Specialty outdoor retailers are showing strong recovery amidst slower growth in the retail sector. In spite of national park restrictions and summer camp closures due to COVID-19, the second quarter of 2020 saw year-over-year sales growth skyrocket for fishing, hunting, and boating companies, as U.S. consumers sought safer ways to enjoy their free time.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that, through the end of June, sales for meal delivery services more than doubled year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In May, 29 percent of American consumers had ever ordered from one of the services in our analysis, up from 23 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. Though rideshare is beginning to bounce back, in June, Uber and Lyft sales were down 78 percent and 75 percent, respectively, year-over-year.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items. By analyzing industry-level data, consumer spending trends can provide insight into which sectors of the economy are recovering fastest.

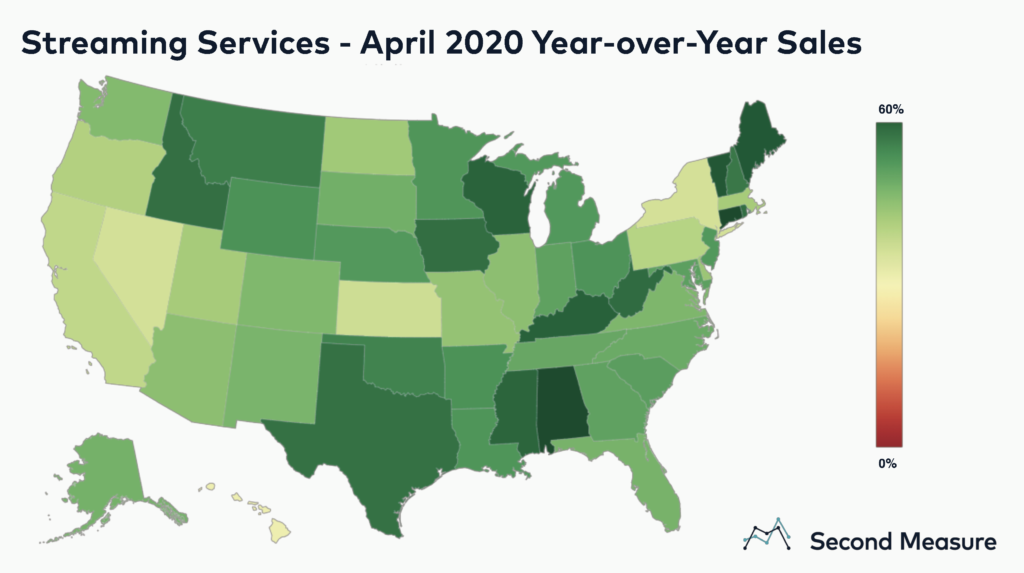

As U.S. consumers stay home amid the pandemic, they are flocking to streaming services for entertainment. The streaming industry’s sales grew 47 percent year-over-year in April 2020 compared to a 39 percent year-over-year sales increase in April 2019. Mandatory stay-at-home-orders, combined with the entry of a new market player, Disney+, and the rising popularity of socially-distant gatherings like Netflix parties, have led to the industry’s growing success.

With U.S. cities and states under shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility has resulted in plummeting sales at rideshare companies. In May, Uber and Lyft sales both fell 86 percent, respectively, year-over-year. Weekly data reveals that, after a steep drop at the end of the last quarter, sales are no longer declining at either company.

Earlier this year, the dawn of COVID-19 triggered mass stockpiling of toilet paper, causing widespread shortages. Second Measure’s data shows that one company in particular has benefited from this: Tushy, which sells bidets and bamboo toilet paper. Both Tushy’s sales and customer counts increased six-fold the week of March 9th, when the frenzy really began.

As many Americans have spent weeks at home during the COVID-19 pandemic, apparel retail has been among the hardest hit industries, while ecommerce has been thriving. Where does this leave online sellers of secondhand fashion? Like the merchandise on their sites, the answer is a mixed bag.

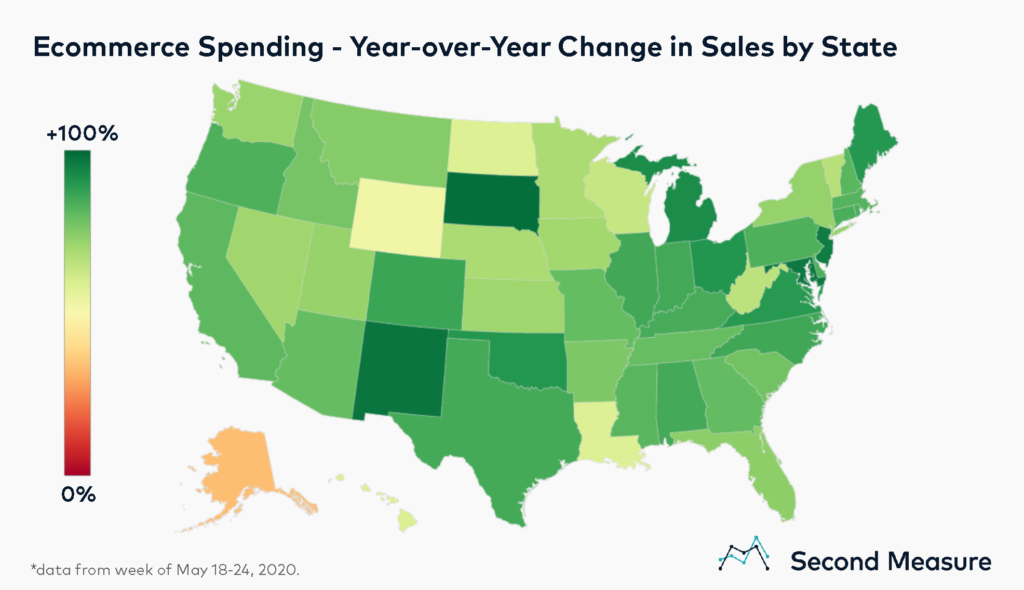

The COVID-19 pandemic has crippled many traditional retailers, with previous analyses showing clothing store sales dropping by half, or more. As many Americans are still unable to patronize brick-and-mortars, that spending may be increasingly displaced toward online shopping. Nationwide, the latest data reveals that weekly ecommerce sales are up 80 percent year-over-year.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

As many Americans continue sheltering in their homes due to the coronavirus pandemic, meal delivery sales have reached new heights. Our data reveals that, through the end of April, meal delivery services saw sales nearly double year-over-year, collectively. As Uber is reportedly working on a deal to acquire Grubhub, these thriving businesses are in the spotlight during the COVID-19 era, while Uber’s rideshare business has taken a major hit.

In response to the coronavirus pandemic, the U.S. government has begun issuing economic impact payments via the IRS to qualifying Americans. To date, the majority of stimulus payments hit bank accounts on April 14, 15, 21, and 22. These cash infusions are helping U.S. consumers cover their basic expenses as well as stimulating the economy at large.