SMI Core data captures the actual spend data from the SMI Pool partners of major holding companies and large independent agencies, representing up to 95% of all US national brand ad spending, to provide a complete monthly view of the SMI Pool market size, investment share and category performance. Core Data delivers detailed ad intelligence across all media types, including Television, OTT, Digital, Out of Home, Print, and Radio.

Christmas is around the corner, and it’s still anyone’s guess still how Santa’s trip will go, with supply-chain break downs, pent up consumer demand, the pandemic unresolved. But Standard Media Index’s forward-bookings data, and the perspective of several industry pundits we interviewed, provide reason for optimism that advertising is in for a strong 4th quarter. “The rebound and upward trends continue and I think it will be significantly better than 2020,” says David Shiffman, executive vice president of research at iHeartMedia.

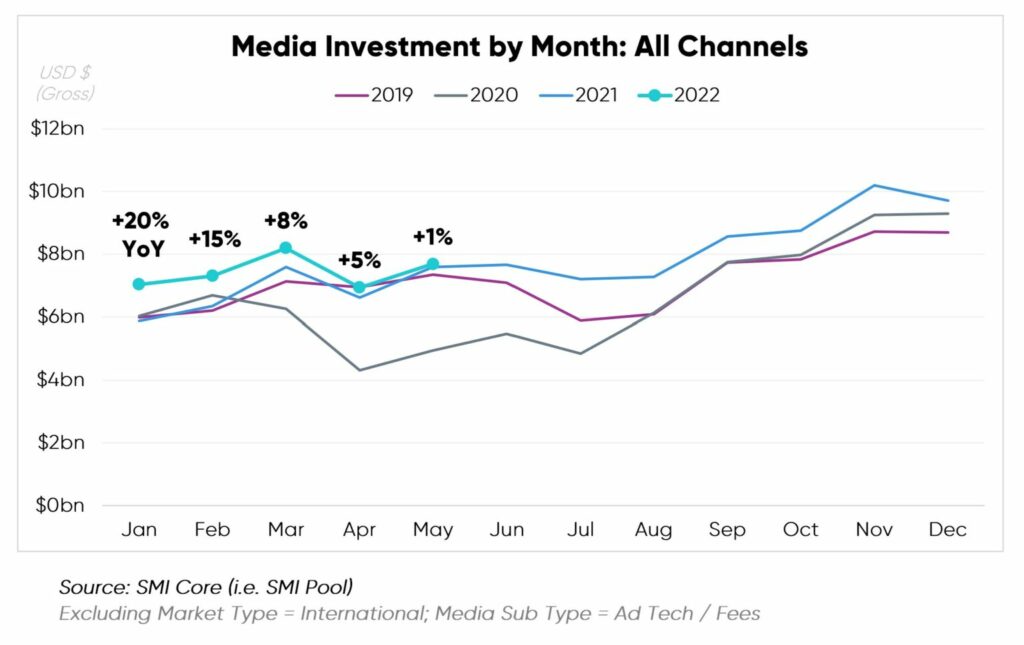

KEY global advertising markets have already begun to recover from 2020’s record declines in ad spend, and our exclusive market intelligence is reporting that the investment by national advertisers in the first quarter of 2021 has grown 1% beyond that achieved in Q1 2019. Standard Media Index collects and publishes real media agency ad spend, and our data shows a strong rebound in the US, UK, Australian, NZ and Canadian markets.

In what has been the hardest-hit and slowest-to-recover ad market, Canada has finally rebound. To understand the effect of the rebound, we leveraged our detailed ad intelligence data sourced from actual spend from the top media agencies in Canada. The data shows that in Q1 2021, national advertising expenditure across all media was up +4% vs Q1 2020 and driven by a strong March month, up +10% vs. March 2021.

In an increasingly fragmented video landscape, the NFL continues to be a juggernaut that generates billions of dollars in ad revenue for their cable and broadcast partners each year. Our NFL data intelligence reports the broadcast and cable networks captured $3.3 billion in ad revenue for the 2020-21 season, excluding Super Bowl LV, a year-over-year increase of +3%.

After a dismal second quarter 2020, the national ad marketplace ended with a strong fourth quarter. SMI reported no category was stronger in the final quarter than Consumer Packaged Goods, with year-over-year ad spend growth of +34%, the most of any vertical. For calendar year 2020, CPG ad spend grew +10%, compared to -7% for the entire ad market.

Performance during the July to September quarter is key for the media industry, with the transition from Summer into Fall; and in some markets, it represents the conclusion of a broadcast season and the start of a new one. This year’s third quarter was even more interesting, as the media industry across all Anglo markets attempted to recover from a disastrous second quarter as a result of the Covid-19 lockdown.

In second quarter 2020 the full impact of the COVID pandemic on the ad marketplace was felt globally. According to Standard Media Index (SMI), second quarter ad spend dropped by an average of -37.1% across five major Anglo markets, the United States, Canada, United Kingdom, Australia and New Zealand, year-over-year. SMI reports ad spend declines had continued and even accelerated throughout second quarter after the pandemic first hit in mid-March.

Australia’s advertising market has been devastated by the COVID pandemic, with SMI reporting record declines in monthly year-on-year ad spend in April and then again in May. But our forwards data clearly shows the market has begun to improve and we’re now providing more detail to help media position themselves for the upswing.

Over the past few months COVID-19 has brought the world to a startling halt. Across Canada, strict lockdown measures in mid-March forced Canadians to stay home. We saw the cancellation of all sporting and live events, the closure of bricks and mortar store fronts, and a significant impact to the economy.

STRONG growth in Newspaper ad spend is the common early COVID-19 ad spend trend across the Australian and New Zealand media markets, although total media market trends vary markedly in March.

Australian media Agency bookings are back 10.6% in March as a lower level than usual of late Digital bookings failed to push the market into a single digit decline, as had been expected.