The future, it would seem, belongs to hybrid work. While many employers are eager to bring more people back to the office, few have set their sights on a five-day in-office work week. And though working from home has its perks, in-person meetings and social interactions with colleagues can be important for morale. The devil, however, is in the details – and as workers and bosses continue to wage the “remote work wars,” it remains to be seen just how the hybrid work week will continue to evolve moving forward.

So with 2023 getting into full swing, we checked in with our Office Building Indexes to see how the office recovery is faring in the new year.

A Hybrid Holding Pattern

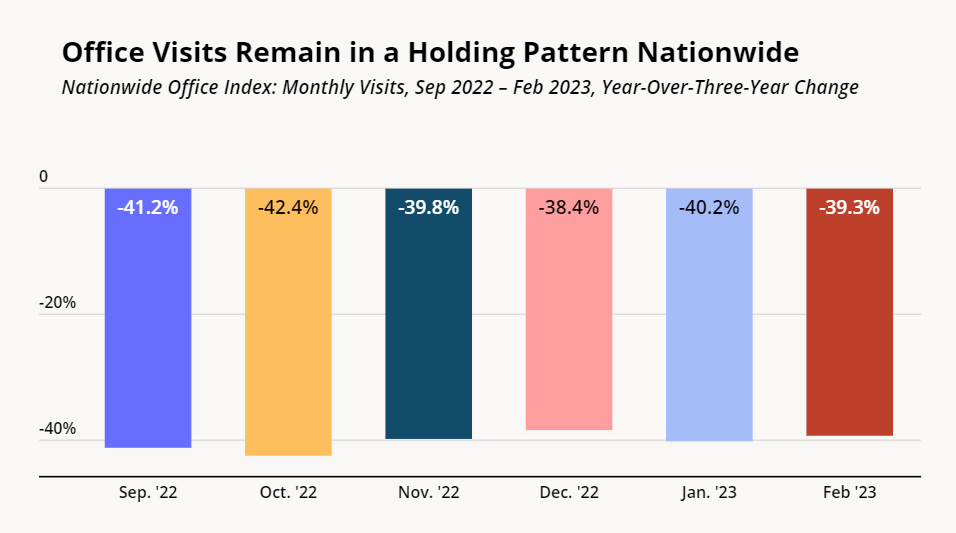

Year-over-three-year (Yo3Y) foot traffic data shows that visits to office buildings are holding steady nationwide, with overall foot traffic remaining about 60% of what it was three years ago. The staying power of this pattern, which despite some fluctuations has remained relatively constant since the second half of 2022, appears to signal the entrenchment of a new hybrid normal.

Zooming in on Local Trends

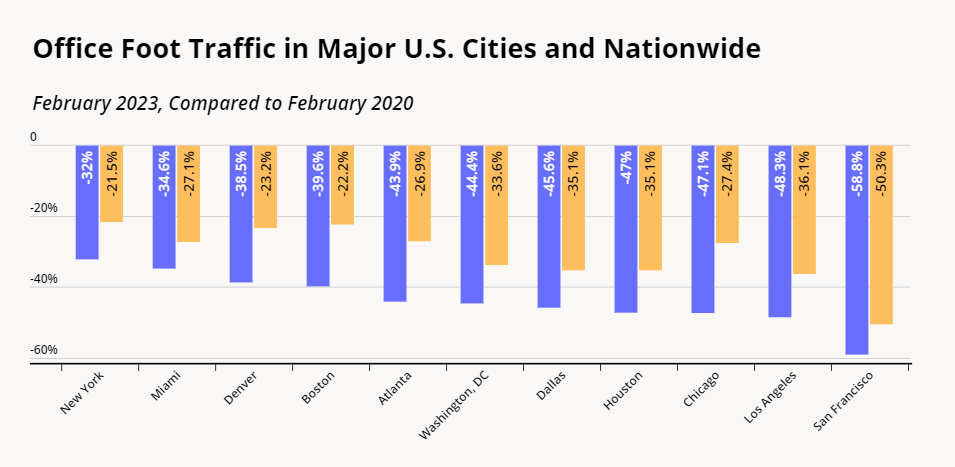

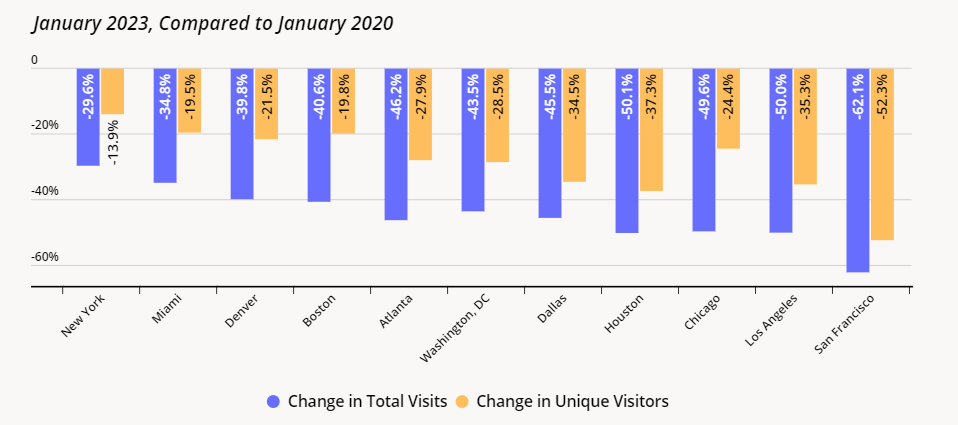

But drilling down into the data for 11 major cities nationwide reveals that there remain important local differences. New York City, which experienced a steady closing of its Yo3Y visit gap throughout 2022 and into January, saw its Yo3Y visit gap widen to 32.0% in February – down from the 29.6% visit gap seen the month before. In Washington, D.C. and Dallas, visit gaps that had narrowed throughout 2022 began to widen in the new year. But in Boston, Denver, Atlanta, Houston, Chicago, Los Angeles, and San Francisco, the overall visit gap shrank between January and February 2023.

As we have pointed out in the past, however, office recovery analyses should account not just for overall foot traffic, but also for unique visitor trends. (Unique visitors refers to the total number of people who visited an office during a specific time period, so that one unique visitor can account for many visits). And interestingly, while many of the analyzed cities experienced narrowing visit gaps compared to January 2023, all but three saw their unique visitor gaps increase, some significantly. This divergence between the overall visit trend and the trajectory of unique visitors may reflect an increase in the frequency of office visits by those workers who have come back to the office.

Key Takeaways

February is a short month – and only time will tell what shape the hybrid work week will take on as the year progresses. Will growing numbers of employers continue to demand that workers come into the office more frequently? And how will evolving economic conditions impact the future of remote work?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.