The popularity of alcohol delivery services has skyrocketed with the introduction of pandemic-driven social distancing policies. Given the closure of bars across the country, consumers are turning towards more convenient alternatives to get their happy hour beverages.

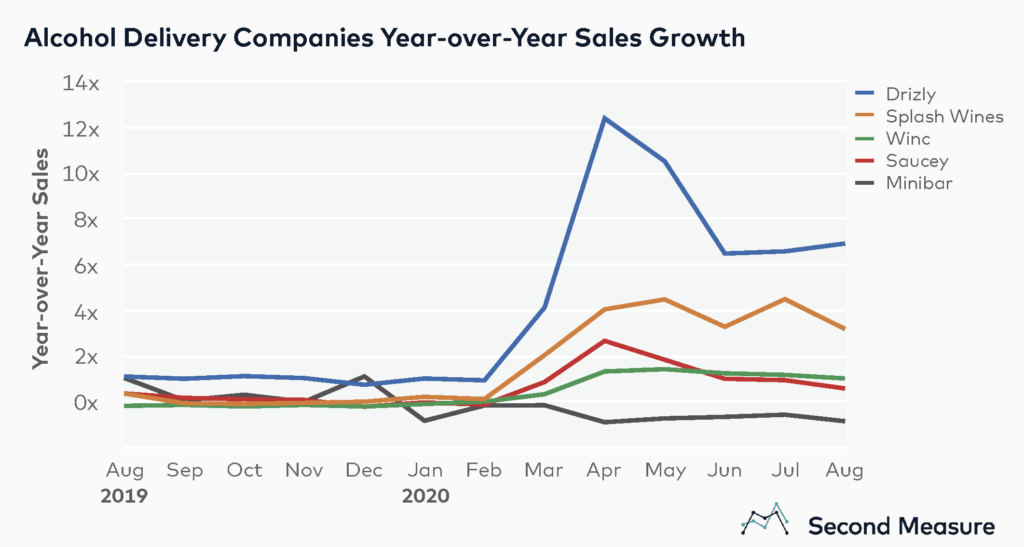

Within the alcohol delivery market, Drizly has set itself apart from the crowd. The company—which recently raised $50 million in a Series C funding round—emphasizes its one-hour delivery guarantee for orders made through the platform, as well as its broad nationwide coverage. Drizly has seen strong growth in the COVID-19 era, boasting twelve-fold year-over-year growth in April 2020, when most states were under shelter-in-place orders.

Drizly outperformed its closest competitor, Splash Wines, with triple the amount of growth earlier this year, when Splash Wines itself saw a solid 404 percent year-over-year sales increase in April 2020. However, the gap has since narrowed, with Drizly posting 693 percent year-over-year growth in August while Splash Wines’ growth was up 319 percent.

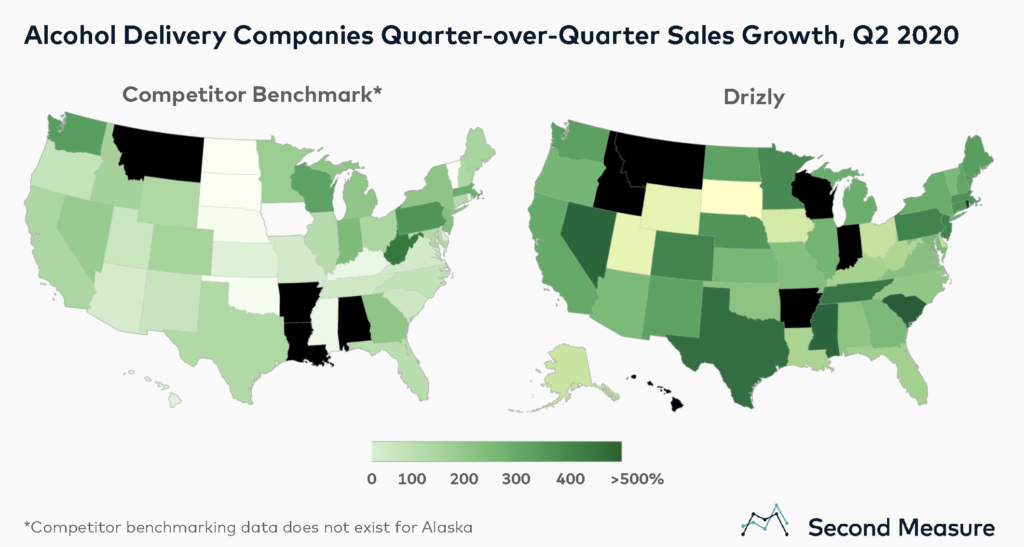

Drizly sales growth outpaces competitors across the country

Drizly has been especially successful in penetrating regional markets across the country, demonstrating higher growth than its competitors, particularly in the Great Plains. In North Dakota, South Dakota, Nebraska, Oklahoma, and Kansas, the company’s sales grew an average of 264 percent quarter-over-quarter in the second quarter of this year. In stark contrast, quarter-over-quarter growth for Winc in the same region fell 70 percent.

Winc is winning at customer retention

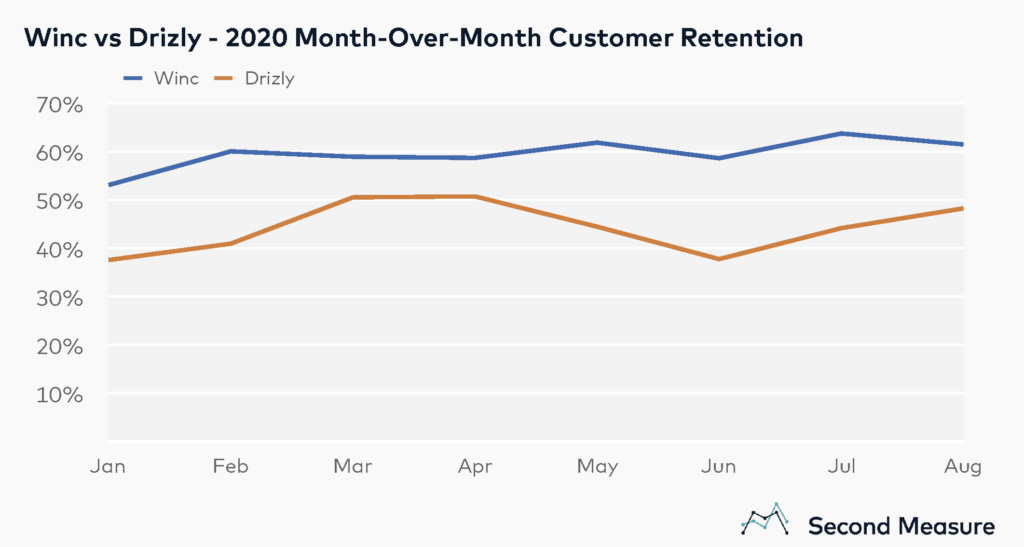

Although Drizly has been quite successful in acquiring new customers, a closer look at monthly customer retention across all companies revealed that Winc has higher customer retention rates.

Drizly has consistently surpassed Winc in new customers as a proportion of total customers by an average of 17 percent since January of this year. This difference was most pronounced in April, when Drizly’s new customers increased fourteen-fold compared to April 2019, while Winc’s new customers grew eight-fold.

However, a closer look at month-over-month customer retention revealed that, in August, Drizly had retained 48 percent of its prior month’s customers, while Winc retained 62 percent, likely due to its subscription-based model.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.