U.S. single-family rents increased 1.7% year over year in May 2020, a sharp slowdown from the prior month, and the lowest growth rate since July 2010, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. Despite local economies beginning to open back up in May, rental demand continued to be impacted by unprecedented unemployment rates and stay-at-home directives, which contributed to the slowing in rent prices.

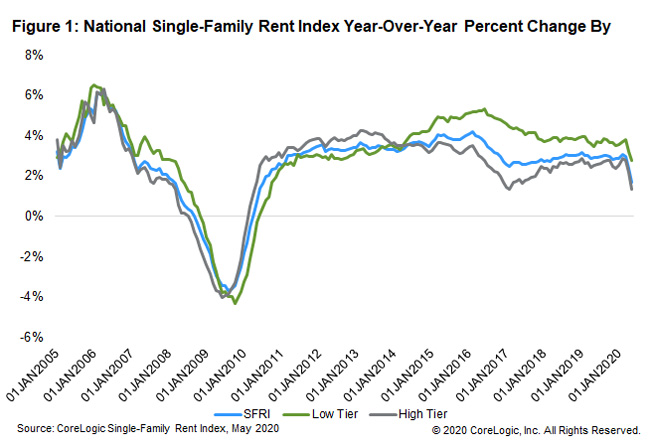

Lower-priced rentals continued to prop up national rent price growth, which has been an ongoing trend since April 2014 (Figure 1). However, year-over-year growth among both tiers did slow in May 2020. Rent prices for the low-end tier, defined as properties with rent prices less than 75% of the regional median, increased 2.8% year over year in May 2020, down from 3.5% in May 2019. Meanwhile, higher-priced rentals, defined as properties with rent prices greater than 125% of a region’s median rent, increased 1.3% in May 2020, down from a gain of 2.5% in May 2019.

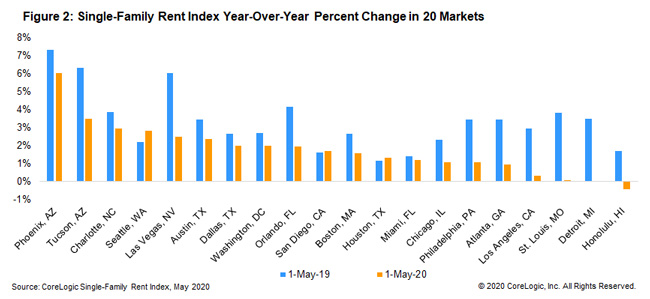

Rent growth varies significantly across metro areas. Figure 2 shows the year-over-year change in the rental index for 20 large metropolitan areas in May 2020. Among the 20 metro areas shown, Phoenix had the highest year-over-year rent growth this May as it has since late 2018, with an increase of 6%, followed by Tucson (+3.5%) and Charlotte (+2.9%). Honolulu, which was hit hard by the collapse of the tourism market, was the only metro to experience an annual decline in rent prices, dropping 0.4%. St. Louis had the largest deceleration in rent growth in May, showing annual rent growth of 3.8 percentage points lower than in May 2019. U.S. unemployment rates remained elevated in May. However, some areas of the country are continuing to experience higher rates of job loss — adversely impacting rental demand and slowing rent price growth. For example, Detroit, a hotspot for the virus, experienced a dramatic, 19.9% decrease in employment, forcing local rent price growth to remain stagnant in May 2020, compared to the year prior. Meanwhile, Phoenix’s employment declines were relatively minimal in May, where rent growth remained strong. As regions like Florida, Texas and Arizona grapple with a resurgence of COVID-19 cases, we may expect to see a more significant impact to rent prices on the local level.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.