Source: https://www.corelogic.com/intelligence/rising-mortgage-rates-eroded-housing-affordability-2022/

Interest rates led to a nearly 60% jump in monthly payments, eating into housing affordability

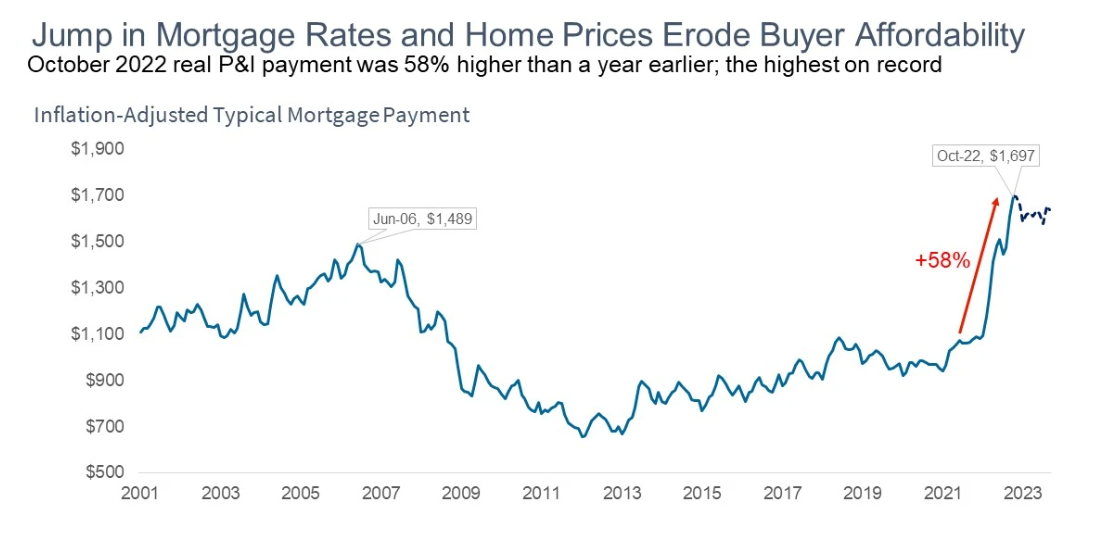

Housing is expensive, and this year, homeowners saw housing affordability decline as their monthly mortgage payments jumped to the highest levels in 15 years. With inflation simultaneously pushing the cost of goods up everywhere, current economic conditions are exerting pressure on current and future homeowners leaving many wondering if they can afford a mortgage.

Over the last year, home prices increased by double digits, with CoreLogic’s most recent Home Price Insights report showing a 10.1% year-over-year increase in October 2022. And this rise in prices is independent of interest rates which spiked to over 7% in mid-November this year.

Mortgage Rates Hit Highs Not Seen Since the Beginning of the Millennium

The question of housing affordability is a common one. Even as the previously overheated market cools down, rates for 30-year fixed mortgages are still higher than they have been in the memories of most younger homeowners. The beginning of the year saw the 30-year fixed mortgage rate hovering at 3.22% for the week ending Jan. 6. From there, rates climbed up to rate hit 7.08% for the week ending Nov. 10, a figure that has not been recorded since 2002.

Since then, mortgage rates decreased a quarter of a point over four consecutive weeks to reach 6.33% for the week ending Dec. 8, the largest decline since 2008, according to Freddie Mac. Still, rates are over double what they were at this time last year (3.1%), prompting many homeowners to keep the affordable mortgage rates that they have already. Since higher interest rates erode overall purchase power by inflating a household’s monthly payments, many homeowners are choosing to stay put, which, coupled with the lack of new construction, has led to a tight housing supply and a decline in affordability.

“Increasing mortgage rates and high home prices have markedly eroded homebuyer affordability in 2022,” said Selma Hepp, interim lead of the Office of the Chief Economist at CoreLogic. “As a result of weakened buyer purchase power, and in light of rising costs across goods and services, consumer sentiment has fallen to an all-time low, and homebuyers have stepped out of the market. Unfortunately, affordability constraints are weighing more heavily on first-time homebuyers and buyers with limited down payments who were likely priced out of the burgeoning housing market during the last two years.”

How Dramatically Has Housing Affordability Declined?

Housing affordability has an inverse relationship with increasing list prices and mortgage rates. Assuming a household retains a median income, the home price they can afford has declined since December 2020. At the same time, the share of their income required to purchase a home increased.

In November 2019, the median home list price in the U.S. was $284,900 and the 30-year fixed mortgage rate was 3.7%. At this time, a median-income household could afford a home costing $487,540 and monthly payments would take 16.5% of their income, according to CoreLogic data. Fast forward to November 2022, and the median home price jumped to $370,000 with the 30-year fixed mortgage rate sitting at 6.8%. At these levels, a median-income household can afford a $392,511 home, a price tag that requires monthly payments that eat up 28.4% of their income.

The effects of these rising rates can be clearly seen in the increasing monthly payments required for the same home at different interest rates. The typical mortgage payment is the monthly payment a borrower would pay for a median-priced home at the going mortgage rate using a 20% down payment. The monthly payment includes principal and interest but does not include taxes and insurance.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.