Investors stuck to the forward transactions route to acquire European office properties in the second quarter of 2020, indicating that investor demand for the asset type is still alive despite concerns over future needs for corporate space.

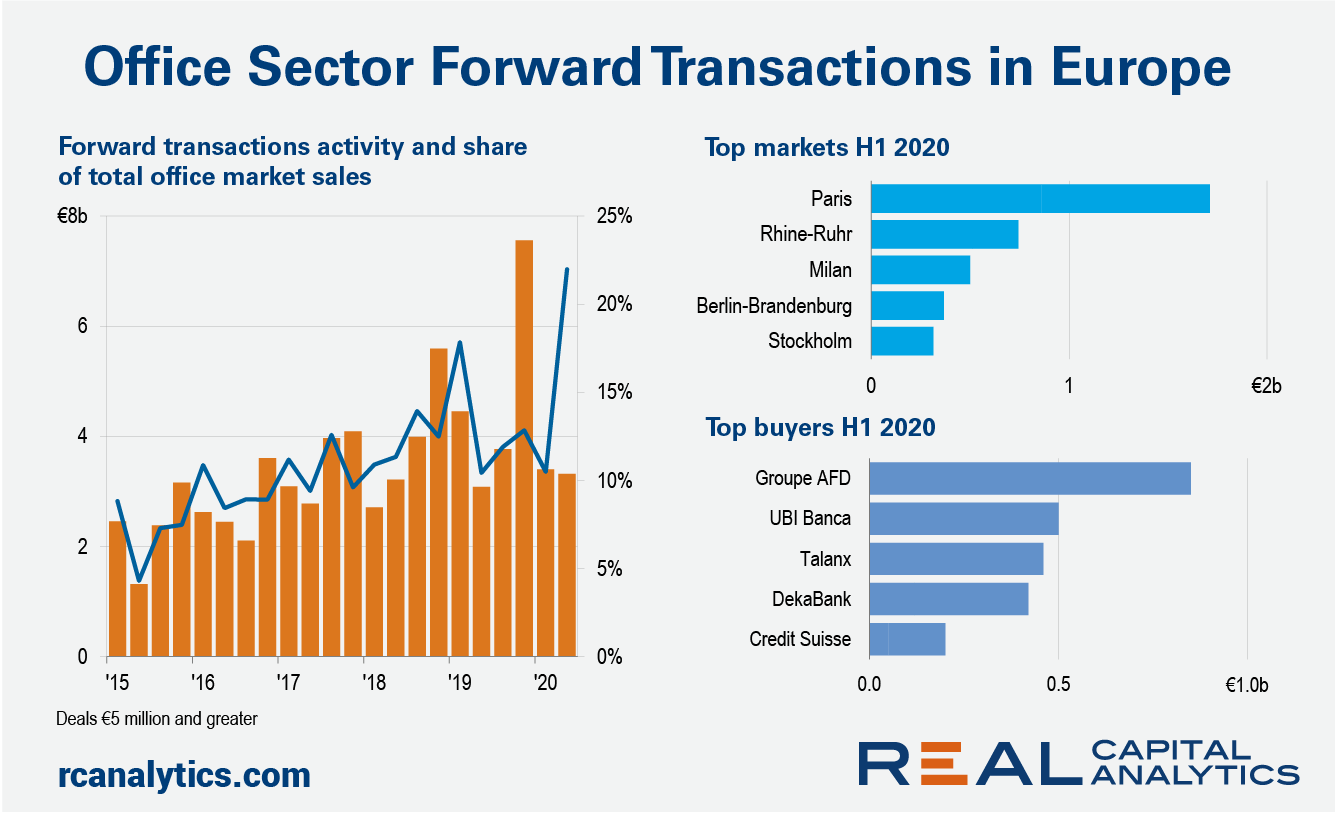

Forward commitments leapt to a record proportion of European office deal volume, with the jump in share reflecting the resilience of these deals and the slump in the office market overall. The purchases of properties still under development came to just over €3.3 billion ($3.9 billion) in the second quarter, up from €3.0 billion a year ago and representing 22% of total office asset sales. Transactions of standing stock, meanwhile, declined 55% year-over-year.

Forward transactions have traditionally held appeal for institutional investors as a means to acquire good quality offices, especially in markets where the flow of existing buildings onto the market has been constricted, competition for assets is steep, and prices have climbed. New buildings will often incorporate the latest technology and better meet environmental standards. To boot, because of the additional complexity of these deals, whether in the form of forward funding (development finance) or a forward purchase, competition can be thinner.

Paris was the most active market for forward commitments in the first half of 2020 and the trend was also evident in July. La Francaise completed the €150 million purchase of an office building in Malakoff, just to the south of Paris, on behalf of a consortium of investors. The 22,000 square meter building will complete in 2021 and is let to aerospace firm Safran on a nine-year lease.

Another notable deal, this time in Belgium, was Deka’s acquisition of the Silver Tower office in Brussels. The building was purchased for €200 million at a yield of 3.3%, which is below the current reported prime yield for offices in the city. The asset is let on a long lease to the Brussels Regional Public Service (SPRB), which puts the deal at the safe end of the risk spectrum.

Of the forward transaction volume in the second quarter of 2020, four-fifths related to assets for owner occupancy or involved assets known to have tenants secured, according to Real Capital Analytics data.

The forward commitment route is not for all investors because of the added complexity of these deals. However, the most sophisticated investors have capital to spend and they need to keep growing portfolios. Even in the first half of this year, PERE reports that capital raising numbers were only slightly down on 2019, and of the $71 billion raised globally, $22 billion was targeted at Europe.

The low interest rate environment should ensure there remains plenty of capital looking for opportunities in commercial real estate; however, structural shifts and uncertainties around the use-case for some sectors means the investable universe is shrinking. Therefore, investors will likely continue to pursue opportunities to acquire new, future-proofed assets let to good quality tenants before they reach the open market.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.