways, improved position. Indoor malls saw a 6.0% increase in median visit duration between October and November – indicating that while visits may have decreased, the value of each of those visits likely increased.

This is also a testament to the more ‘well-rounded’ experience top tier malls are aimed at providing and to their ability to bring in the right customer for a more comprehensive visit.

And it touches on overall spend too. According to Salesforce, Average Order Volumes online were up over 5% on Black Friday and the Saturday that followed, even though both days saw online visits either flat or down. These increases in order value alongside the decreases in overall visits online and offline indicates that shoppers are coming with more intent and more focus than before. This is likely happening in brick and mortar as well making each visit more significant for offline and online sales, especially since physical retail visits are playing an ever increasing role in the product discovery process.

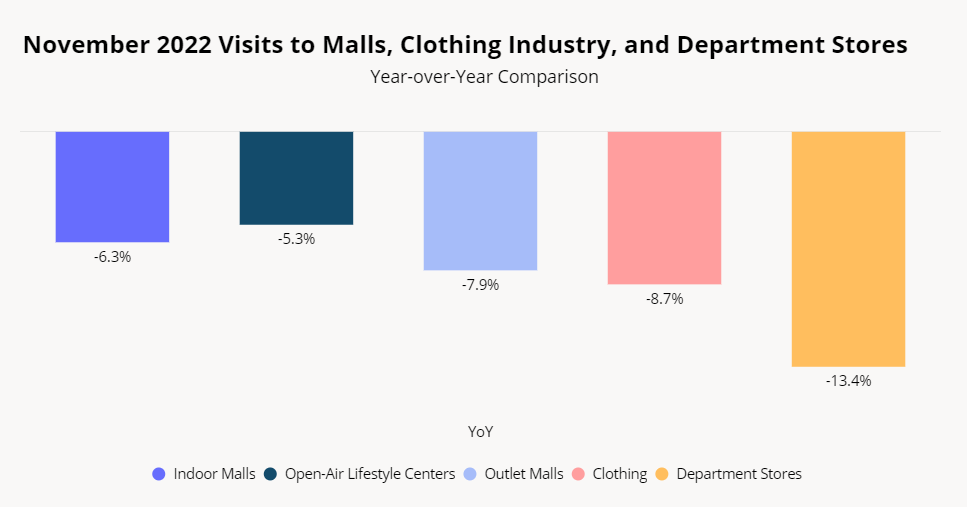

Another sign of the evolving strength is the larger declines being seen in ‘traditional’ mall anchors like department stores and apparel. Visits to those segments were down even more than malls, indicating that the shifts malls have been making to broaden their tenant mix are helping to offset holiday shopping changes.

It’s also important to note that the holiday season isn’t over – and malls often get a significant foot traffic boost closer to the end of the year, as last-minute gift shoppers head to the mall to make some final purchases before the holidays. So while visit numbers remained muted over Black Friday, there is still an entire month to this year’s holiday retail season – and the pre-Christmas gift scramble may well bring the category’s foot traffic levels up in December.

Will super Saturday drive last minute visit spikes to malls this year?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.