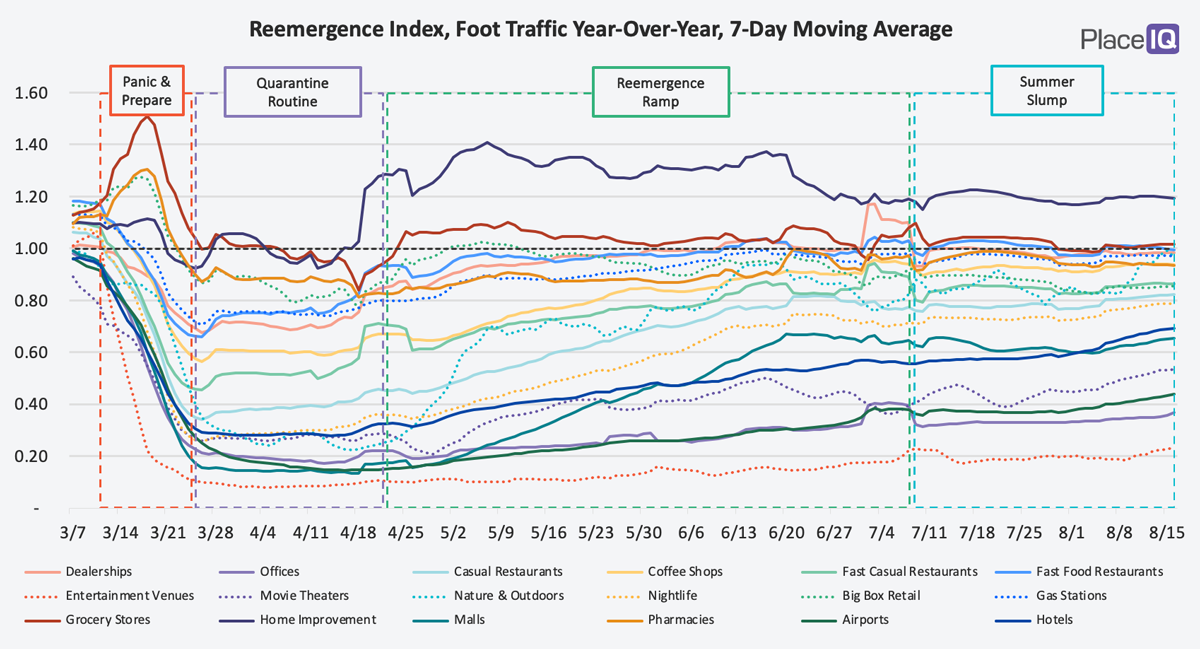

It appears as though the Summer Slump continues on. In one more week, it will match the duration of the Reemergence Ramp. Traffic is mostly flat, aside from traffic to Nature & Outdoor venues (which has been cycling a bit with recent weather patterns) – and some signs of life among the lower trafficked categories, like hotels and movie theaters. In a week or so, we’ll have a better idea if Reemergence truly is sneaking up on us again.

Today we’ll be checking out what back to school shopping looks like this year. Unlike past seasons, shifts in traffic were subtle. With the rise of distance learning, foot traffic was more subdued, though there is a notable success story we’re happy to share with you.

Back to School, from a Distance

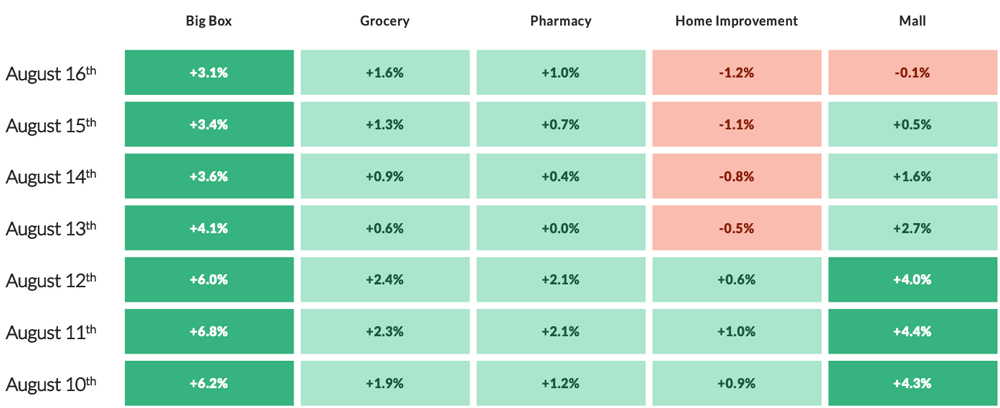

Foot traffic volumes have been mostly flat throughout the Summer Slump. Rarely do categories post sustained growth or decline rates +/- 3%. However, when we took a look at the retail sector this week, big box was a notable exception:

The percent change in foot traffic is calculated by comparing the average foot traffic volume over the past 7 days to the 7 days prior.

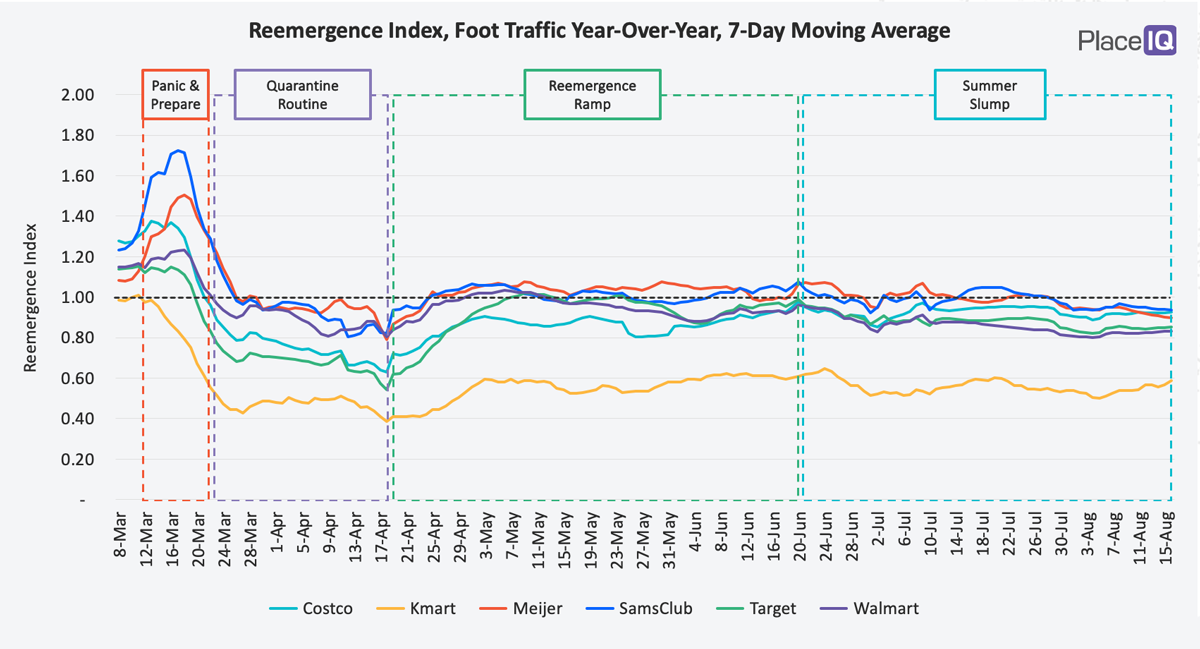

Traffic is up quite significantly, especially compared to the rest of the retail sector. However, the category’s Reemergence Index has been steadily down for over two weeks. Here we can see a clear recent decline among the major brands:

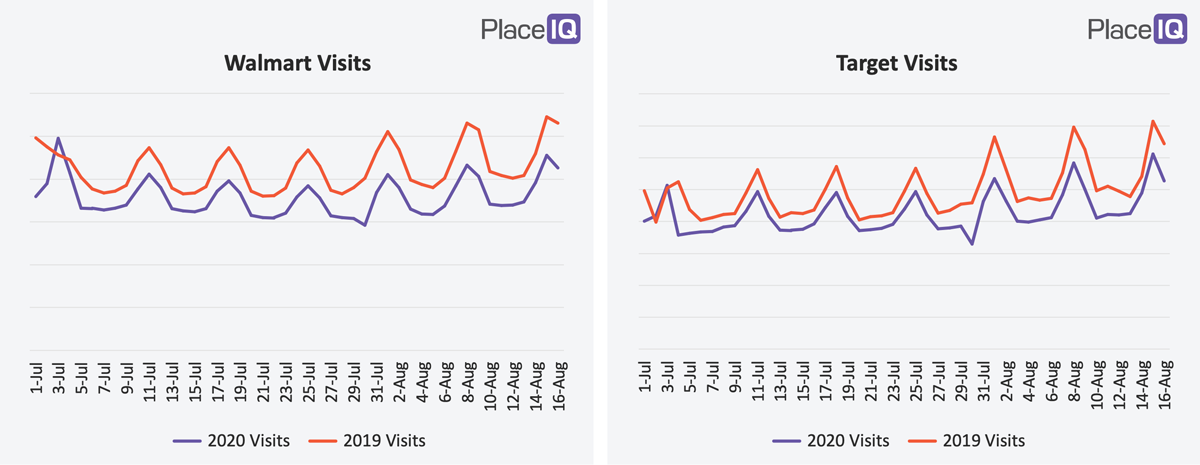

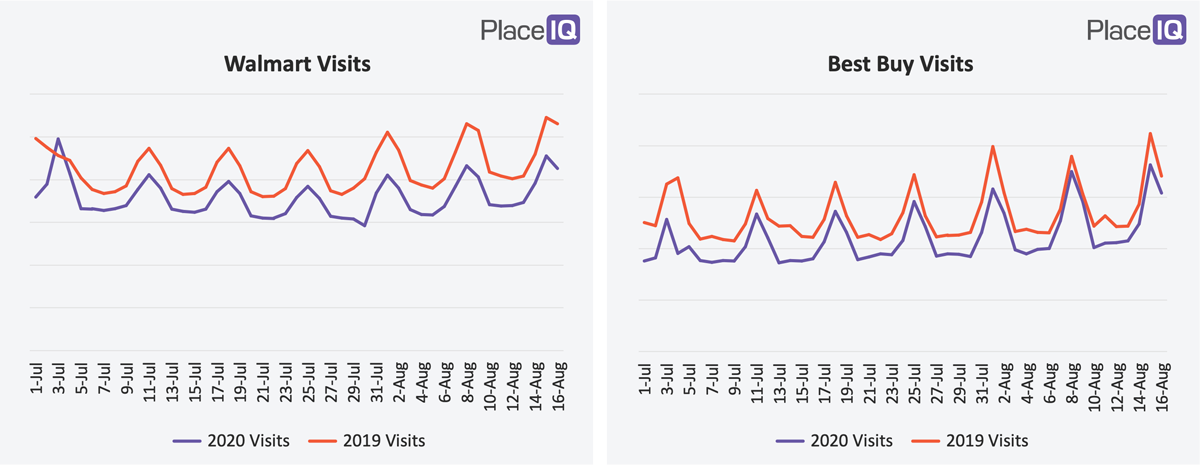

When traffic is up while the year-over-year index is down it’s generally a clue that the issue is seasonal. Traffic is up, on schedule, but not as much as last year. Which is not unexpected given our socially distant state. Below, we can see the 2020 back to school pop for Target and Walmart pale compared to the 2019 lift:

Given current circumstances, Target did pretty well keeping pace with 2019! But there’s another brand, outside the big box category, that did even better:

Demand for laptops and tablets is high, as parents look to create the best learning environment they can at home. Given this, Best Buy nearly matches its 2019 back to school traffic.

It’s not surprising that back to school traffic is soft this year, given distance learning and economic headwinds driving a recession mindset among consumers. Best Buy’s success reminds us that upside is often found in a new environment.

However, there’s something here that we found more notable, especially as we consider the 2020 holiday season: back to school surges in traffic kept the same schedule as last year. Overall traffic volume was less, but preparation began like clockwork at the beginning of August. Other holiday schedules haven’t been as consistent. Easter, for example, seemed to catch us all off guard. Foot traffic rose only a day or two ahead of time, compared to weeklong spikes we’d usually see. This shortened prep time was consistent throughout the Reemergence Ramp.

A return to our usual foot traffic schedule, if not our usual foot traffic volume, is a great sign for the holidays. We may see overall less traffic (if we find ourselves in a similar situation in Q4), but that traffic stands to start at its usual time.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.