The COVID-19 pandemic put tremendous pressure on the new mortgage market in the United States through May 2020. While COVID-19 has made the in-person home inspection process more challenging, it has not slowed the pace of new mortgage applications and re-financing through this time period.

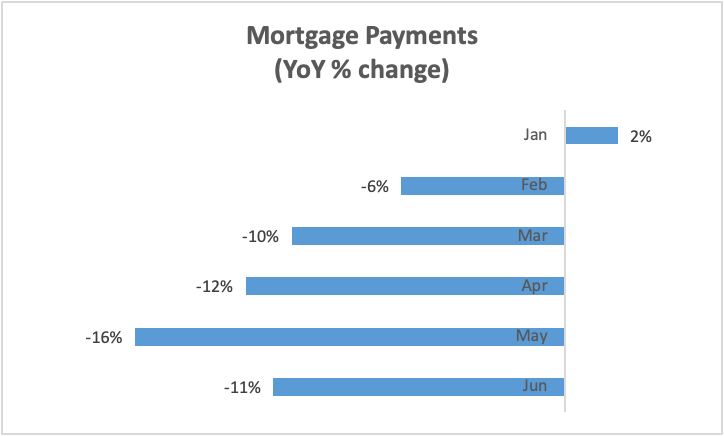

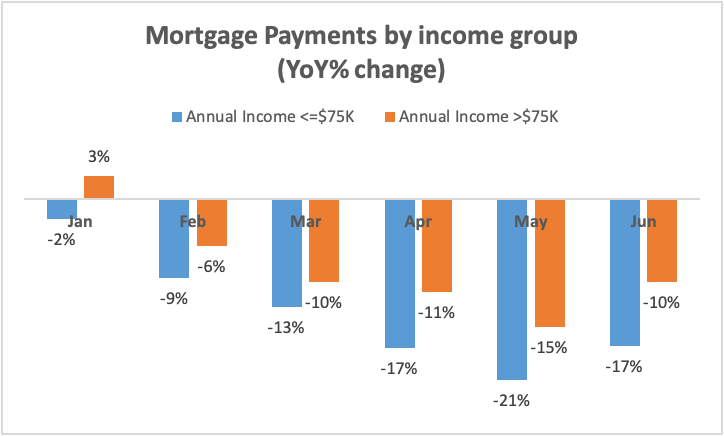

An analysis of trends in mortgage payments by existing mortgage holders shows a slight uptick in payments in June 2020 compared to the Spring months. The initial dip in mortgage payments was expected, due largely to forbearance programs implemented for federally-backed loans and the impact of increased unemployment on mortgage delinquencies. In particular, there was a decrease of mortgage payments among lower income groups.

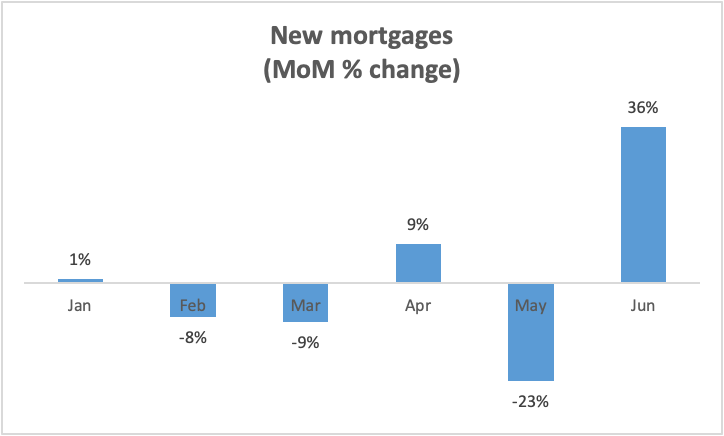

Our analysis also shows a sharp increase in new mortgages in June 2020, rivaling June 2019 levels. June saw a 36% increase in new mortgages compared to the previous month. According to a survey by the Mortgage Bankers Association, there has also been a surge in new mortgage applications, leading to the possibility that the trend will continue through the summer.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.