Source: https://www.placer.ai/blog/placer-ai-mall-index-february-2023-reasons-for-continued-optimism

About the Placer.ai Mall Indexes: These Indexes analyze data from more than 100 top-tier indoor malls, 100 open-air lifestyle centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas. Placer.ai uses deidentified location analytics from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations.

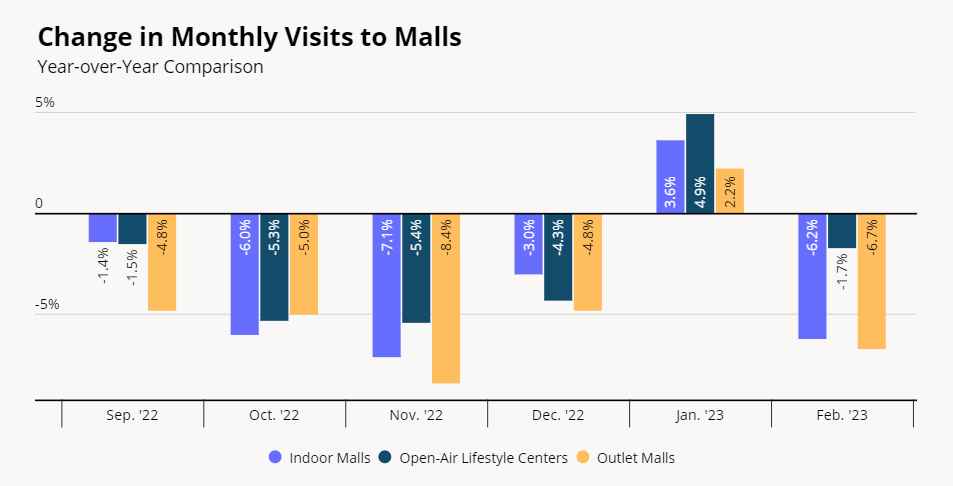

Impressively, especially considering the wider economic context, mall visits have been consistently tracking closely to year-over-year (YoY) levels for months. Yet, our January mall update showed YoY growth for the first time since July of 2022 – a potentially very strong sign to kick off the year.

However, the comparison to an Omicron affected January in 2022 set up a far easier comparison than other months, putting an added importance on February performance to gauge the true state of the mall recovery.

Did the mall recovery take another step forward? Or did the pattern of near-YoY levels continue?

Tougher Comparisons in February

After all three indexes saw YoY growth in January, all three returned to declines in February with visits down 6.0% in indoor malls, 2.0% in open-air lifestyle centers and 6.7% for outlet malls. Looking at visits from a monthly perspective indicates that the pattern of “just under” YoY levels returned as the lower bar from January was replaced with a far more challenging February comparison. This reinforces the impressive recovery of malls in the face of a challenging economic environment, but shows that the true ceiling of the sector is still being limited by these headwinds.

However, it’s noteworthy that open-air lifestyle centers saw their strongest month from a YoY perspective since September, with visits down just a few percentage points.

Weekly Visit Trend Shows Promise

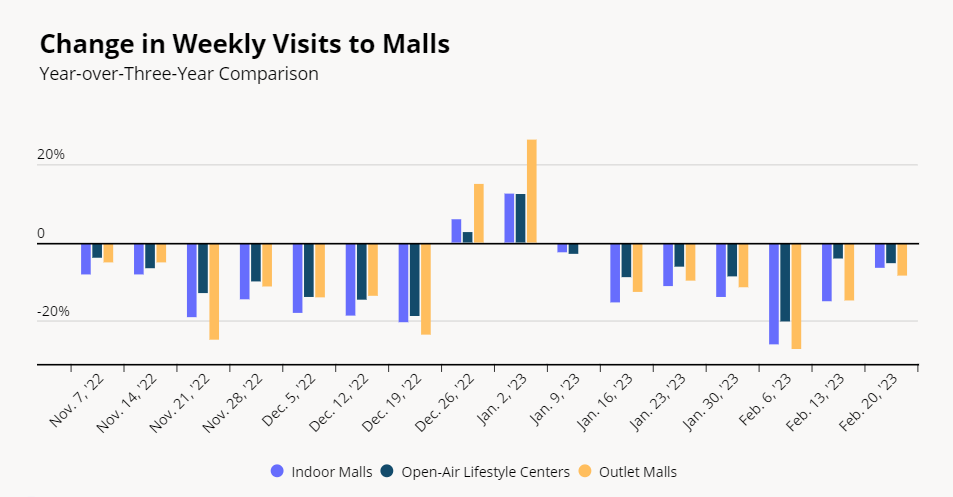

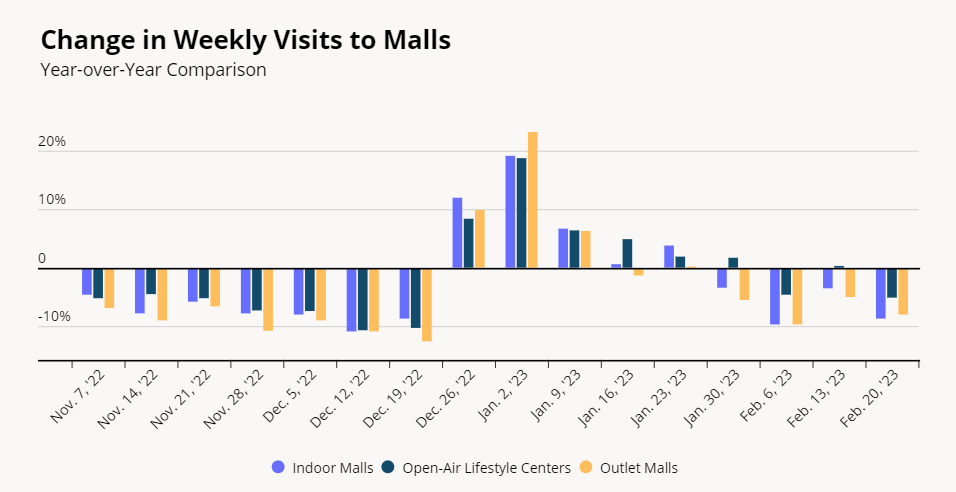

And while the overall picture for February was one of decline, much of the drop compared to pre-pandemic February 2020 centered around the week beginning February 6th. Following that week, visit rates improved significantly, showing a steady trend of recovery, an especially positive sign considering the dramatically different economic environment being faced this year.

Looking at weekly visits YoY presents a similar picture, with visits showing improvements compared to early February even as the comparison challenges grow when looking at 2023 in relation to the relatively strong February and March visits rate in 2022. With these comparisons likely to continue through the spring, it’s fair to expect relative strength to continue to show itself as minor YoY declines.

Malls continue to show a unique level of strength in the face of a challenging economic environment. Can that pace continue deeper into 2023?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.