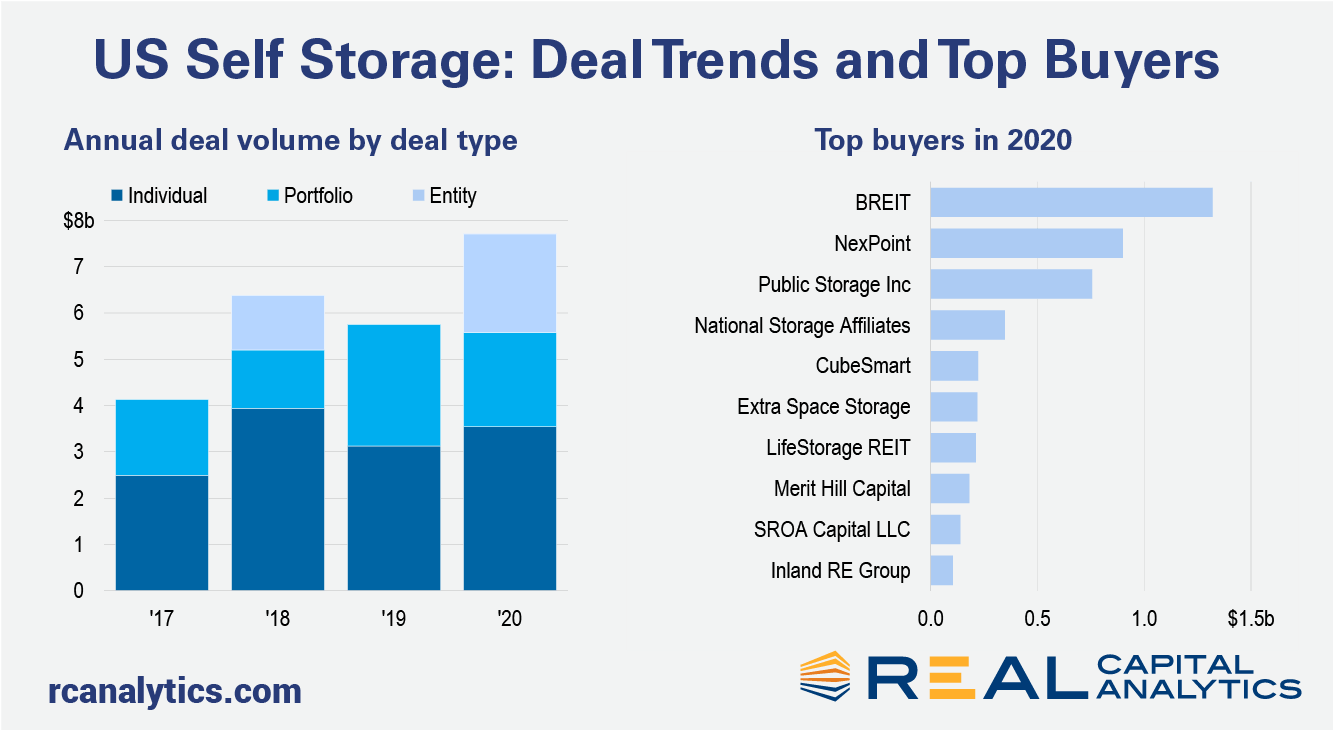

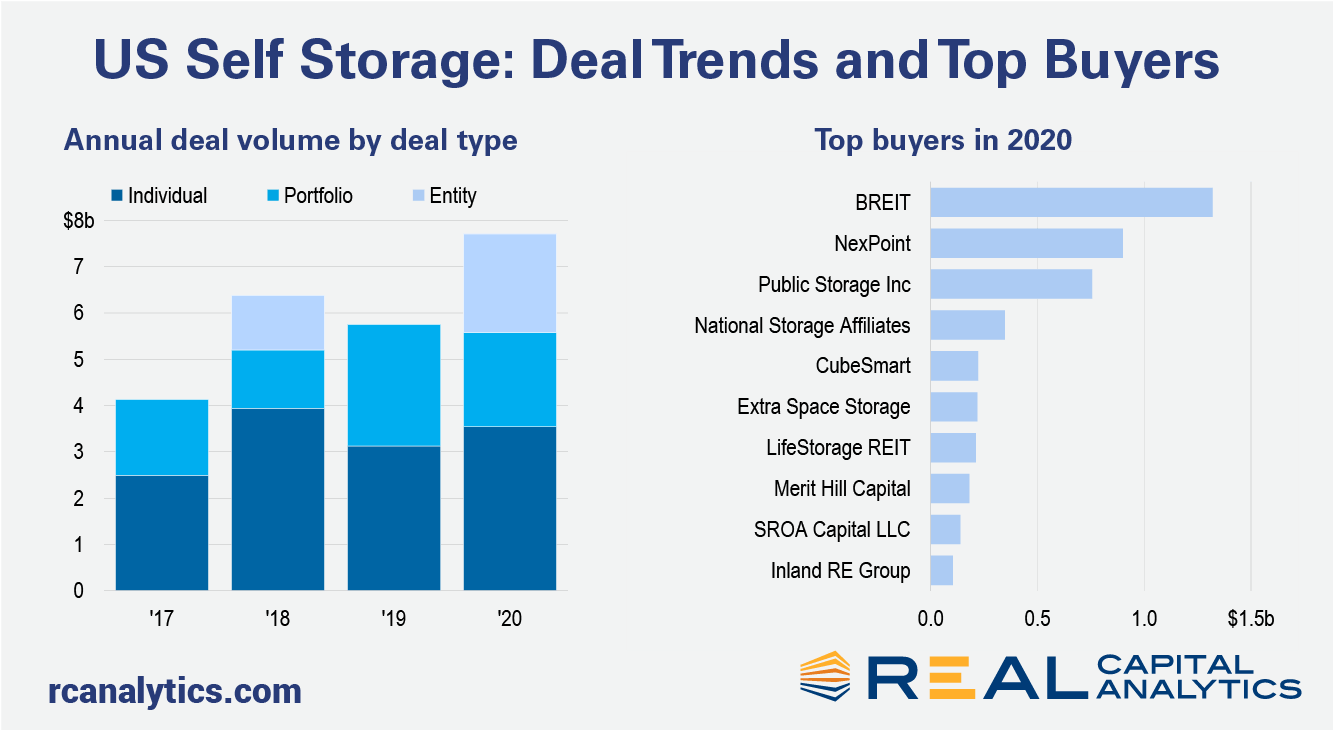

Transactions involving U.S. self storage assets reached a record level in 2020 despite the disruption and uncertainties caused by the global pandemic. While two outsized entity-level deals boosted transaction volume, individual deals and a wide range of buyers are evidence of ongoing broad interest in the sector.

At $7.7 billion for the year, self storage deal activity was one-third higher than that of 2019, a stark outperformance compared to the U.S. market overall which slumped by more than a quarter. BREIT’s acquisition of Simply Self Storage and Nexpoint’s acquisition of Jernigan Capital, both of which took place in the fourth quarter, accounted for over 25% of annual volume. Still, sales of single assets, a better indicator of the health of the market, were also higher than 2019: $3.5 billion worth of individual assets changed hands in 2020, up 13% year-over-year.

The number of unique investors in the self storage sector dwindled in the second quarter of 2020, at the height of Covid-19’s disruption, but recovered by the end of the year to reach 125, the highest number in Real Capital Analytics records.

As is usual for the sector, private investors were the most dominant source of capital, accounting for 58% of investment for the year as well as four of the top 10 investors. Five REITs and one institutional player rounded out the top 10. Only a single REIT company — Public Storage — was a top 10 investor and developer in 2020.

Construction starts for self storage assets tapered last year. Preliminary figures from RCA suggest the value of construction put in place fell 20% from 2019. Pricing trends suggest that a pullback in construction was warranted.

At 6.1%, cap rates for self storage assets are at or below their long-term averages across all geographies. Pricing in the sector has remained competitive, but yields are not compressing as they had in the recent past. Self storage cap rates in the 6 Major Metros, in fact, moved up 10 bps from the levels seen in 2019.

By contrast, investor demand for the industrial sector is so intense that cap rates fell 20 bps to hit 6.0% at year-end, even amidst the pandemic. This difference in cap rate trends is not meant to suggest waning interest in the sector; again, sales were up, in addition to the number of unique buyers. But with slowing cap rate compression, it is helpful that the pace of construction pulled back in 2020.

Through February of 2021, the $968 million in investment activity is already the highest in RCA records for the first two months of a year. While self storage has proved resilient through the Covid-induced downturn, only time will tell how the sector performs post-pandemic.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.