Athleisure has become a global fitness trend. But brand preferences differ significantly across geographies. In today’s Insight Flash, we take advantage of CE Transact Global’s seven-country coverage to examine which brands are trending by geography in terms of direct-to-consumer market share, spend growth, and average ticket.

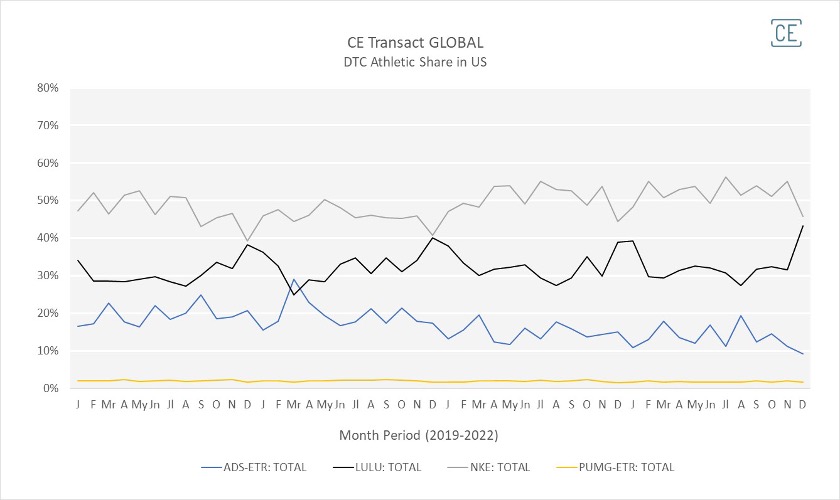

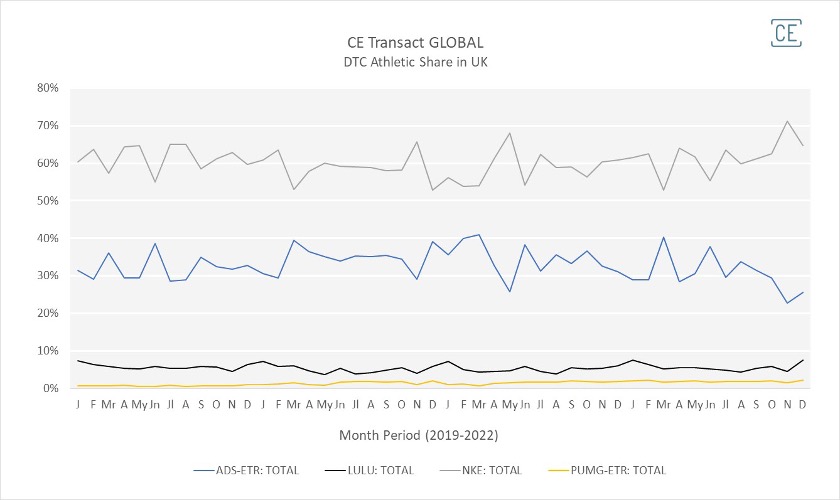

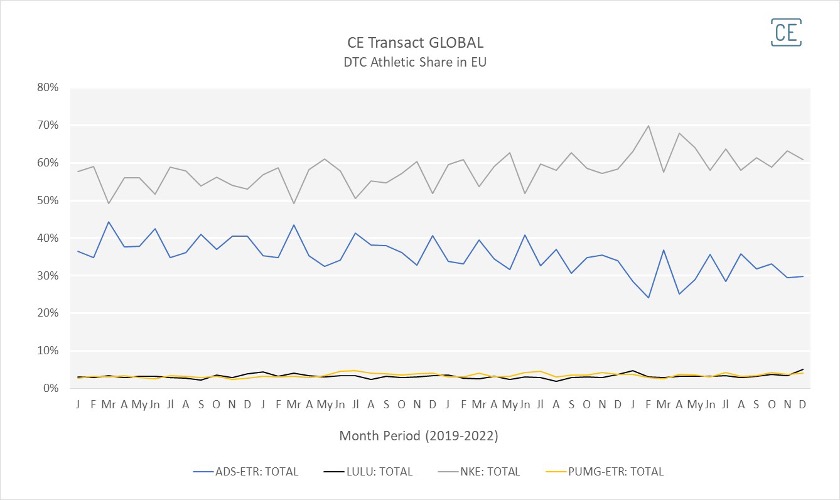

Nike’s direct-to-consumer business has the highest spend share among the four top tracked brands across the US, UK, and EU. Lululemon has the second-highest share in the US, and almost matches Nike’s around the holidays. Adidas has the second-highest share in the UK and EU, but this share has been declining over the last year as the company cut ties with Kanye West and his successful Yeezy line.

Spend Share by Geography

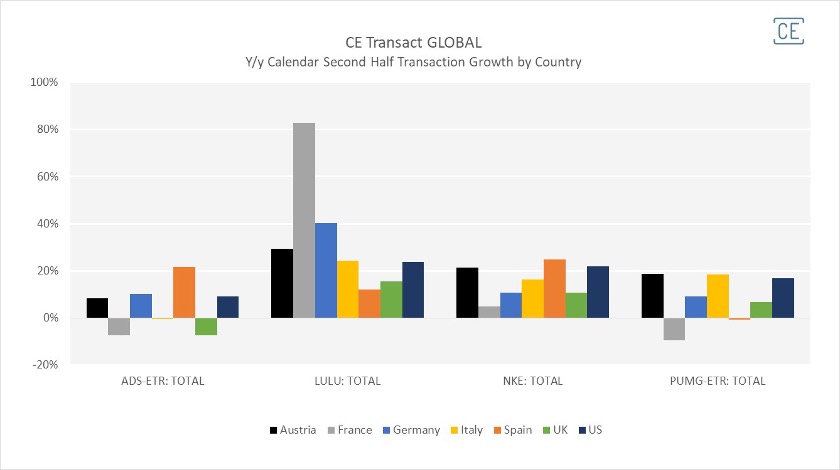

Over the last year, direct-to-consumer transaction growth has differed dramatically by company. Lululemon has shown the strongest transaction growth in the second half of 2022 versus the second half of 2021 across geographies, although the growth was off a small base in EU countries outside of Germany. Spain was the one tracked market where Lululemon growth lagged Adidas and Nike, but this may strengthen in the beginning of 2023 as the company’s Spanish launch late last year begins to pick up traction. Nike also saw positive direct-to-consumer growth across all tracked markets. The picture wasn’t as rosy for all parent companies, however. Adidas saw declining y/y transactions in France, the UK, and Italy while Puma saw declining transactions in France and Spain.

Transaction Growth by Geography

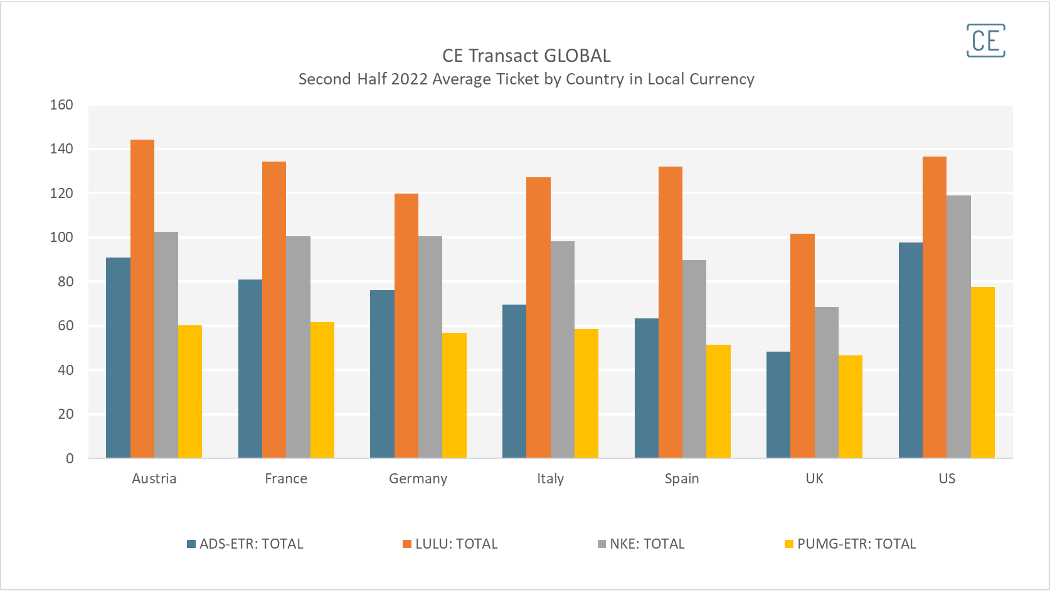

In all seven countries tracked by CE Transact Global, Lululemon has the most expensive basket in local currency, followed by Nike, then Adidas, then Puma. Lululemon’s delta to the average basket across brands is highest in Spain and the UK and lowest in the US. Nike’s basket is relatively highest in Germany and Italy versus the delta to competition in other countries. Adidas has the highest relative basket versus competition in Austria and the US, while Puma has the highest in the US and UK versus the other markets.

Average Ticket by Geography

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.