Over the past few months COVID-19 has brought the world to a startling halt. Across Canada, strict lockdown measures in mid-March forced Canadians to stay home. We saw the cancellation of all sporting and live events, the closure of bricks and mortar store fronts, and a significant impact to the economy.

The effects of the pandemic forced many brands to pivot millions of dollars in allocated advertising spend.

In Canada alone, the industry makes up $11billion dollars in annual ad revenue. Brands, agencies and publishers found themselves quickly shifting, content and programming in a way that the industry had never before seen.

By looking closely at the current media landscape and identifying trends across media types and product categories, we can begin to understand how brands, agencies and publishers can leverage these insights to make better advertising decisions, particularly in times of uncertainty. Through data collected by Standard Media Index, the most trusted global source of advertising pricing and spend, we are able to understand and identify where opportunities for growth exist.

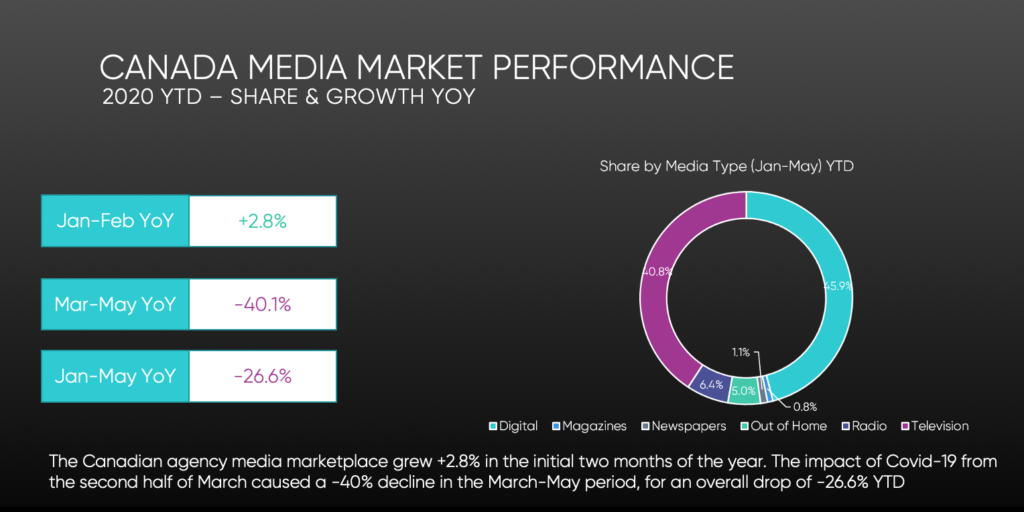

In the first two months of 2020 the Canadian media marketplace showed signs of growth as a result of a strong economy, with an increase of +2.8% in advertising spend, compared to the same period in 2019. However, the impact of COVID-19 in the second half of March caused a quick and steep decline in media investment, resulting in a -40% drop in brand media spend by May. This is by far the most significant decline the media industry has seen.

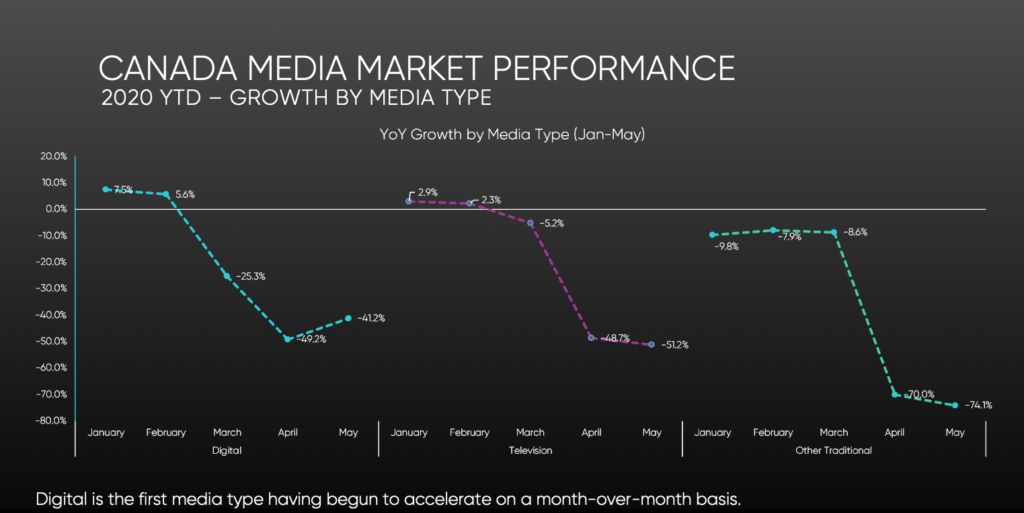

Not surprisingly, Television and Radio and Out of Home advertising were the most severely impacted media platforms, and continue to see declines in spend, even as the economy opens up. Digital media was the only media type to experience an increase in spend of +8% in the month of May, however year over year spend continues to be down by -41.2%. The improved performance of Digital can be attributed to the adaptability of the media platform – allowing brands to easily shift spend from other more traditional media types, like Out of Home and TV. We expect Digital media to continue on an upward trend in the coming months leading to a quicker recovery. E-commerce has also fuelled the uptick in Digital, as more shoppers shift from in store to online purchases.

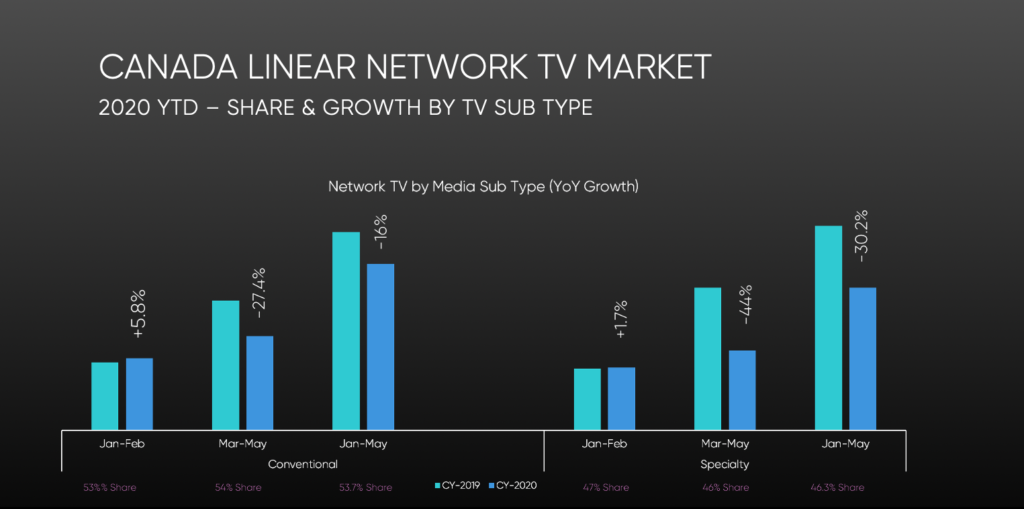

The abrupt cancelation of sports programming left Specialty TV with inventory to fill, contributing to a significant decline of -44%, between March and May, when compared to spend 2019. Sport specific programming experienced an incredibly steep decline in ad revenue at -81%, between March and May. Conventional TV, on the other hand fared better, with a decline of only -27.4%, aided by the positive performance of news programming.

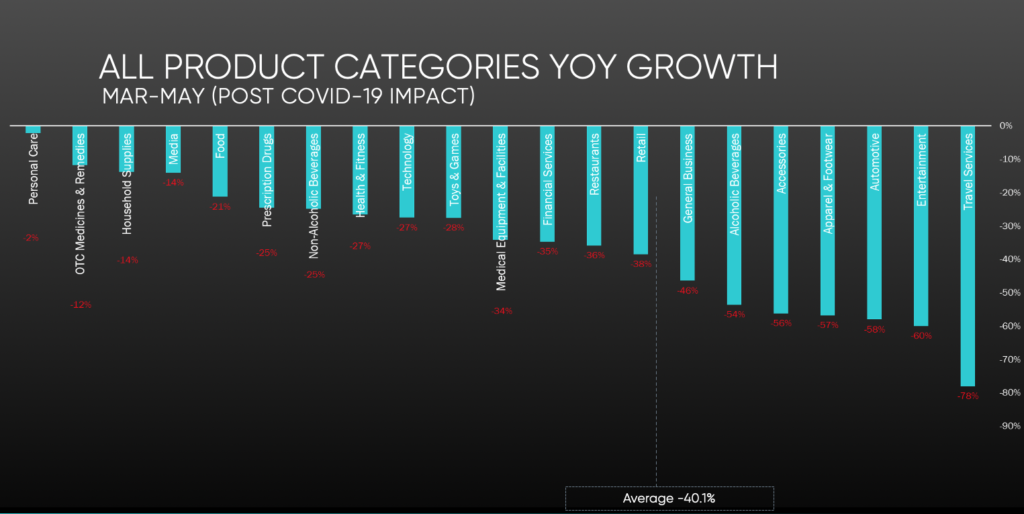

Although all product categories experienced a decline in ad spend during March, April and May, certain categories responded better than others.

For example, Personal Care and Prescription Drugs are two categories that continued to advertise through the pandemic, with Personal Care demonstrating signs of growth at +6% year over year. Toys and Health & Fitness categories, although impacted, managed to remain among the third and fourth least impacted categories. Alcohol and Travel Services however, experienced the steepest declines in year over year growth at -47% and -53% respectively. Travel in particular is expected to continue on a downward trend over the next few months. Even as carriers like West Jet and Air Canada begin to operate aircrafts at full capacity.

It will be interesting to see how the advertising industry recovers as the country slowly returns to a new normal. We can expect that the advertising and media industry will begin to show signs of recovery, particularly in certain product categories and among certain media types. However, with continued restrictions on live sports and entertainment, work from home measures still in place for many companies and continued social distancing regulations, we can expect recovery to be slow. As we move forward in the coming weeks and months, we at Standard Media Index will keep a close eye on trends happening across the industry as we look to help all players in the Canadian media ecosystem understand where the best opportunities for growth lie.

To learn more about the data behind this article and what SMI has to offer, visit https://www.standardmediaindex.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.