Beauty companies like Ulta Beauty (NASDAQ: ULTA) have been in the spotlight over the past several months, in response to rising cosmetic sales in the wake of high inflation and economic uncertainty (a phenomenon sometimes referred to as the “lipstick effect”). In fact, Ulta recently surpassed investors’ expectations in its third quarter earnings report and even boosted its holiday sales outlook. So how did the beauty retailer’s holiday sales fare? Using consumer transaction data, Bloomberg Second Measure analyzed holiday spending trends at Ulta and its LVMH-owned competitor Sephora. We found that direct-to-consumer (DTC) holiday sales increased year-over-year at both Ulta and Sephora, but the main purchasing channel (online or retail) for each company differed.

Direct-to-consumer holiday sales at Ulta Beauty (NASDAQ: ULTA) and Sephora increased in 2022 compared to previous years

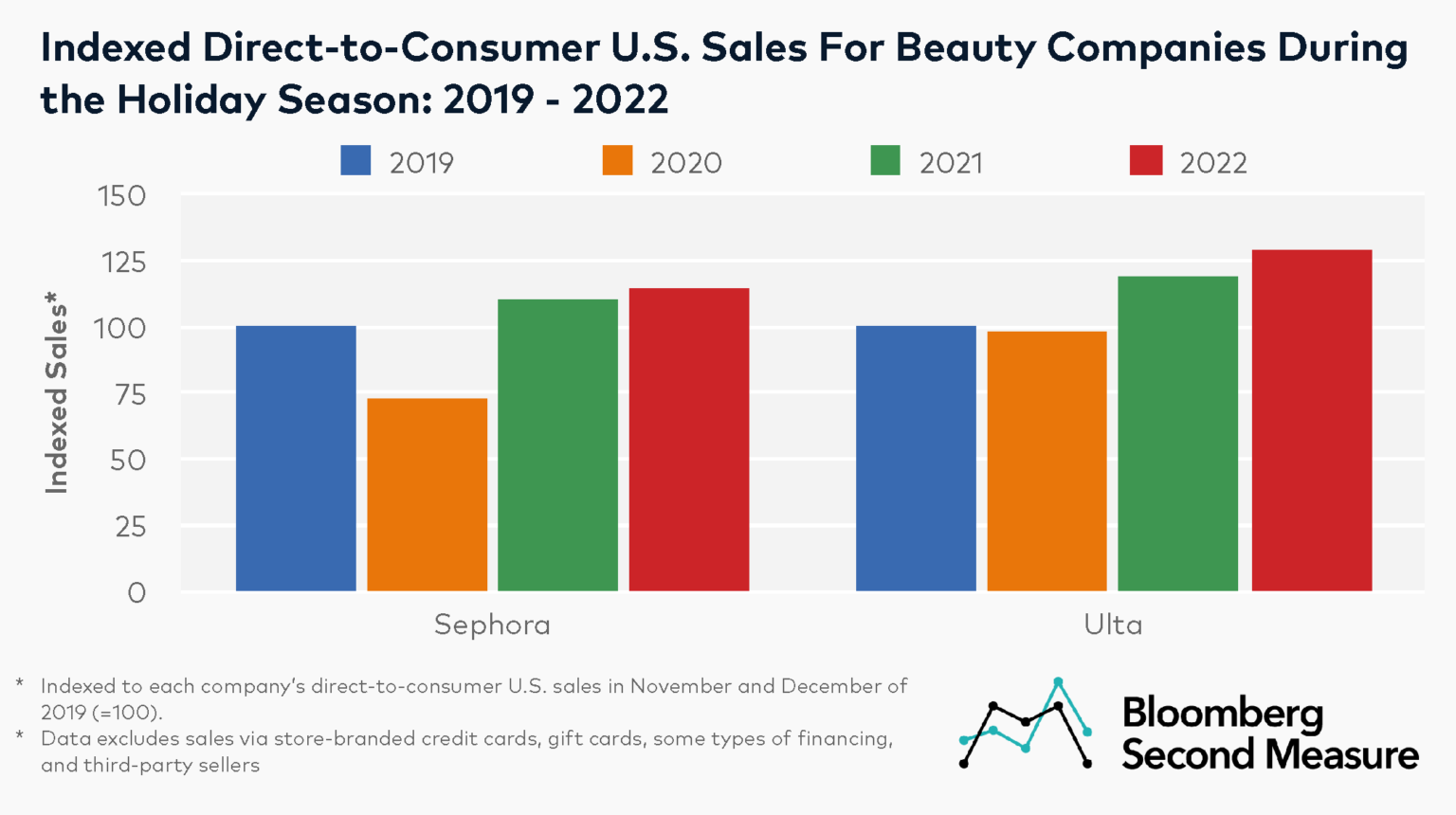

Consumer transaction data reveals that, with the exception of 2020, holiday season sales (defined in our analysis as combined sales in November and December) at Ulta and Sephora have been on the rise over the last few years. Ulta’s combined U.S. direct-to-consumer sales in November and December of 2022 were up 8 percent year-over-year, while Sephora’s DTC sales grew 4 percent.

Ulta’s holiday sales in 2022 also increased 31 percent compared to the same period in 2020 and were up 28 percent from 2019. Likewise, Sephora’s holiday sales in 2022 increased 58 percent compared to 2020 and 14 percent compared to 2019. Both beauty companies typically host multiple sales events throughout November and December (such as the Sephora Holiday Savings Event and Ulta’s Holiday Beauty Blitz), in addition to participating in Black Friday and Cyber Monday.

Notably, this analysis excludes spending via gift cards, store-branded credit cards, and some types of financing. The data also only captures sales through each company’s U.S. stores and websites and excludes sales from third-party sellers.

Most of Ulta’s direct-to-consumer holiday sales in 2022 came from stores, while most of Sephora’s came from online

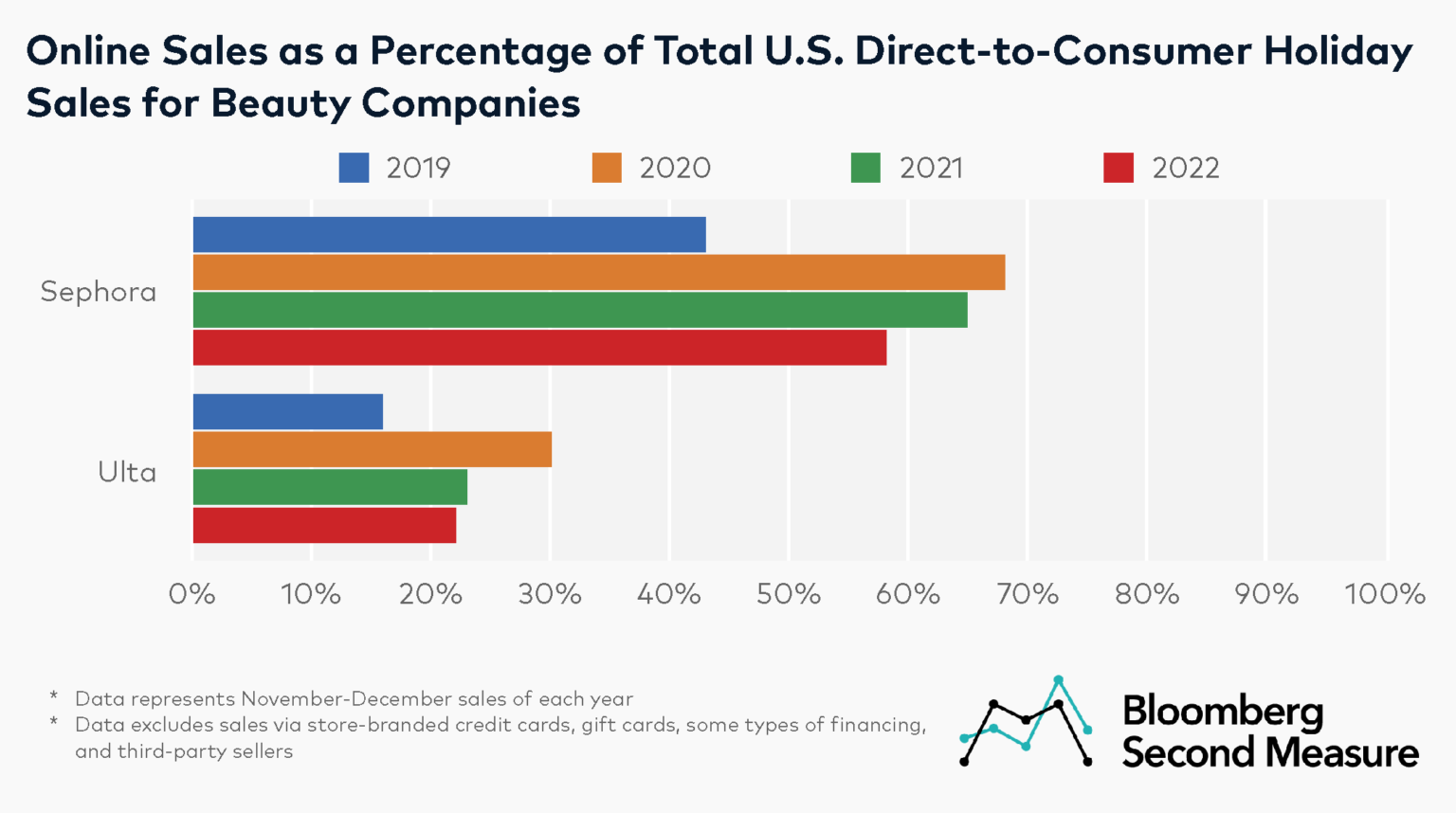

Other major holiday spending trends highlight how retail and online shopping have evolved for the two beauty companies since the pandemic began. In the COVID-19 era, most of Sephora’s DTC holiday sales have come from the online channel. In 2019, 43 percent of Sephora’s holiday sales took place online. By 2022, that share increased to 58 percent and was even higher (68 percent) in 2020. Ahead of the 2022 holiday season, Sephora launched a same-day unlimited delivery subscription.

On the other hand, Ulta’s share of online sales as a percentage of total sales has remained elevated compared to before the pandemic, but it is still lower than its share of in-store sales. Sixteen percent of Ulta’s DTC holiday sales took place online in 2019, compared to 22 percent in 2022, and was 30 percent during the height of the pandemic in 2020. Ulta also recently launched retail initiatives such as a new store layout, as well as new services to its salon offerings.

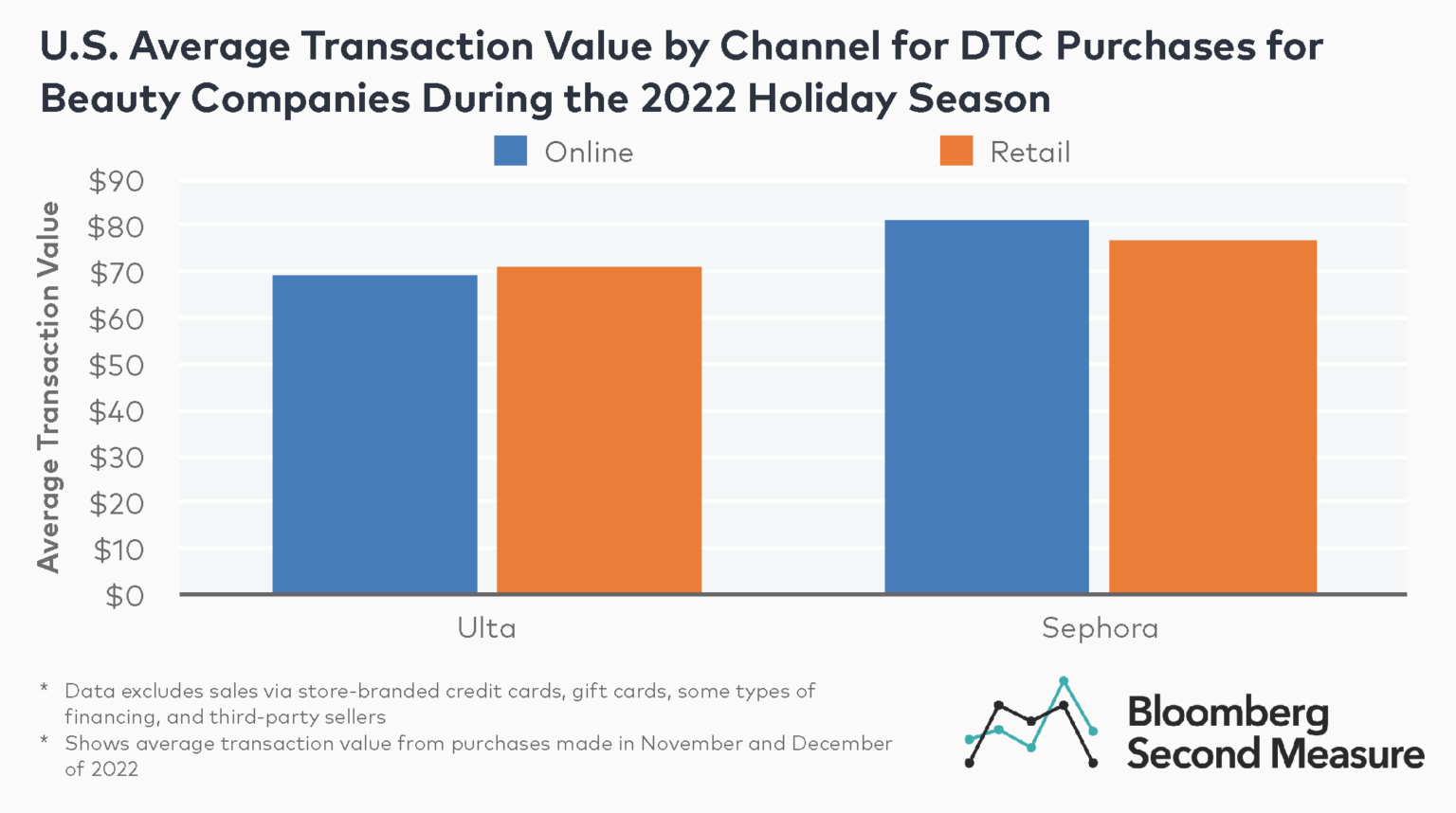

A similar pattern regarding online vs. retail spending emerges with average transaction values during the holiday season. Sephora’s average transaction value for DTC purchases during the 2022 holiday season was higher for the online channel, while Ulta’s was slightly higher for the retail channel. In November and December of 2022, Sephora’s average transaction value was $81 for the online channel and $77 for the retail channel. During the same time period, the average transaction value at Ulta was $71 for retail purchases and $69 for online purchases.

In recent years, both beauty companies have also turned to new partnerships to generate new business. Specifically, Ulta has partnered with Target and Sephora has partnered with Kohl’s to sell their beauty products (though these third-party sales are not included in Bloomberg Second Measure’s analysis). In 2022, Ulta also reportedly launched new partnerships with brands like Olaplex and Supergoop to further drive makeup sales.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.