Source: https://www.standardmediaindex.com/insights/nfl-tv-ad-revenue-up-to-3-3-billion-in-2020-2021-season/

NFL TV ad revenue increased +3% in the 2020/21 Season, now up to $3.3 Billion

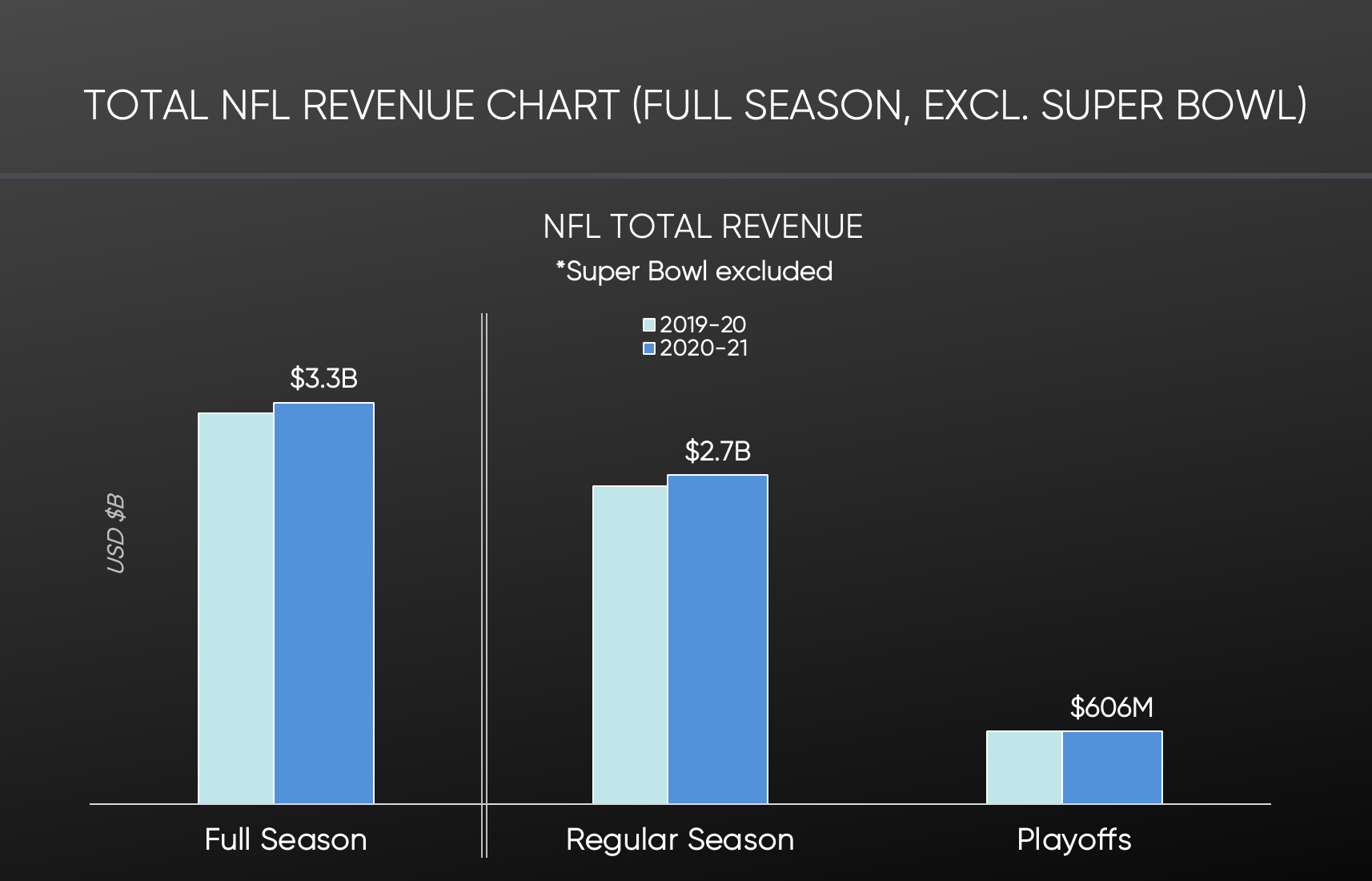

In an increasingly fragmented video landscape, the NFL continues to be a juggernaut that generates billions of dollars in ad revenue for their cable and broadcast partners each year. Our NFL data intelligence reports the broadcast and cable networks captured $3.3 billion in ad revenue for the 2020-21 season, excluding Super Bowl LV, a year-over-year increase of +3%.

In the 17-week NFL regular season, ad revenue in 2020, reached $2.7 billion, an increase of +3% from 2019. The newly expanded postseason, televised throughout January 2021, provided an additional $606 million in ad dollars, a slight YOY decline of -0.2%.

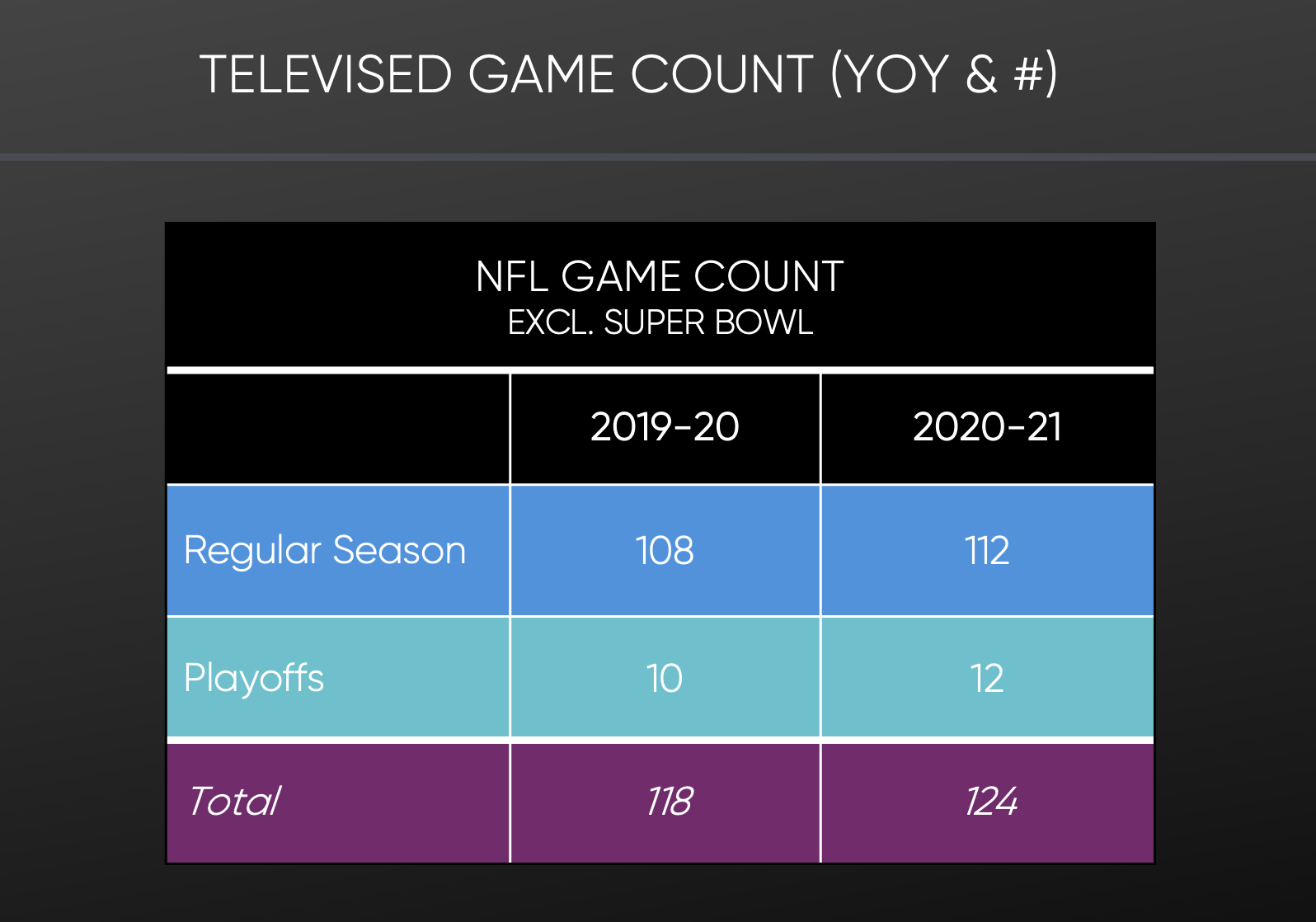

For the season, the networks had upped the number of nationally televised games for the regular season and postseason. In total, heading into the Super Bowl, there were 124 NFL televised games for the 2020-21 season, up from 118 in 2019-20. Fox, with its package of Thursday night and Sunday afternoon games, televised over one-third of the games, the most of any network.

The number of televised regular-season games was 112, an increase from 108 in 2019. With the NFL adding an extra playoff team in each conference, the opening “wild-card” playoff weekend now consists of a tripleheader of games to be played on both Saturday and Sunday. Subsequently, heading into the Super Bowl, there are now 12 postseason games, across three weekends in January, up from ten. (In 2021, Fox and NBC each televised one additional postseason game from 2020.)

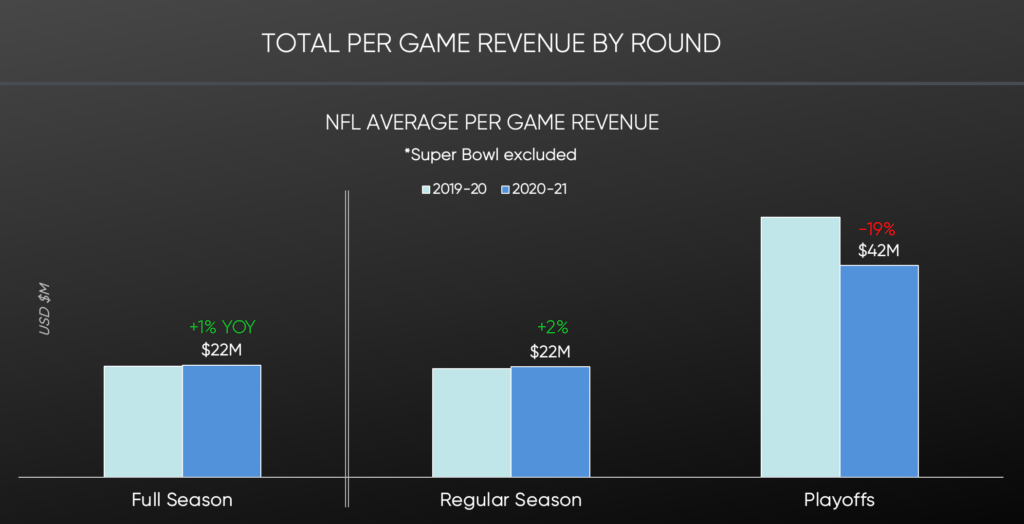

SMI analysis found the average national ad revenue for each regular season NFL national telecast in 2020 was $22 million, unchanged from the previous year. For the NFL postseason (excluding the Super Bowl), which delivers higher ratings, the average ad revenue per game was $42 million, nearly double the regular season. When compared to previous year, however, ad revenue per postseason game dropped by -19%. The increase in postseason games may have been the reason for the drop in ad dollars per game.

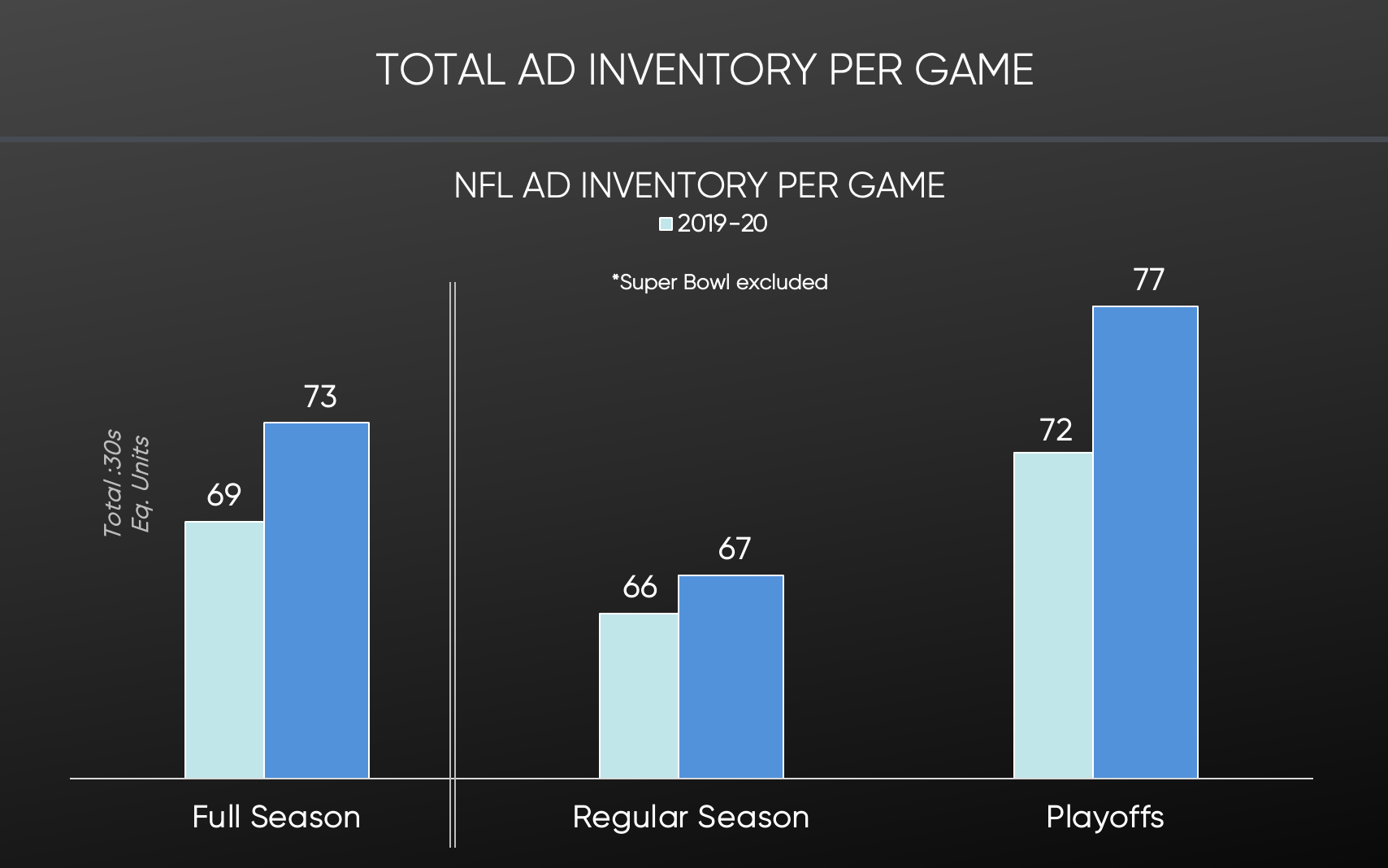

Another factor with NFL ad revenue was the amount of in-game advertising units the networks sold. For the 2020 regular season, the networks sold an average of 67 ad units (equivalized:30’s) per game, a slight uptick from the previous season of 66 ads. For the postseason, however, the average number in-game ad units grew to 77 over the 12 games (924 total ads). By comparison, the previous year, the in-game ad inventory had been 72, over ten games (720 total ads).

There will be further changes ahead for the NFL and their television partners. In 2021, an additional week will be added to the NFL regular season, extending it to 18 weeks (each team still has one bye week). Hence, for the 2021 season, there will be more than 112 televised regular-season games. Also, with TV rights fees set to expire soon, the NFL is currently negotiating contract renewals with their TV (and possibly streaming) partners. Both will have an impact on ad revenue.

As these changes occur, you can rely on SMI to continue to provide insights on the ad revenue of NFL games in the years ahead.

To learn more about the data behind this article and what SMI has to offer, visit https://www.standardmediaindex.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.