In this Placer Bytes we dive into the data surrounding JCPenney and Darden Restaurants.

JCPenney’s Buyout

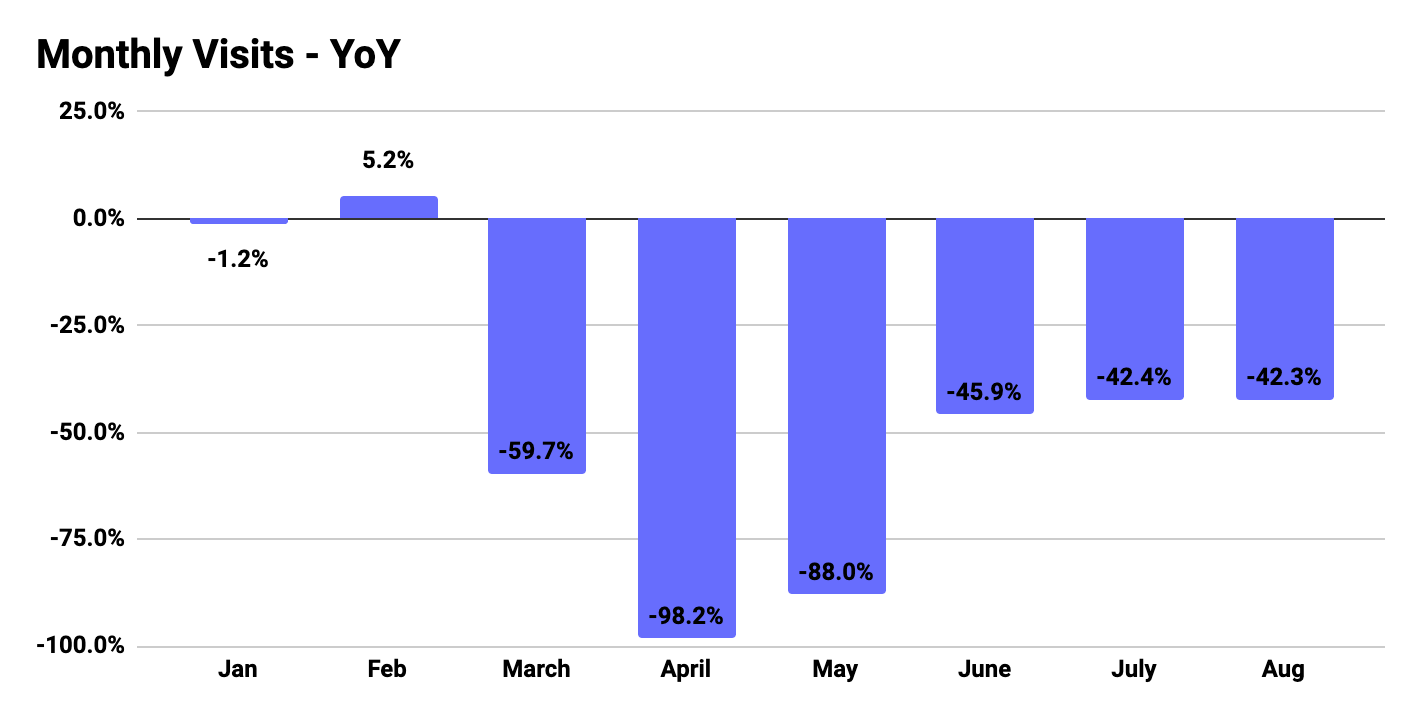

Despite filing for bankruptcy back in May and being recently bought out by mall operators Simon Property Group and Brookfield Property Group, JCPenney’s foot traffic has been increasing since the retail economy was allowed to reopen across the country. Visits for the brand bottomed out in April, but began to bounce back during in May, with visits 88.0% down before taking a huge step forward in June, with visits reaching just 45.9% down year over year.

But, since that point, visits have stagnated when compared to 2019 numbers. While there are clearly elements that are related to JC Penney specifically, much of the struggles have been connected with wider issues for the apparel sector, the malls that they generally call home and have been directly related to resurgences of COVID cases in key states during those months.

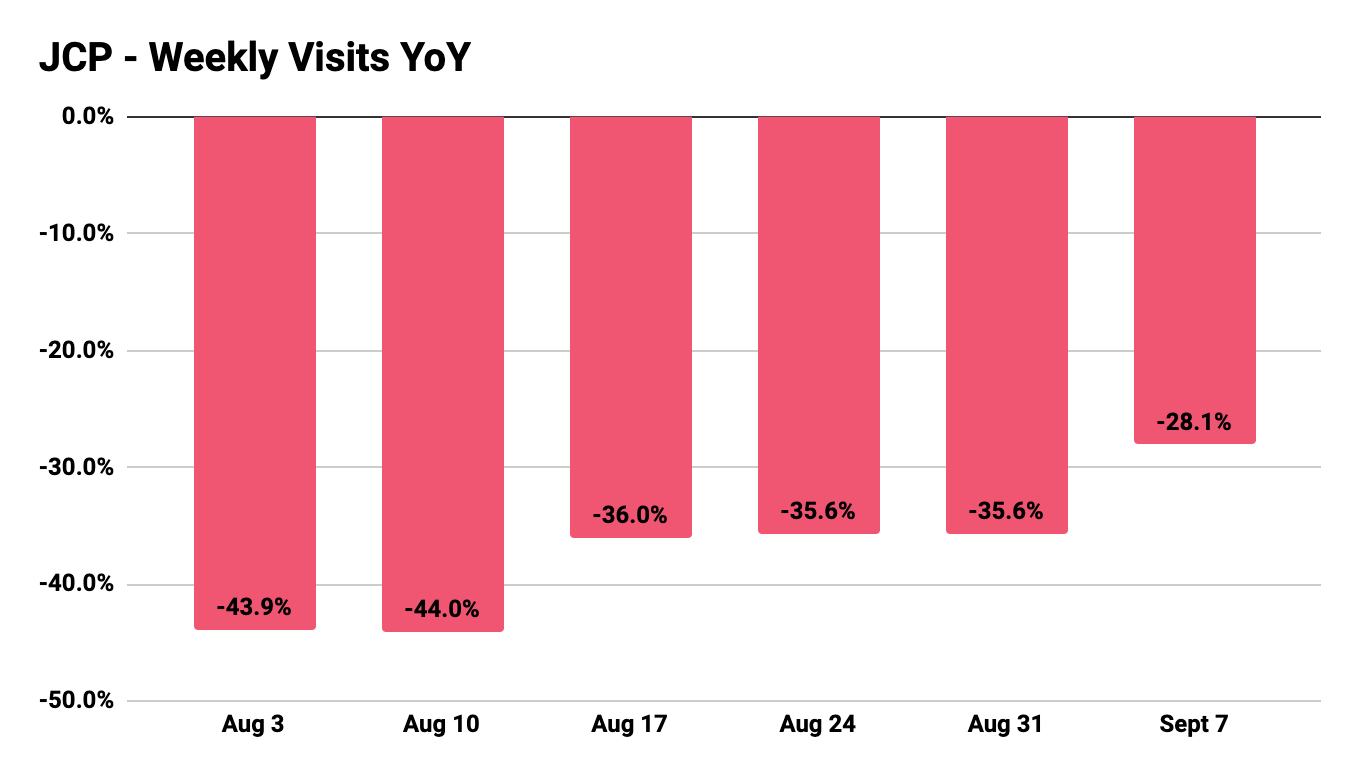

However, while monthly visits were at a standstill, the weekly visits began to tell a different story from the middle of the month. When looking at year-over-year weekly traffic since the beginning of August, we see traffic moving back towards 2019 levels. Traffic has improved every week since August 10th, with the week of Sept. 7th drawing visits closest to 2019 levels, with visits just 28.1% down — the closest since mid-June. With a new owner and recovering visits, the brand could be poised for a strong close to 2020.

Darden Restaurants

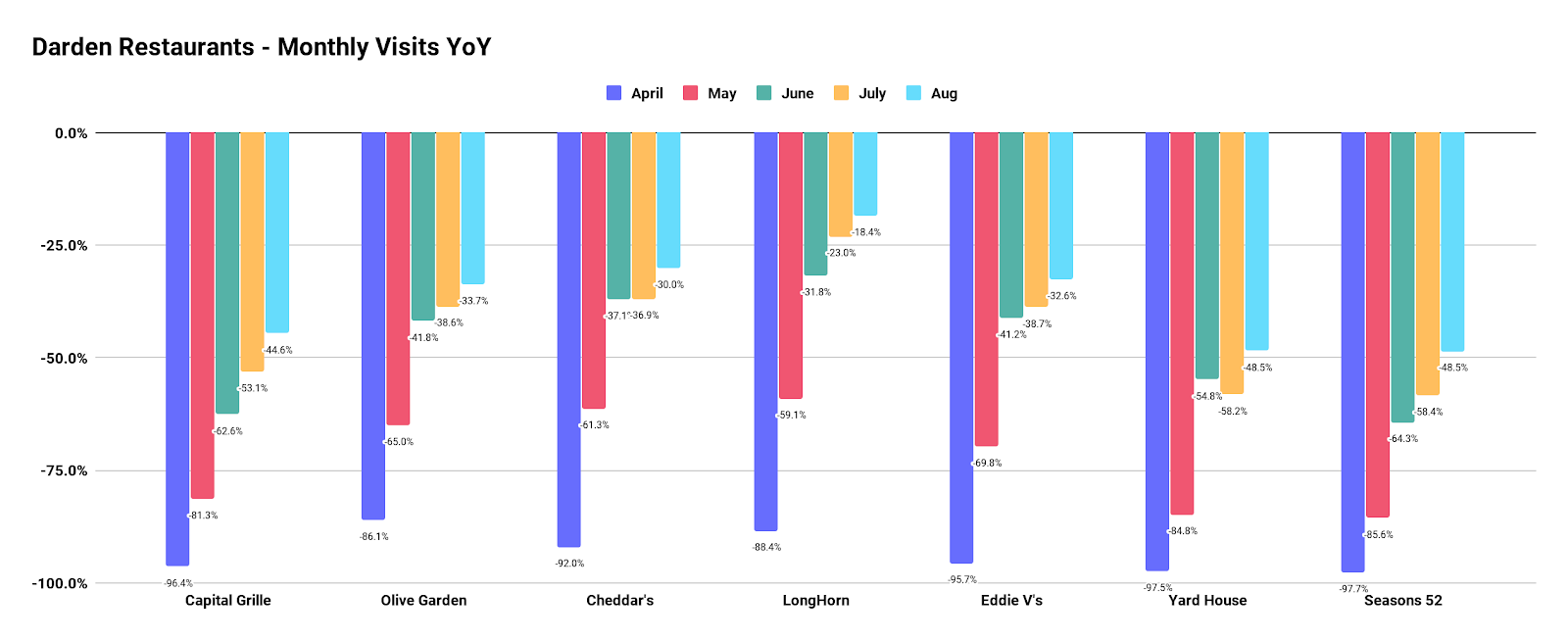

It’s no surprise that the restaurant industry was among the hardest hit sectors during the pandemic, but it’s almost been one of the quickest to rebound. Darden Restaurants has seven different chains around the country, and all of them have been inching closer to pre-COVID levels. Each of these seven had positive year-over-year growth at the beginning of 2020, for both January and February, but of course, plummeted during COVID.

Cheddar’s, LongHorn Steakhouse, Olive Garden and Eddie V’s have had the fastest recoveries of the group, with year-over-year traffic in August down 30.0%, 18.4%, 33.7% and 32.6%, respectively. And, while the other restaurants in the group were slightly behind in their recovery process, they are still continuing to push closer to 2019 levels. But, it’s also important to note that, while Seasons 52 and Yard House are recovering the slowest, with visits down 48.5% for both restaurants for August, many of their locations are in Florida — one of the hardest hit states with a recent resurgence of cases.

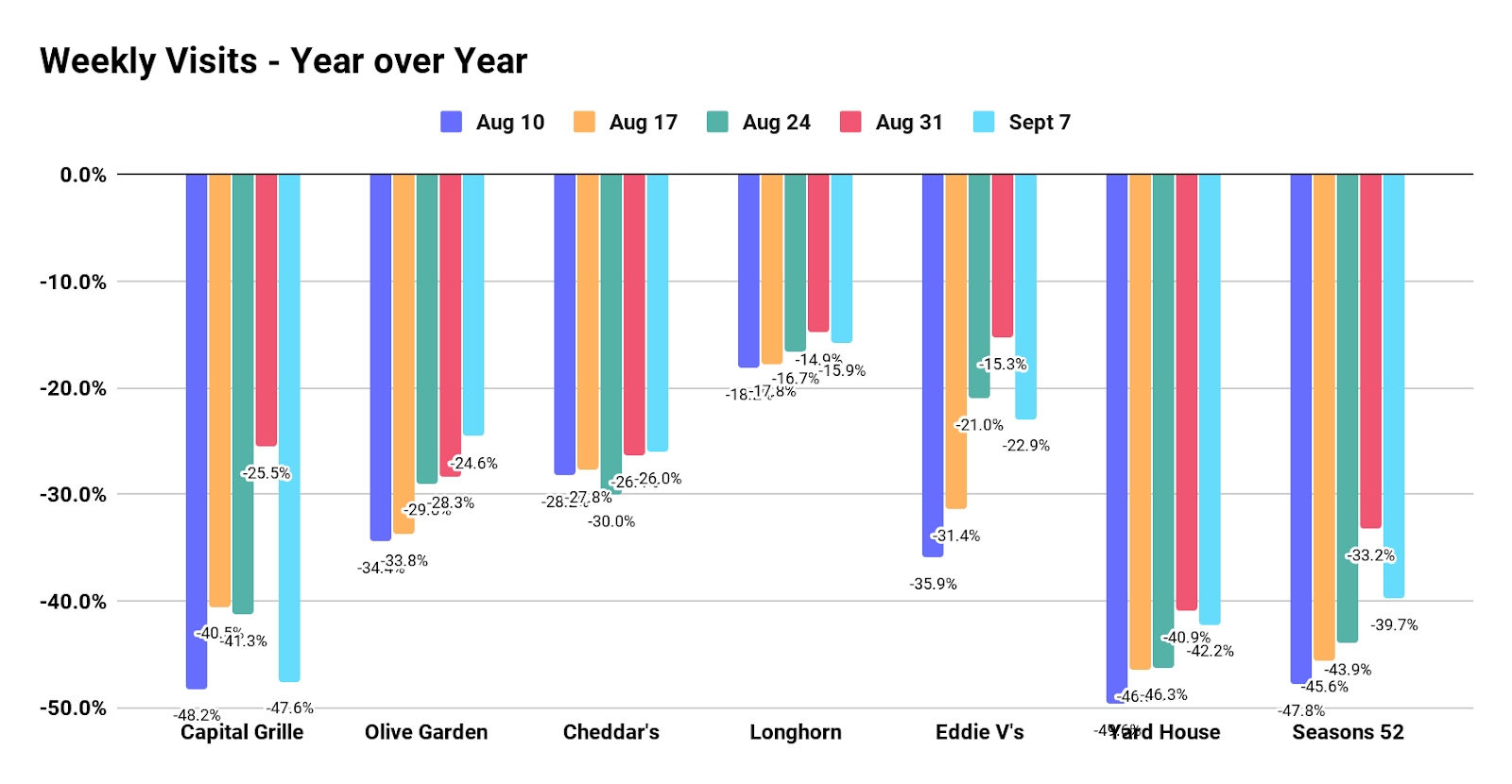

Weekly visits are also on the rebound. All but Capital Grill, generated numbers for the week of Sept. 7th that were better than those at the beginning of August. And while Capital Grill is still on the rebound, it seems to be doing so at a slower rate likely because of its regional distribution and approach.

The brand is both expensive in a time where economic uncertainty prevails and city-oriented when these have been the hardest hit areas with many cases of residents fleeing and higher income professionals not coming in as often.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.