Source: https://www.corelogic.com/blog/2020/8/limited-for-sale-inventory-driving-home-prices-higher.aspx

National home prices increased 4.9% year over year in June 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The June 2020 HPI gain was up from the June 2019 gain of 3.5%. Strong demand, especially by younger home buyers, and low supply helped push home prices higher in June.

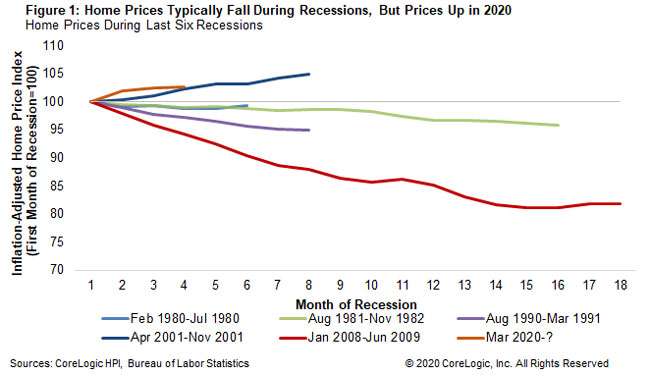

The economic downturn that started in March 2020 is predicted to cause a 1% drop in the HPI by June 2021, which would be the first decrease in annual home prices in over 9 years. Figure 1 shows movements in the inflation-adjusted HPI[1] for the last six recessions starting from the first month and through the end of each recession. Numbers below 100 indicated falling home prices, which has been a feature of four of the six recessions. However, at four months in, the 2020 recession is following the path of the 2001 recession, which is the only one of the six with increasing home prices. The worst of the six recessions was the Great Recession that started in 2008, which was characterized by excess supply of homes for sale, which is not the case in today’s tight-supply housing market.

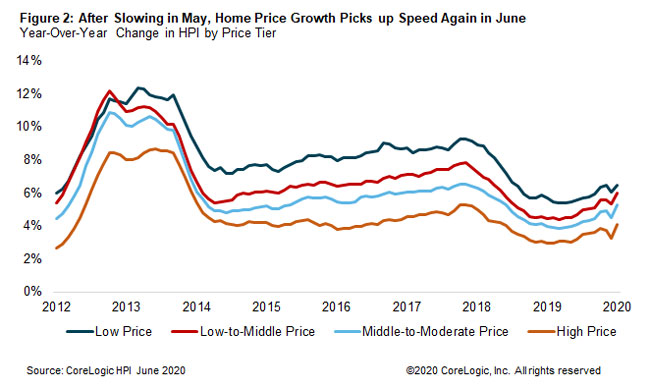

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price[2]. Growth in the lowest price tier overtook the other price tiers in 2013 as inventories in this segment of the market tightened. The lowest price tier increased 6.5% year over year in June 2020, compared with 6% for the low- to middle-price tier, 5.3% for the middle- to moderate-price tier, and 4.1% for the high-price tier. Home price growth has accelerated for all four price tiers this year.

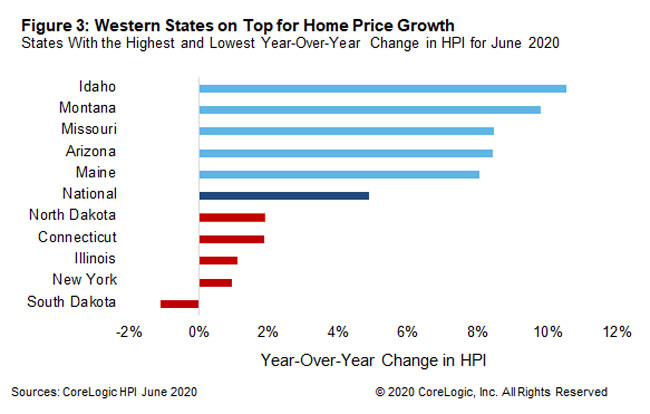

Figure 3 shows the year-over-year HPI growth in June 2020 for the 5 highest- and lowest-appreciating states. Idaho led the states in appreciation as it has since late 2018, with annual appreciation of 10.5% this June. At the low end, South Dakota saw a decrease in home prices of 1.1%. Prices in 33 states are forecast to decrease over the next year as the country continues to grapple with the coronavirus pandemic, with the largest decrease predicted to occur in Nevada with a year-over-year drop of 9.5%.

[1] The Consumer Price Index (CPI) Less Shelter was used to create the inflation-adjusted HPI. It is important to adjust the HPI for inflation to compare recessions, especially since two of the recessions occurred during very high inflation periods.

[2] The four price tiers are based on the median sale price and are as follows: homes priced at 75% or less of the median (low price), homes priced between 75% and 100% of the median (low-to-middle price), homes priced between 100% and 125% of the median (middle-to-moderate price) and homes priced greater than 125% of the median (high price).

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.