Distribution warehouses continued to be a target for investors in the second quarter of 2020 amid heightened attention on the backbone of logistics infrastructure.

While sales activity in the U.S. industrial sector dropped during the quarter, buffeted by lockdown restrictions and economic uncertainties, the sector’s decline was the smallest of any major property type. And, of the $11.1 billion in industrial transaction volume, around one-third came from sales of distribution warehouses.

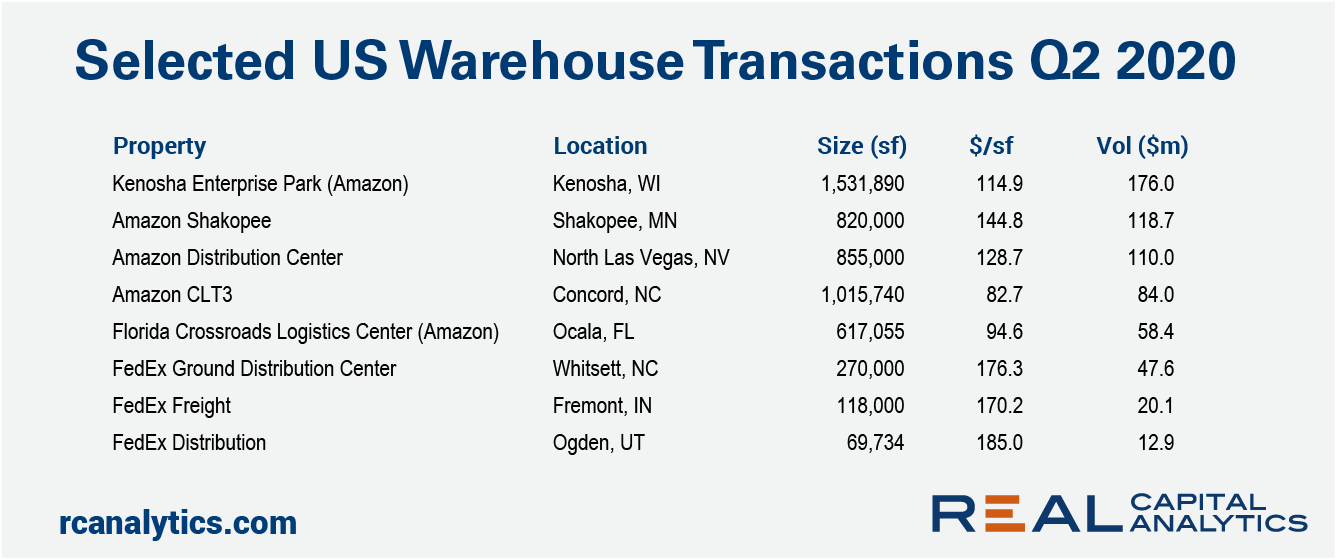

In the table below we show a selection of second quarter property deals with Amazon or FedEx – two delivery behemoths that have benefited from the surge in online shopping during the pandemic – as the sole tenant.

The largest of these deals was the Kenosha Enterprise Park in Wisconsin, an Amazon distribution center. The 1.5 million sqft warehouse sold in June for $176 million. KKR paid $115 per sqft for the warehouse. KKR was also the buyer behind another of these Amazon deals in June, buying a 1 million sqft distribution center in North Carolina from Morgan Stanley for $84 million.

The FedEx properties that sold in the second quarter were smaller than the Amazon ones and, as is more typical with properties of this size, commanded higher pricing. All three warehouses with FedEx as a tenant sold for more than $170 per sqft, as compared to the second quarter average of $97 per sqft for single tenant warehouses in the U.S.

Monmouth REIT purchased two of the FedEx buildings separately in May and both were newly constructed logistics properties. One, a 270,000 sqft property in North Carolina, sold for $176 per sqft, while the other, in Utah, was 70,000 sqft and sold for $185 per sqft.

As for July, Real Capital Analytics has so far recorded one property tenanted by FedEx and one by Amazon changing hands. The FedEx property, in Tarra, Pennsylvania, was appraised at $296 per sqft.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.