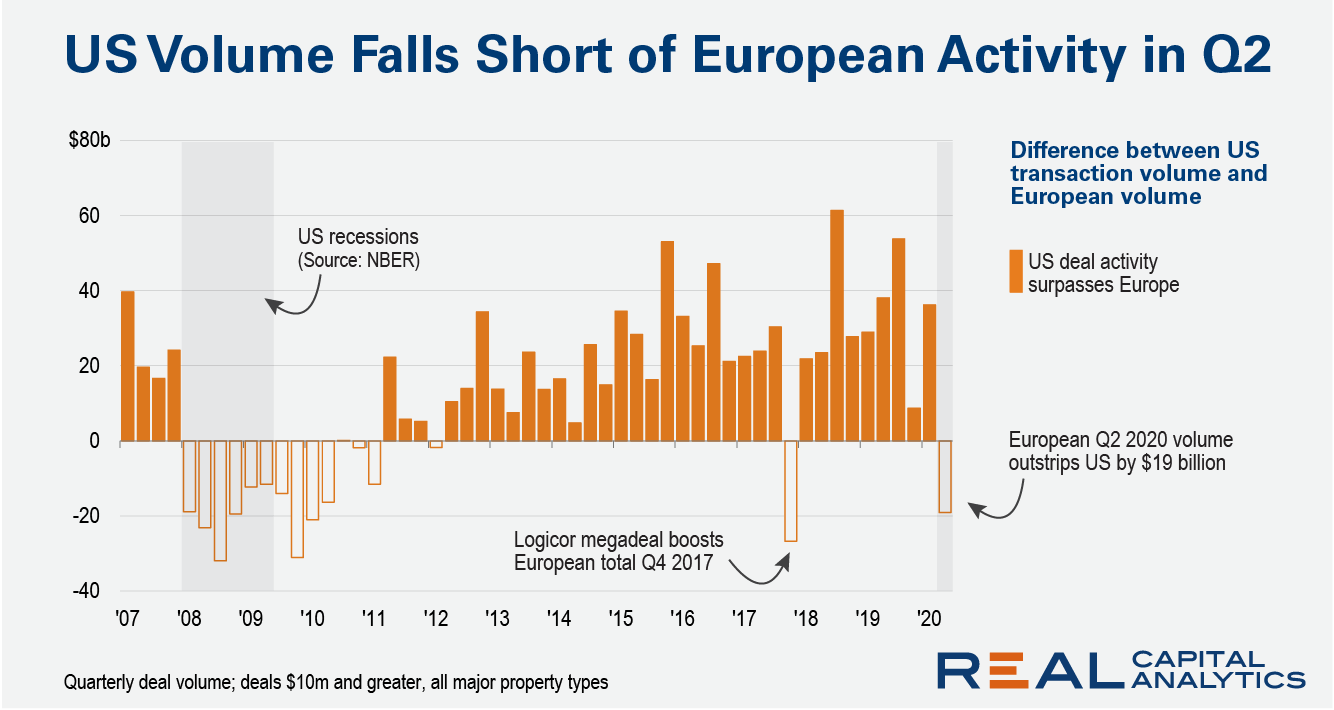

In normal periods the U.S. is the largest, most liquid region for commercial real estate deal activity worldwide. In the second quarter, however, Europe surpassed the U.S. as a hub for investment. Trends into July are not looking favorable for the U.S.

Commercial real estate exists to support the needs of a local economy and deal volume can be a sign of the expectations for the health of that local economy. Expanding that view from the perspective of a local market to that of a national and regional view, the commercial real estate data suggests that there is less confidence in the U.S. at the moment.

The last time deal volume in the Europe regularly surpassed that of the U.S. was during the Global Financial Crisis. The U.S. housing market was the spark that set off that global economic downturn and confidence in the U.S. economy lagged for some time after that recession ended. A single large entity-level transaction boosted quarterly European deal activity ahead of that of the U.S. in late 2017, but otherwise the U.S. has been a larger investment market.

As the U.S. slipped into recession in March 2020, commercial real estate investment plummeted. In the second quarter, U.S. investment volume for deals priced $10 million and greater slipped behind those in Europe by $19 billion.

Granted, the U.S. dollar has fallen versus the euro, amplifying the value of European transaction volume when converted into dollars. Even if Americans could fly to Europe today, now is not the time for a European vacation, with the U.S. dollar currently buying only €0.85 versus €0.92 in May. Most of the slide in the dollar, however, has happened only since late May.

The issue faced in the U.S. today is the uncertainty around the economic fallout from a harsher impact from Covid-19. In mid-August, daily deaths from Covid-19 in the U.S. were nearly 10 times greater than that in the European Union, a region with roughly 120 million more people than the U.S.

With a harsher public health situation in the U.S., investors face greater uncertainty around underwriting future income trends for a property. The social safety nets of European countries can look more expensive, but in a time of crisis, they can also help investors understand how economic losses will be distributed.

Preliminary figures for July show a continuing high double-digit annual decline in U.S. deal volume. If there is one silver lining in the preliminary data, deal volume for the month is still higher than $10 billion, while in 2009, deal activity averaged only $6 billion per month over the full year and nearer $5 billion for July. So while conditions in the U.S. are poor, as of yet, investment activity is not as bad as the last downturn.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.