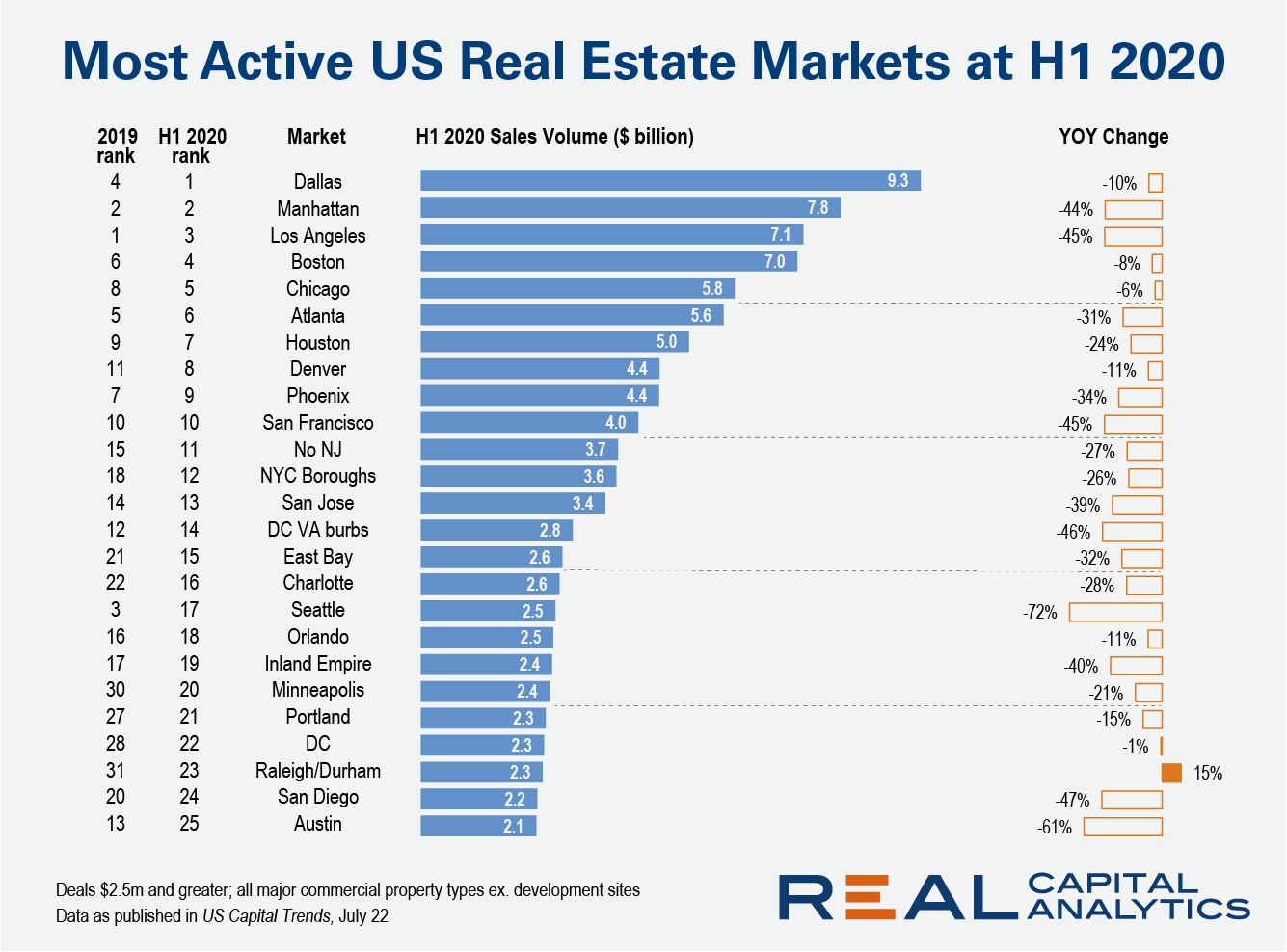

For the first time ever, Dallas ranked as the #1 U.S. commercial property market at the halfway mark of the year, despite a dip in investment activity. Dallas overtook Manhattan and Los Angeles, where sales activity fell by more than 40% compared to the first six months of 2019 as the Covid-19 crisis scuttled dealmaking and sidelined investors.

Transaction activity in Dallas was heavily weighted towards the first quarter when it was exposed to several large portfolio deals including the Prologis acquisitions of Liberty Property Trust and Industrial Property Trust.

At #4, Boston moved up two slots from 2019 and looking at the second quarter alone it was the top U.S. market. Unlike Dallas, single asset transactions accounted for over 95% of activity for the first six months of the year. The largest transaction in the market was the second quarter office sale of 245 Summer Street.

Of the top 25 U.S. markets, Raleigh/Durham was the only one to post positive growth at midyear. Claiming the #23 spot, this market rose from #31 in 2019. This move up the ranks is not so much a trend as it is the function of two one-off deals.

After only one full quarter of activity with the impact of Covid-19 in force, it is too early to discern whether changes in rankings are part of emerging trends and changes in investor preferences, or simply virus-related turbulence. For answers, we will need to pay attention to where volumes shake out in the next quarter and beyond.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.