The youngest cohort, known as Gen Z, is also entering the housing market

Quick Takes:

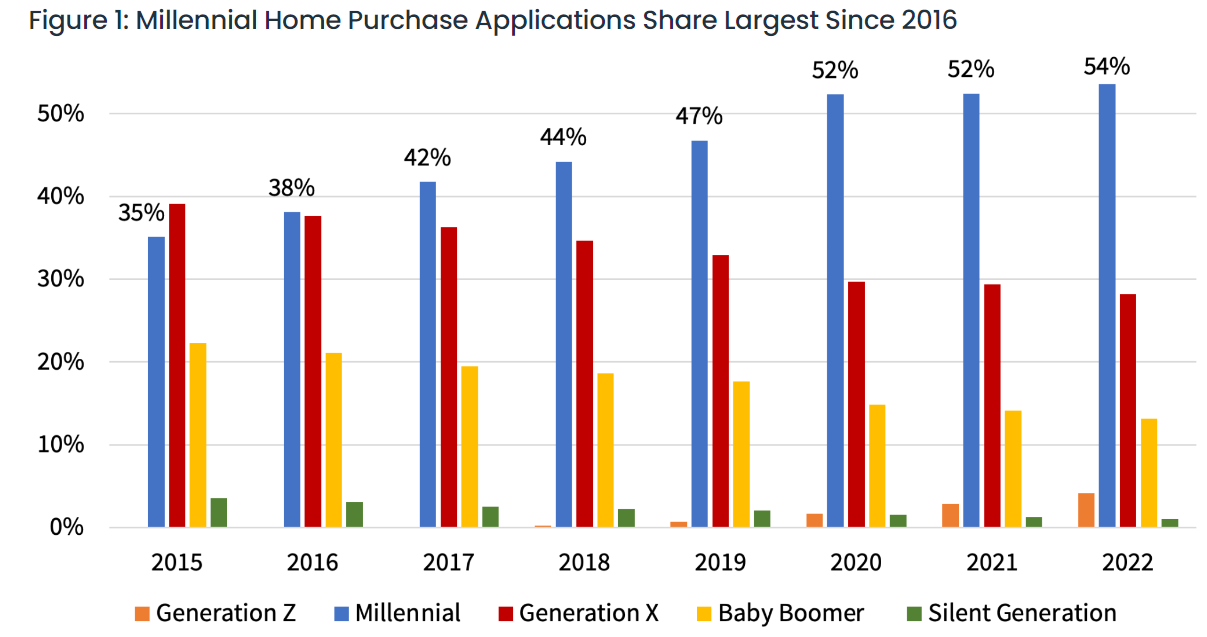

Millennials have made up the largest share of home purchase mortgage applications for the last six years. According to the CoreLogic Loan Application Database, Millennial homebuyer share rose to its highest level in 2022, comprising about 54% of overall home-purchase applications (Figure 1). The Millennial home purchase share has steadily increased since 2015, rising about two to three percentage points per year. At the same time, Gen Z — the generation succeeding Millennials whose members were born after 1997 — is entering the housing market. This year, the cohort comprised about 4% of overall home-purchase applications.

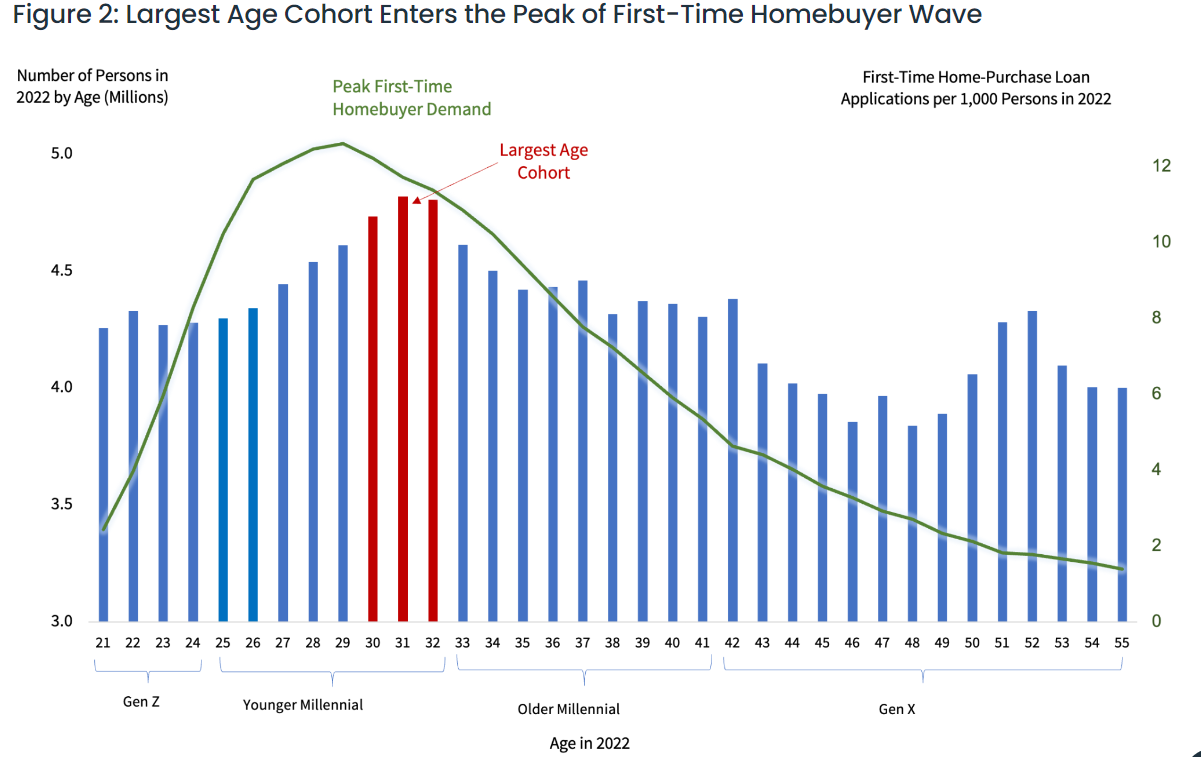

The share of Millennial first-time homebuyer (FTHB) mortgage applications is even higher than the share of overall Millennial home purchase applications, a figure that comprises both FTHB and repeat buyers. About 72% of all the FTHB home-purchase applications in 2022 were from Millennial applicants. This is not surprising, as the largest cohort of the Millennial generation has already approached the peak age of first-time homeownership.

Gen Z, the youngest cohort, made up 9% of the first-time home purchase applications in 2022, up three percentage points from 2021. Their share is likely to increase in the coming years.

Figure 2 shows the U.S. population distribution by age, and the left axis highlights the largest demographic cohort reaching the peak age of FTHB. The right axis of the chart, displayed by the green line, represents first-time home-purchase loan applications per 1,000 individuals in 2022. For example, the highest share of FTHB is among younger Millennials who are aged 29. Data shows that more than 12 in 1,000 Millennials at age 29 were FTHBs in 2022.

There are still many younger Millennials under 30 who have yet to become homeowners, so the demand from these Millennials is likely to remain strong in the coming years. At the same time, older Millennials are more likely to become repeat homebuyers. The share of Millennial repeat buyer home-purchase applications was already 43% in 2022, eight percentage points higher than Gen X’s share.

That said, while the demographic tailwind remains favorable for the home purchase market, historically low for-sale inventories along with sky-high home prices and higher mortgage interest rates create affordability challenges. These headwinds may slow the influx of new Millennials entering the home purchase market. In addition to younger Millennials, Gen Z members are also likely to fuel the demand for housing over the next couple of years, especially if affordability improves.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.