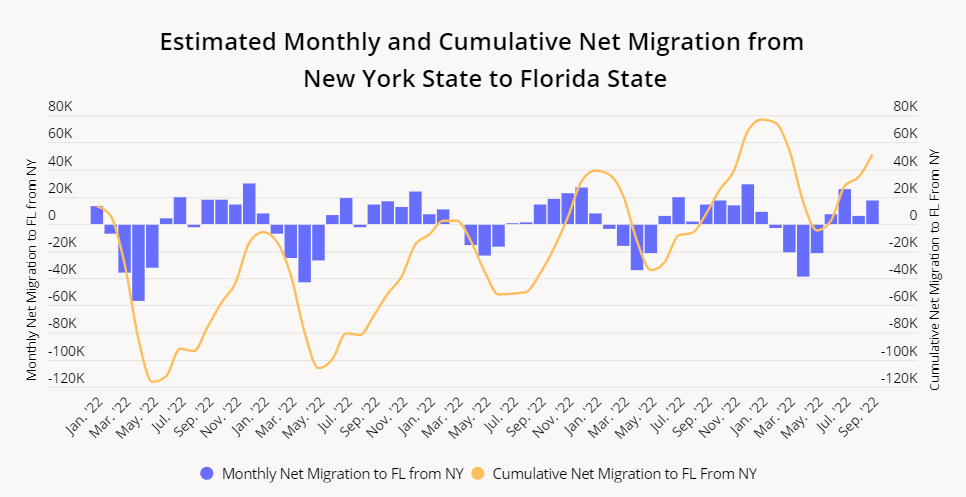

Long a popular destination for New Yorkers on the move, Florida boasts an estimated 1.6 million residents hailing from the Big Apple. Warmer weather, inviting beaches, and a lower cost of living have all been cited as factors contributing to the Sunshine State’s draw. With no state income or payroll taxes, Florida is also a preferred destination for many entrepreneurs seeking a more business-friendly regulatory environment.

Greater New York Area Heading South

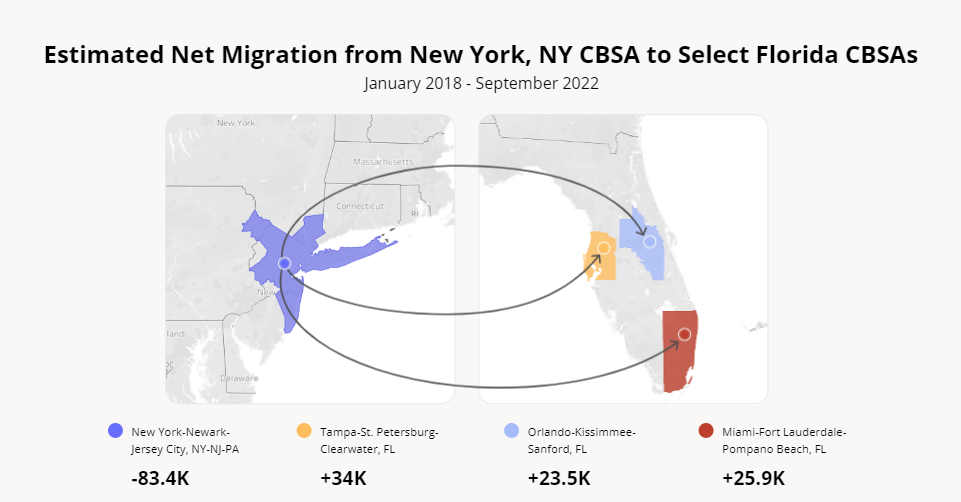

Focussing on former residents of the New York-Newark-Jersey City CBSA heading to Florida paints an even more striking picture than looking at southbound migration out of New York State. Since January 2018, more than 140,000 people from the greater New York area – or the New York-Newark-Jersey City CBSA – have made Florida their home. This trend intensified in the wake of COVID, as office closures and expanding work-from-home opportunities freed people up to seek cheaper housing and improved living standards outside the city. Many of these migrants flocked to major metropolitan areas, like Tampa, Miami, and Orlando, each of which experienced a net influx of more than 20K former New Yorkers since January 2018.

The data on New Yorkers moving to these three metropolitan areas reveals some common trends. First, migration to all three Florida CBSAs analyzed has traditionally followed (somewhat different) seasonal patterns, which were disrupted to varying degrees during COVID. Second, in all three cities, cumulative net migration from the New York region increased significantly following the pandemic – meaning that overall, a lot more people moved to these areas from New York than the other way around. And third, as often happens when wealthier populations converge on more affordable areas, Tampa, Orlando, and Miami have all experienced a significant rise in home prices.

But the data also reveals some interesting differences between the three locales. In this blog post, we’ll dive into the location analytics to examine each city’s specific migration trends and explore how influx from the Empire State has impacted local real estate markets.

Tampa: On the Up and Up

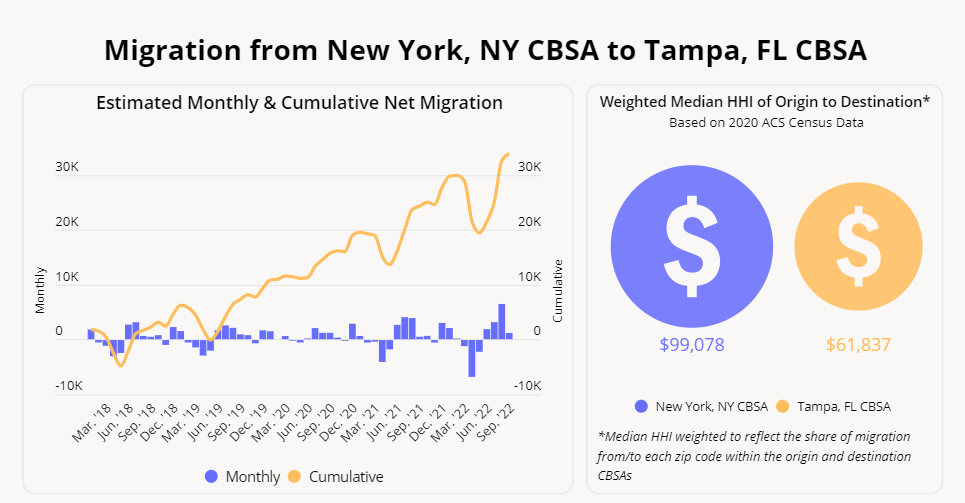

The Tampa CBSA, which includes St. Petersburg and Clearwater, has become a key destination in recent years for New Yorkers seeking to improve their quality of life.

Traditional Seasonal Patterns

The yellow line in the graph below represents cumulative net migration from New York to Tampa since January 2018, and the blue bars represent the net migration between New York and Tampa each month – positive if more people moved from New York to Tampa, and negative if the reverse occurred.

Location intelligence shows that peak season for New Yorkers relocating to Tampa has traditionally been in the summer. In 2018 and 2019, net migration from New York to Tampa reached its highest points during the summer months, with smaller upticks in December and January. Between February and May of those years, net migration remained negative, with many New Yorkers leaving the area for the spring.

COVID’s Impact

In 2020, negative net migration all but ceased, as more and more New Yorkers chose to ride out the pandemic down south. Spring outbound movement from Tampa to New York began to rebound in 2021, and in 2022 even exceeded pre-pandemic levels, with more than 7000 people leaving Tampa for New York in April 2022 alone. Still, the number of New Yorkers remaining in Tampa has stayed high – with cumulative positive net migration reaching more than 30K in September 2022.

Skyrocketing Rental Rates

To get a sense of how this New York influx may be impacting demographic trends, we compared the median household income (HHI) for the zip codes of New Yorkers moving to the Tampa area with the median HHIs of their destination zip codes. While New Yorkers relocating to Tampa tend to earn less than those moving to Miami (see below), the median household income of this population is a whopping 60.2% higher than those of the local population.

This demographic shift appears to have had a dramatic impact on the Tampa real estate market. Once known for its affordable housing, the city has seen rental rates skyrocket since 2020, surpassing the national average in 2021. And like Miami and Orlando, Tampa remains one of the few metropolitan areas nationwide where housing prices continue to soar despite rising interest rates.

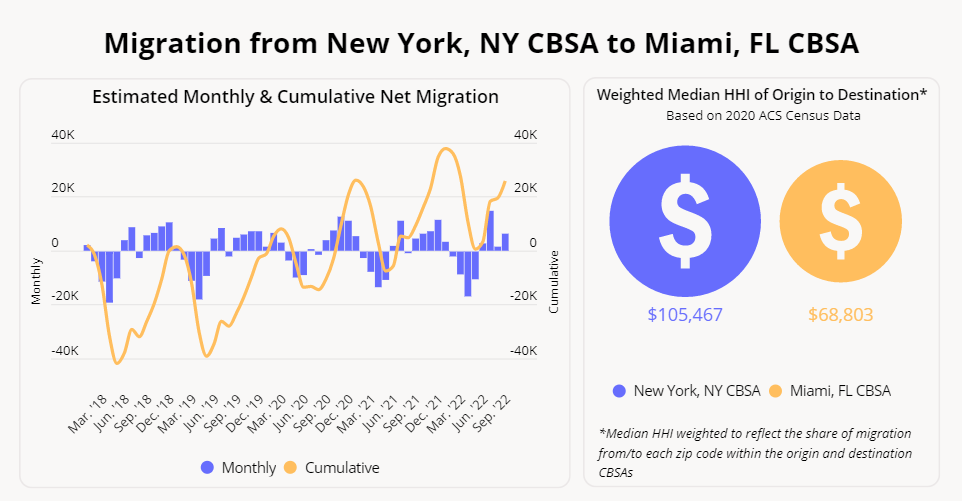

Miami: Not Just for Snowbirds

The Miami CBSA, which encompasses popular hotspots like the City of Miami, Boca Raton, and West Palm Beach, has also been a go-to destination for New Yorkers for years. Between January 2018 and September 2022, the area experienced a net influx of almost 26,000 people from the New York area.

Traditional Seasonal Patterns

Unlike Tampa, location data from 2018 and 2019 shows that migration to Miami from New York has typically peaked in the winter, when snowbirds flock to the popular beach town to escape the cold. Then, starting in February, net migration turned negative, as the temporary residents headed back home. Following the spring exodus, migration from New York to the Miami CBSA picked up again in June and July, indicating that many New Yorkers spent their summer vacations at the beach.

Pandemic Disruptions

The pandemic disrupted these seasonal patterns, with positive net migration continuing through March 2020. Negative net migration resumed the following month, though at much lower levels than in previous years. Then, in June 2020, in another sharp deviation from the pre-pandemic norm, net migration remained negative, as many New Yorkers began returning home and others canceled plans to summer in Florida.

A Shifting Baseline

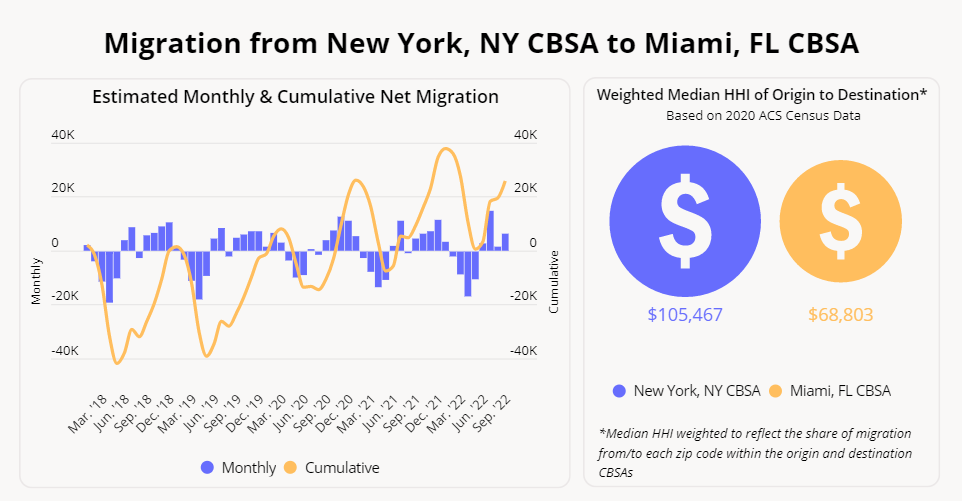

Even more significantly, COVID drove a notable increase in the number of New Yorkers permanently moving to Miami. The graph below shows that between January 2018 and January 2019, Miami experienced minimal cumulative net migration from the New York area. In early 2020 this began to change, and the clear upward trajectory has continued since.

The traditional seasonal patterns seen before the pandemic, for their part, have mostly resumed in 2022, with negative net migration between February and May and positive net migration in June and July – but the positive migration into Miami continued in August, a month that had typically seen net negative migration pre-COVID.

The reduced outward migration and higher inward migration of the past couple years have continually edged the net migration baseline higher – and this cumulative influx is impacting local demographics. The New Yorkers flocking to Miami hail from areas even wealthier than those going to Tampa – with HHIs 53.3% higher than those of their destination areas. In addition to its likely impact on the housing market, this demographic shift has also contributed to the success of luxury shopping hubs like the Miami Design District.

Orlando: A More Permanent Destination?

Of all the areas analyzed in this post, Orlando experienced the greatest COVID-induced shifts in migration patterns.

Traditional Seasonal Patterns

Data from 2018 and 2019 shows that Orlando’s seasonal peaks have traditionally been concentrated in June and July, as northerners converge on the city – home to popular attractions like Disney World and Universal Orlando – for summer vacation. During those years, net negative migration reached its highest point in August. The remaining months followed similar patterns to the other Florida cities – with positive migration in the fall and winter, and negative seasonal migration in the spring.

COVID: No Negative Migration at All

During COVID, the summer spike was far more muted, perhaps due to the theme parks’ closures during the height of the pandemic. However, from October 2019 through July 2021, the city experienced no negative net migration at all, meaning that for that entire period more people moved from New York to Orlando than the other way around.

The New Normal

While seasonal migration patterns bounced back last year, the negative net migration usually seen in August and again in the spring has not returned to pre-pandemic levels. In addition, the cumulative increase in permanent migrants from the Empire State appears even more dramatic than that seen in Tampa or Miami.

The median HHI of New Yorkers relocating to Orlando is significantly lower than that of the new Miami and Tampa residents – and only 32.1% higher than that of the areas they are moving to in Orlando itself. With seasonal patterns that are less pronounced than those seen in Tampa or Miami, it is possible that more people who move to Orlando come in search of a permanent home, rather than someplace to live for just part of the year.

Key Takeaways

Given the large numbers of New Yorkers who have decamped to Florida over the past several years, some have coined it the Empire State’s “sixth borough.” While some pandemic migrants may be ready to return home – and environmental risks may deter others – there is reason to believe that Miami, Orlando, and Tampa will all remain attractive destinations for some time to come. Despite rising prices, all three metropolitan areas boast a higher percentage of homes likely to be affordable to a four-person family earning 120% of the area median income, as well as a lower cost of doing business than the New York area. If current trends continue, the three Florida hotspots will continue to draw large numbers of migrants from the New York area.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.