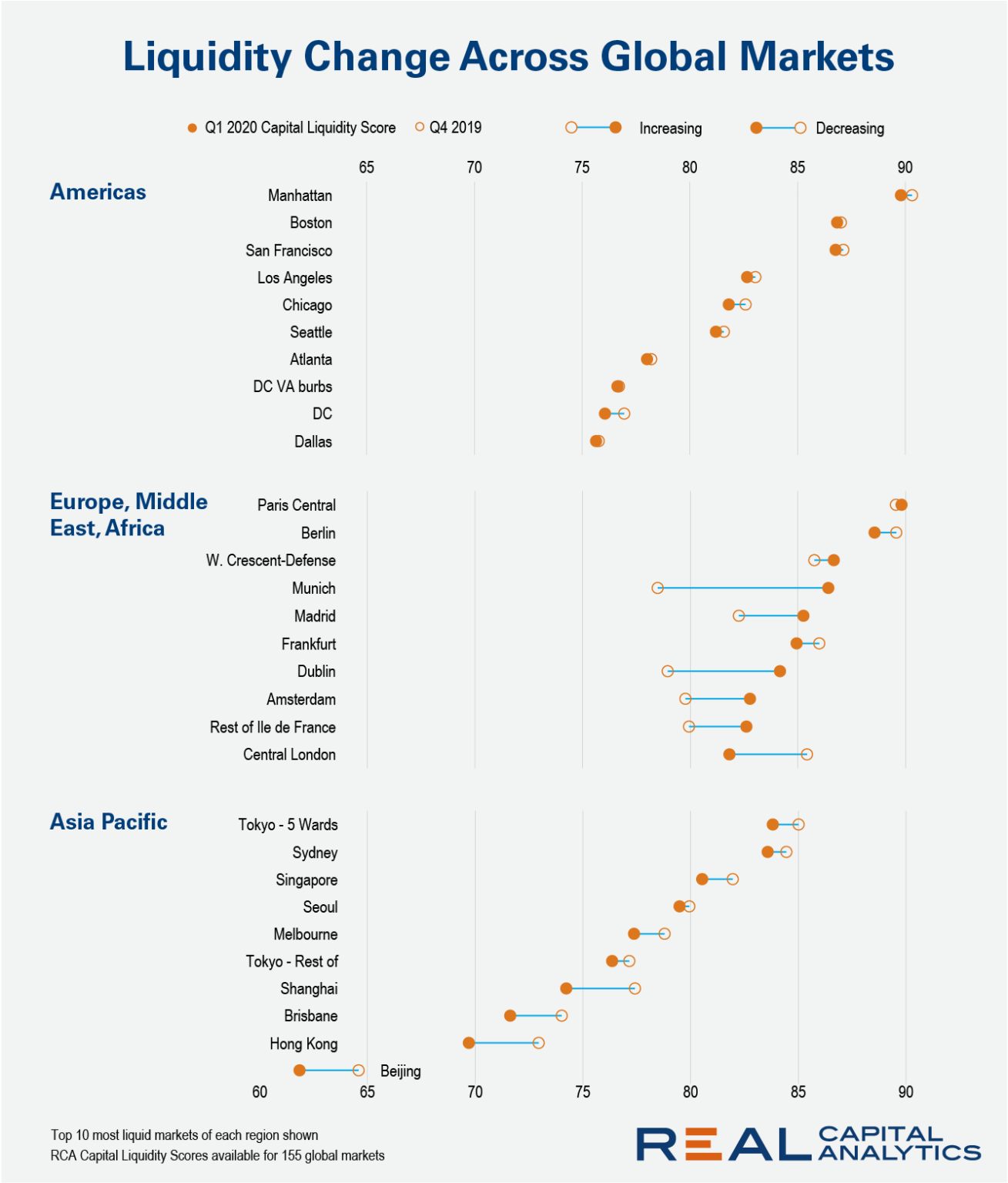

Central Paris tied Manhattan as the world’s most liquid market in the first quarter of 2020 after an exceptional period of dealmaking in the French capital. The latest update of the RCA Capital Liquidity Scores shows that the Covid-19 crisis arrived too late in the quarter to dent liquidity in either European or North American markets significantly.

By contrast, in the Asia Pacific region, the majority of markets covered recorded a drop in liquidity compared with the end of 2019. This was dramatic in some cases, reflecting the scale of the market slowdown; for example, Shenzhen registered a 30% decline in its score. In troubled Hong Kong, where the market slowdown began in mid-2019, the liquidity score is now at a three-year low with the expectation of further declines.

In North America, the sharpest slowing was seen in secondary and tertiary markets such as Milwaukee and Cleveland, but the top 10 most liquid markets, starting with Manhattan in first place and finishing with Dallas in 10th, all saw liquidity down on end-2019 levels. The scale of the liquidity pullback is relatively small for now, but the latest transaction data heralds a much sharper fall at the end of the second quarter for North America and for Europe as the physical lockdown restrictions and resultant macro and micro uncertainties restrict dealmaking.

In Europe, liquidity across U.K. markets was already ebbing. Liquidity dropped in all but one of the 14 markets covered compared with a year prior. The slowdown is most notable in Central London, where liquidity finished March at levels similar to those recorded during the depths of the Global Financial Crisis.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.