In this Placer Bytes we dive into the data and recoveries for three major apparel retailers – Macy’s, JCPenney and Dillard’s.

Macy’s Recovery Stalls

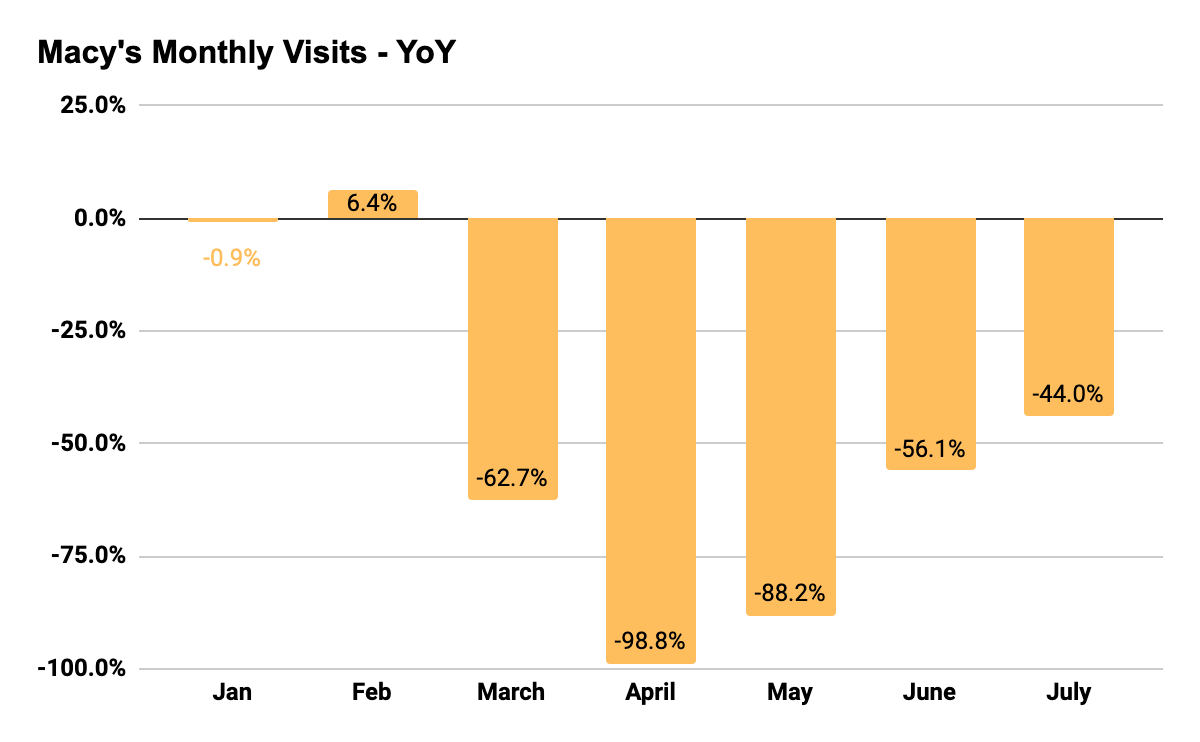

Macy’s started off 2020 with mixed results, with year-over-over visits for January down 0.9% but up 6.4% for February. As expected, visits dropped to 62.7% down for March as coronavirus hit the United States, and continued to decline into April – bottoming out completely. But, monthly visits seem to be making their way back. Visits for May were down 88.2%, but visits in June were down just 56.1%, while July visits pulled closest to 2019 levels, within 44.0%.

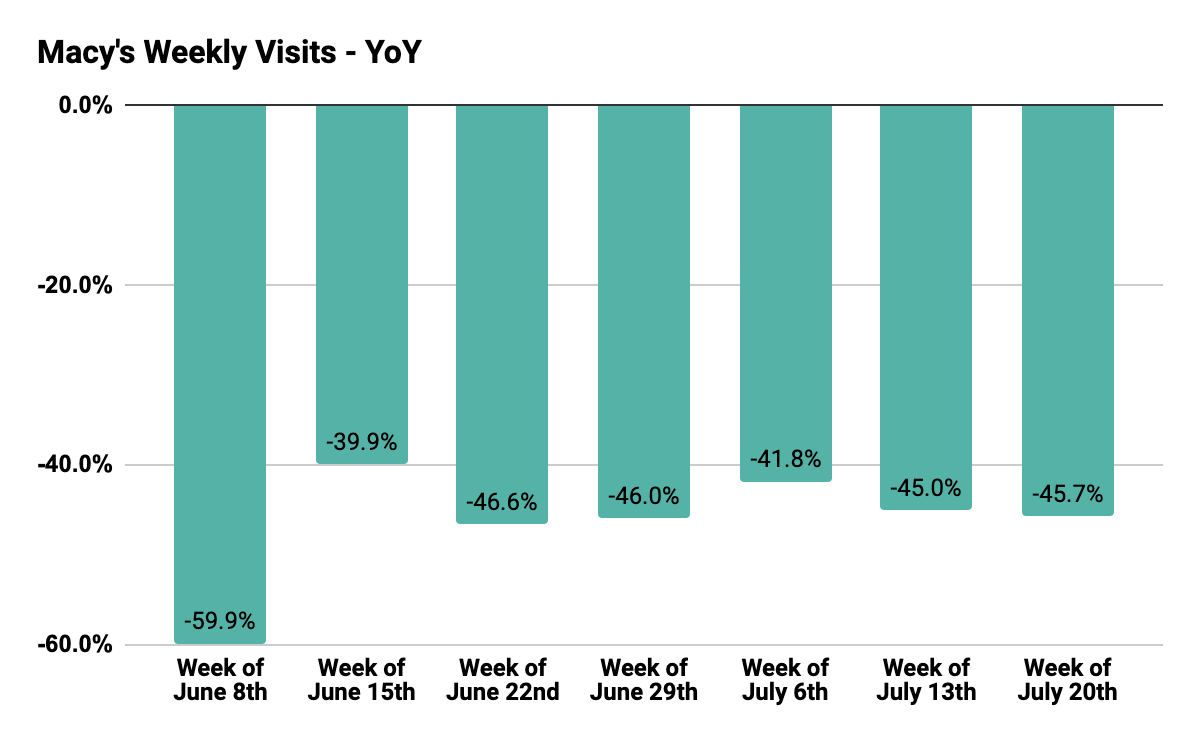

However, looking at the pace of recovery for the retailer shows a different narrative. While visits for June and July are certainly better than those during the prior months, traffic seems to be plateauing – a trend that has been felt across the apparel sector as COVID resurgences hit key states like California, Florida and Texas. The week of June 15th garnered visits for Macy’s that were closest to 2019 levels at 39.9% down, marking the best week out of all the weeks analyzed. But, every week post June 15th has fallen short of that mark. Visits for the week of July 13th and July 20th, were 45.0% and 45.7% down, stalling Macy’s growth, with the brand appearing to be increasingly affected by the ongoing impacts of the pandemic.

Can JCPenney Bounce Back?

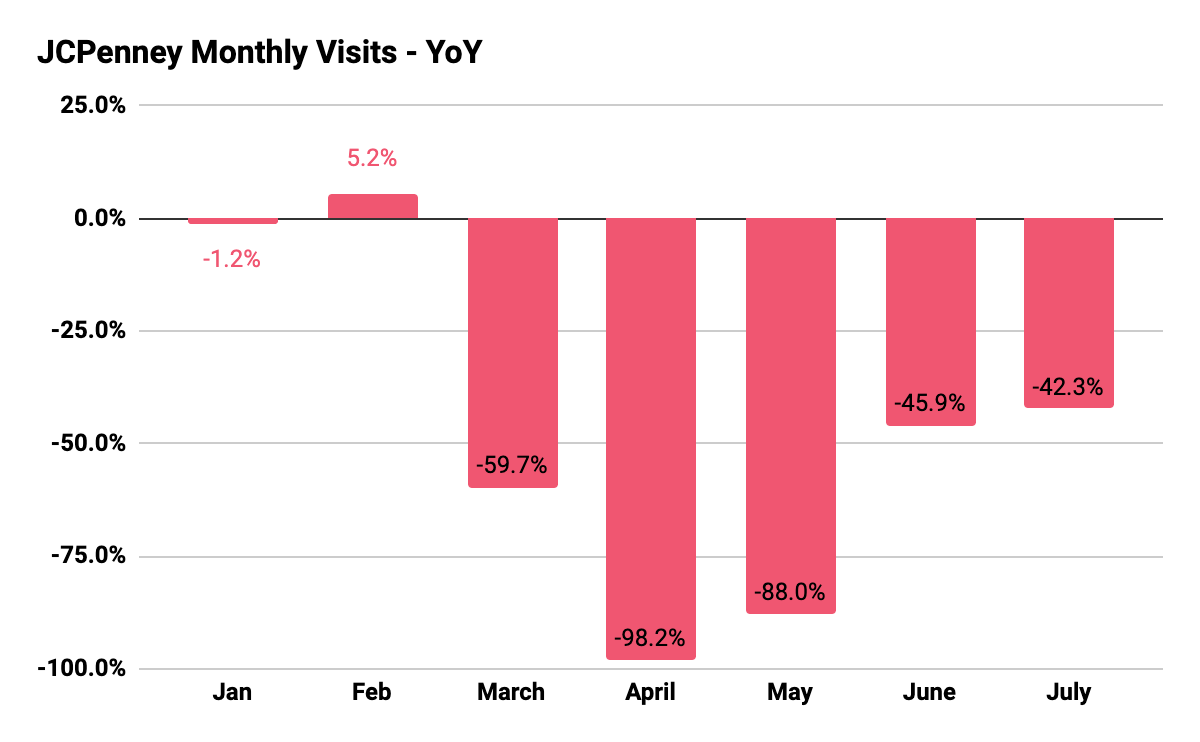

JCPenny is a brand that’s been making waves with its recent headlines regarding layoffs, store closures and bankruptcy. Despite the relatively negative press surrounding the retailer, the brand was off to a seemingly good start to 2020, with visits for February 2020 up 5.2% year over year. Similar to other brands analyzed, a recovery looks to be underway for JCPenney with visits jumping to 42.3% down for July.

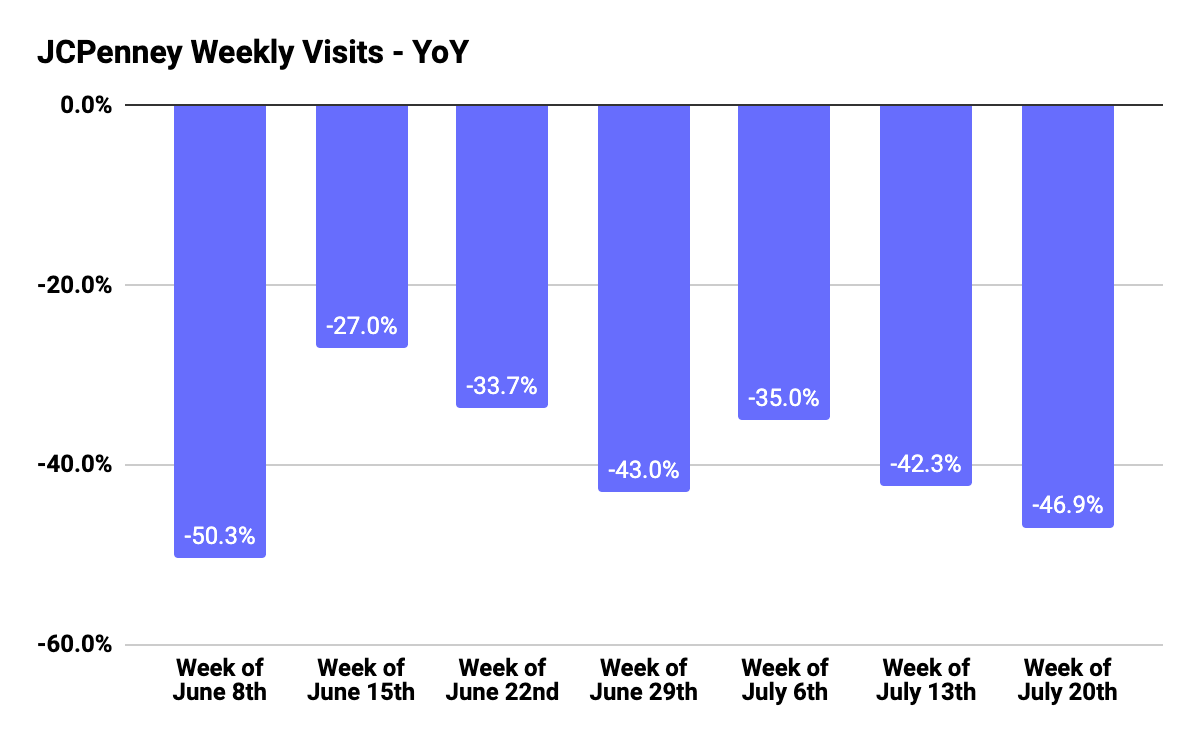

But, as with Macy’s , visits have been declining since a June 15th high point that pulled visits within 27.0% of 2019 numbers. And traffic since then dropped to a low point on the week of July 20th with visits down 46.9%. With continued closures on the horizon, and a large number of stores in hard hit states, an uncertain future for JCPenney lies ahead.

Dillard’s Recovery

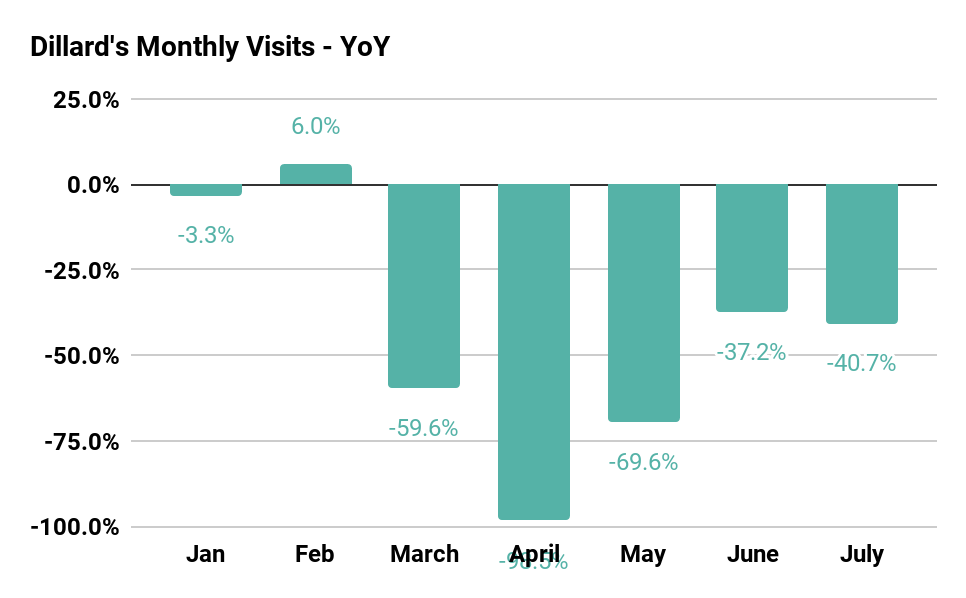

The department store struggles continue with Dillard’s seeing similar results as the previous two brands analyzed. Year-over-year traffic for February was up an impressive 6.6% before the pandemic spread across the country. Visits flatlined in April before both May and June saw visits that were moving closer to pre-COVID levels. Visits for May were nearly 70.0% down and jumped significantly in June when traffic was just 37.2% down, inching even closer to normalcy.

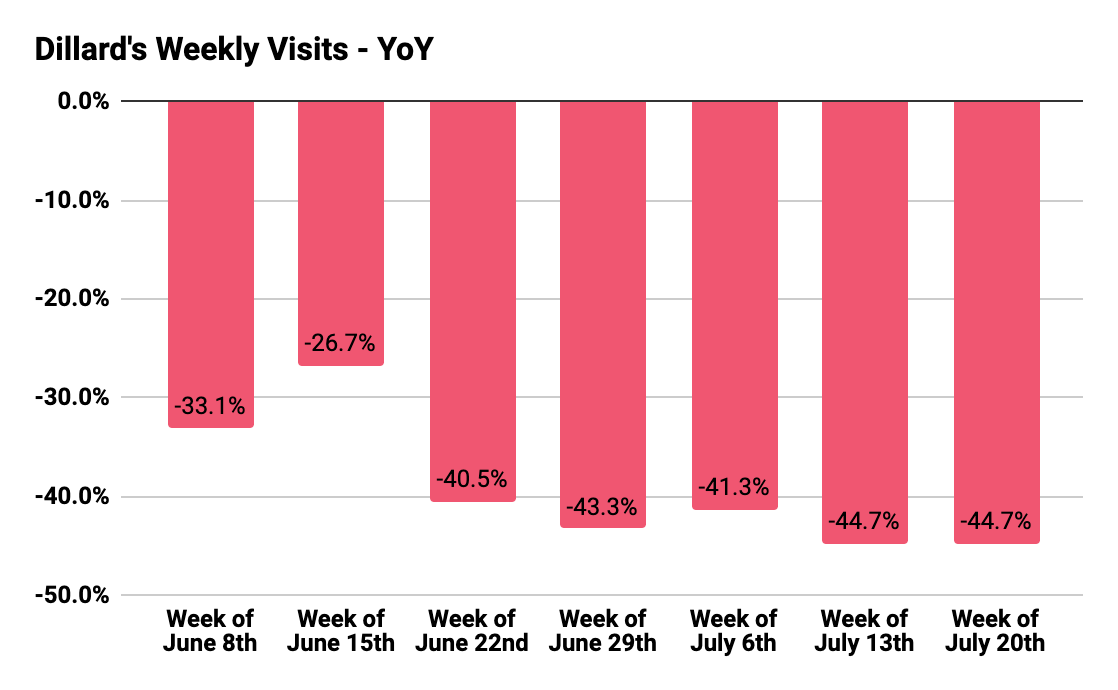

But while monthly visits are certainly up year over year, we see the same trend emerging for Dillard’s, as Macy’s and JCPenney. The brand’s recovery pace is falling off, or plateauing, from its initial traffic rush after being allowed to reopen. Although visits were just 26.7% down for the week of June 15th, the closest to 2019 levels, traffic has continued to decline since then. In fact, visits for the week of July 13th and July 20th generated some of the lowest traffic across the weeks measured, at 44.7% down year over year. Also it’s likely that the massive resurgence of COVID cases across states such as Texas and Florida, where most of Dillard’s locations are situated, has significantly impacted traffic.

Departmental Conclusions

We see clear trends emerging across the department store sector, with recoveries stymied by a resurgence in cases leading to a reversal of the positive trends we had been seeing in May and June. It increasingly appears that the success of this sector – at least in the short term – will depend on the government’s ability to effectively control the impact of the pandemic. Should COVID’s reign continue deeper into 2020 and beyond, the effect could be very difficult to overcome.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.