Key takeaways:

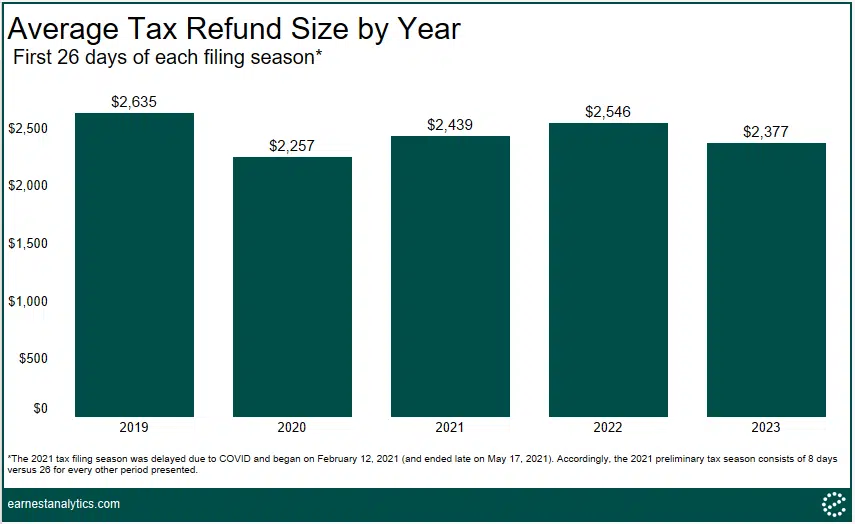

Average Tax Refund Size Falls High Single Digits YoY During Preliminary 2023 Tax Season

Through the first 26 days of the tax filing season, the average refund size is down 7% YoY to $2,377 in Earnest Analytics’ IRS Payments dashboard, in-line with reported figures**. The IRS began accepting and processing tax returns on January 23, 2023 and Americans have until April 18, 2023 to file. As the tax season kicked off, the IRS warned taxpayers should expect smaller refunds in 2023 relative to 2022 due tax law changes such as the elimination of the Advance Child Tax Credit and Recovery Rebate credit to claim pandemic stimulus payments.

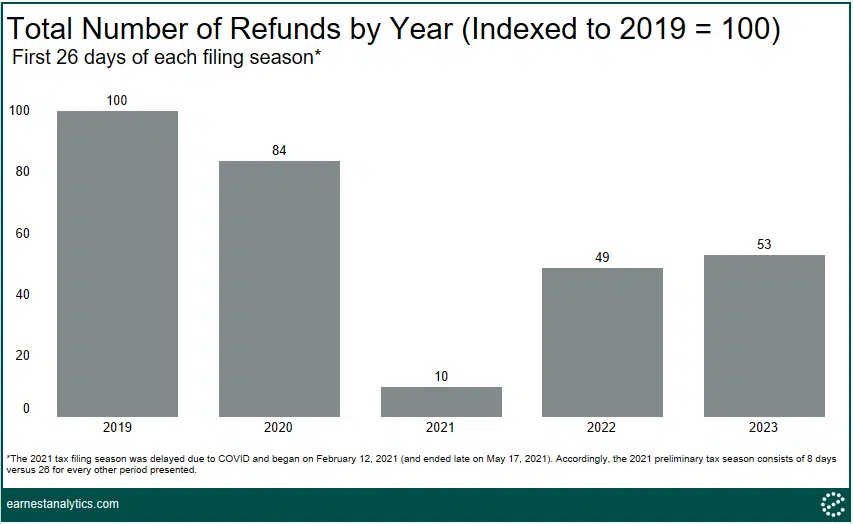

Early Season Refunds Increase YoY But Remain Materially Below Pre-Pandemic Levels

In the first 26 days of the 2023 tax filing season, the total number of refunds issued grew 8% YoY in the data. Importantly, however, the total number of refunds in the preliminary tax filing season remained materially below pre-pandemic levels (down 37% Yo3Y in the data) suggesting Americans continue to wait until later in the season to file returns which may provide a boon to consumer spending in the coming months.

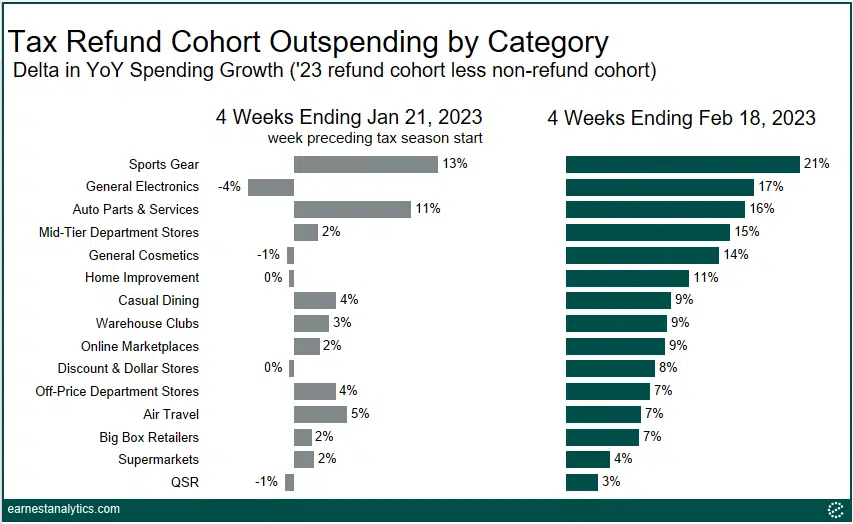

General Electronics, Mid-Tier Department Stores, General Cosmetics, & Home Improvement Saw Largest Lift Relative To Pre-Tax Season

Consumers who received a tax refund in the preliminary 2023 tax season outspent their peers on a YoY basis across most categories in the four weeks ending February 18, 2023. General Electronics, Mid-Tier Department Stores, General Cosmetics, and Home Improvement experienced >10 points of additional outspending compared to the four weeks ending January 21, 2023 (week prior to the beginning of tax season). The outperformance follows a relatively stagnant holiday period for these categories, indicating certain consumers may have delayed discretionary purchases as inflation remains hot. Sports Gear and Auto Parts & Services saw double-digit outperformance by tax refund recipients, but the lift was more modest relative to pre-tax season spend.

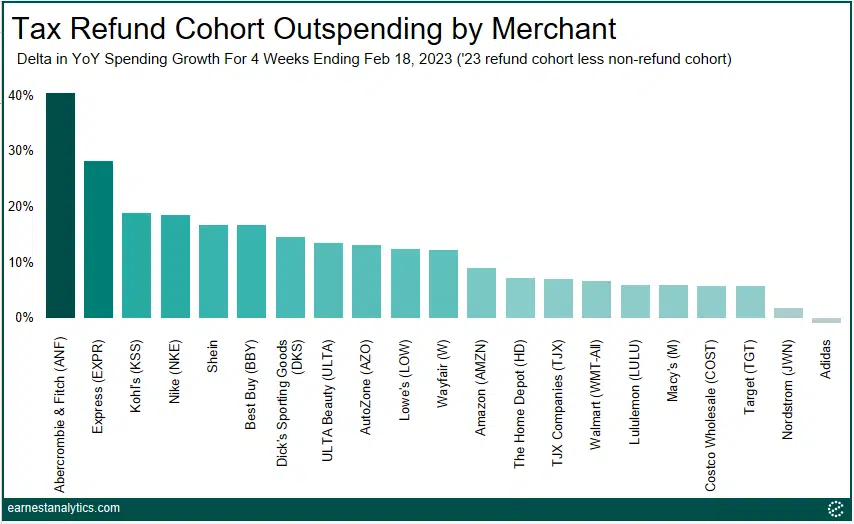

Abercrombie, Express, Kohl’s, Nike, Shein, Best Buy, and Dick’s Are Benefitting Most

Tax refund recipients outspent by the widest amount at Abercrombie, Express, Kohl’s, Nike, Shein, Best Buy, and Dick’s, which all experienced >15 points of outperformance from the tax refund cohort in the four week period ending February 18, 2023. Notably, Abercrombie, Express, and Shein saw significantly more outspending by tax refund recipients than the broader Apparel category; Kohl’s saw 6 points more outspending relative to Macy’s; and Nike saw >10 points more of outperformance compared to Lululemon and Adidas.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.