In this Placer Bytes, we dive into BJ’s continued rise, what Dick’s Sporting Goods performance tells us about back-to-school, and the brands that could benefit from Stein Mart’s closures.

BJ’s Momentum

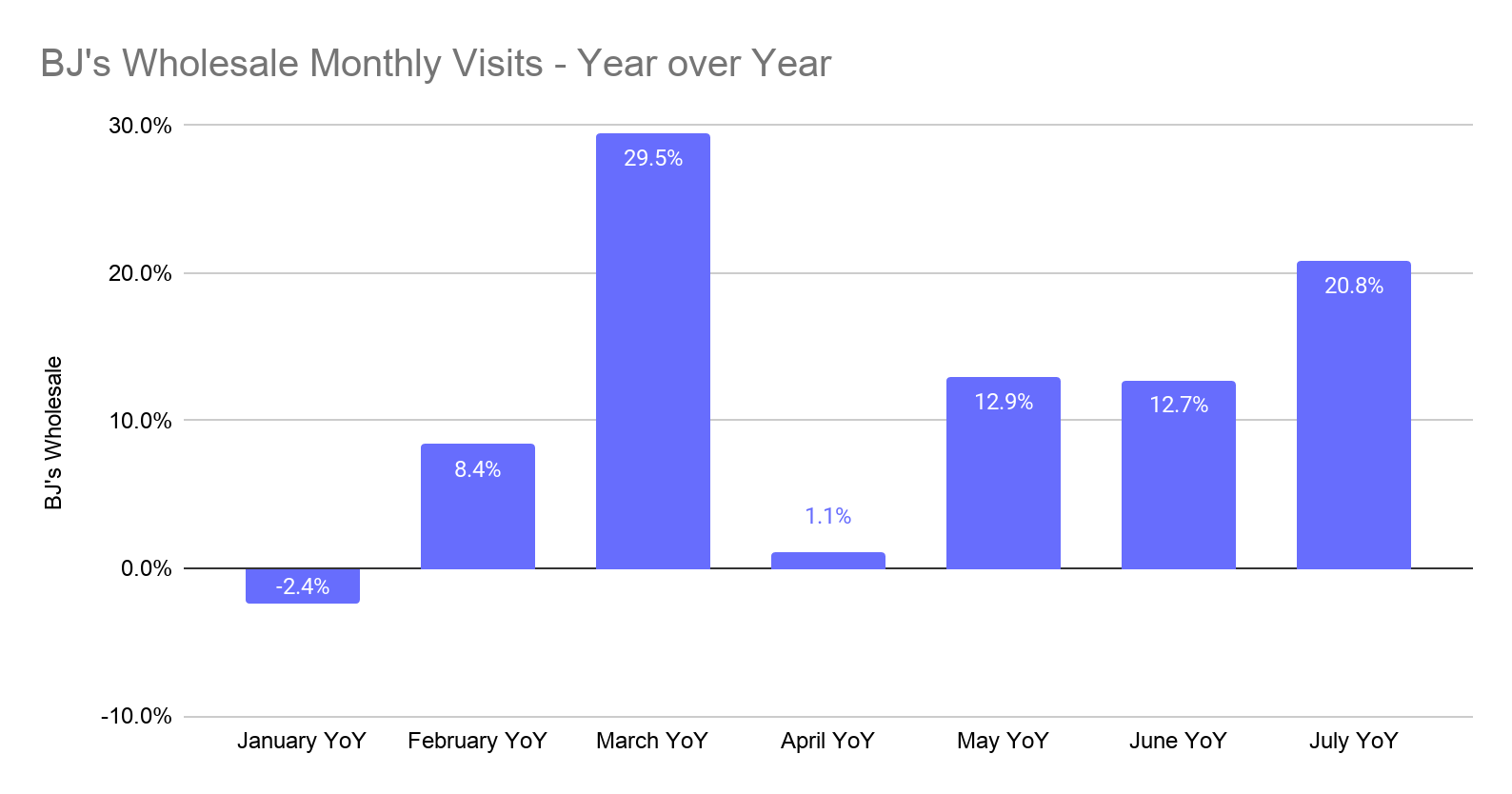

When we last checked in on BJ’s Wholesale it was becoming clear that COVID helped to re-establish the brand within the wholesale category. This was an especially important moment as it came after a period where BJ’s had seen losses, even while competitors Costco and Sam’s Club were enjoying extended periods of growth.

And while the jumps in traffic were impressive, the sustained draw has been all the more promising. While BJ’s saw visits increase 12.9% and 12.7% for May and June respectively, July’s growth surged to 20.8% year over year. And the pace is growing. From the week beginning July 6th to the week beginning August 3rd, year-over-year visit increases averaged over 22% indicating that August could prove to be even stronger.

Growth In Context

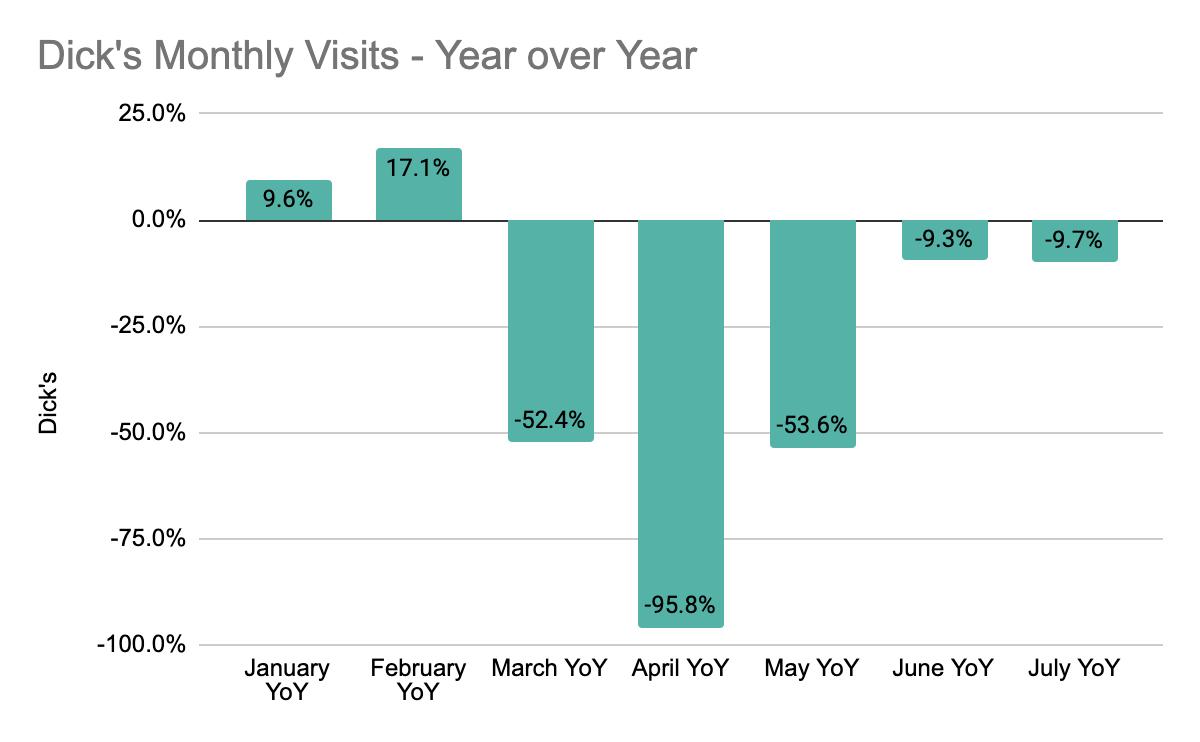

Dick’s Sporting Goods has had one of the most rapid and strongest recoveries of any retailer, with visits in June and July down just 9.3% and 9.7% respectively year over year. And this after May visits were down over 53% year over year. Yet, there are reasons for concern.

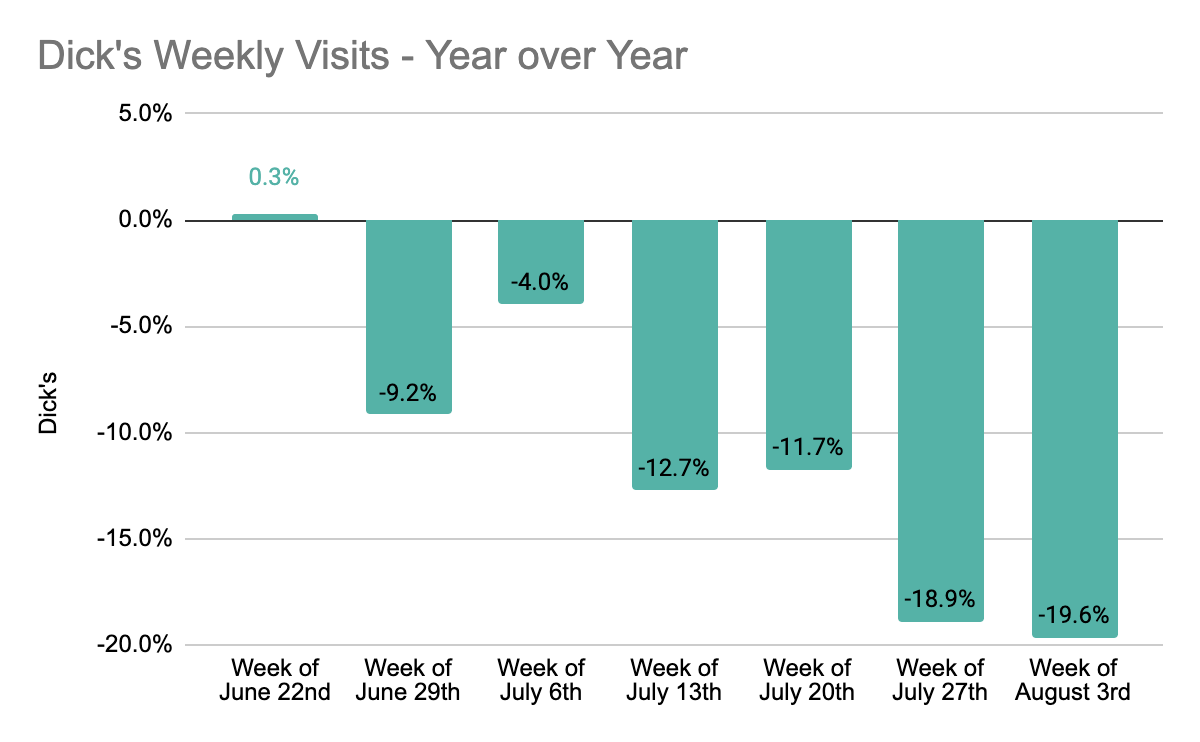

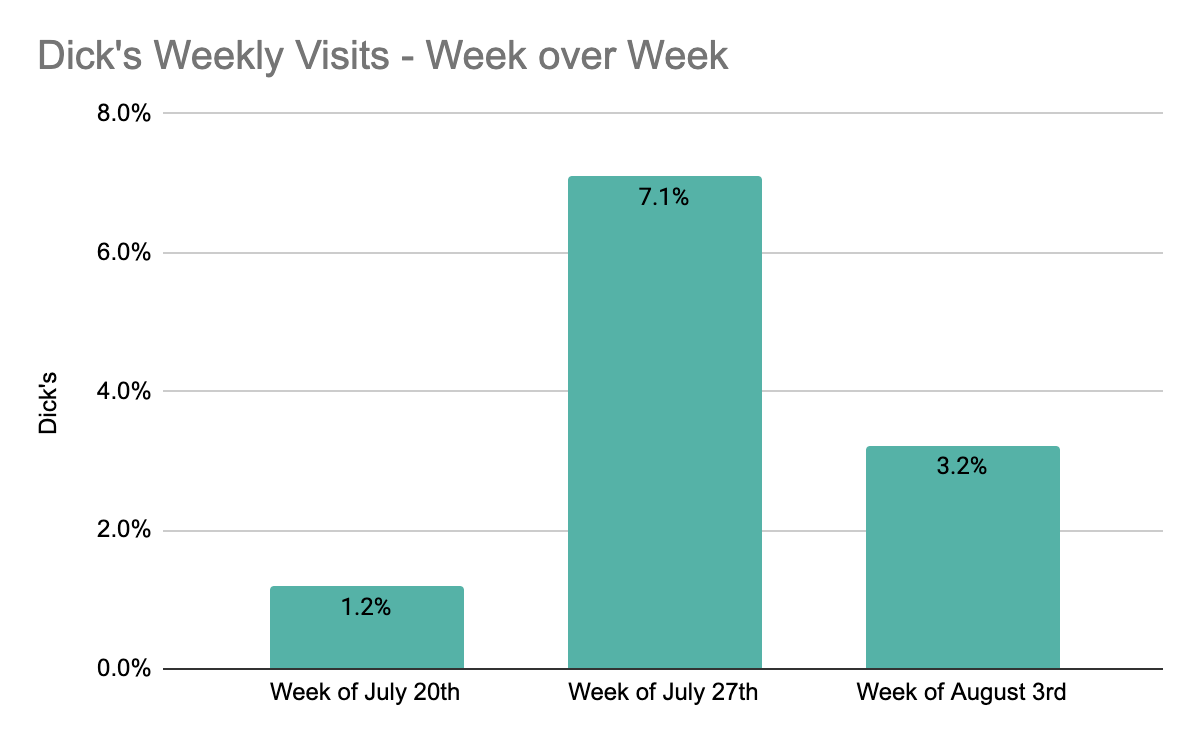

After watching visits grow 0.3% year over year the week of June 22nd, visits were down 19.6% the week of August 3rd, a dramatic reversal. However, this result requires more context and likely speaks less to any weakness at Dick’s Sporting Goods and more to an uncertain back-to-school season.

While Dick’s visits were down more year over year, they were actually rising closer to normal. Looking at week over week data shows consistent growth even as the year-over-year gaps expand. And the real takeaway here may be that the incredible back-to-school season that brands like Dick’s, Target and others experienced in 2019 is likely going to be heavily tempered. And while it is possible that much of that ‘peak’ will happen later in the season as there is more clarity around actual school restarts, the comparisons identify a critical element of measuring context. While back-to-school clearly means a lot to these brands, exaggerating the ‘weaknesses’ during this season could create an unfair perspective that minimizes the actual growth they are showing.

Stein Mart Closures Beneficiaries

With another apparel player moving towards bankruptcy and large scale closures, the situation again looks to benefit one of the sector’s strongest. TJX, which owns both T.J. Maxx and Marshalls, looks to benefit most with 52.9% of Stein Mart shoppers also visiting T.J. Maxx locations and 44% also visited Marshalls since the start of 2019. Kohl’s and Macy’s could also see needed boosts with 49.4% and 42.8% of Stein Mart shoppers also visiting locations for those retailers during the same period.

The potential reinforces a critical element of the demise of several apparel players and the vacuum they leave will likely be filled by a competitor that can survive the post-pandemic period. And this is a hugely important element – some players are going to see a long-term boost in their potential as a result of a thinning competitive landscape.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.