For a moment, it seemed like Manhattan and its surrounding boroughs were on the verge of losing their status as America’s economic and cultural capitals. COVID-19 hit the city particularly hard, and a substantial out-migration had some saying that the city would never recover, with a popular narrative claiming that cities were “over” in favor of the suburbs. But it takes a lot more than a pandemic to keep New York down.

To understand COVID’s impact on the city – and appreciate the subsequent recovery – we took a closer look at population trends in New York City’s five boroughs (Manhattan, Brooklyn, the Bronx, Queens, and Staten Island) over the past five years. We also explored the urban revival that is taking place in areas such as Northwest Brooklyn and Lower Manhattan to understand what these trends mean for the fate of cities post-pandemic.

Changes in Population For New York & the Boroughs

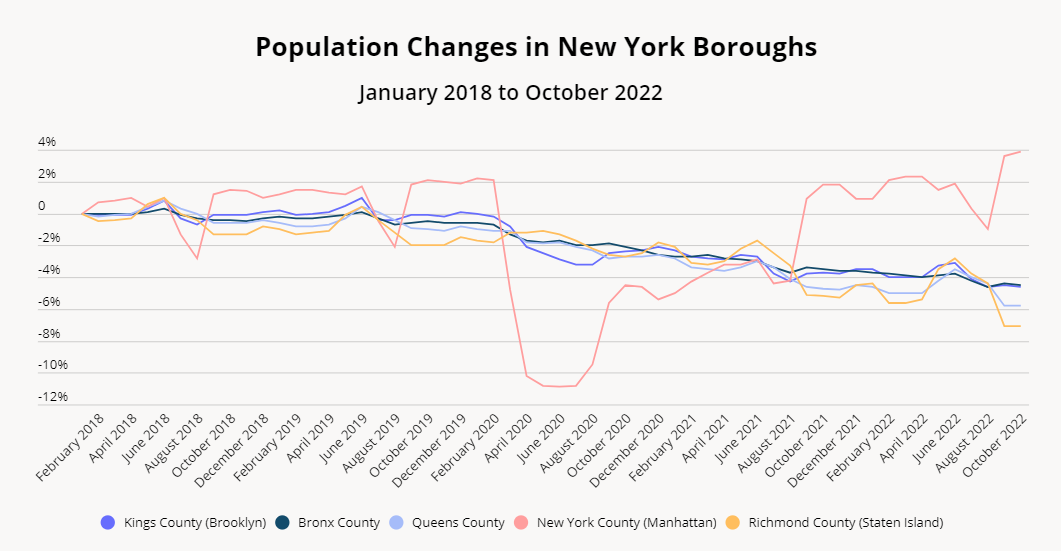

Like many major metropolitan areas, New York County (Manhattan) and the surrounding boroughs saw a significant population drop during the pandemic – between February and April 2020, Manhattan lost an estimated 8.1% of its population. The four surrounding boroughs also lost residents, though the outbound migration was less marked than in Manhattan.

But over the summer of 2020, the tide began to turn – and by October 2022, Manhattan had more than recovered its pandemic losses. The county is the only one of the five boroughs where the population is now higher than it was pre-pandemic, with a nearly 4% increase in residents between January 2018 to October 2022. Meanwhile, the Bronx, Brooklyn (Kings County), Queens, and Staten Island (Richmond County) saw population declines of 4.5%, 4.6%, 5.8%, and 7.1%, respectively, in the same period.

The Manhattan Comeback

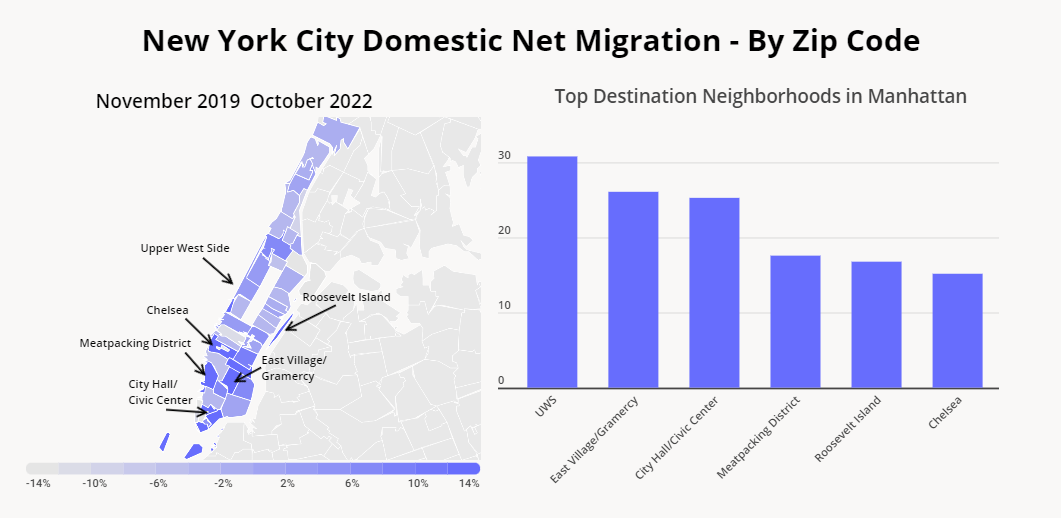

Manhattan is now undergoing something of a downtown renaissance, with areas like the Civic Center and Lower East Side seeing some of the most pronounced in-migration in the city. Part of the draw to these neighborhoods may well be their proximity to Brooklyn, which has firmly cemented itself as the hipper, sometimes cheaper alternative to Manhattan. In fact, the top five most popular neighborhoods in Manhattan as ranked by real estate searches are all close to Brooklyn.

Lower Manhattan and parts of Brooklyn are attracting plenty of business investments, particularly from the tech sector, which may help fuel these growth patterns. People living and working in Brooklyn can enjoy ease of access to Manhattan, and Brooklynites can choose to live in a hip neighborhood while not missing out on the exciting work opportunities offered in Manhattan.

But the population influxes are not limited to lower Manhattan – the Upper West Side saw significant growth as well. So while the pandemic did drive some to move away from major cities, it appears that others may now be leading an urban revival. After two years of social distancing, many people may be looking for more opportunities to get out of the house and spend time with friends. Manhattan’s active nightlife, ample dining options, and robust cultural institutions may be attracting people looking to jumpstart their social life.

And while it is true that the pandemic saw plenty of people leaving the city, sending rental prices plummeting, that trend seems to have been short-lived, with some renters reporting increases of 65% year over year. Whatever negative migration patterns hit Manhattan lasted as long as the pandemic did, and today, the city is bustling once again.

Back in the BK

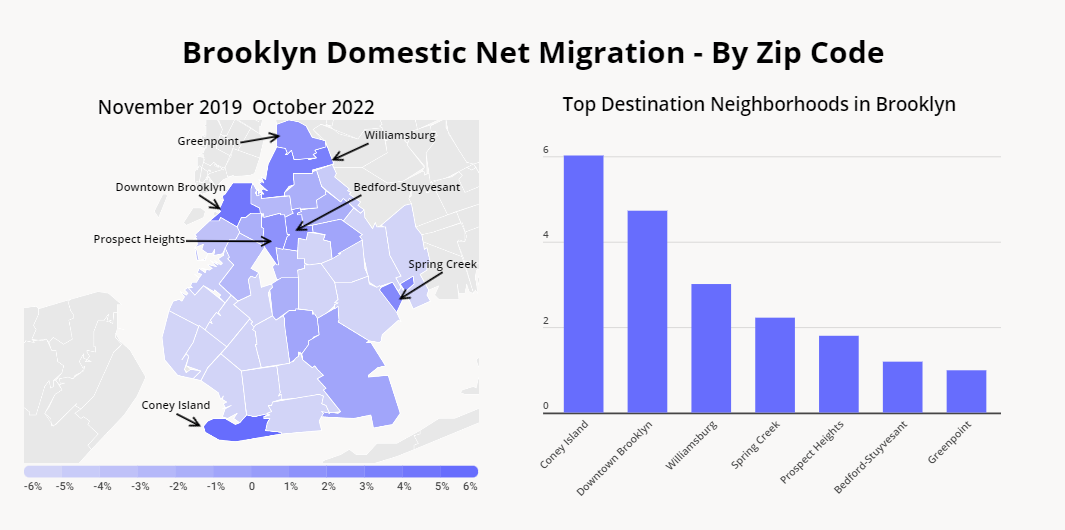

But the post-COVID urban revival is not impacting all areas equally. Even as Manhattan’s population exceeds pre-pandemic levels, Brooklyn’s population is still recovering from COVID-19’s impact – as of October 2022, the population of King’s County (Brooklyn) was 4.4% lower than it was in November 2019.

However, digging into zip code-level migration patterns shows that some parts of the city are still thriving. For the most part, neighborhoods near Manhattan saw population increases, while neighborhoods deeper inside Brooklyn saw their populations decline.

Brooklyn Heights, Williamsburg, and Greenpoint are situated close to Manhattan in northwest Brooklyn, and have been rising in popularity (and price) for quite some time. These neighborhoods have also been relatively unaffected by the pandemic-induced out-migration from Brooklyn and have continued to see pronounced population growth over the past 36 months. Two other neighborhoods, Bedford-Stuyvesant and Prospect Heights, also saw positive population growth. Both are slightly further away from Manhattan but are well-served by public transport to the city, making them attractive options for young New Yorkers.

On the other side of Brooklyn, two different areas are also seeing a resurgence – Coney Island, known for its iconic amusement park, sometimes referred to as the “last affordable Brooklyn neighborhood,” and Spring Creek, a quiet residential waterfront neighborhood. Coney Island saw its population grow by 6% from October 2019, while Spring Creek grew by 2.2%. Both are seeing renewed interest in development – talks of a Coney Island casino are in the works, and a $1.2 billion redevelopment plan is underway in Spring Creek.

It seems like several narratives are unfolding in this county. Northwest Brooklyn’s growth is tied to its connection to Manhattan and fueled by an influx of high-income professionals, which shielded it from the worst of COVID population losses. Meanwhile, quieter, lower-cost areas in the south of Brooklyn are experiencing a resurgence from people eager to live on the water without contending with the sky-high real estate prices often seen in Downtown Brooklyn. At the same time, most inner neighborhoods of Brooklyn did not fare as well, seeing non-insignificant population declines.

New York State of Mind

Brooklyn and Manhattan’s recent domestic migration patterns may offer a more general insight into the current state of the post-COVID urban recovery. While the pandemic led some people to move away from city centers towards more suburban, or even rural, areas, others may be moving to cities in search of community and activities that have been off-limits over the past two years. But the post-COVID urban revival is likely to be unevenly distributed. Cities and neighborhoods with a unique offer – such as Manhattan’s buzziness, northwest Brooklyn’s cool vibes, or south Brooklyn’s quiet charm – will likely thrive, while other areas, including Brooklyn’s southwestern and northeastern areas, may continue seeing their populations fall.

Still, the ongoing strength of the neighborhoods featured here indicates that there is still demand for urban living post-COVID.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.