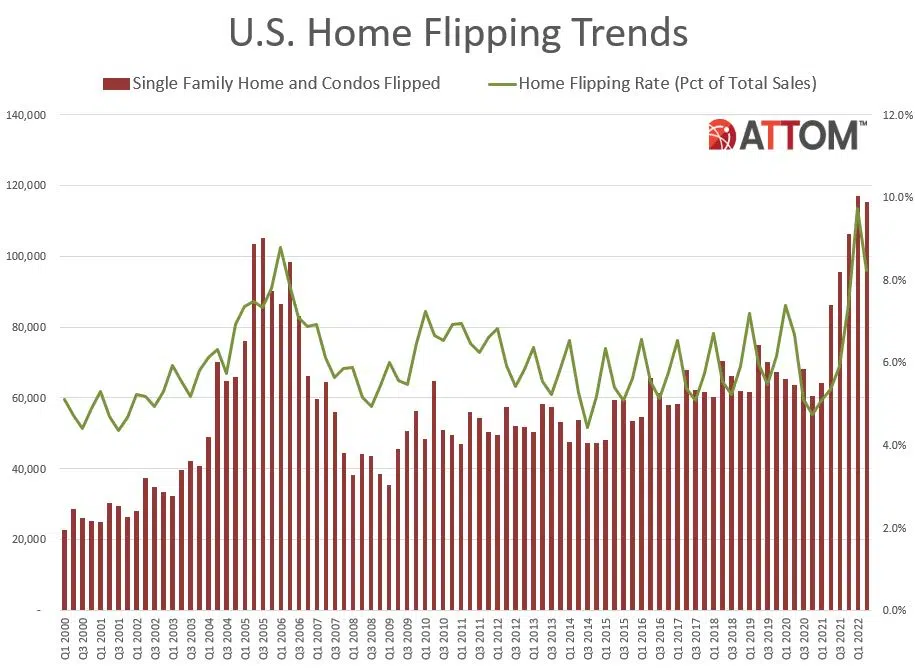

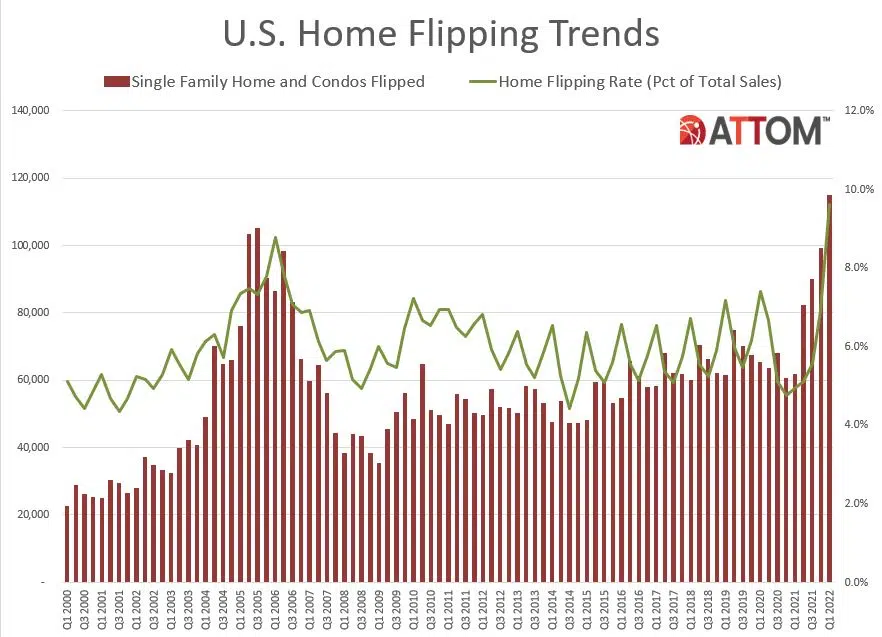

ATTOM, a leading curator of land, property, and real estate data, today released its year-end 2022 U.S. Home Flipping Report, which shows that 407,417 single-family homes and condos in the United States were flipped in 2022. That was up 14 percent from 357,666 in 2021, and up 58 percent from 2020, to the highest point since at least 2005. The report reveals that the number of homes flipped by investors last year represented 8.4 percent of all home sales, also the largest figure since at least 2005.

ATTOM’s just released Q1 2023 U.S. Single Family Rental Market Report, which ranks the best U.S. counties for buying single-family rental properties in 2023, found that the average annual gross rental yield on three-bedroom properties (annualized gross rent income divided by purchase price) is projected to be 7.5 percent in 2023. According to ATTOM’s latest single family rental market analysis, that figure is up from an average of 6.7 percent in 2022 in those same markets and marks the first time since at least 2019 that the figure rose across the country.

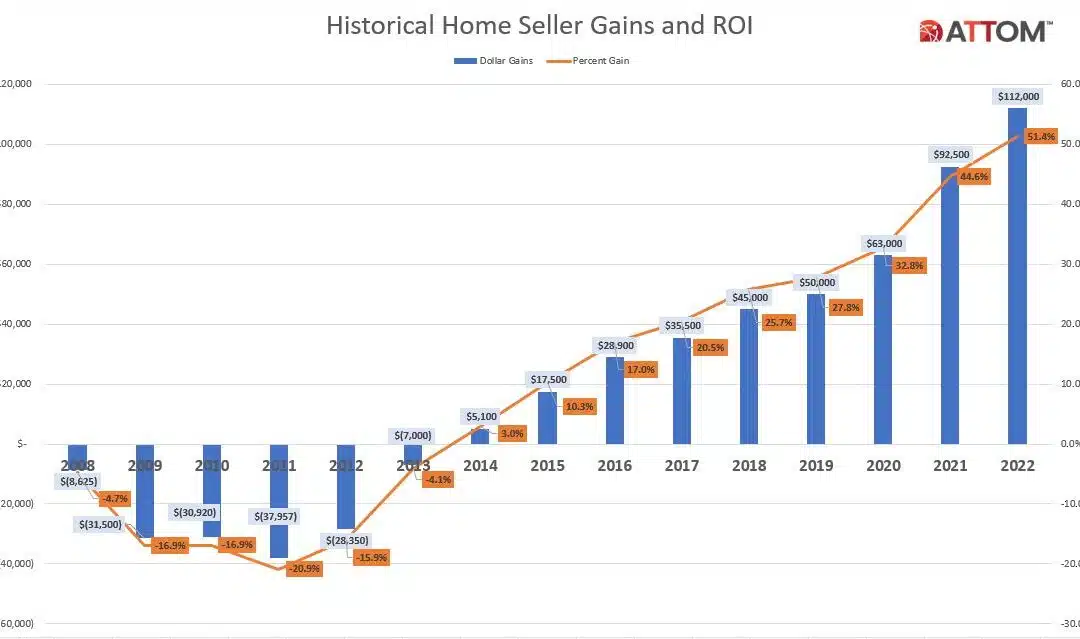

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its Year-End 2022 U.S. Home Sales Report, which shows that home sellers nationwide realized a profit of $112,000 on the typical sale in 2022, up 21 percent from $92,500 in 2021 and up 78 percent from $63,000 two years ago. Despite a market slowdown in the second half of last year, profits rose from 2021 to 2022 in 98 percent of housing markets with enough data to analyze.

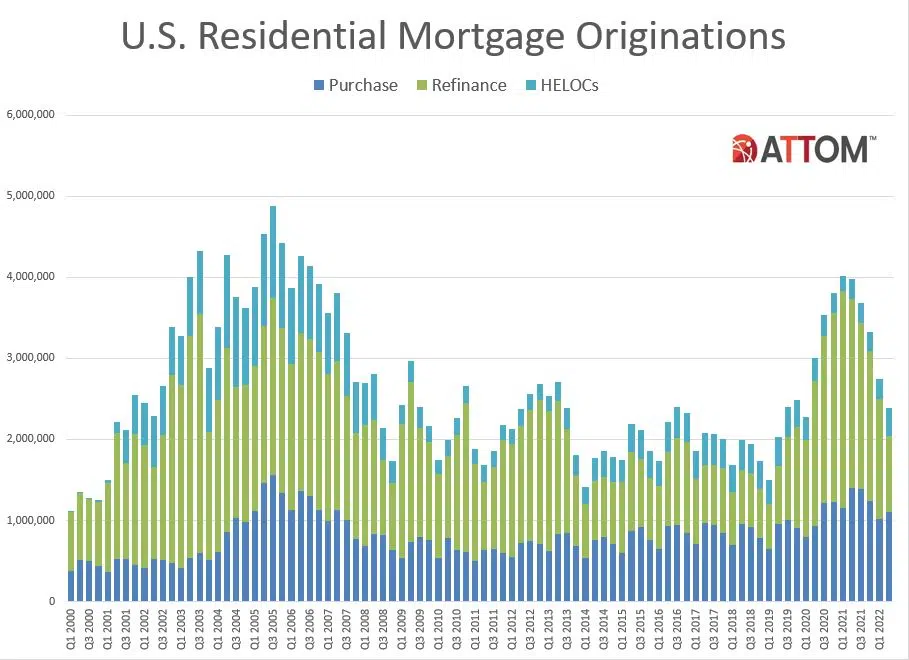

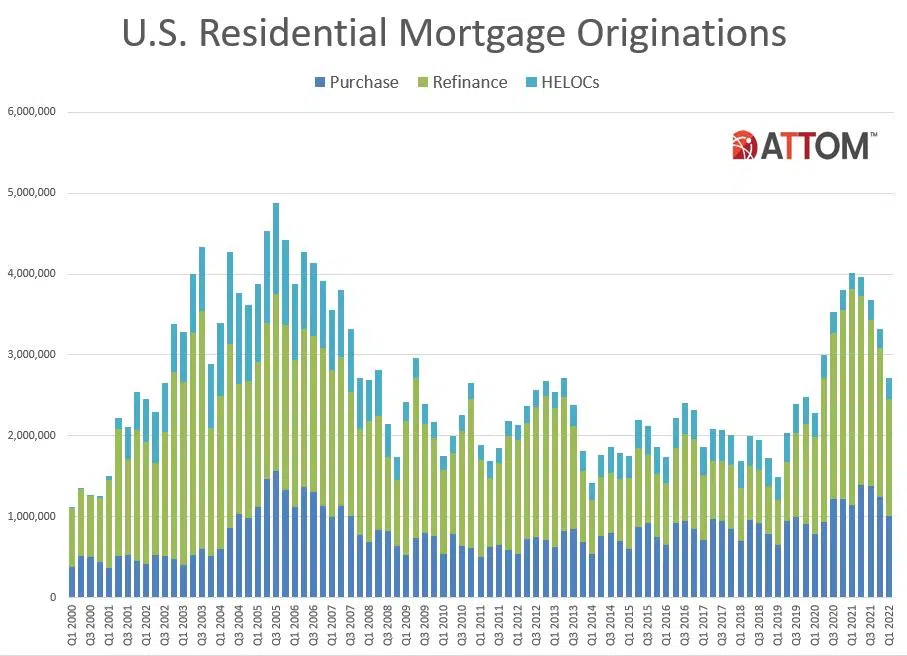

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its third-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 1.97 million mortgages secured by residential property (1 to 4 units) were originated in the third quarter of 2022 in the United States. That figure was down 19 percent from the second quarter of 2022 – the sixth quarterly decrease in a row – and down 47 percent from the third quarter of 2021 – the biggest annual drop in 21 years.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Home Flipping Report showing that 115,198 single-family houses and condominiums in the United States were flipped in the second quarter. Those transactions represented 8.2 percent of all home sales in the second quarter of 2022, or one in 12 transactions. The latest portion was down from 9.7 percent, or one in every 10 home sales, in the nation during the first quarter of 2022, but still up from 5.3 percent, or one in 19 sales, in the second quarter of last year.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 2.39 million mortgages secured by residential property (1 to 4 units) were originated in the second quarter of 2022 in the United States. That figure was down 13 percent from the first quarter of 2022 – the fifth quarterly decrease in a row – and down 40 percent from the second quarter of 2021 – the biggest annual drop since 2014.

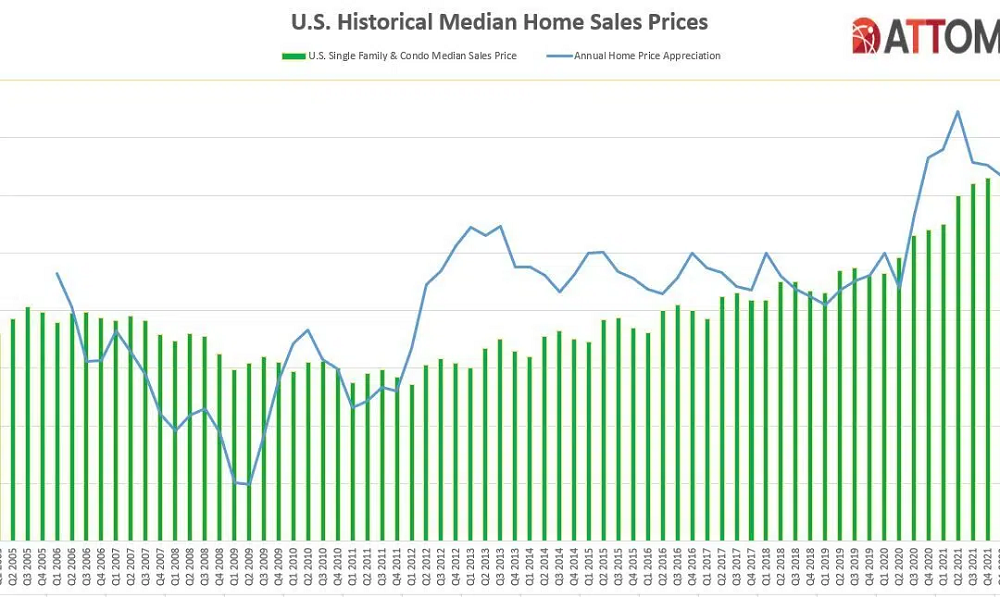

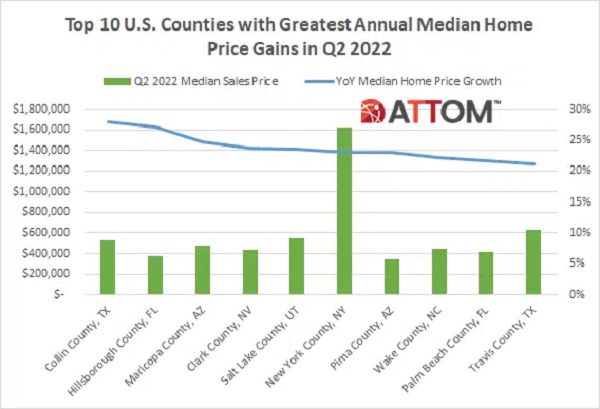

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its second-quarter 2022 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales across the United States hit another new record of 55.5 percent following the largest quarterly gain in a decade.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its Midyear 2022 U.S. Foreclosure Market Report, which shows there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022. That figure is up 153 percent from the same time period a year ago but down just one percent from the same time period two years ago.

ATTOM’s just released Q2 2022 U.S. Home Affordability Report shows that median-priced single-family homes and condos were less affordable in Q2 2022, compared to historical averages in 97 percent of U.S. counties. The report noted that figure was up from 69 percent in Q2 2021, to the highest point since 2007 – just before the housing market crashed during the Great Recession of the late 2000s.

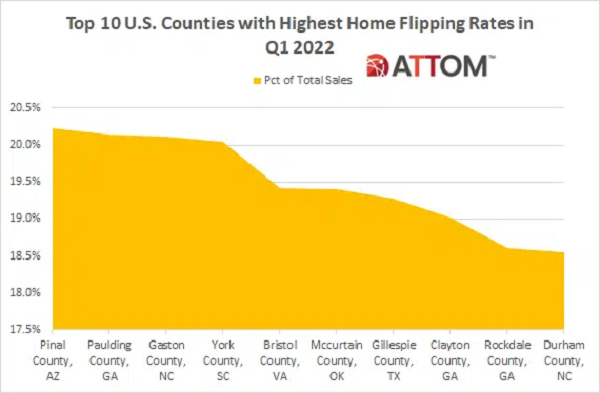

According to ATTOM’s just released Q1 2022 U.S. Home Flipping Report, the home flipping rate in the first quarter was at the highest level since at least 2000, with single-family home and condo flips representing 9.6 percent of all home sales. The report noted that figure was up from 6.9 percent in Q4 2021 and 4.9 percent in Q1 2021. ATTOM’s latest home flipping analysis also reported that jump in the home flipping rate in Q1 2022 marked the fifth straight quarterly increase, and the largest quarterly and annual percentage-point gains since 2000.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its first-quarter 2022 U.S. Home Flipping Report showing that 114,706 single-family houses and condominiums in the United States were flipped in the first quarter. Those transactions represented 9.6 percent of all home sales in the first quarter of 2022, or one in 10 transactions – the highest level since at least 2000. The latest total was up from 6.9 percent, or one in every 14 home sales in the nation during the fourth quarter of 2021, and from 4.9 percent, or one in 20 sales, in the first quarter of last year.

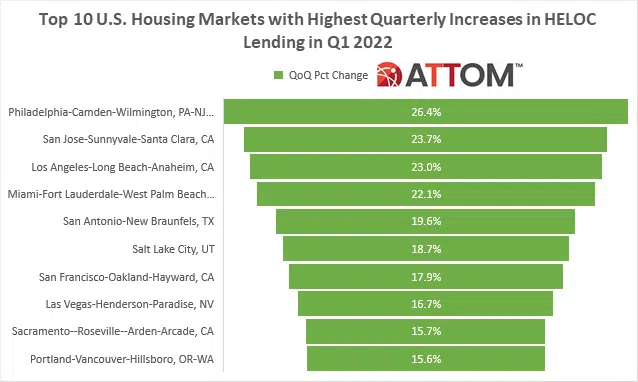

According to ATTOM’s Q1 2022 U.S. Residential Property Mortgage Origination Report, 2.71 million mortgages secured by residential property were originated in Q1 2022 in the U.S. – down 18 percent from Q4 2021, the largest quarterly decrease since 2017, and down 32 percent from Q1 2021, the biggest annual drop since 2014. The report noted that the decline in residential mortgages, which marked the fourth straight quarterly decrease, resulted from double-digit downturns in purchase and refinance activity – even as home-equity lending rose.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its first-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 2.71 million mortgages secured by residential property (1 to 4 units) were originated in the first quarter of 2022 in the United States. That figure was down 18 percent from the fourth quarter of 2021 – the largest quarterly decrease since 2017 – and down 32 percent from the first quarter of 2021 – the biggest annual drop since 2014.

ATTOM’s newly released Best Days to Sell A Home Analysis reveals that the months of May, June and July offer seller premiums of 10 percent or more above market value, based on home sales over the past 11 years – with the top 15 best days to sell in the month of May alone. According to ATTOM’s latest analysis of more than 46 million single family home and condo sales between 2011 and 2021, the Spring and Summer months continue to prove more profitable for home sellers.

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, today released its Q1 2022 U.S. Foreclosure Market Report, which shows a total of 78,271 U.S. properties with a foreclosure filing during the first quarter of 2022, up 39 percent from the previous quarter and up 132 percent from a year ago.

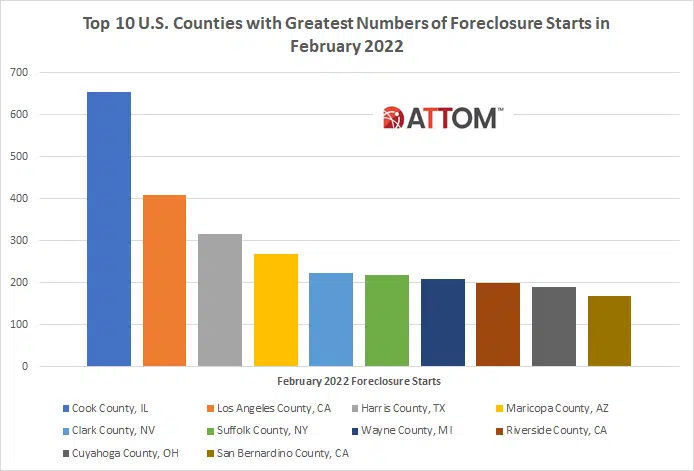

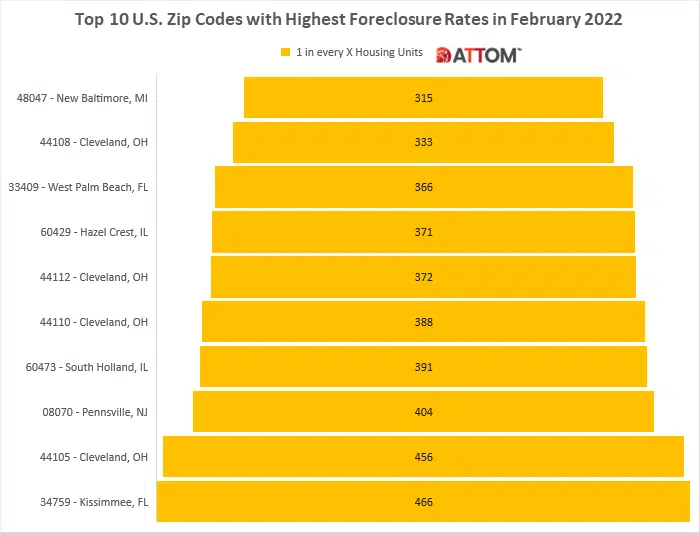

ATTOM’s February 2022 U.S. Foreclosure Market Report revealed that lenders started the foreclosure process on 16,545 U.S. properties in February 2022. That figure was up 40 percent from January 2022 and 176 percent from February 2021. According to ATTOM’s latest foreclosure activity analysis, those states that saw the greatest numbers of foreclosures starts in February 2022 included: California (1,868 foreclosure starts); Florida (1,527 foreclosure starts); Texas (1,488 foreclosure starts); Illinois (1,168 foreclosure starts); and Ohio (1,144 foreclosure starts).

According to ATTOM’s February 2022 U.S. Foreclosure Market Report, foreclosure filings in February 2022 were up 11 percent from January 2022 and 129 percent from February 2021. ATTOM’s latest foreclosure activity analysis found there were a total of 25,833 U.S. properties with foreclosure filings reported in February 2022. The report noted that lenders repossessed 2,634 of those properties through completed foreclosures (REOs), down 45 percent from January 2022 but up 70 percent from February 2021.

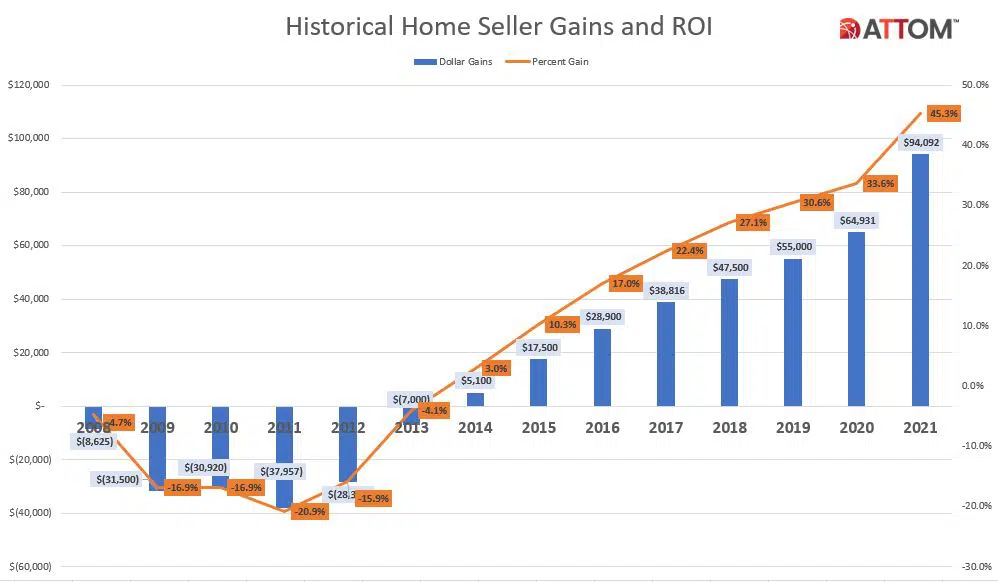

ATTOM, curator of the nation’s premier property database, today released its Year-End 2021 U.S. Home Sales Report, which shows that home sellers nationwide realized a profit of $94,092 on the typical sale in 2021, up 45 percent from $64,931 in 2020 and up 71 percent from $55,000 two years ago. Profits rose in more than 90 percent of housing markets with enough data to analyze and the latest figure, based on median purchase and resale prices, marked the highest level in the United States since at least 2008.

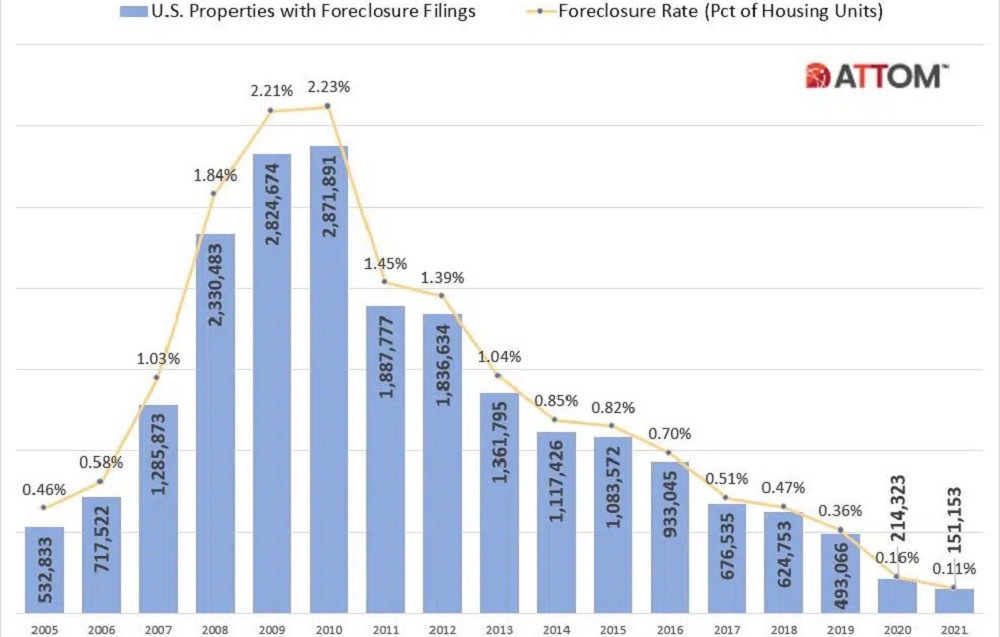

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, today released its Year-End 2021 U.S. Foreclosure Market Report, which shows foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 151,153 U.S. properties in 2021, down 29 percent from 2020 and down 95 percent from a peak of nearly 2.9 million in 2010, to the lowest level since tracking began in 2005.

According to ATTOM’s just released 2022 Rental Affordability Report, home ownership remains more affordable than renting, even though median home prices have increased more than average rents and more than averages wages in 88 percent of U.S. counties analyzed. ATTOM’s 2022 rental affordability report shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58 percent of the counties analyzed.