The blows to the US retail sector continue. Well-known names declaring bankruptcy include Neiman Marcus, JC Penny, J. Crew, Tuesday Morning and GNC. More recently, Lucky Brand, Brooks Brothers, and Sure La Table have joined the list. One analysis is even suggesting the recent COVID-19-induced hit to retail is worse than that experienced during the Great Recession. The news is no better in the UK, where JD Sports seems likely to enter administration; alongside Victoria’s Secret UK, Debenham’s, Laura Ashley, and DVF Studio earlier this year. Job cuts continue in both the US and UK at all levels and unemployment levels grow as economies struggle to recover.

Each Month Sees Worsening Credit Trend

US General Retail Firms

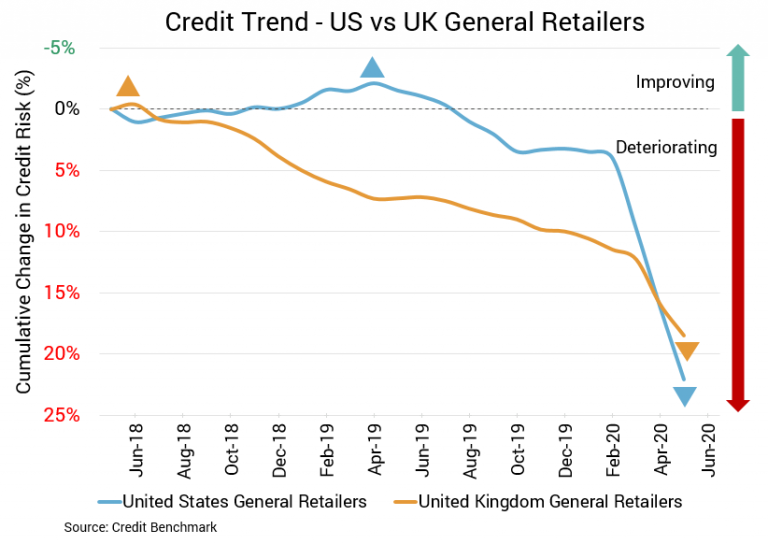

The decline in credit quality for US general retail firms continues to hasten, with deterioration averaging 6% in each of the last three months. The latest update shows a steep drop of 6% month-over-month, 11.8% over the last two months, and 18.8% over the last three months. On a year-over-year basis, the drop is 23.9%. Average probability of default for this sector is now 57 basis points, compared to 54 basis points in the prior month, 51 basis points two months prior, and 48 basis points three months prior. At the same point last year, average probability of default was 46 basis points. Approximately 80% of firms this aggregate with a CBC rating are at bbb or lower with the most recent update, and the overall CBC rating for this aggregate is bb+.

UK General Retail Firms

Credit quality also continues to worsen for UK general retail firms. The latest data show a drop of 1% month-over-month and 6% over the last two months. Year-over-year, credit quality deteriorated by 10.3%. Average probability of default for UK general retail firms remains significantly higher than that of their US counterparts. It’s now 75 basis points – just three points away from a downgrade to a CBC score of bb-. At the same point last year, average probability of default was 68 basis points. The percentage of firms in this aggregate with a CBC rating of bbb or lower (92%) is higher than with the US aggregate. The overall CBC rating for this aggregate is bb+.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.