Discount and dollar stores thrived during the pandemic, with the category gaining popularity with a wider shopper base. As inflation concerns persist, discount and dollar stores are positioned to capture an even larger share of the market.

The Big Discount Picture

Four players that dominate the discount and dollar store space – Dollar Tree, Family Dollar (owned by parent company Dollar Tree), Dollar General, and Five Below – were among the biggest foot traffic winners throughout the pandemic and 2022.

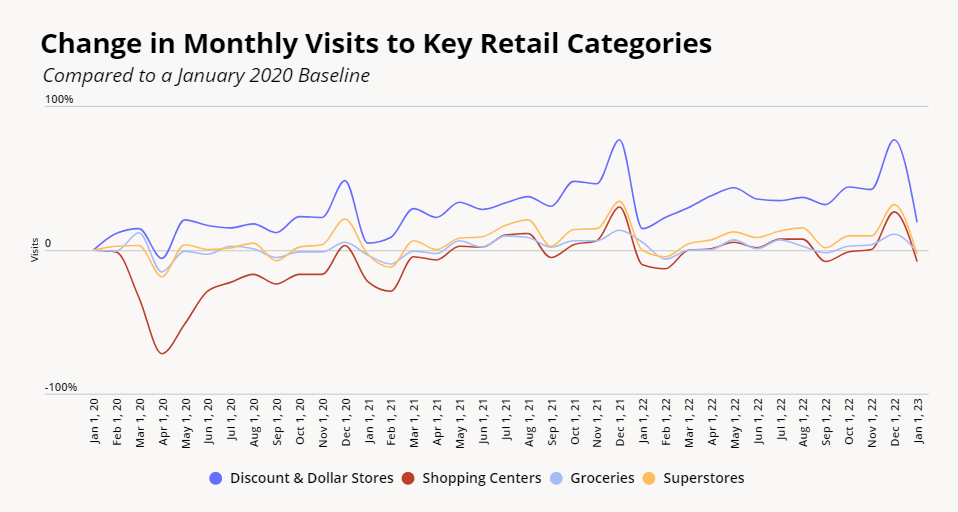

Comparing the foot traffic for the segment to a pre-pandemic baseline of January 2020 highlights the strength of the sector. Visit growth to discount & dollar stores consistently outpacing other similar categories that were similarly considered essential businesses retail categories during the pandemic, including grocery stores, drugstores, and superstores.

Year-over-Year Visits Indicate Strength

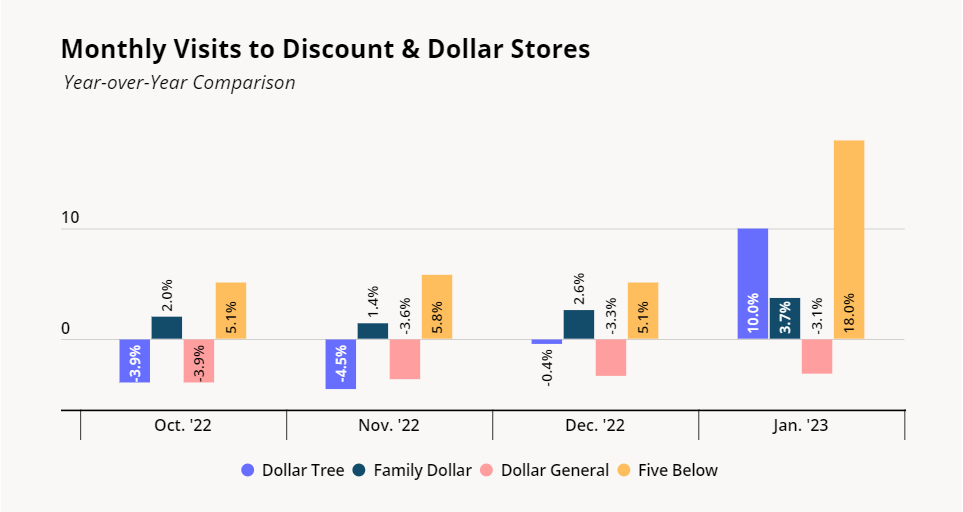

Most discount and dollar brands continued growing last year, with visits most months of 2022 outpacing those of 2021. And while some chains saw slight dips in foot traffic during the second half of the year, framed within the context of an unusually strong 2021, these gaps only highlight how resilient dollar stores are.

Five Below and Family Dollar showed steady increases in customer foot traffic in all months analyzed. Dollar Tree and Dollar General, on the other hand, experienced slight lags compared to the previous year, but still maintained their strength with foot traffic tracking closely to visit numbers from 2021.

By January 2023, three of the four chains – Dollar Tree, Family Dollar, and Five Below saw year-over-year (YoY) visit growth of 10.0%, 3.7%, and 18.0%. And though Dollar General did experience a decrease in visits compared to January 2022, the difference was the smallest YoY visit gap the chain has posted in the past four months – though the comparison was also the easiest considering the impacts of Omicron on January visits in 2022.

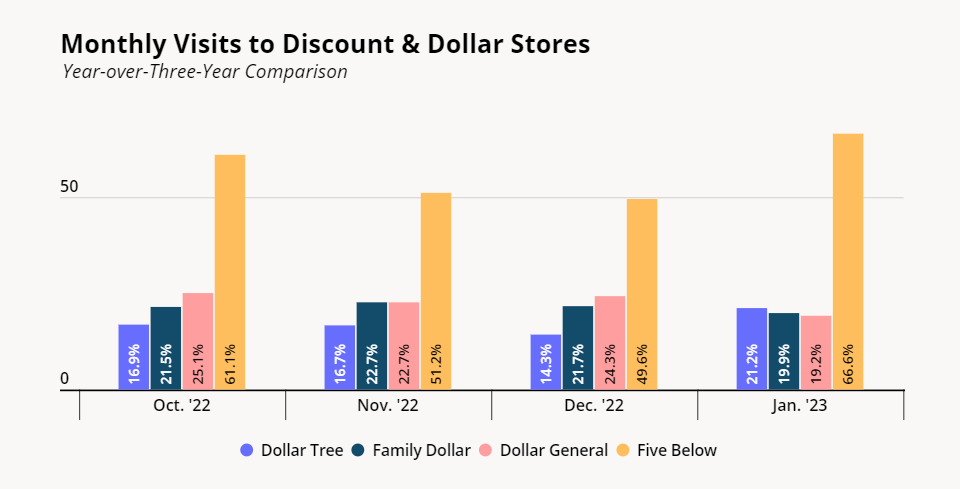

Year-over-Three-Year Strength

Given the volatility of 2021 and early 2022, a more complete view of the discount and dollar segment calls for an examination of year-over-three-year (Yo3Y) foot traffic. All months analyzed saw impressive visit growth, with January 2023 seeing foot traffic increase by 21.2%, 19.9%, 19.2%, and 66.6% for Dollar Tree, Family Dollar, Dollar General, and Five Below, respectively.

The foot traffic tracks closely with the patterns seen for the segment overall – while YoY visits to discount stores have shown more variance, Yo3Y visits remain consistently elevated. And though the pandemic’s impact on retail may be fading, the category has continued to see visit increases, likely due to the rising cost of living in 2022. As people look for ways to save money on groceries, discount stores have become a popular choice, creating a challenge for traditional grocery stores. And since the large footprint of most dollar & discount stores puts most Americans within several miles of a store, the category’s strength is likely to continue in 2023.

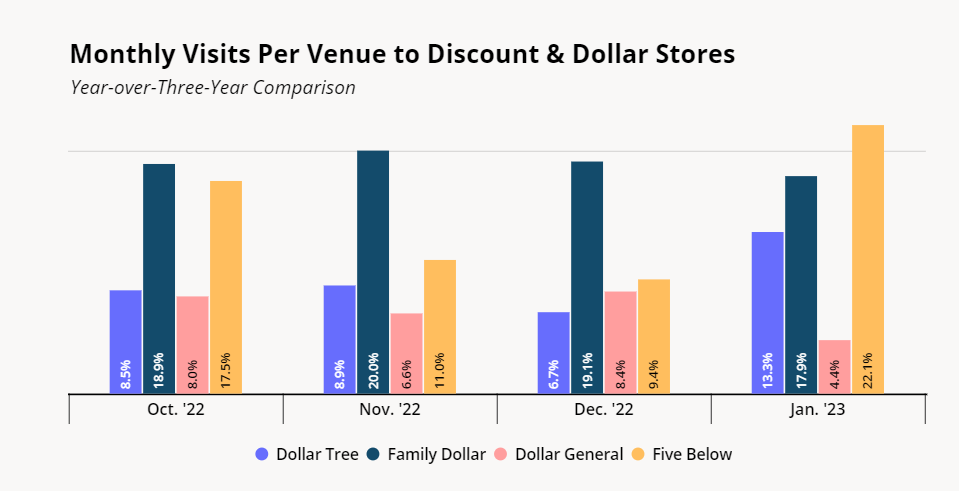

Visits Per Venue – Proof of Concept

Driving the growth in foot traffic may be the ambitious expansion plans and strategic shifts these chains undertook throughout the pandemic. Dollar Tree, which boasts over 8,000 stores under its Dollar Tree banner, has debuted two new retail concepts – Dollar Tree Plus and Dollar Tree Combo. Similarly, Five Below is continuing its expansion plan, with 200 new stores slated to open in 2023, while Dollar General is leaning into its higher-priced Popshelf concept, hoping to reach 300 locations by the end of 2023.

The decision to expand clearly helped boost visit metrics, but looking at visits per venue helps to reinforce the demand that has driven the growth in reach. Average visits per venue to these chains – the average number of people visiting each location – exceeded 2019 levels all months analyzed, with January posting visit per venue growth of 13.3%, 17.9%, 4.4%, and 22.1% for Dollar Tree, Family Dollar, Dollar General, and Five Below. The per location metrics show that the expansions were based on a recognition of growing demand and potential – an element that only reinforces the unique power of these chains.

Don’t Discount Dollar Stores’ Potential

The segment is on a decided upswing as it continues to attract new and returning customers with its attractive retail and grocery options. With a shift in how people shop, discount and dollar stores can hope to continue thriving into 2023.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.