Specialty outdoor retailers are showing strong recovery amidst slower growth in the retail sector. In spite of national park restrictions and summer camp closures due to COVID-19, the second quarter of 2020 saw year-over-year sales growth skyrocket for fishing, hunting, and boating companies, as U.S. consumers sought safer ways to enjoy their free time.

Both industries were hit hard at the start of the pandemic, but the retail industry has seen a slower recovery. While retail has yet to reach positive year-over-year growth, the outdoor goods sector began observing positive growth the week of May 25. In the last week of June alone, the industry enjoyed 27 percent year-over-year growth, while retail was down 15 percent.

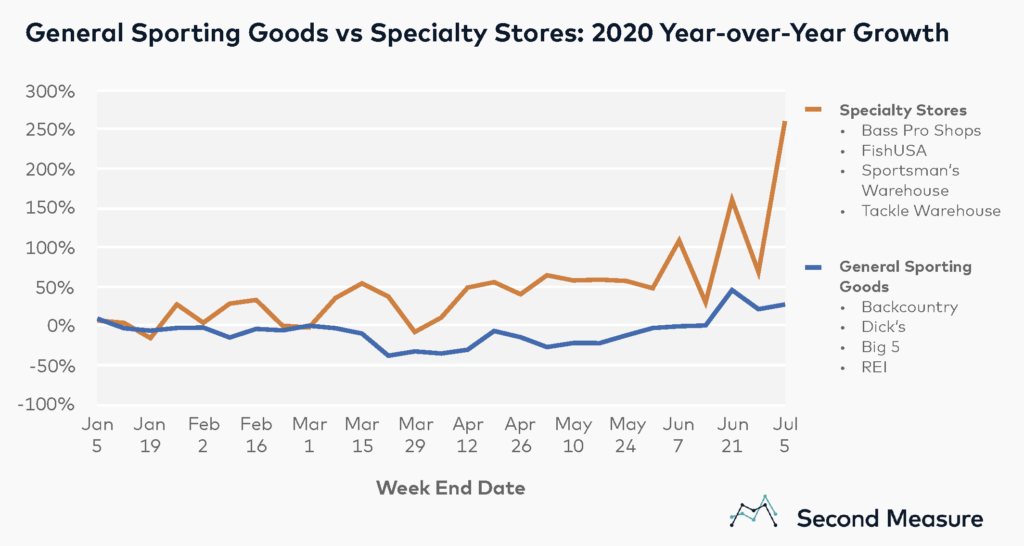

Specialty goods stores outperforming general sports retailers

Hunting and fishing companies are reeling in the biggest sales, showing the strongest growth among specialty outdoor retailers. FishUSA led the pack, posting 108 percent average weekly year-over-year growth since the start of shelter-in-place orders. Similarly, Bass Pro Shops and Sportsman’s Warehouse observed 50 and 70 percent average weekly year-over-year growth, respectively.

Companies that sold a wider range of outdoor and sporting equipment, not limited to fishing and hunting, are still struggling to achieve positive growth. Dick’s Sporting Goods saw weekly average year-over-year sales fall by 15 percent the last week of June, while Big 5 Sporting Goods was down 20 percent.

Among general sporting goods retailers, Backcountry races ahead of the pack. The company enjoyed year-over-year growth of 55 percent last month, largely due to its strong online presence. Conversely, REI remains the only outdoor retailer in this competitive set to post negative growth in the last month. REI’s year-over-year growth was down 15 percent in June, though an improvement over its 48 percent drop in year-over-year sales in May. Unlike Backcountry, the company generated nearly 70 percent of sales through its brick-and-mortar stores prior to the pandemic.

Outdoor-inspired subscription services becoming increasingly popular

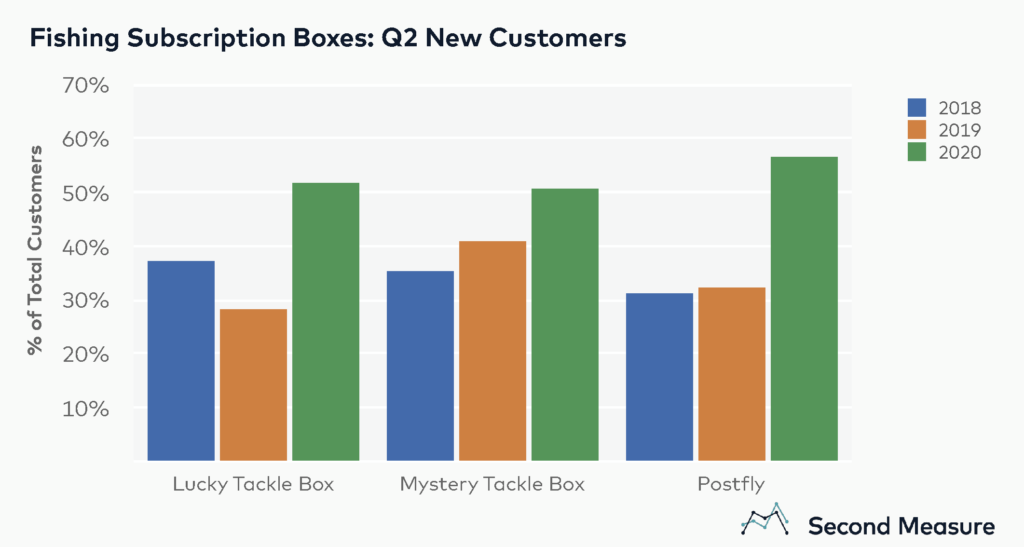

Smaller e-commerce businesses are also enjoying the growing wave of interest in outdoor gear. Companies like Postfly, Lucky Tackle Box, and Mystery Tackle Box provide an assortment of fishing gear on a subscription basis to customers looking to try out new tackle. These subscription boxes experienced a surge in demand during the second quarter of 2020, with new customers making up a record percentage of total customers.

Overall, sales in the budding industry grew 32 percent month-over-month in June. All three companies witnessed a significant increase in new customers in the second quarter of 2020, with more than 50 percent of total customers being new ones.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.