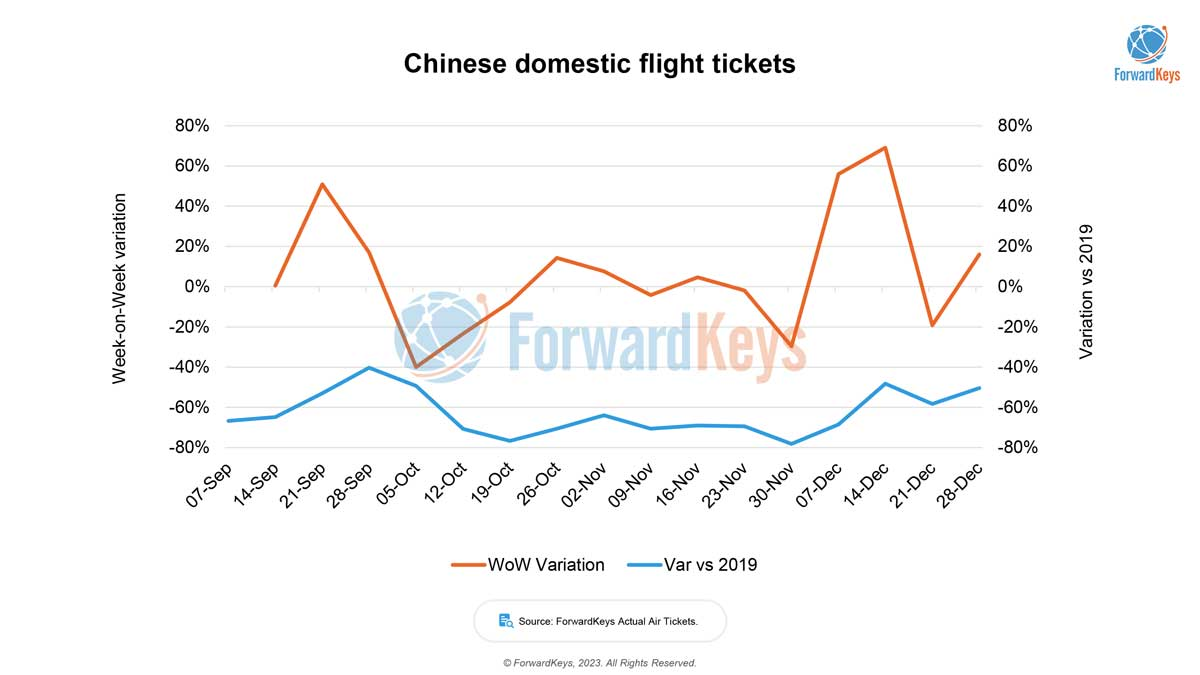

China’s decision to ditch its zero-Covid policy has triggered a surge in flight bookings, according to the latest data from ForwardKeys. On 7th December, Chinese authorities announced that a negative PCR test would no longer be required for air travel between provinces. Domestic flight bookings immediately surged 56% on the previous week and continued to increase 69% the following week. On 26th December, China removed all COVID-related restrictions on domestic air travel; and bookings surged again, reaching 50% of 2019’s level in the final week of the year.

As of 3rd January, domestic flight bookings during the upcoming Chinese New Year period, 7th January – 15th February, were 71% behind pre-pandemic (2019) levels and 8% behind last year, with the most popular destinations being Beijing, Shanghai, Chengdu, Kunming, Sanya, Shenzhen, Haikou, Guangzhou and Chongqing. Before the announcement on 7th December, they were 91% behind 2019.

China’s aviation regulator plans to restore flight capacity to 70% of pre-pandemic levels by 6th January, and to 88% by 31st January. However, a full recovery is not possible immediately, as the industry needs some time to re-hire staff and meet all flight safety and service requirements.

Also announced on 26th December, and taking effect on 8th January, were the end of the cap on the number of international flights to China and quarantine measures. In addition, Chinese citizens can now renew expired passports and apply for new ones.

Outbound flight bookings between 26th December and 3rd January jumped 192% compared to same period last year, but they are still 85% behind pre-pandemic levels. Currently, the most popular return trips are to Macau, Hong Kong, Tokyo, Seoul, Taipei, Singapore, Bangkok, Dubai, Abu Dhabi and Frankfurt. Notably, bookings to Abu Dhabi which has traditionally been a major gateway between China and the West, are 51% behind 2019. Looking at onward bookings from there, 11% will go to Paris, 9% to Barcelona, 5% to London, 3% to Munich and 3% to Manchester.

67% of bookings made between 26th December and 3rd January were for travel during the Chinese New Year period.

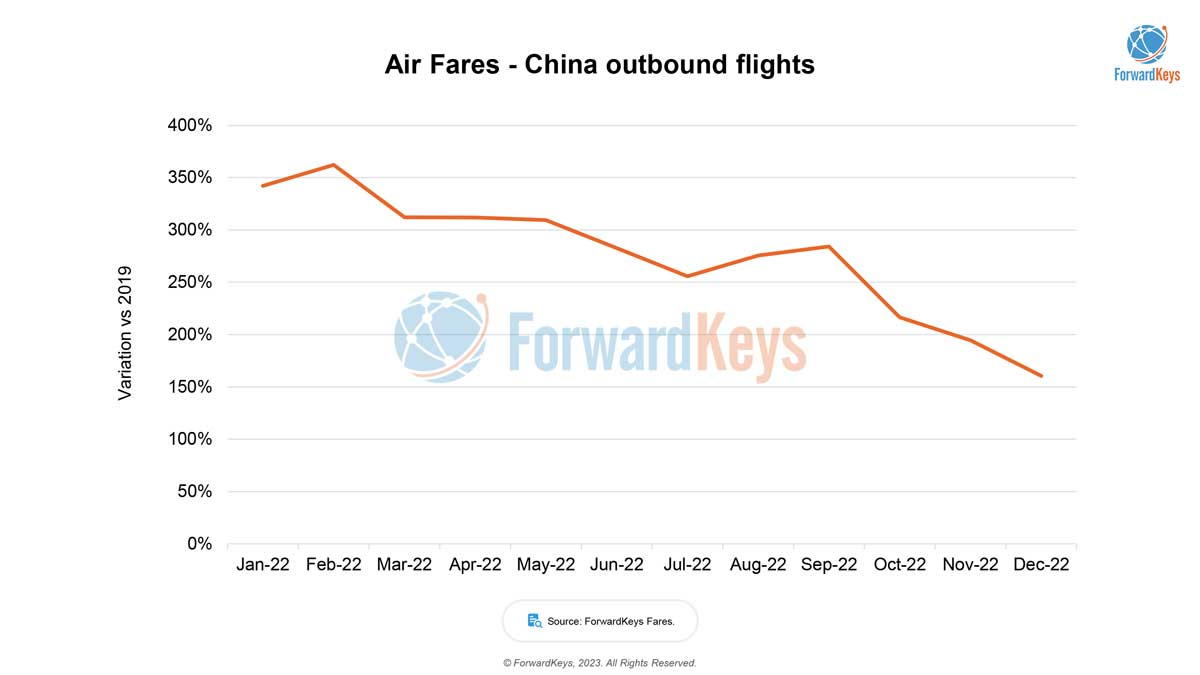

Olivier Ponti, VP Insights, ForwardKeys, commented: “Although Chinese New Year is likely to see international travel rebound for the first time in three years, we will need to wait longer before we see a resurgence in Chinese tourists exploring the globe. The reasons are: First, current scheduled international flight capacity is only at 10% of 2019’s level; and owing to approval requirements for traffic rights and airport slots, it will be difficult for airlines to gear back up in less than a few months. Second, Ticket prices remain high, with average air fares in December 160% higher than in 2019. That said, there has been a downward trend since June, when quarantine was reduced from three weeks to seven days, and then to five days in November.”

“Third, some destinations, including the US, the UK, India, Qatar, Canada, Australia and all 27 EU member countries now require a pre-flight COVID-19 test for Chinese visitors; and others, such as Japan, South Korea and Italy, will impose testing on arrival and quarantine for those who test positive. Finally, a bottleneck processing passport renewals and visa applications is likely; and some countries, such as South Korea and Japan, are restricting short-term visas for Chinese travellers until the end of this month. Right now, we expect the Chinese outbound market will pick up strongly in Q2 2023, when airlines schedule capacity for the spring and summer, which include the May holiday, Dragon Boat festival in June and summer holidays.”

Three years ago, China first implemented major travel restrictions during the Chinese New Year holiday. This New Year, the country has finally reopened, with no domestic travel restrictions or quarantine-on-return for international travelers. So what should we expect from China’s travel market over the upcoming Chinese New Year holiday and beyond?

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.