The pandemic is wreaking havoc on school reopenings as decisions around in class vs. remote learning vary by county and sometimes by week. It’s no surprise that the Back to School (B2S) spending season is feeling this impact. In this analysis, we analyzed spending at traditional B2S retailers (see our piece from last year) across the East South Central and Mountain states, which tend to have earlier start dates than the rest of the country. We will continue monitoring B2S spending through Labor Day, when the rest of the country’s schools are set to reopen in some capacity.

Key Takeaways

Weak B2S Sales Nationwide, Early States Slightly Better

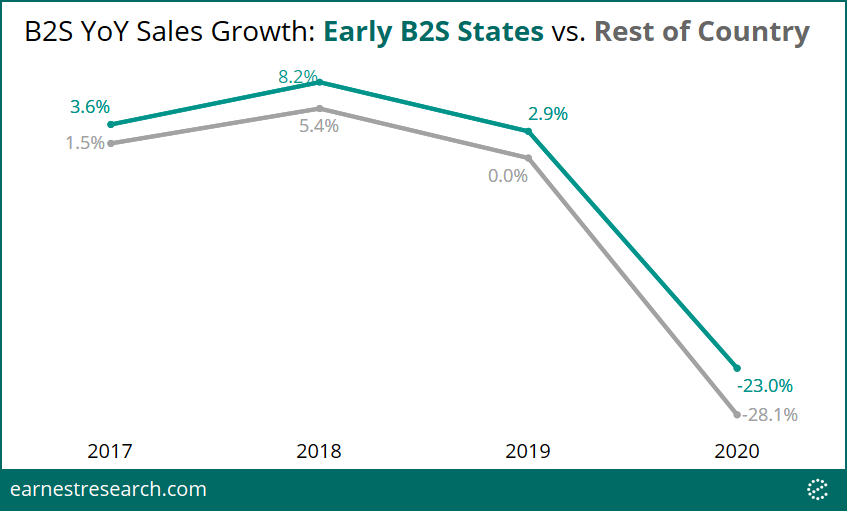

Early B2S spending* declined ~27% YoY this year relative to a historical low-to-mid single-digit growth. The delayed and online-only school start dates—not to mention the general pandemic-driven retail recession—is certainly at the core of it. There are roughly 5 points of outperformance in the early B2S states**, declining 23% vs. the rest of the country’s 28%, which is a few points more outperformance than historically seen in these states.

*Early B2S States include Alabama, Arizona, Colorado, Idaho, Kentucky, Montana, Mississippi, New Mexico, Nevada, Tennessee, Utah, Wyoming.

A Bright Spot in Online Sales

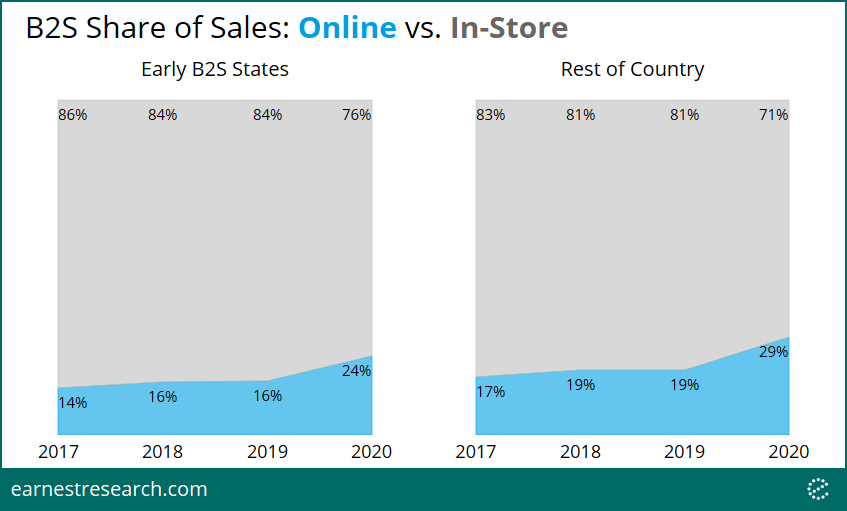

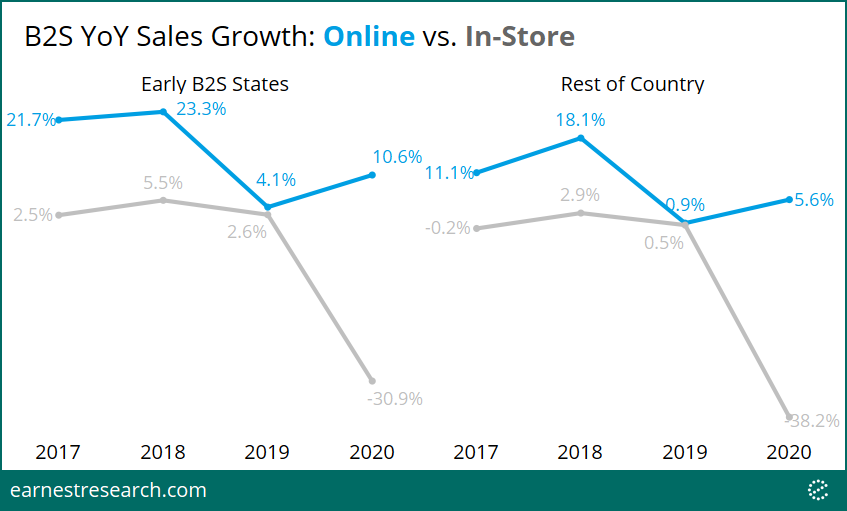

Given the pandemic-driven migration to online, we analyzed spend by channel. While the share of online spending in the early B2S states increased 8 percentage points this season to 24%, the rest of the country saw an even bigger online share increase of 10 points.

Although online sales are growing faster in the early B2S states, in-store sales are declining more slowly than the rest of the country, likely implying that people are more comfortable going back to physical stores in the early B2S states.

Sporting Goods, Under Armour, The Gap Come Out on Top

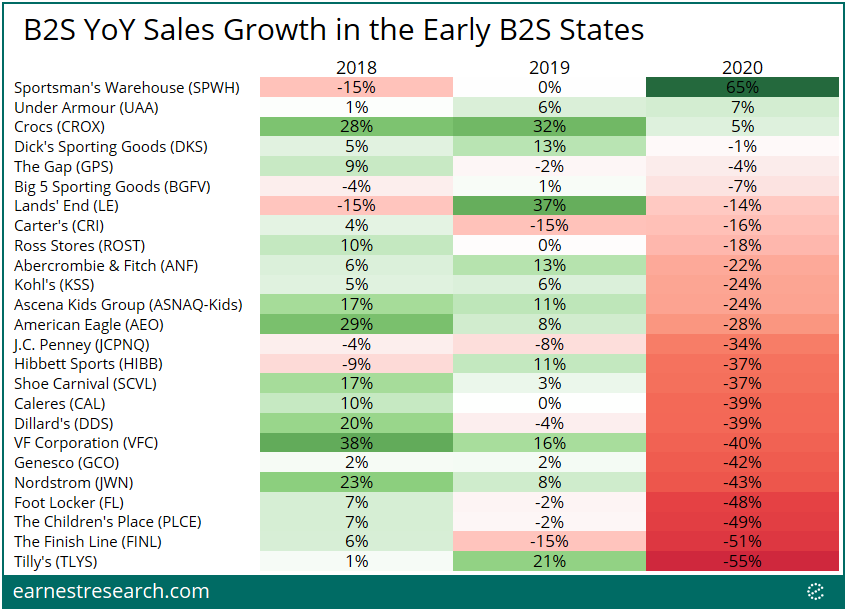

We also looked at sales performance in the relevant states across 25 retailers that typically see increased volume during the B2S season.

Sporting Goods retailers (Sportsman’s Warehouse, Dick’s, Big 5) stand among the top of the list. Under Armour and The Gap managed to outperform their peers, exhibiting roughly the same growth this season as last; an impressive achievement in this environment. Most retailers, however, saw material YoY declines with some more hurt than others versus historical growth rates: Crocs, Lands’ End, Abercrombie, Ascena-Kids (Justice), American Eagle, VF Corp, Nordstrom, and Tilly’s previously grew double digits during this important season, making this year’s double-digit declines that much worse.

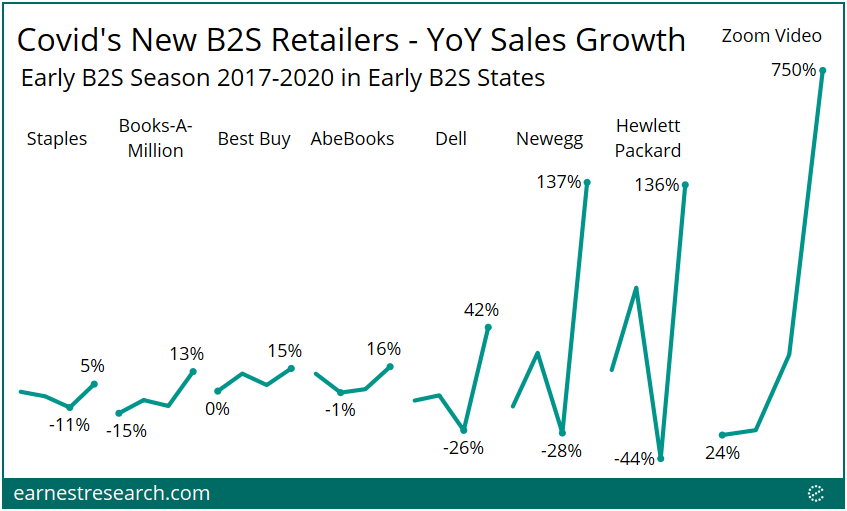

The New Winners of B2S: Zoom and Computer Hardware

With the reality of online-only and remote learning this school year, we looked beyond traditional apparel retailers to uncover companies in our coverage universe that have newly benefitted from this year’s switch to online learning. Zoom and computer hardware companies like Hewlett Packard and Newegg seem to be the new 2020 winners, showing over 100% growth during this B2S season.

Notes

*B2S dates defined as the two weeks leading up to the second Monday in August. In this analysis, we analyzed spending at traditional B2S retailers (see our piece from last year) across states with the earliest start dates.

**Early B2S States include the East South Central (Alabama, Kentucky, Mississippi, Tennessee) and Mountain states (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming). Majority, but certainly not all counties in these states, tend to open their schools by the second week of August. Because of the pandemic this year, many schools in these counties have postponed their open dates or have resorted to online-only classes to start the semester.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.