ATTOM Data Solutions’ newly released July 2020 U.S. Foreclosure Market Report shows that U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — are continuing a downward trend amid the Coronavirus pandemic, with 8,892 filings reported in July 2020.

According to ATTOM’s latest foreclosure activity report, foreclosure filings in July 2020 are down four percent from June 2020 and 83 percent from July 2019. The report features commentary from EVP of RealtyTrac (a subsidiary company to ATTOM), Rick Sharga, noting, “Even as mortgage delinquency rates climb, foreclosure activity continues to be artificially low due to moratoria put in place by the Federal and State governments. It’s inevitable that there will be a significant increase in foreclosures once these moratoria have expired, although it’s unlikely that we’ll see default rates reach the levels we saw during the Great Recession.”

ATTOM’s new foreclosure market analysis reported that nationwide one in every 15,337 housing units had a foreclosure filing in July 2020. The analysis points out the states with the highest foreclosure rates were Delaware (one in every 6,489 housing units with a foreclosure filing); South Carolina (one in every 7,328 housing units); Maine (one in every 7,542 housing units); New Mexico (one in every 8,255 housing units); and California (one in every 9,194 housing units).

The report also notes that among the 220 metro areas with a population of at least 200,000, those with the highest foreclosure rates in July 2020 were Trenton, NJ (one in every 3,445 housing units with a foreclosure filing); McAllen, TX (one in every 3,833 housing units); Davenport, IA (one in every 4,038 housing units); Dayton, OH (one in every 4,055 housing units); and Albuquerque, NM (one in every 4,452 housing units).

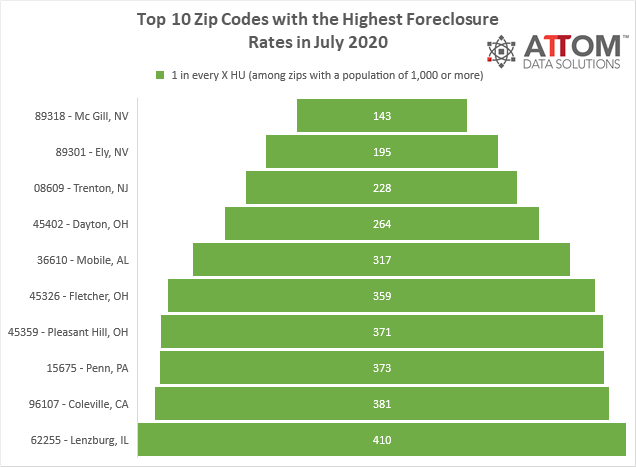

In this post, we take a deeper dive into the data behind ATTOM’s July 2020 foreclosure market report to unveil the top 10 zip codes with the highest foreclosure rates among those with a population of 1,000 or more. Those top zips seeing the highest foreclosure rates include: 89318 in Mc Gill, NV (one in every 143 housing units); 89301 in Ely, NV (one in every 195 housing units); 08609 in Trenton, NJ (one in every 228 housing units); 45402 in Dayton, OH (one in every 264 housing units); 36610 in Mobile, AL (one in every 317 housing units); 45326 in Fletcher, OH (one in every 359 housing units); 45359 in Pleasant Hill, OH (one in every 371 housing units); 15675 in Penn, PA (one in every 373 housing units); 96107 in Coleville, CA (one in every 381 housing units); and 62255 in Lenzburg, IL (one in every 410 housing units).

ATTOM’s most recent foreclosure market analysis also reported that a total of 4,530 U.S. properties started the foreclosure process in July 2020, down 7 percent from June 2020 and 83 percent from July 2019. The report cites that counter to the national trend, several states posted month-over-month increases in foreclosure starts, including Connecticut (up 54 percent); Michigan (up 42 percent); Missouri (up 34 percent); Virginia (up 32 percent); and California (up 1 percent).

The report noted that among metro areas with a population greater than 1 million, those with the greatest number of foreclosure starts in July 2020 were Los Angeles, CA (285 foreclosure starts); New York, NY (190 foreclosure starts); Chicago, IL (182 foreclosure starts); Houston, TX (174 foreclosure starts); and Atlanta, GA (125 foreclosure starts).

Lastly, according to the report, lenders foreclosed (REO) on a total of 2,163 U.S. properties in July 2020, down 14 percent from June 2020 and 80 percent from July 2019, to the lowest since we began tracking in 2005. States that posted the greatest number of completed foreclosures (REOs) in July 2020, included Ohio (222 REOs filed); California (188 REOs filed); Illinois (165 REOs filed); New York (161 REOs filed); and New Jersey (144 REOs filed).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.