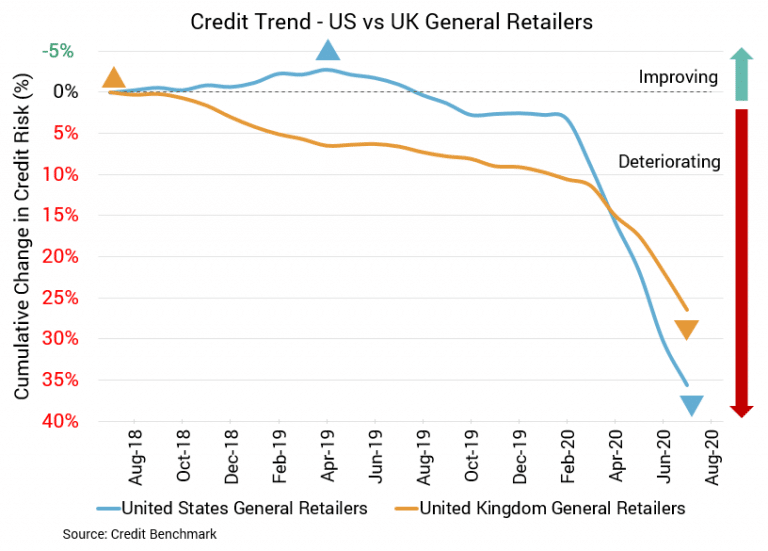

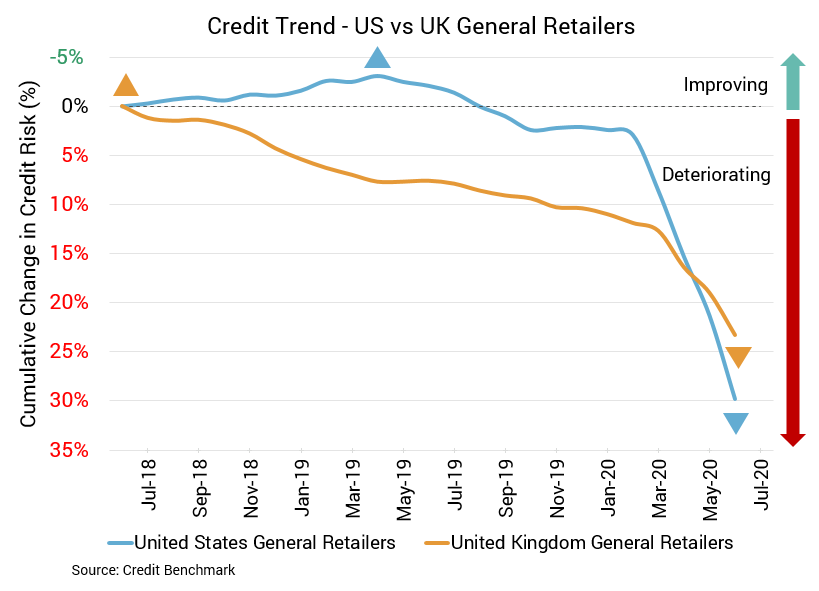

Except for a few lonesome doves, general retailers in the US continue to struggle. Sales have returned to pre-pandemic levels, but the composition is different and recent sales recoveries were lower than anticipated. Consumer spending increases have been moderate. Something similar can be said for UK retail and for UK consumer spending. COVID-19 remains an issue for each country.

Equity markets used to ignore credit risk, but COVID has changed all that. There is a growing demand to understand corporate and financial credit risk at all levels, from single issuers and corporate families to sectors, industries and countries. How far do equity market movements reflect credit developments during the COVID crisis?

With rising infection rates and concerns about the looming virus season, the COVID crisis is clearly far from over. But with the first wave behind us, it is possible to see the past six months of market volatility in its broader context. The S&P500 is now higher than it was in February 2020, having at one stage lost one third of its value. The VIX spiked from a mid-February level of 14% to a mid-March high of 85%, and currently trades at 33%. The Global BBB spread\[1\] tripled from 1.5% to 4.5% and currently sits at 1.7%.

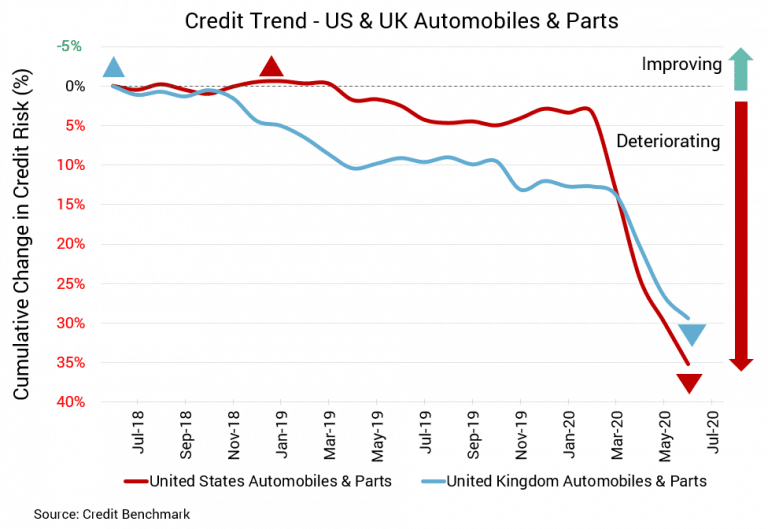

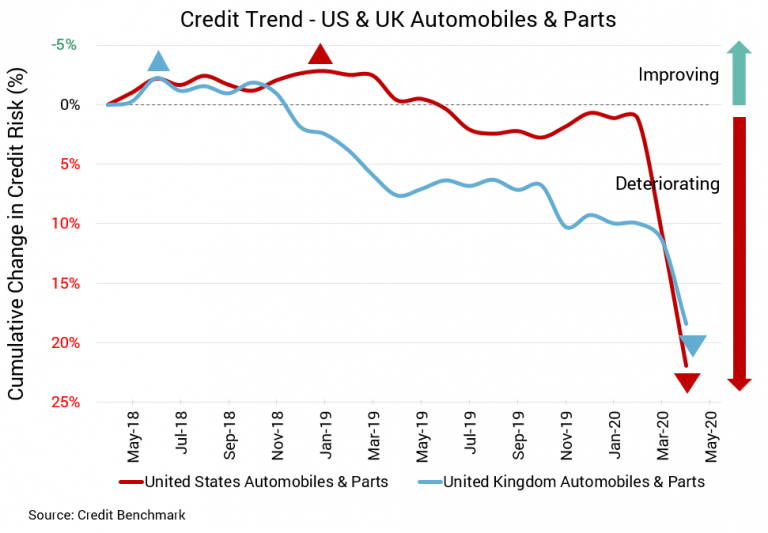

While there are some signs the US auto industry is restarting after COVID, numerous challenges remain – and that’s not even factoring in overall weakness in the economy and personal finances. Credit weakness continues, and it’s unlikely to get much better until everything else improves. Similar can be said about the UK, where car sales are on the rise but where the economy is coming off its worst drop on record.

Problems for the beleaguered US energy sector have continued to mount this year. Demand for oil plummeted, bringing down prices as competition and supplies grew. Bankruptcies continue in the industry as the broad economy continues to struggle, and it’s not clear how many firms will benefit from any improvement in prices.

The ranks of the Fallen Angels – firms whose credit quality has made the shift from investment-grade to high yield, or “junk” status – continue to grow, but the pace may be slowing down. Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies have now entered the Fallen Angel category.

In the Ernest Hemingway novel The Sun Also Rises, Mike is asked how he went bankrupt. “Two ways,” he answers. “Gradually, then suddenly.” COVID-19 seems to have rewritten the financial rules: Central Banks are pushing interest rates further into negative territory and Government support for businesses and their employees has pushed Sovereign debt to levels not seen since the Second World War.

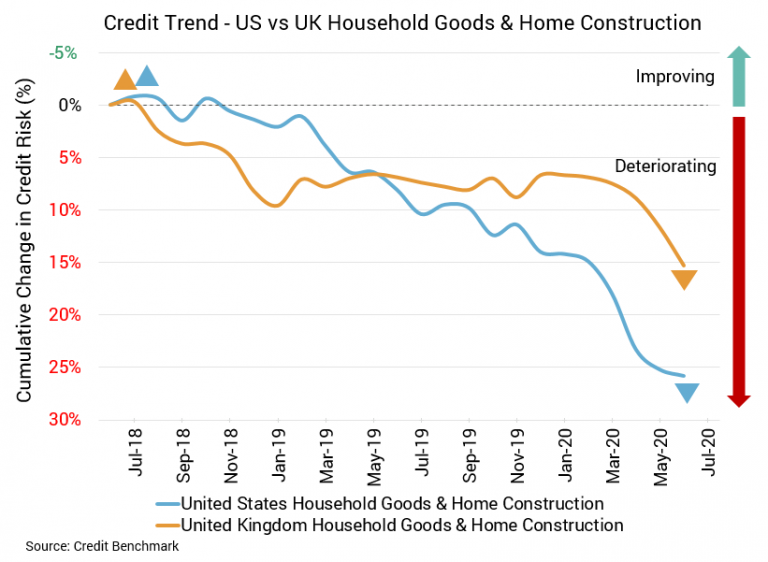

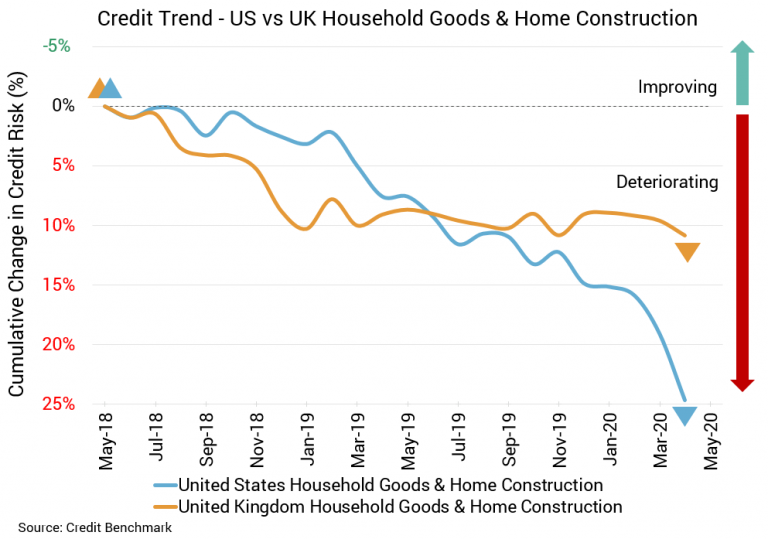

The US housing sector can breathe a (perhaps temporary) sigh of relief. The UK housing sector, however, may be taking a turn for the worse, with credit quality diminishing. There have been some positive signs in recent weeks, like rising sales, increased construction, and regulatory changes that allow for more construction. But with the UK experiencing the worst recession on record, this sector’s credit prospects may be restrained for some time.

The August CCIs have seen significant further credit deterioration for UK, EU and US Industrial companies. Credit quality continues to worsen month-on-month for UK Industrial companies, with a third consecutive month of decline. The CCI jumped down several points to register at 40.9 this month, down from 44.2 last month.

COVID-19 has caused major economic damage, especially in sectors connected with travel and leisure. But in manufacturing and technology there will be some strong winners: increased factory automation, major house-building and property conversion programs, increased demand for private cars, new software to facilitate social distancing in a broad range of situations, and major supply chain restructuring.

Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by.

Problems in credit quality abound, yet few sectors are seeing deterioration like the US energy sector. Supplies remain elevated as demand remains lower, and the economy remains weakened as new COVID-19 cases surge throughout the country. So great is the strain for the sector that Deloitte projects up to $300 billion in write downs or impairments, and the list of bankruptcies is growing.

Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of these are companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment-Grade to “Junk” – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.

Last month’s swing from near-neutral credit quality to pronounced deterioration for UK Industrial companies continued for a second month in similar severity. The CCI for this month is 44, a very slight worsening from last month’s CCI of 44.4. Recent output figures indicated that industrial manufacturing and production in the UK improved from April to May against expectations.

The blows to the US retail sector continue. Well-known names declaring bankruptcy include Neiman Marcus, JC Penny, J. Crew, Tuesday Morning and GNC. More recently, Lucky Brand, Brooks Brothers, and Sure La Table have joined the list. One analysis is even suggesting the recent COVID-19-induced hit to retail is worse than that experienced during the Great Recession.

Fewer cars bought. Fewer miles driven. Less travel. Reduced or eliminated paychecks and massive spikes in unemployment. The problems are legion for the US auto sector. Even with some initial estimates of the difficulties proving to be overstated, credit challenges could remain with the US auto sector for some time. The UK auto sector, where production has been reduced drastically and jobs are being cut, finds itself in a similar situation.

The Covid19 crisis has exposed the risks in single, long and complex supply chains that are only as strong as their weakest link. Companies are moving quickly to multiple, short, simple and robust supply structures wherever possible. Some companies view their supply chain details as trade secrets, but a number of financial data platforms – such as Bloomberg and Factset – provide detailed information on suppliers and customers for many of the largest firms in the world.

Each monthly credit update brings more bad news for the energy sector. Even with positive signs, such as increased air travel and the gradual reopening of the economy, demand remains suppressed. Default risk continues to surge and shows no sign of immediate improvement.

A myriad of problems are confronting the US housing market — far fewer homes are being built and new construction planning processes are diminishing. The rate of home sales is also falling. While there is some evidence emerging that things are beginning to look up, credit problems persist for this sector.

Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of the downgrades have been for companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment Grade to Junk – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.