Placer.ai’s Q4 Quarterly Index Report presents location intelligence data for beauty & self care brands, discount & dollar stores, superstores, grocery brands, malls, fitness chains, and offices. Using yearly, quarterly, and weekly visit patterns, the report reveals how these key categories fared in 2022 and what their performance tells us about consumer behavior and brick-and-mortar retail in the new normal.

Q4 and 2022 Yearly Overview

After two years of pandemic restrictions, 2022 was slated to mark the great brick-and-mortar retail comeback – until inflation and high gas prices started to negatively affect retail foot traffic in the spring, with the impact continuing through much of the year. But although the current economic situation is undoubtedly impacting consumers, the ongoing inflation and shifts in consumer shopping habits are also creating new opportunities and setting up certain brands and categories for success.

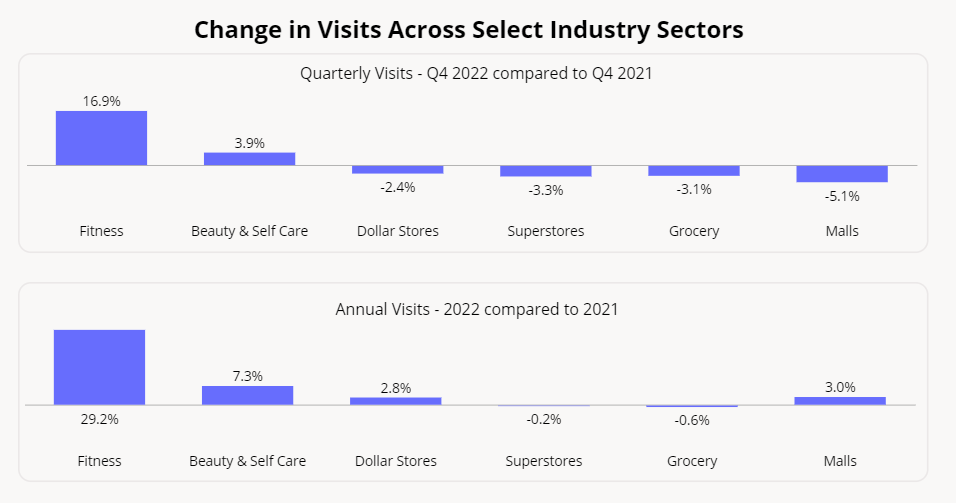

Foot traffic data showed that several key retail categories including discount & dollar stores, grocery chains, and superstores saw visits dip year-over-year (YoY: 2022 compared to 2021).

But focusing exclusively on YoY metrics makes the retail landscape appear worse-off than it really is. Late 2021 was particularly strong for retail, as the combination of pent-up demand, accumulated savings, and months of store closures drove an unusually high number of consumers to brick-and-mortar retailers, especially in October 2021. This means that YoY dips in Q4 foot traffic could be attributed more to 2021’s strength and less to any real drop in consumer demand.

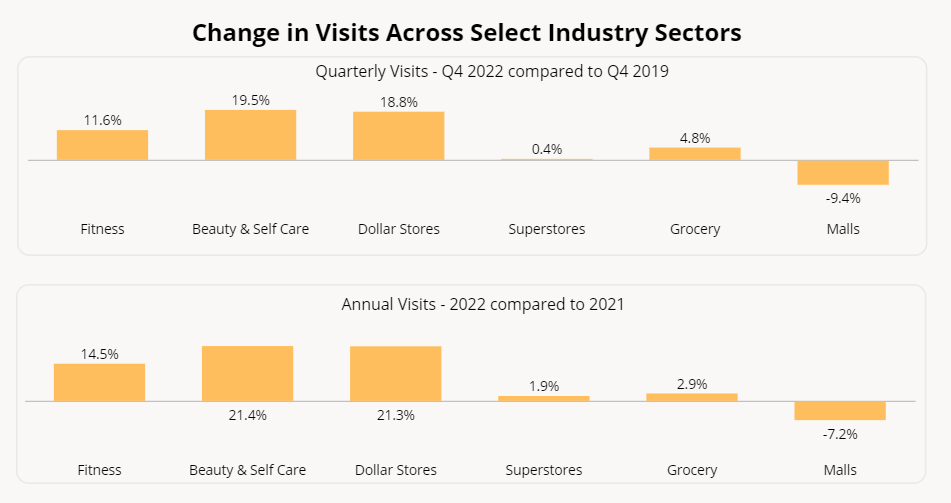

Adopting a wider lens and comparing foot traffic not just to the unusually strong 2021 but also to pre-pandemic 2019 paints a significantly more optimistic picture. Year-over-three-years (Yo3Y:2022 compared to 2019) visits for the fitness, beauty & self care, discount & dollar stores, superstores, and grocery categories were up in Q4 and in 2022 overall – indicating that demand for these categories remains strong, even in the face of tighter consumer budgets. Malls did see a drop in visits, but visit duration – especially during the second half of the year – has been increasing relative to both 2021 and 2019, which may indicate that while foot traffic is dropping, the quality of those visits has increased.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.